#RealMadrid 2019/20 accounts cover a season when they won La Liga, were quarter-finalists in the Copa del Rey, won the Supercopa de Espana and exited the Champions League in the last 16. Finances impacted by COVID-19 in the last 3 months. Some thoughts in the following thread.

#RealMadrid profit before tax fell from €53m to €2m (after tax down from €38m to €313k), as revenue dropped €42m (6%) from €757m to €715m, while expenses rose €84m and profit on player sales was up €3m to €101m. Profit boosted by €72m swing in impairment provision.

Most #RealMadrid revenue streams fell: membership fees & stadium revenue, down €47m (27%) to €126m; TV, down €24m (14%) to €149m; and international competitions & friendlies, down €8m (7%) to €116m. Growth in marketing, up €17m (6%) to €312m, and Other, up €20m to €22m.

Despite the revenue reduction, #RealMadrid wages rose €17m (4%) from €394m to €411m, split football €378m and basketball €33m, and there were increases in player amortisation, up €55m (53%) from €104m to €159m, and other expenses, up €15m (6%) to €254m.

Even though #RealMadrid post-tax profit fell significantly in 2019/20 to just €313k, this was still a decent result, given the pandemic impact. In contrast, their main rivals Barcelona posted a huge €97m loss. Worth noting Madrid’s figures include €26m loss from basketball.

