#Milan 2019/20 accounts cover a season when they finished 6th in Serie A and reached the semi-final of the Coppa Italia, but were excluded from Europe for FFP issues. Second season under the ownership of American hedge fund, Elliott Management Corporation. Some thoughts follow.

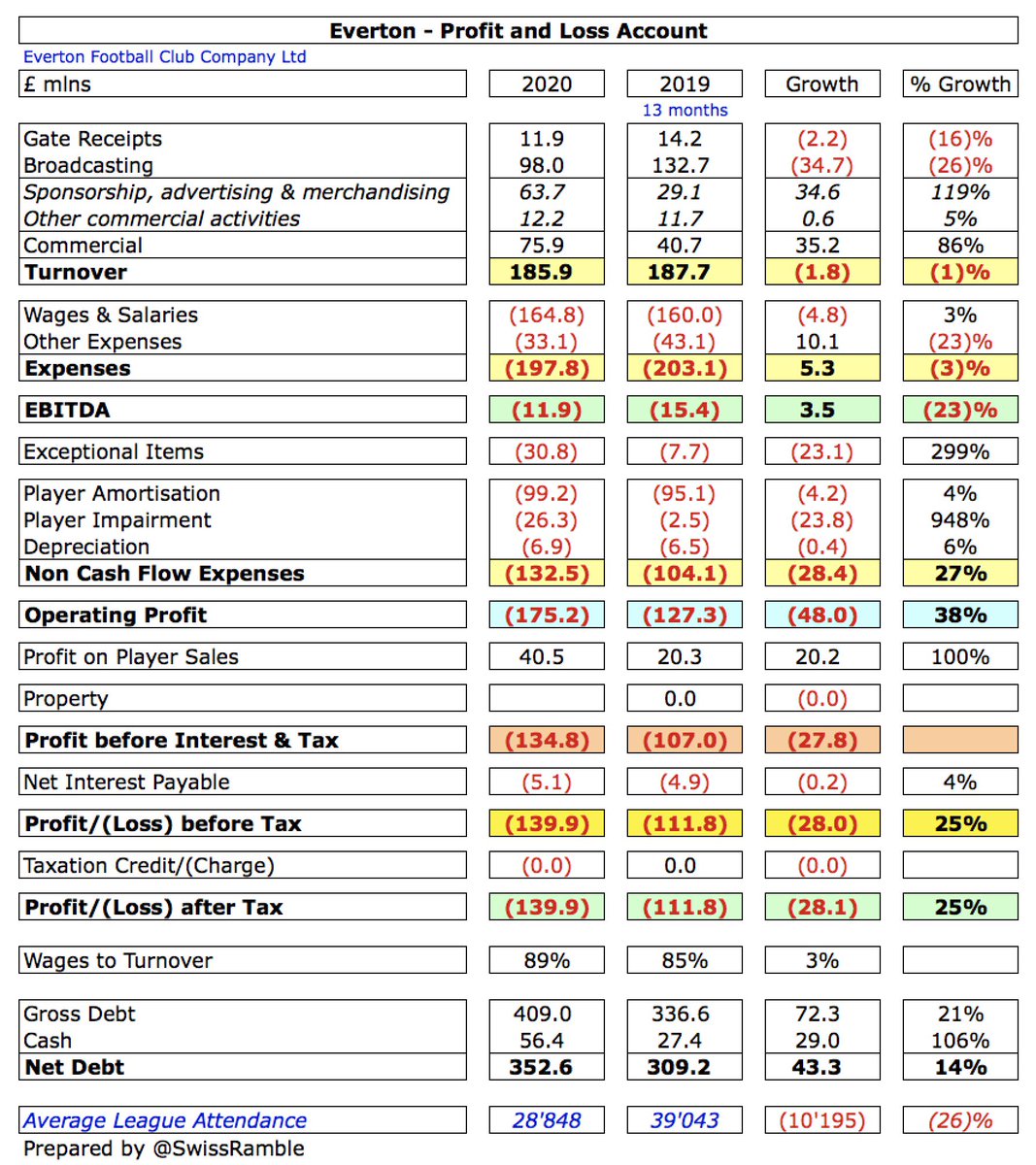

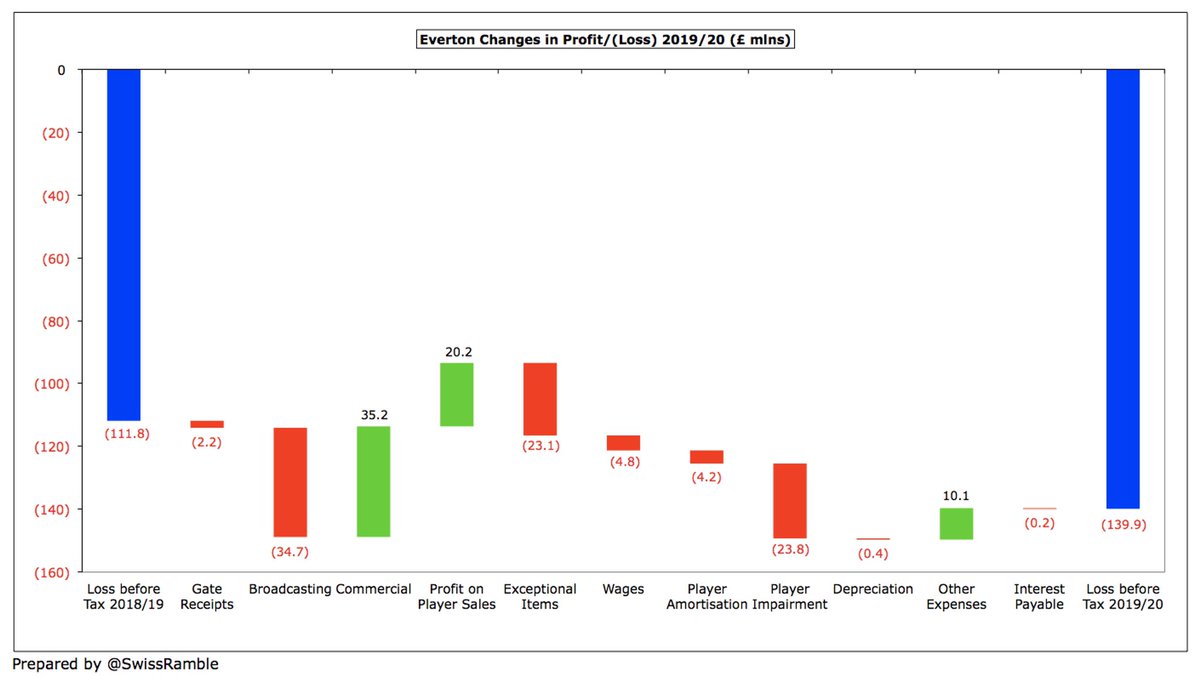

#Milan pre-tax loss widened from €143m to €192m (post-tax €195m), the worst result in club’s history (partly due to COVID), as revenue fell €56m (25%) from €228m to €172m, while profit on player sales up €3m to €15m. Expenses slightly lower, including €30m exceptionals.

