#StockMarket WE update. #SPX as expected we rallied to my first target lvl above 3800, derived from a measured move off the box breakout. Some consolidation is likely here or even a retracement. RSI poked above 70 for the first time since Aug...

#stockmarket New Seq Demark 13 sell possibly this wk (earliest weds). Propulsion up tgt of 3907 still in view. maybe we hit the tgt while posting the new 13 sell? Reminder the propulsion lvls can act as magnets but also exhaustion lvls. Last 2 13 sells saw short +2% drawdowns...

#stockmarket weekly #SPX could post a Demark combo 13 sell this wk and a sequential 13 sell next wk....

#stockmarket #nasdaq Demark propulsion up tgt almost reached on Friday (32 pts away - 13240) w/ 12 Seq count & likely 13 sell printing tmrw. Last 13 seq sell saw an ensuing 12% drawdown - ouch! ...

#stockmarket #nasdaq weekly chart now w/ a Demark 9-13-9 sell to go along w/ pot'l daily exhaustion counts. lots of confluence happening....

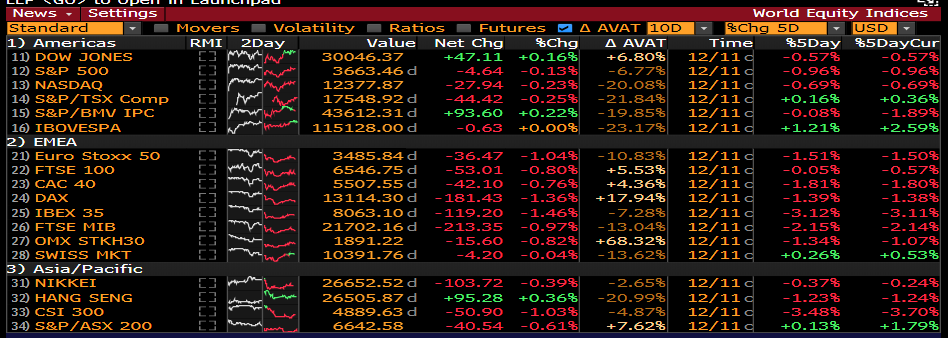

#stockmarket #dowjones also now w/ a new Demark combo 13 sell to go along with the seq 13 sell from 1/4. Weekly chart just posted a 9 sell as well....

#stockmarket keep in mind that the last 5 days have recorded quite a few Demark sell signals in the market. my counts show: NYSE w/ 179 Seq 13 sells & 195 9 sells. Nasdaq w/ 283 Seq 13 sells and 127 9 sells. starting to pile up...

#stockmarket I've illustrated a # of times how stretched the indices have become, & here is more substantiation. #nasdaq quarterly BB chart now shows +upper BB for 3Q's in a row. Thats NEVER happened. Last attempt was during the Internet bubble which resulted in a 78% drawdown...

#stockmarket #SPX not quite as stretched but never has it ended above the upper BB for 2Q's in a row as it appears now. Last attempt was in Q4 '18 which was sold down very hard. Will history repeat? ...

#stockmarket Net New highs exploded last wk, which is bullish, but is it too bullish? Last time we were this elevated was on Jan 12, 2018. Deja Vu? ...

#stockmarket Smart Money Index is something i've discussed numerous times, still struggling w/ some negative divergence & approaching a big lvl....

#stockmarket Staples vs SPY ( $XLP vs $SPY) ratio is a barometer of risk w/ new Demark combo 13 buy. Last 2x this signal appeared we saw #SPX retracements....

#stockmarket $VVIX or vol of vol, could post its first Demark Seq 13 buy as early as tomorrow. Last 13 buy saw this rise 35% and the $VIX 80%. can't say it enough, buy cheap protection...

#stockmarket here is another example of how stretched we are per valuation basis. mkt cap as a % of GDP @ ATH's...

#StockMarket Lastly, something I posted last wk. Maybe time for the Semi rotation to revert back into SW. here is the chart of the ratio showing a new Demark 9 buy that printed on Fri. very good history of reactions & the SW stocks had a very good day....

#stockmarket CONCL: tough to be overly bearish as long as we hold +3720 & the 20 day remains defended. A close below could open the door for momentum to come out of the mkt. Given the aforementioned, I will be paring down risk this wk, adding to hedges, & trade quicker...

• • •

Missing some Tweet in this thread? You can try to

force a refresh