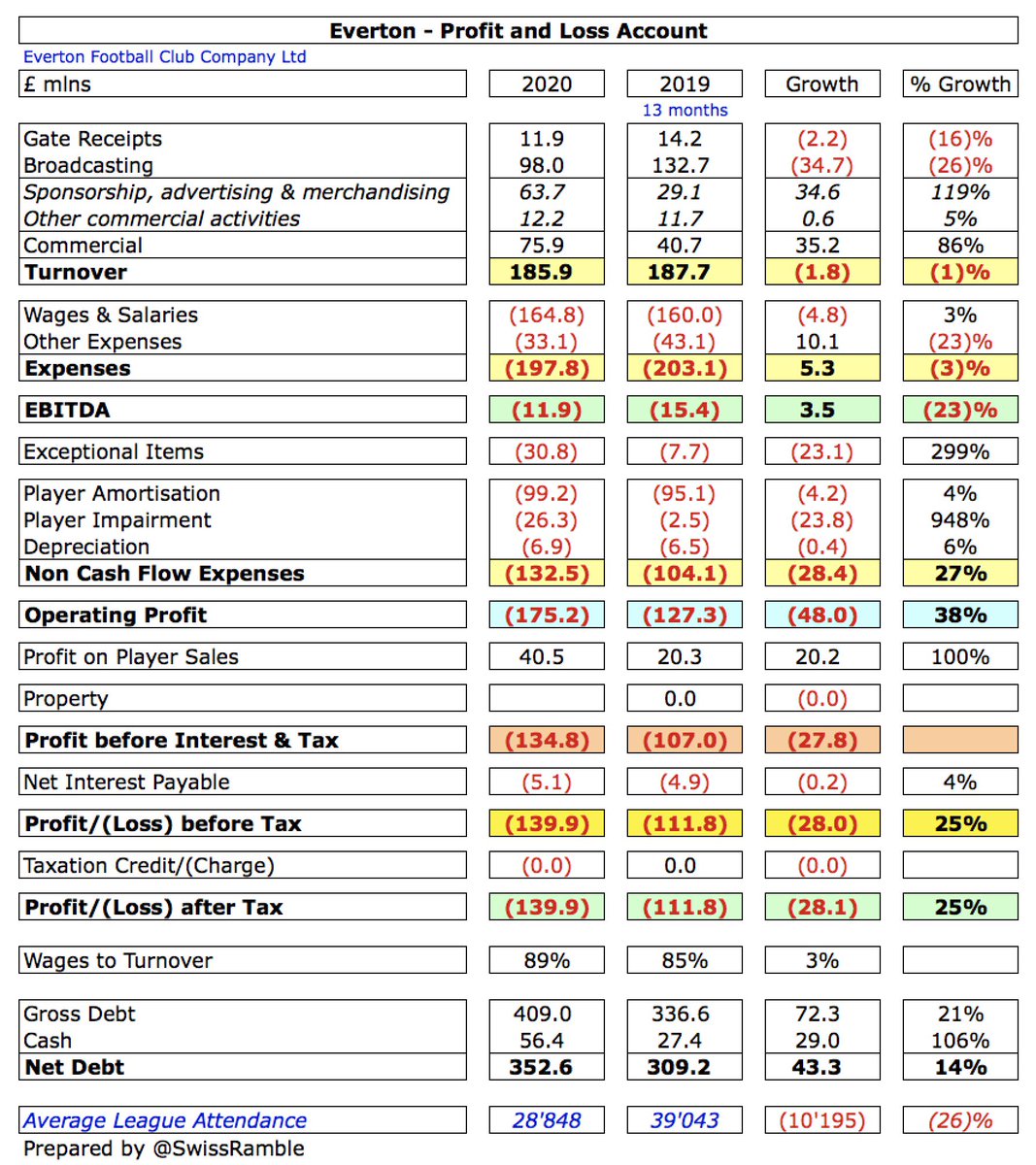

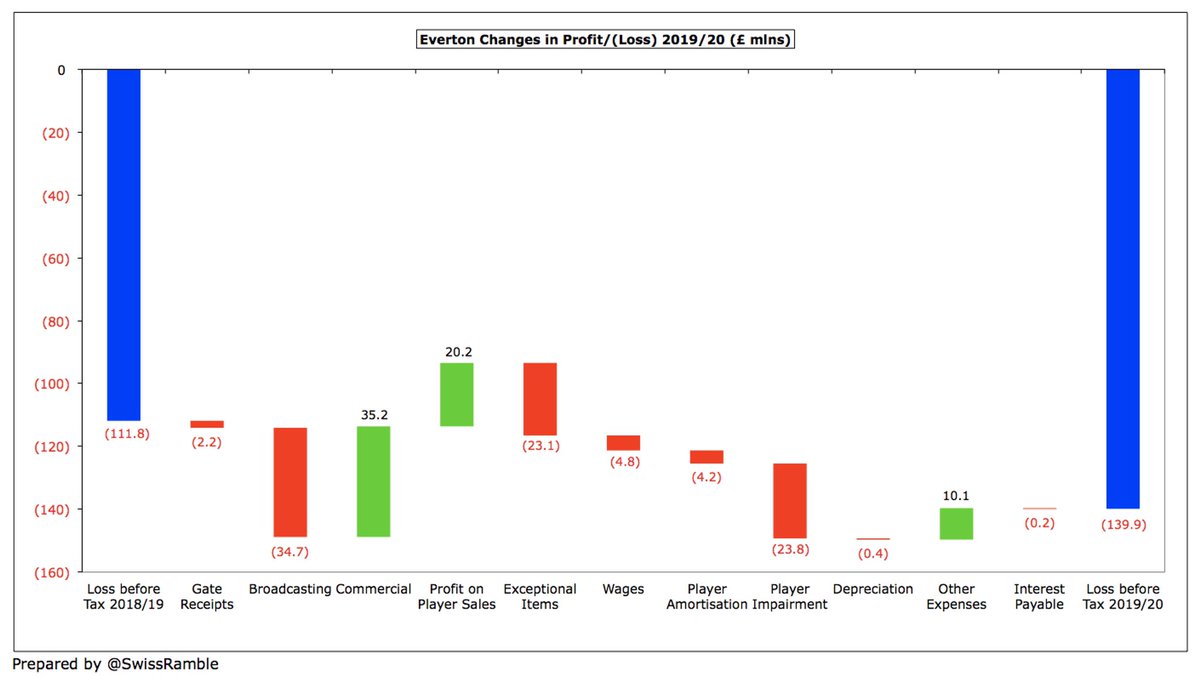

Clearly, COVID has had a major adverse impact on finances in 2019/20 with many leading clubs across Europe reporting horrific losses, e.g. Roma €204m, Milan €195m, Everton €158m, Inter €100m, Juventus €90m and Tottenham €72m, so #RealMadrid breaking-even is pretty good.

COVID reduced #RealMadrid 19/20 revenue by €106m (13%). Excluding this impact, revenue would have grown 8% from €757m in 18/19 to €821m. Partly offset by €70m cost savings: revenue-related €16m, 10% wages cut €36m, other €18m. Made €3.5m donation for medical supplies.

#RealMadrid did benefit from profit on player sales rising from €99m to €101m, probably Kovacic to #CFC, Llorente to Atleti, De Tomas to Benfica, Hernandez to Milan and Navas to PSG. Only surpassed in Spain by Atleti’s €136m (mainly Griezmann), just ahead of Barcelona €95m.

#RealMadrid are normally highly profitable, due to their ability to generate revenue. In the 9 years before 2019/20, they accumulated an impressive €397m profit, averaging €44m a season. However, they have budgeted a €91m loss for 2020/21 (€70m after tax), due to COVID.

Like many other clubs, #RealMadrid have become more reliant on player sales with average profits nearly tripling in last 2 years to €100m. The 2020/21 budget includes €88m, which has already been achieved via summer sales, including Hakimi to Inter and Reguilon to Spurs.

#RealMadrid EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), a proxy for cash profit, fell from €124m to €50m. Including player sales, this dropped from €223m to €151m. Note: the club’s figure of €177m includes €26m release of impairment provision.

At an operating level (i.e. excluding player sales and interest), #RealMadrid loss more than doubled from €44m to €101m. Profit was as high as €38m in 2016. In fairness, most clubs run an operating loss, as seen in 2018/19, when Madrid were mid-table in the Money League.

#RealMadrid revenue decrease in 2019/20 from €757m to €715m follows a marginal increase from €751m the previous season. Nevertheless, revenue has still grown by €95m (15%) in the last 4 years. However, the 2020/21 budget anticipates a further fall to €617m.

This means that COVID will have cost #RealMadrid nearly €400m in lost revenue over two seasons: €106m in 2019/20 and €283m in 2020/21. Before the pandemic the club expected revenue to grow to €900m this season, but they currently budget almost €300m less.

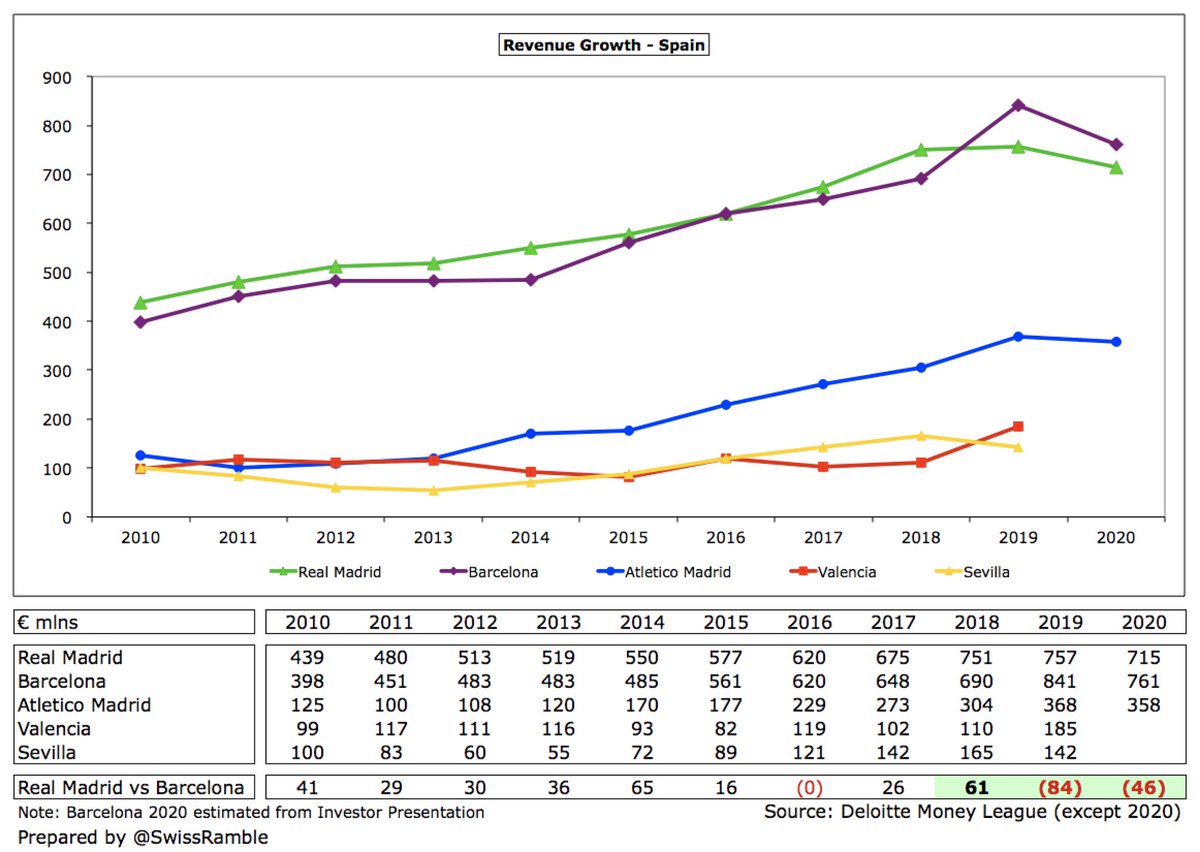

In fairness, Barcelona’s 2019/20 revenue has dropped by €80m from €841m to €761m, which is almost twice as much as #RealMadrid €42m decrease to €715m. That said, the Catalans’ revenue is still €46m higher than Madrid.

However, #RealMadrid €715m revenue is still twice as much as Atletico Madrid €358m, followed by Valencia €188m & Sevilla €142m (2018/19 figures). Put another way, the combined €1.5 bln revenue of Barcelona & Real Madrid is almost as much as the other La Liga clubs combined.

Furthermore, #RealMadrid 6% (€42m) revenue decrease in 2019/20 is one of the better results of clubs that have so far published accounts with most announcing significant reductions of over 15%: #MUFC €133m, Juventus €88m, Roma €87m, #THFC €78m and Inter €66m.

In the last edition of the Deloitte Money League, based on 2018/19 accounts, #RealMadrid were overtaken by Barcelona, partly due to the Catalans taking merchandising inhouse. Madrid’s revenue mix was: commercial 47%, broadcasting 34% and match day 19%.

#RealMadrid commercial income rose €14m (4%) from €355m to €369m, a record for the club. In 2018/19 only surpassed by Barcelona €384m, PSG €363m & Bayern €357m. Looking to increase revenue by bringing retail activities in-house, but it carries more risk in current climate.

It’s an “arms race” in shirt sponsorships and kit deals, but #RealMadrid’s are among the very highest with Emirates and Adidas paying €70m and €110m a year respectively. Emirates deal runs to 2022, while Adidas agreement has been extended to 2028 (merchandising is on top).

#RealMadrid broadcasting income fell €27m (11%) from €258m to €231m, partly due to 6 games played after June accounting close, so revenue deferred to 2020/21 accounts. Had 6th highest TV revenue in the world previous season, a fair way below #LFC €299m and Barcelona €298m.

After years of individual deals in Spain, La Liga have introduced a collective deal, based on 50% equal share, 25% performance over last 5 years and 25% popularity (1/3 for average match day income, 2/3 for number of TV viewers). Gross income reduced by liabilities (7%).

Even after the changes, Barcelona €153m and #RealMadrid €145m still receive by far the highest TV income from La Liga’s TV deal, followed by Atletico Madrid €116m, then a big gap to Valencia €76m and Sevilla €73m. Lowest payment went to Mallorca €41m.

#RealMadrid benefited from La Liga international TV deal rising 30% in 2019/20, giving total TV rights of €2.0 bln. Although still a long way behind the Premier League €3.6 bln, it is comfortably ahead of the others: Bundesliga €1.4 bln, Serie A €1.3 bln & Ligue 1 €1.2 bln.

#RealMadrid earned €84m from the Champions League, around the same as previous season, when they were also eliminated in the last 16. Barcelona and Atletico Madrid received €104m and €95m respectively for reaching the quarter-finals. These figures are before any COVID rebate.

Worth noting the influence on Champions League money of the UEFA coefficient payment (based on performances in Europe over 10 years), where #RealMadrid had the highest ranking in 2019/20, thanks to winning the competition 4 times in 5 years up to 2018, giving them €35m.

Thanks to their fantastic record in the Champions League, #RealMadrid have earned a hefty €419m from European competition in the last 5 years, which is €23m and €60m more than Barcelona and Atletico Madrid respectively. In Europe, this is only surpassed by Juventus.

#RealMadrid match day revenue fell €29m (20%) from €145m to €116m, despite €8m from Supercopa de Espana in Saudi Arabia, as 6 home games were played behind closed doors. In 2018/19 they had the second highest revenue in the world from this stream, only below Barcelona €159m.

#RealMadrid average attendance fell 25% from 60,598 to 45,662, the second highest in Spain, below Barcelona 53,400, but above Atletico Madrid 42,146. All these figures were impacted by games being played without fans after La Liga was suspended in March.

Work on the €575m redevelopment of #RealMadrid’s Santiago Bernabéu stadium continued as planned with estimated completion date of 2023 (€114m investment to date). Funding is in place, charging 2.5% over 30 years. Annual loan repayments of €29.5m start in July 2023.

#RealMadrid football wages rose €16m (5%) from €362m to €378m, despite 10% wage cut (€36m) in response to COVID (would have been 20% if league had not restarted). Total wages, including €33m basketball, were €411m. Budgeted at €448m in 20/21, though talk of another 10% cut

#RealMadrid €378m wage bill is significantly lower than Barcelona’s last reported figure of €501m (2018/19 accounts) with the prior year gap up to €139m. They are still €151m more than Atletico Madrid €227m.

Clearly, #RealMadrid €378m wages are a lot more than the other Spanish clubs, e.g. Valencia €116m, Athletic Bilbao €104m and Sevilla €92m. In fact, in 2018/19 they had the 4th highest wage bill in Europe, only surpassed by Barcelona, Manchester United and PSG.

Following the decrease in revenue, #RealMadrid wages to turnover ratio worsened from 48% to 53%, still one of the lowest in Spain, much better than Barcelona 59% and Atletico Madrid 63%. In 2018/19 they had one of the best ratios in Europe, miles better than, say, Juventus 66%.

The other #RealMadrid staff cost, player amortisation, the annual charge to write-down transfer fees over the length of a player’s contract, has significantly risen by €55m (53%) from €104m to €159m, which means this expense has increased by €76m (91%) in just 2 years.

#RealMadrid total amortisation of €177m (including €18m depreciation) is the highest in Spain, ahead of Barcelona €160m (2018/19) and Atletico Madrid €135m. Reflects 2019/20 purchases of the likes of Hazard, Jovic, Militao, Mendy, Rodrygo and Reinier.

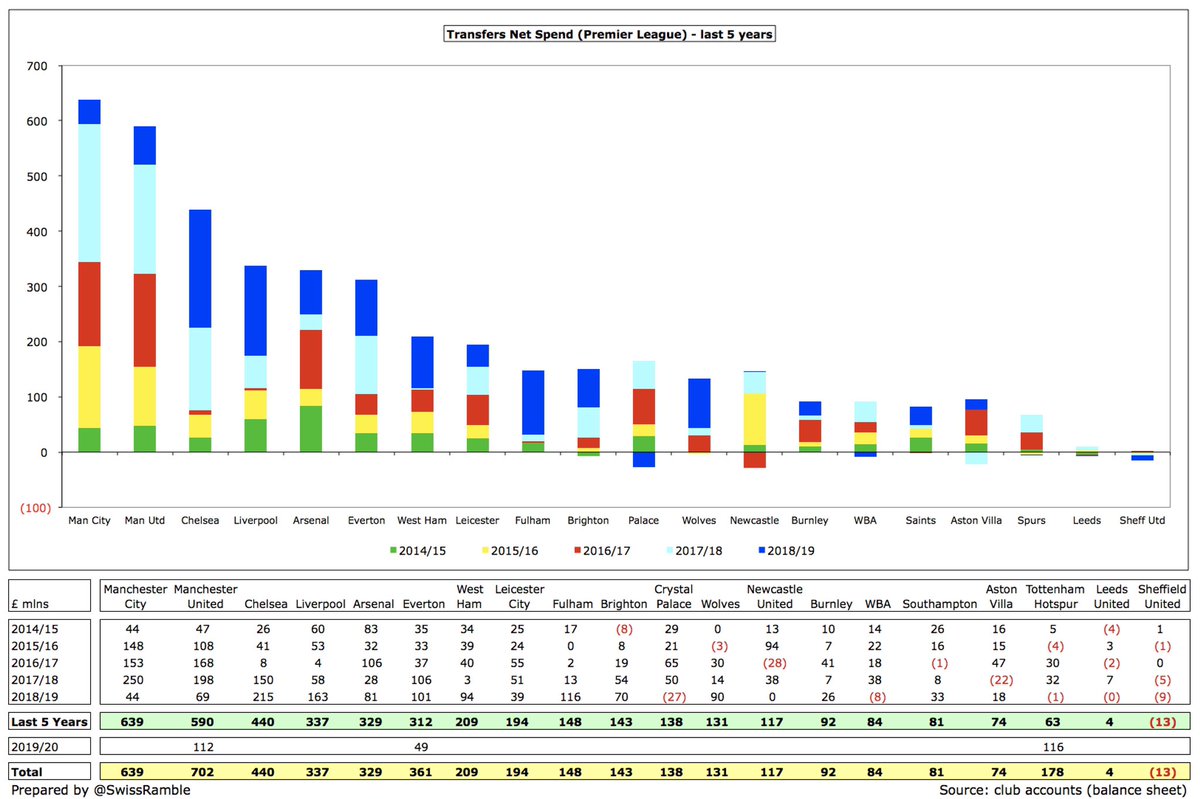

#RealMadrid have splashed the cash in the transfer market in the last two years, with €571m gross spend – €308m net spend. This included €323m purchases in 2019/20, partly offset by €139m sales. However, they made no purchases at all in the 2020 summer transfer window.

Based on Transfermarkt figures, #RealMadrid only had €56m net spend in the last five seasons (including €99m net sales in 2020/21 to date). This was the fourth highest in La Liga, around €300m less than Barcelona’s €359m in this period, but only just ahead of Getafe €52m.

Even in gross spend #RealMadrid’s €589m over the last five years was only the third highest in Spain, obviously well below Barcelona’s massive €1,044m, but also behind Atletico Madrid’s €668m. As La Liga president Javier Tebas said, “clubs are now looking to reduce costs.”

After 4 years when they enjoyed net funds, #RealMadrid swung to €354m net debt in 2019/20 (€241m financial debt plus €114m stadium). This is per the club’s definition, which includes transfer debt. Bank borrowings rose from €50m to €205m to compensate for COVID losses.

#RealMadrid cash balances decreased from €156m to €135m. Despite the postponement of the collection of membership fees and some sponsorship money, cash was boosted by the club taking on additional debt, just before the semi-annual wage payment in July.

Based purely on financial debt, #RealMadrid €83m in 2018/19 was one of the lowest in Europe, miles below #THFC €746m (new stadium), #MUFC €580m and Juventus €473m. Will further rise with stadium loans (another €275m in July 2020 and €200m in July 2021).

#RealMadrid actually had €1m net interest receivable in 2019/20, much better than the position at their rivals, who both had to pay out substantial interest on loans: Atletico Madrid €34m and Barcelona €28m. This will change, as Madrid’s stadium development debt ramps up.

#RealMadrid transfer fees debt rose from €16m to €196m, while amounts owed by other clubs are up to €91m, giving net payables of €105m. On the one hand, this is much higher than position 2 years ago, but on the other hand only half as much as €211m net debt 11 years ago.

Most clubs now use transfer debt, i.e. stage payments, as a form of financing, so #RealMadrid €116m gross transfer debt not that high in 2019, far behind Barcelona €261m, Juventus €221m and #MUFC €213m, though that changed after the 2019/20 transfer campaign.

Using broadest possible definition of debt, #RealMadrid total liabilities shot up from €606m to €901m in 2020, including €139m staff wages, €132m accruals, €50m trade creditors & €21m tax. Despite the increase, still lower than #THFC, #MUFC & Barcelona, all above €1.2 bln.

#RealMadrid are a cash machine, generating €1.1 bln from operations in the last 9 years, though this has fallen from €195m in 2016 to €18m in 2020, when they spent €117m (net) on players, €68m capex and €11m tax, leading to €176m fall in cash, offset by €155m new loans.

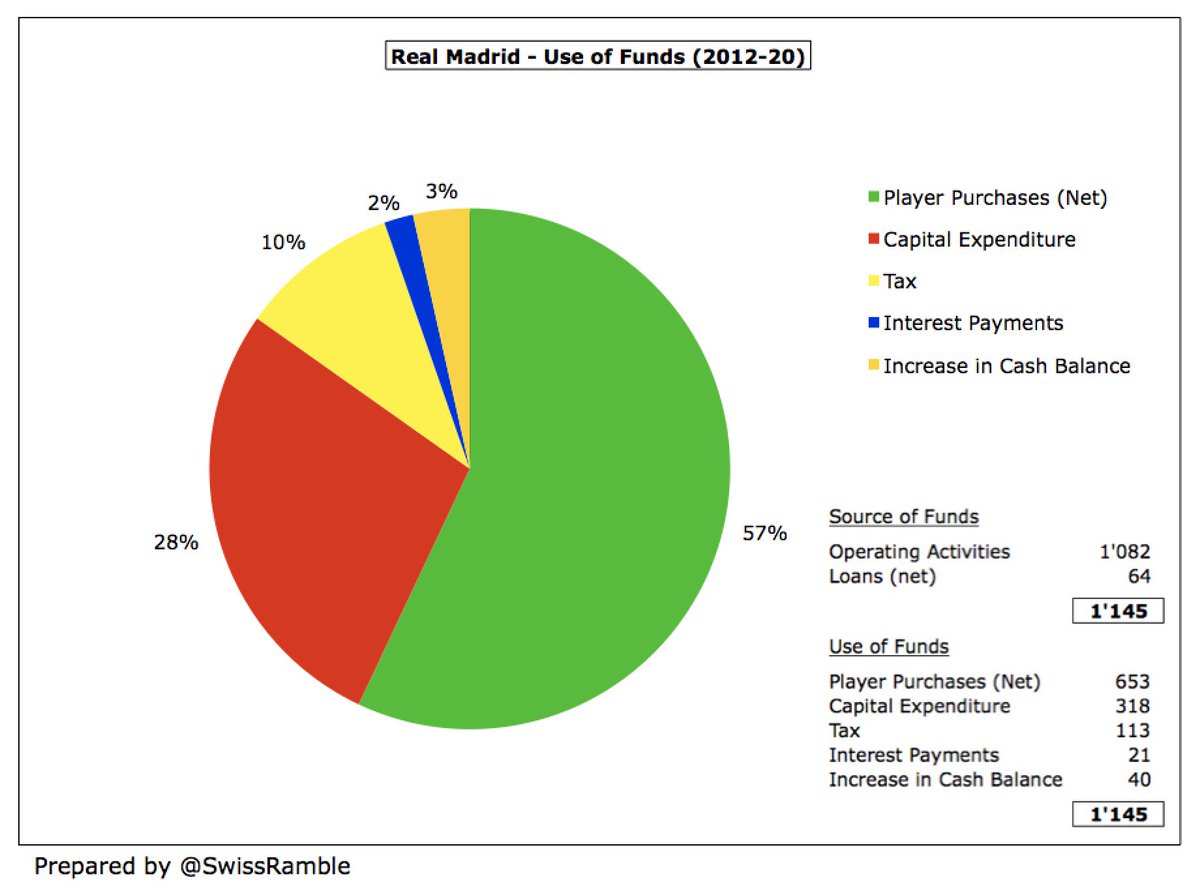

Since 2012 #RealMadrid have used over half of their available €1.1 bln cash on player purchases €653m, but have also invested €318m into stadium improvements and Real Madrid City. They also spent €113m on tax and €21m on interest, while increasing cash balance by €40m.

#RealMadrid have had a clear strategy: success on the pitch leads to higher revenue, allowing them to pay more to players. This model has worked well for many years, but has stalled, partly due to COVID. The Bernabéu stadium development will also represent a major challenge.

• • •

Missing some Tweet in this thread? You can try to

force a refresh