#Milan largest revenue decrease came from broadcasting, down €42m (40%) from €105m to €63m, though match day also fell €10m (31%) from €34m to €24m and player loans were down €5m to €8m. Commercial was slightly higher, up €1m to €77m.

As a technical aside, this international definition of #Milan €172m revenue is different to the one used in the club accounts, which also includes €20m gain on player sales plus a tiny increase in asset values, giving revenue of €192m, down €49m (20%) from prior year €241m.

#Milan wage bill was cut €24m (13%) from €185m to €161m, while other expenses were down €7m (8%) to €88m. Player amortisation rose €14m (18%) to €95m, while player write-downs increased €18m from €2m to €20m. Net interest decreased €4m from €10m to €6m.

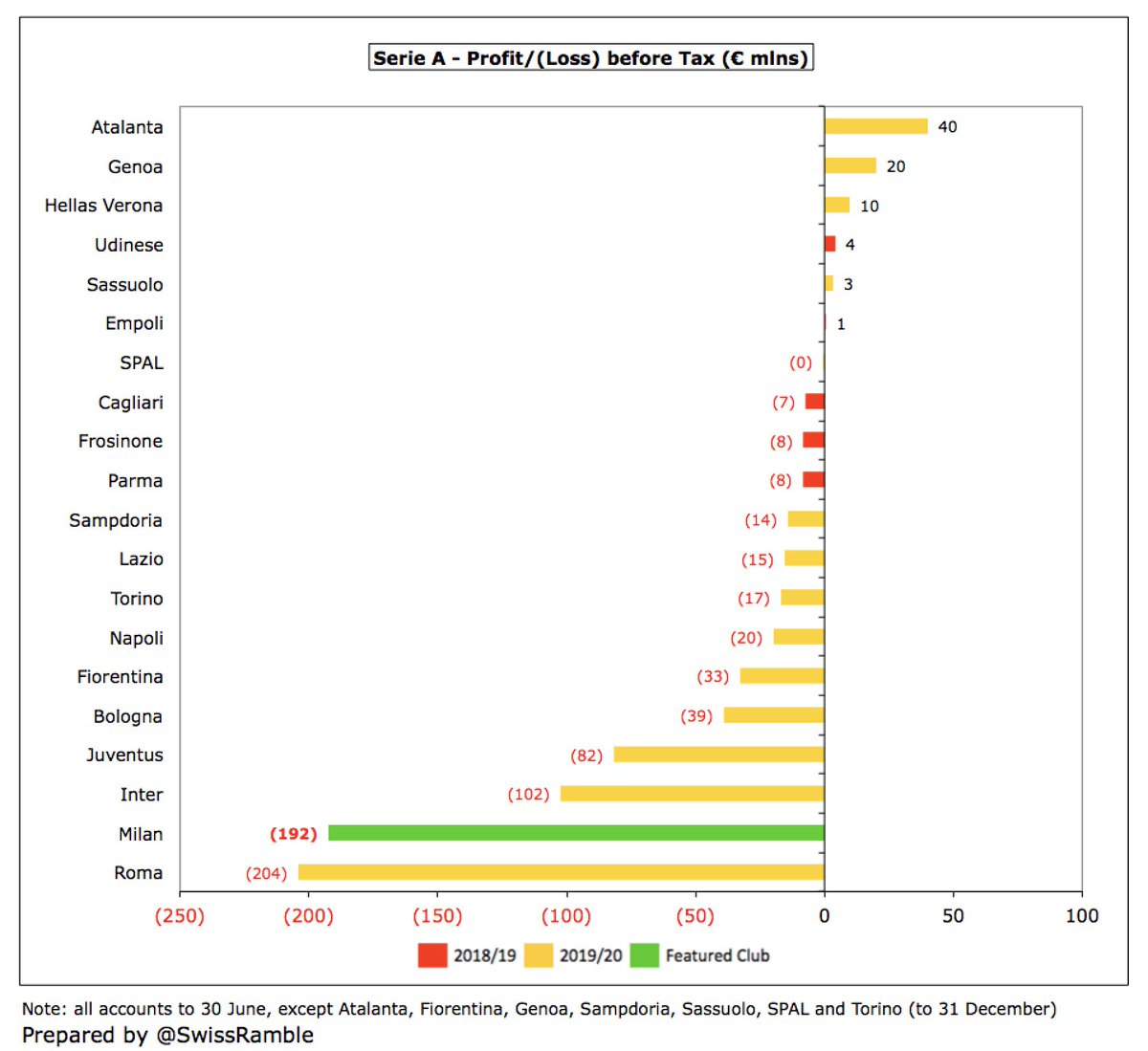

#Milan’s huge €195m post-tax loss is almost the worst in Italy, only surpassed by Roma €204m, while Inter €102m and Juventus €90m also posted hefty deficits, impacted by COVID. Note: some clubs have 31 December year-end, so their 2019/20 accounts do not reflect the pandemic.

Clearly, COVID has had a major adverse impact on finances in 2019/20 with many leading clubs across Europe reporting horrific losses, e.g. Everton €158m, Barcelona €97m and Tottenham Hotspur €72m, but #Milan €195m is one of the highest (worst).

COVID has reduced #Milan revenue in 2019/20 by an estimated €42m: broadcasting €27m (Serie A revenue after 30 June deferred to 2020/21), match day €10m and commercial €5m. Without this loss, reported revenue would have been €214m, i.e. only 6% below prior year.

#Milan profit on player sales rose €3m to €15m, mainly Cutrone to #WWFC €17m & Embelo to Lille €3m, offset by losses for Piatek to Hertha €4m & Borini to Verona €1m. One of smallest gains from this activity in Italy, significantly lower than Juventus €167m & Napoli €96m.

#Milan have lost an incredible €735m in last 7 years (before tax). In fact, it’s really 6.5 years, as 2017 was only 6 months after the change in accounting date from December to June. That means an average annual loss of €113m over this period.

It is worth noting the impact of exceptional costs, which have increased #Milan losses by €146m since 2014. The 2019/20 accounts included €20m player write-downs (mainly Andre Silva, Paqueta, Rodriguez and Reina) and €10m provisions for management changes, restructuring, etc.

Unlike many leading clubs, #Milan have made very little from player sales. In fact, they have only averaged €11m profit a year since 2014, including actually losing money in two of those years. This is a third of the €33m average reported in the preceding 3-year period.

One reason #Milan have struggled financially is they have been poor at selling players. In the last 5 years, they only made €72m profit here, which is miles below Juventus €563m, Roma €372m and Napoli €325m. Not sold a single player for a profit above €20m in last 3 years.

#Milan EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered a proxy for underlying profitability, as it excludes once-off items like player sales and exceptional items, fell from €(51)m to €(76)m, the second worst in Italy, only ahead of Roma €90m.

Similarly, #Milan operating loss (excluding profit from player sales and interest) widened from €144m to €202m, down from only €23m in 2014. The traditional “Big Four” Italian clubs all make large operating losses: Juventus €234m, Roma €195m and Inter €133m.

#Milan ongoing revenue has declined €75m (30%) since 2013 from €247m to €172m, mainly due to not qualifying for Champions League, which has driven €56m reduction in broadcasting & €21m fall in commercial. By club’s definition, revenue down €86m (31%) from €279m to €192m.

As a result, #Milan’s €172m revenue is less than half of Juventus €407m and around €140m below Inter €311m. They are now 4th highest in Italy, having been overtaken by Napoli €179m, though are ahead of Roma €149m and Atalanta €141m.

Due to COVID, most clubs have seen revenue fall dramatically in 2020, so #Milan €42m reduction (excluding player loans) is actually better than Roma €90m, Inter €63m and Juventus €58m. Atalanta and Fiorentina accounts closed in December, i.e. before the pandemic.

That said, #Milan 25% revenue decrease in 2019/20 is one of the worst results of clubs that have so far published accounts with most managing to limit the damage to falls below 20% (Juventus 18%, Inter 18%, Napoli 17%). Only Roma are higher with 37%.

Based on 2018/19 accounts, #Milan dropped 3 places from 18th to 21st in the Deloitte Money League, which ranks clubs worldwide by revenue. In 2004 it was a different story, when they were ranked 3rd, generating €83m more revenue than 10th placed club, but are now €254m lower.

#Milan broadcasting revenue decreased €42m (40%) from €105m to €63m, mainly due to domestic TV dropping €27m (30%) from €90m to €63m, but also no UEFA prize money, which was €15m prior year. Top three earn much more: Juventus €166m, Napoli €121m and Inter €115m.

In 2018/19 #Milan received €77m TV money from Serie A: 50% equal share; 30% performance (15% last season, 10% last 5 years, 5% historical); and 20% supporters. However, 2019/20 revenue was €27m lower, as some income deferred to 2020/21 after a few games played in July & August.

It is imperative that #Milan qualify for Europe, ideally the Champions League, to boost their broadcasting income, as the TV rights in Serie A are relatively low. Indeed, there were big increases in England and Spain in 2019/20 and France in 2020/21, while Italy was unchanged.

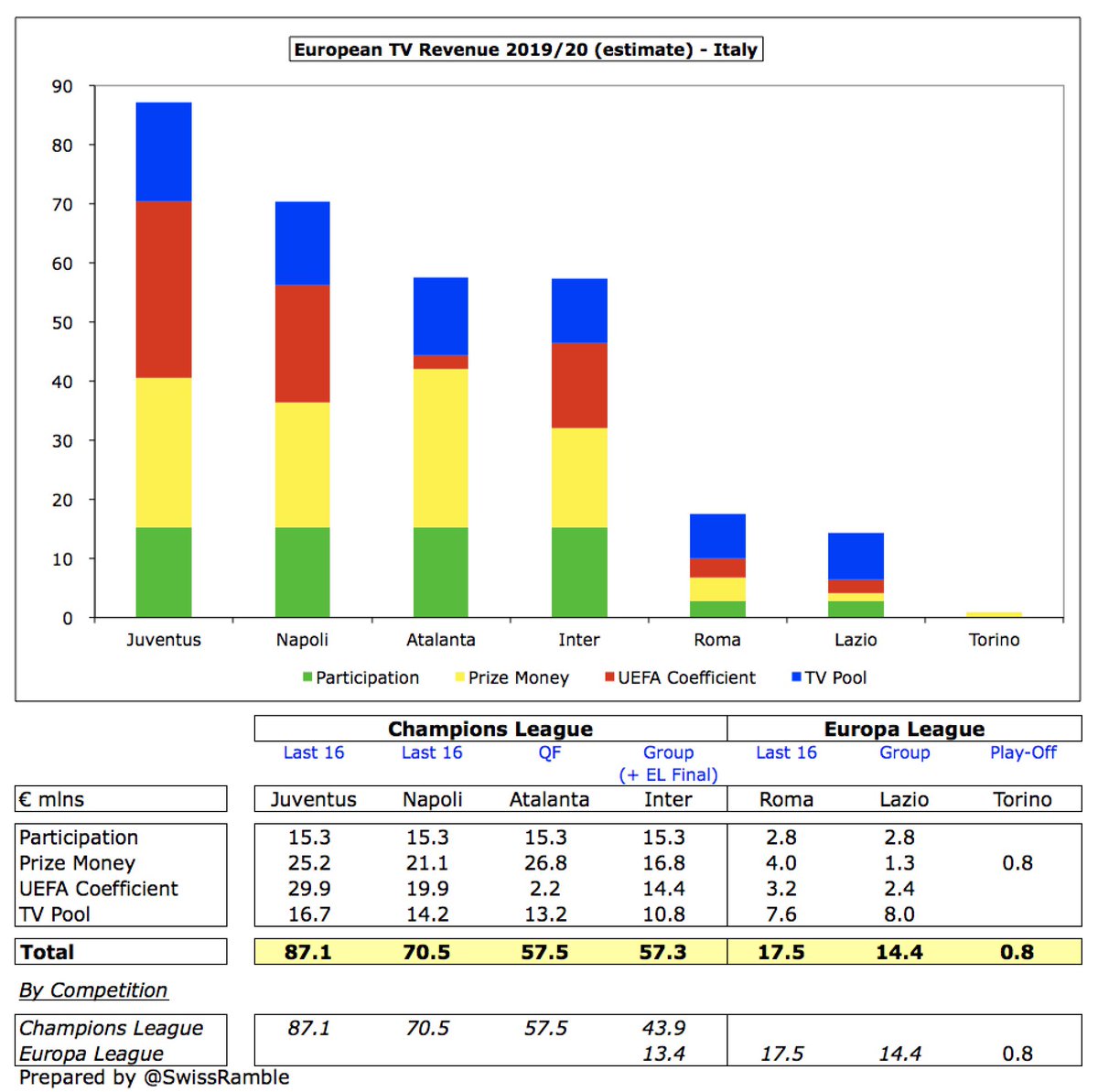

Although #Milan qualified for the Europa League, UEFA’s FFP 1-year ban meant they could not participate in 2019/20, so lost out on €15m revenue (per 18/19). Other Italian clubs took advantage with highest earners being Juventus €87m, Napoli €70m, Atalanta €57m & Inter €57m.

#Milan have only received €29m from Europe in the last 5 years, miles behind Juventus €449m, Roma €255m and Napoli €246m, due to those clubs consistently qualifying for the Champions League in recent times. Last time Milan earned decent money from Europe was 2014 (€38m).

#Milan match day income fell €10m (30%) from €34m to €24m, with reductions in domestic €9m and Europe €1m. Adversely impacted by no European games and 6 home games behind closed doors, due to COVID. This was 3rd highest in Italy, far below Juventus €49m and Inter €44m.

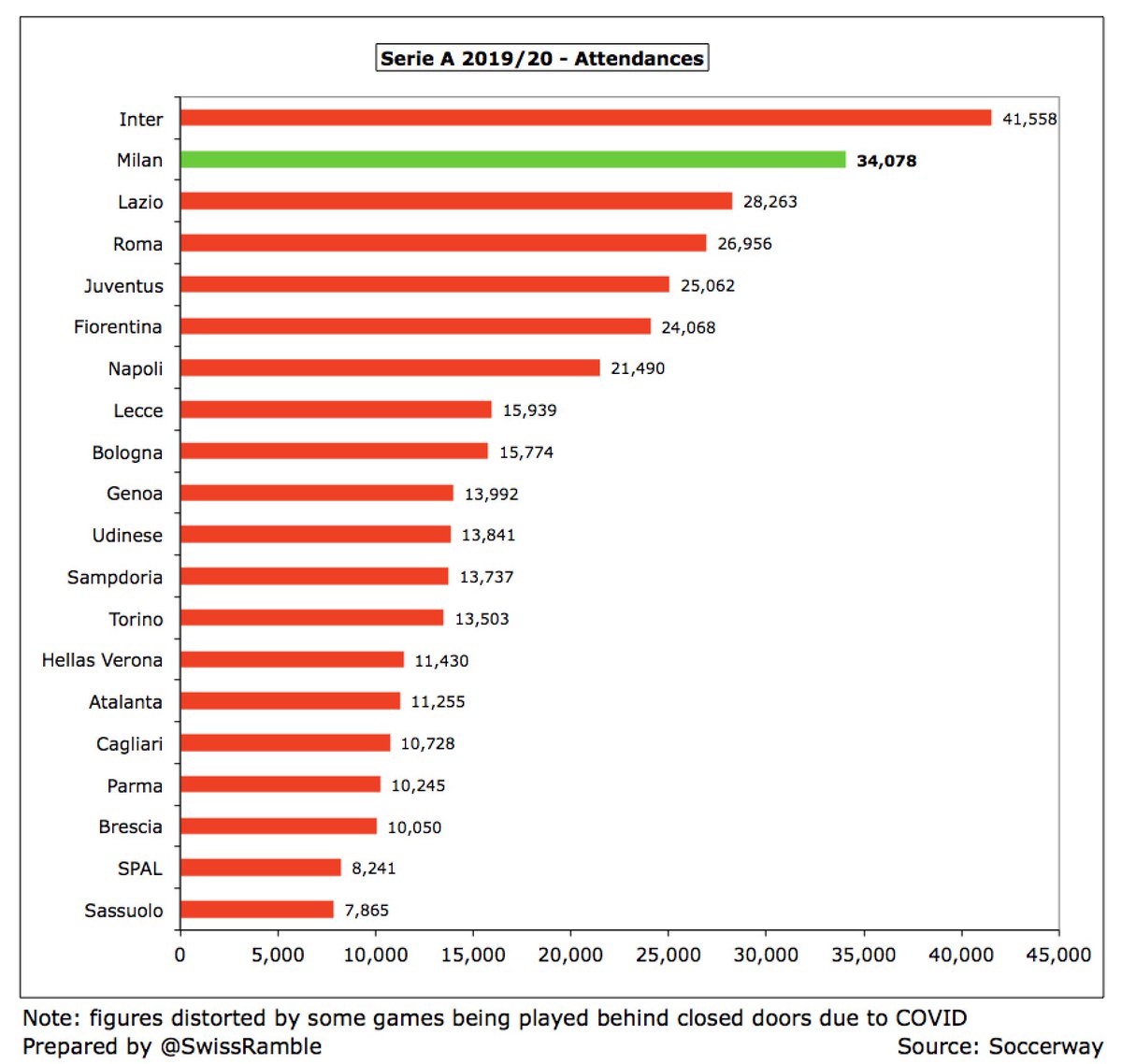

#Milan average attendance decreased from 54,639 to 34,078, again due to 6 games being played behind closed doors. This remained the 2nd highest in Italy, only below Inter 41,558, though ahead of Lazio 28,263, Roma 26,956 and Juventus 25,062, who all saw similar falls to Milan.

#Milan and Inter have been working on a joint project to build a new stadium. A plan has been approved by the council, though it required some modifications, which will preserve part of the iconic San Siro. Discussions continue, but chief executive Ivan Gazidis is “optimistic”.

#Milan commercial revenue rose €1m (1%) to €77m, as small falls in sponsorship and publicity were offset by other income. This is the third highest in Italy, but is significantly behind Juventus €186m and Inter €142m, as Milan have lost much of their brand appeal.

Just 4 years ago #Milan’s commercial income was the highest in Italy, but it has dropped €30m since then, while Juve and Inter have grown by €83m and €65m in the same period. Milan’s revenue has been flat for last 3 seasons. This is an area that Gazidis will look to improve.

#Milan Emirates shirt sponsorship has been extended to 2023 at €10m, less than previous €14m, but can now sell training, sleeve and women’s deals separately. Much lower than Juve’s Jeep deal, recently increased to €45m. Puma kit deal is worth €11m, also running to 2023.

#Milan income from player loans income fell from €13m to €8m, mainly Gustavo Gomez (Palmeiras), Suso (Sevilla) and Diego Laxalt (Torino). This is an important revenue stream for some Italian clubs with Milan only behind Inter’s €9m, but ahead of Roma and Atalanta, both €7m.

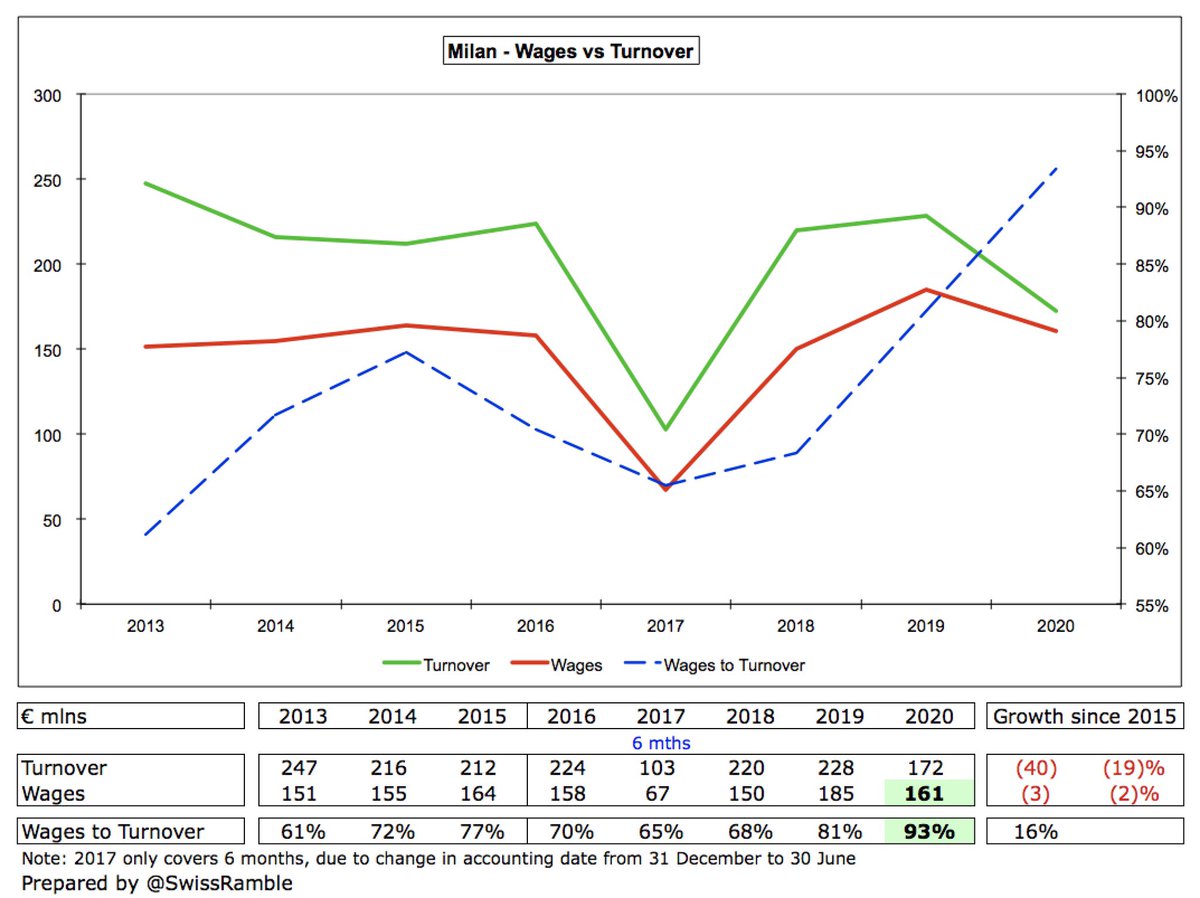

#Milan wage bill fell €24m (13%) from €185m to €161m, but wages to turnover ratio increased from 81% to 93% following the steep revenue reduction. In response to the pandemic, the first team squad did not take a salary for the month of April, equivalent to a €3.9m cut.

Since 2016 #Milan wages have slightly reduced, while there have been significant increases at most of their rivals, e.g. Inter €74m, Juventus €63m and Napoli €56m. Only Roma have seen a comparable lack of wages growth over this period.

Nevertheless, #Milan €161m wage bill is still the third highest in Italy, just ahead of Roma €155m and Napoli €141m. However, they are a long way below Juventus €284m and Inter €198m.

#Milan wages to turnover ratio of 93% is 3rd highest in Italy, only surpassed by Genoa and Roma. This is a lot higher than Napoli 79%, Juventus 70% and Inter 64%. As Gazidis said, “we have to bring our wage bill down, while increasing performance, which is not easy to do.”

#Milan player amortisation, the annual cost of writing-off transfer fees, rose €15m (18%) from €80m to €95m, which means this expense has more than doubled in 4 years (from €44m in 2016). Talk of using recent law to suspend this charge in 20/21 accounts (deferred to future).

As a result, #Milan player amortisation of €95m is the fourth highest in Italy, just ahead of Roma €94m, though still a fair way behind Juventus €167m, Inter €120m and Napoli €118m.

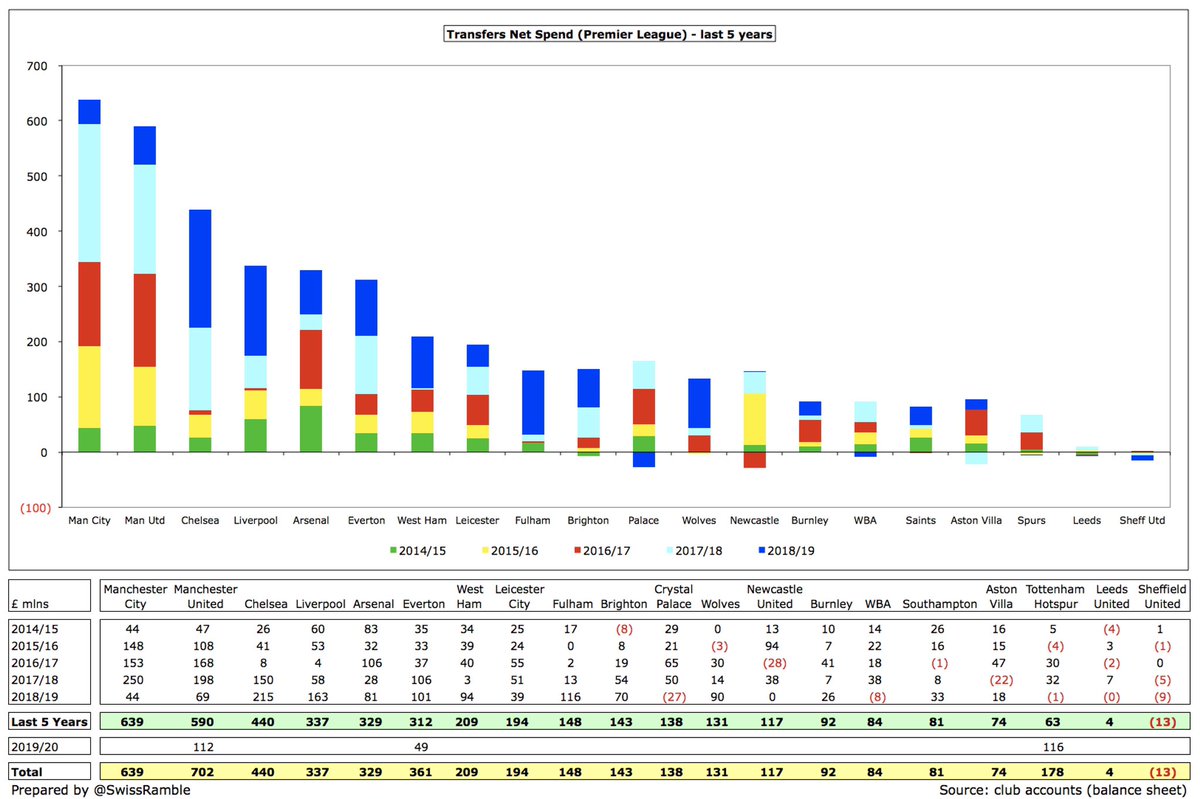

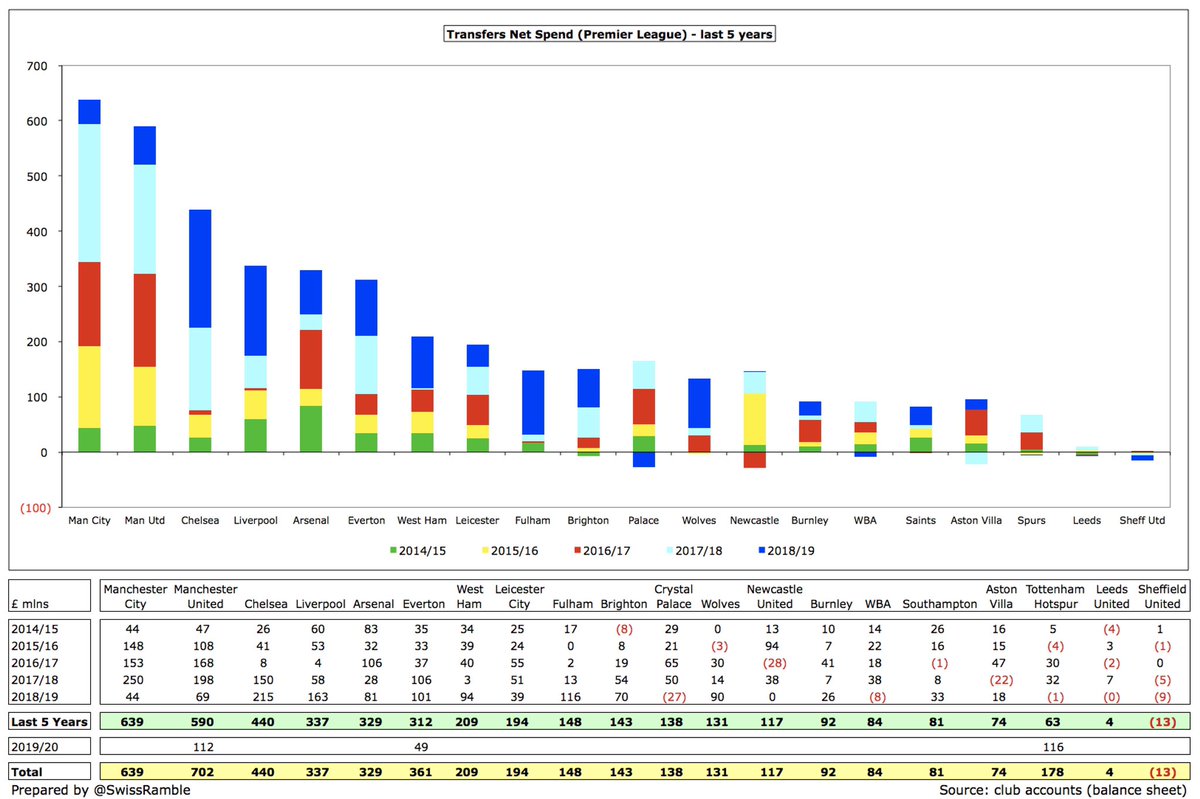

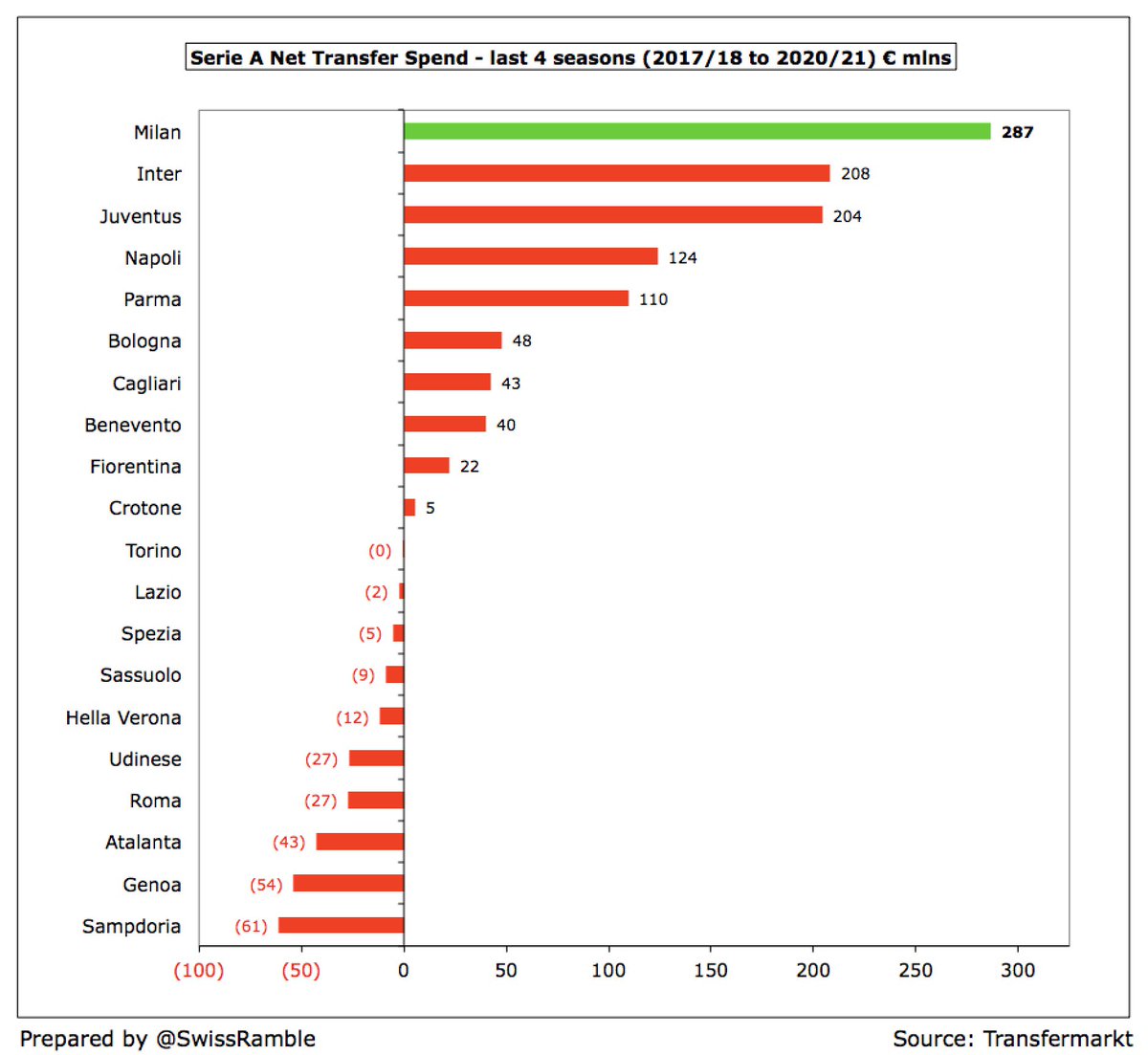

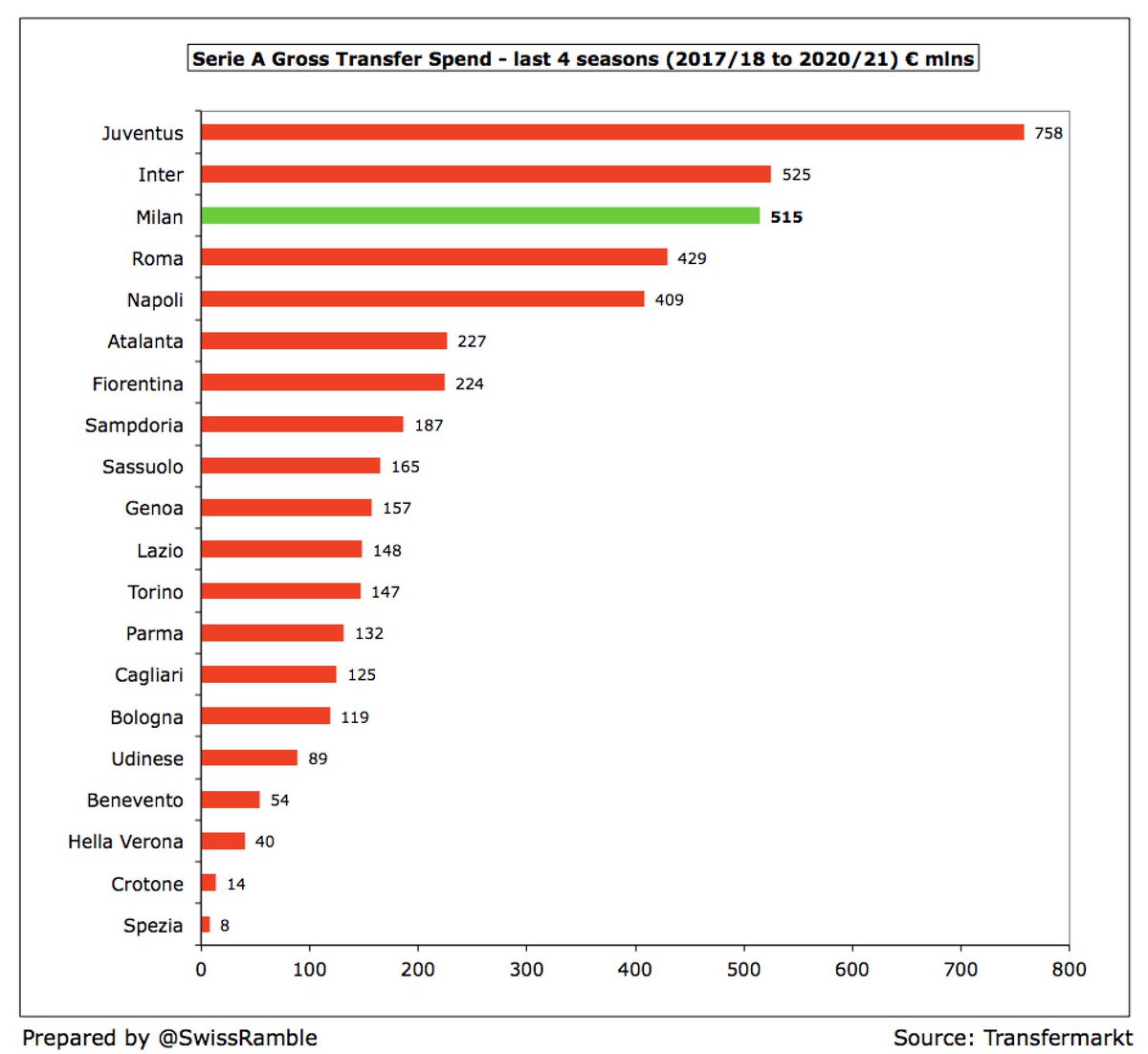

#Milan have really ramped up their expenditure in the transfer market with net spend of €287m in the last 4 years (gross €515m), though they put on the brakes this season. In 2019/20 acquired Leao €30m, Theo Hernandez €22m, Bennacer €16m, Duarte €11m and Krunic €9m.

In fact, over the last 4 seasons up to 2020/21, #Milan have the highest net spend in Serie A with their €287m well ahead of Inter €208m, Juventus €204m and Napoli €124m. In contrast, Atalanta and Roma had net sales of €43m and €27m respectively.

However, in terms of gross spend, #Milan €515m were outpaced by both Juventus €758m (partly the Ronaldo factor) and Inter €525m. In 2020/21 player purchases were only €28m, including Tonali (loan), Hauge, Rebic, Saelemaekers and Kjaer.

#Milan gross debt increased by €19m from €96m to €115m, which is due to a factoring deal with Unicredit linked to future TV revenue. Elliott repaid the bonds and shareholder loans from the previous Chinese ownership a couple of years ago.

#Milan €115m gross financial debt is by no means the highest in Italy, and is below Inter €461m (Goldman Sachs financing), Juventus €396m (mainly for new stadium) and Roma €318m (mainly bond issue). Milan’s debt was as high as €260m in 2013.

Thanks to Elliott’s early repayment of the bonds, #Milan net interest payable is down to €6m (from prior year’s €10m), a lot better than Roma €32m, Inter €26m and Juventus €15m. The rossoneri have reduced this expense from €23m in 2018, which is a positive from the owners.

#Milan have also been successful in reducing gross transfer debt in last 2 years from €172m to €76m, falling from €119m to just €20m on a net basis, i.e. considering amounts owed by other clubs. Gross payables much lower than Juventus €301m, Roma €191m and Napoli €143m.

#Milan cash balance fell from €13m to €11m. Most Italian clubs hold very little cash with the exception of Napoli’s incredible €124m. It is likely that the balance at Inter €55m and Udinese €20m will be lower after they publish their detailed COVID-impacted 2019/20 accounts.

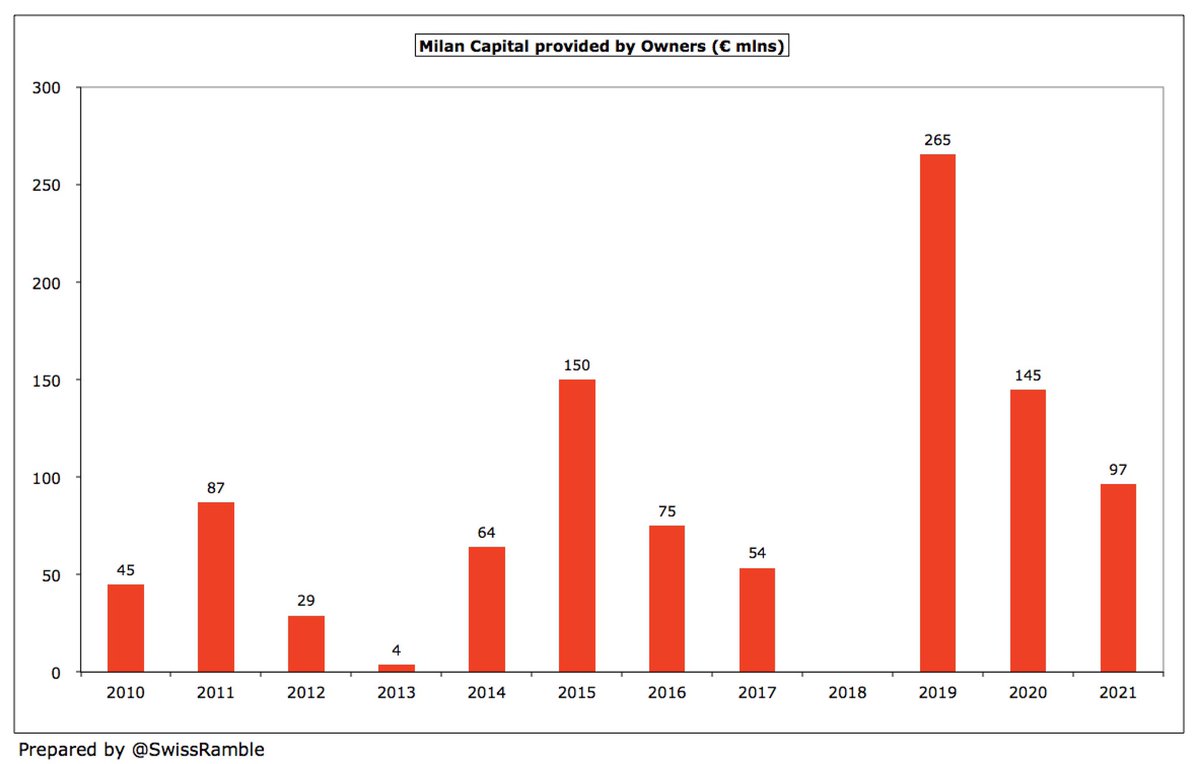

#Milan have been very reliant on increases in capital from their owners, including €145m from Elliott in 2019/20 plus a further €97m after the accounts closed, making €507m in 3 years. Since 2014 various owners have had to put in around €850m to cover the club’s large losses.

#Milan have had problems meeting Financial Fair Play regulations, initially resulting in UEFA banning them for 2 years from European competitions. This was overturned by CAS, but the club eventually agreed a 1-year ban, missing out on the Europa League in 2019/20.

Despite UEFA relaxing their FFP rules, e.g. adjusting for COVID losses and combining 2019/20 and 2020/21 seasons, the club still anticipates some form of future sanction. However, Gazidis confirmed that next evaluation will only take place in October 2021.

Like all other clubs, #Milan 2019/20 results have been hit by COVID, but their operational performance was already suffering before the pandemic struck. Their young team needs to continue to perform on the pitch, as Champions League money is vital for the project to succeed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh