Thread: Trade Plan - My thoughts and experience.

You must have heard “Plan your trade and trade your plan”.

#tradeplan #trading #investing #definedge

You must have heard “Plan your trade and trade your plan”.

#tradeplan #trading #investing #definedge

Many experienced traders, authors and analysts keep saying trade as per your plan.

You must write your plan of taking trades and focus on the execution. But you will not see many people really doing that - even many experienced traders.

Possible reasons:

You must write your plan of taking trades and focus on the execution. But you will not see many people really doing that - even many experienced traders.

Possible reasons:

1. Lack of awareness – What’s Trading plan?

2. Do not know how to do that or need guidance.

3. We keep learning new things, making it difficult to stick to a plan.

4. Like to rely on other’s studies and recommendations, no need of plan.

5. Trading is art, not science.

2. Do not know how to do that or need guidance.

3. We keep learning new things, making it difficult to stick to a plan.

4. Like to rely on other’s studies and recommendations, no need of plan.

5. Trading is art, not science.

6. Technical analysis does not work.

7. Don't believe in process because of the belief that market is a game of speculation, you need good judgement & info to make money.

8. Lot of people share their studies & showcase their talent to predict. Hence plans do not necessarily work.

7. Don't believe in process because of the belief that market is a game of speculation, you need good judgement & info to make money.

8. Lot of people share their studies & showcase their talent to predict. Hence plans do not necessarily work.

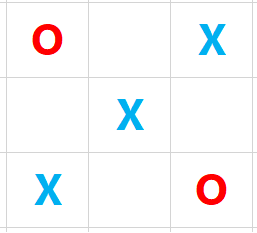

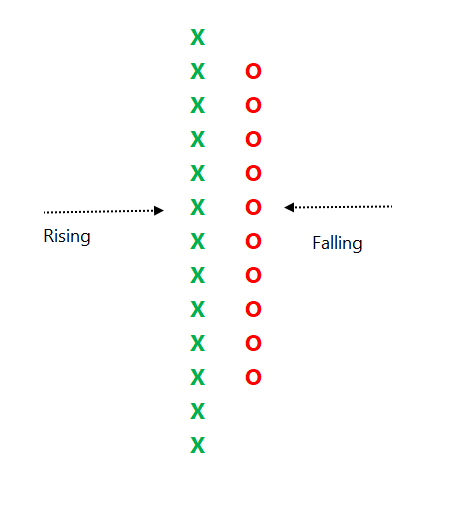

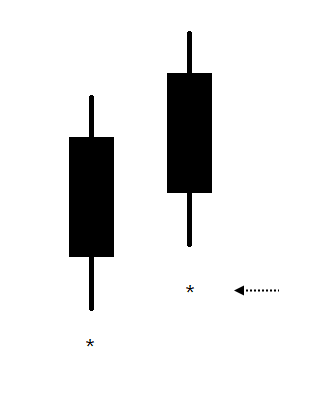

For point 1 –Trading plan is deciding your process of taking the trades. Which instruments or universe you will trade, what parameters, entry & exit conditions, position size, maximum risk that you will take, steps you will follow etc everything is mentioned in the trade plan.

It should be a clearly mentioned and there should not be any ambiguity.

For 2- The format is easily available. We have got a good data to study this behaviour. We have been making people write trading plan since last many years. Sharing what I have learnt.

For 2- The format is easily available. We have got a good data to study this behaviour. We have been making people write trading plan since last many years. Sharing what I have learnt.

Almost everyone likes the concept initially. We make the format available and explain them how to write it. We even give a sample trade plan. Very few however actually write their own plan, and fewer still end up sticking to the plan for a considerable time.

Is trading a plan same as trading system or Algo trading? Trade plan is a pre-requisite of designing an objective trading system or Algo.

For Point 3, 4, 5 - Trade plan can be prepared for all types of traders and investors, and for subjective analysis as well.

For Point 3, 4, 5 - Trade plan can be prepared for all types of traders and investors, and for subjective analysis as well.

For example, deriving tradeable ideas based on chart analysis can or "Friend ne bola" can be a part of entry conditions. Gradually it will keep improving. We keep learning and evolving - your plan will also undergo changes and improvement

For 6 – It is not only about TA. For 7&8 - Trade plan will not suit them.

Mentioning the thought process clearly on paper will allow us to prepare a check list. That will allow us focus on the process rather than the outcome. It will help us to manage risk & curtail over trading

Mentioning the thought process clearly on paper will allow us to prepare a check list. That will allow us focus on the process rather than the outcome. It will help us to manage risk & curtail over trading

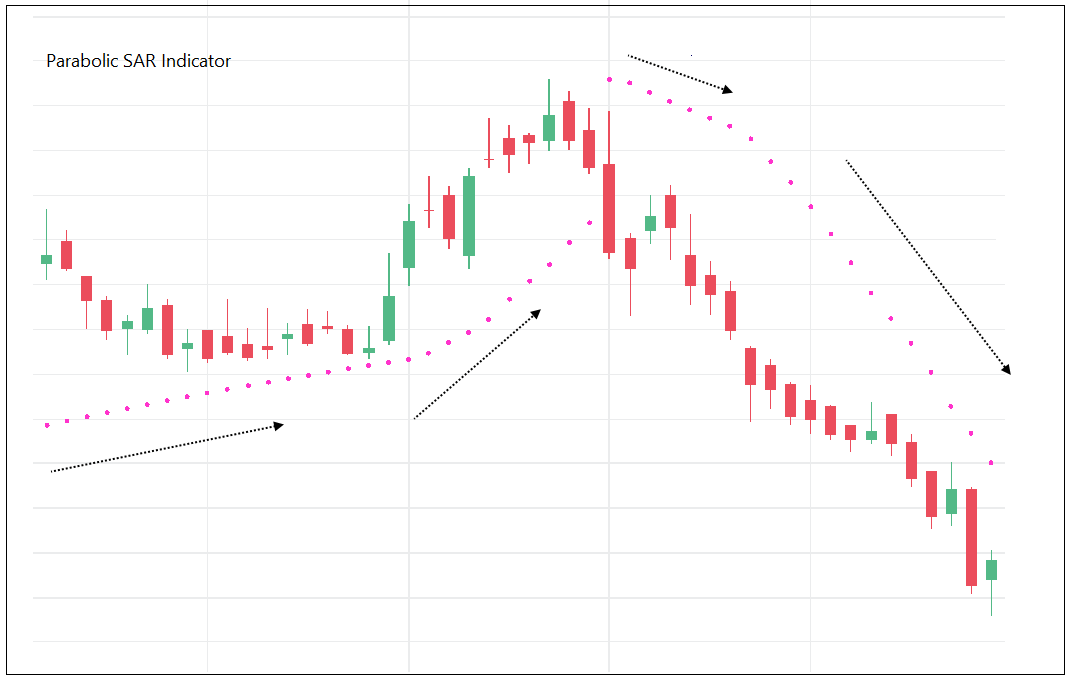

I believe in allowing some conditions in Trade plan which can't be clearly defined. Eg: I'll study the market phase before deciding on the trade. Because I may not be clear right now about how to define it. If I find some way to define it, I will add that in the plan. This way,

I'll know my pain areas as well. Practical trading has a lot to do with handling the emotions – Trade plan is a good tool to organise ourselves.

Think about this. If everything happens as per my like, wish or passion – there is no need to go to the school in the first place.

Think about this. If everything happens as per my like, wish or passion – there is no need to go to the school in the first place.

There are endless techniques, methods, and market experts. Trade plan is an essential tool to regulate our thoughts and remain focussed.

There must be a separate plan for each time frame & universe. If you learn a new method – study, get convinced, write a sample plan first.

There must be a separate plan for each time frame & universe. If you learn a new method – study, get convinced, write a sample plan first.

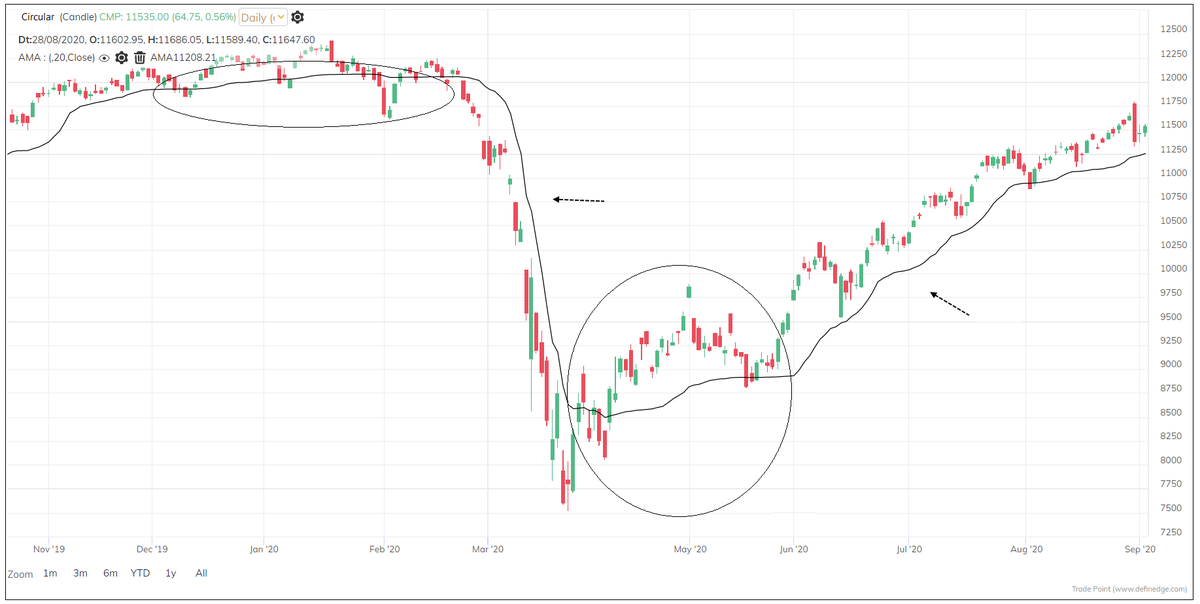

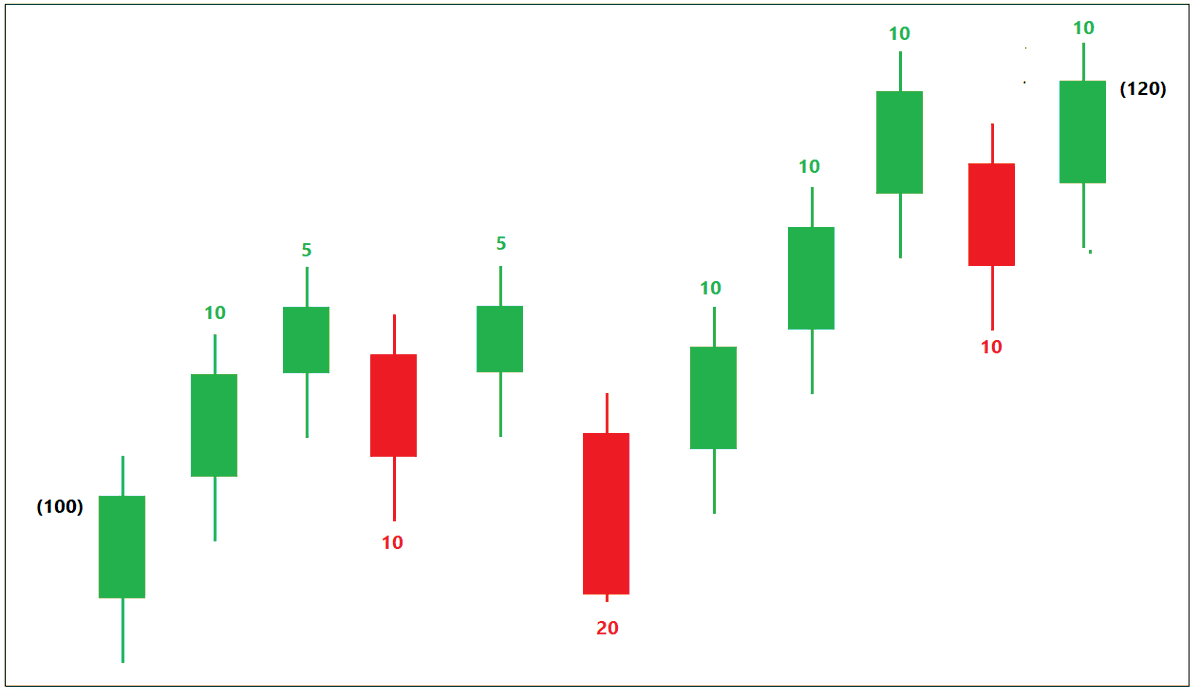

Do not fiddle with your active and tested plan. Remember, markets are dynamic. A trade plan should have provision for dealing with different scenarios and volatility. There can be separate plans for event days. Idea is - a good documentation of the process.

Lot of experienced people rely on their judgement which they have got after years of practicing. You need to survive till you develop that. As they say, initially in markets you have money, no experience. Later, you have lots of experience but no money. Let that not happen.

It is not necessary to gain good prediction skills to trade the markets successfully. Trading can be treated as a business which needs well defined process and execution.

I have thoughts on types of plan but that is for a future thread.

I have thoughts on types of plan but that is for a future thread.

Even after reading abt the plan & having the format, it may still be difficult to write a plan or stick to it. If you can manage to do that, you will gain a significant edge in the business of trading. I strongly advocate process-oriented trading. Trade plan is an imp part of it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh