1. Every time the Altcoin market has dipped as of late...

People forget that Altcoin Market Cap broke its 2017 highs

Let's take a look at the last time Altcoin Market Cap broke its old All Time High just to truly appreciate how significant an event this really is...

A thread:

People forget that Altcoin Market Cap broke its 2017 highs

Let's take a look at the last time Altcoin Market Cap broke its old All Time High just to truly appreciate how significant an event this really is...

A thread:

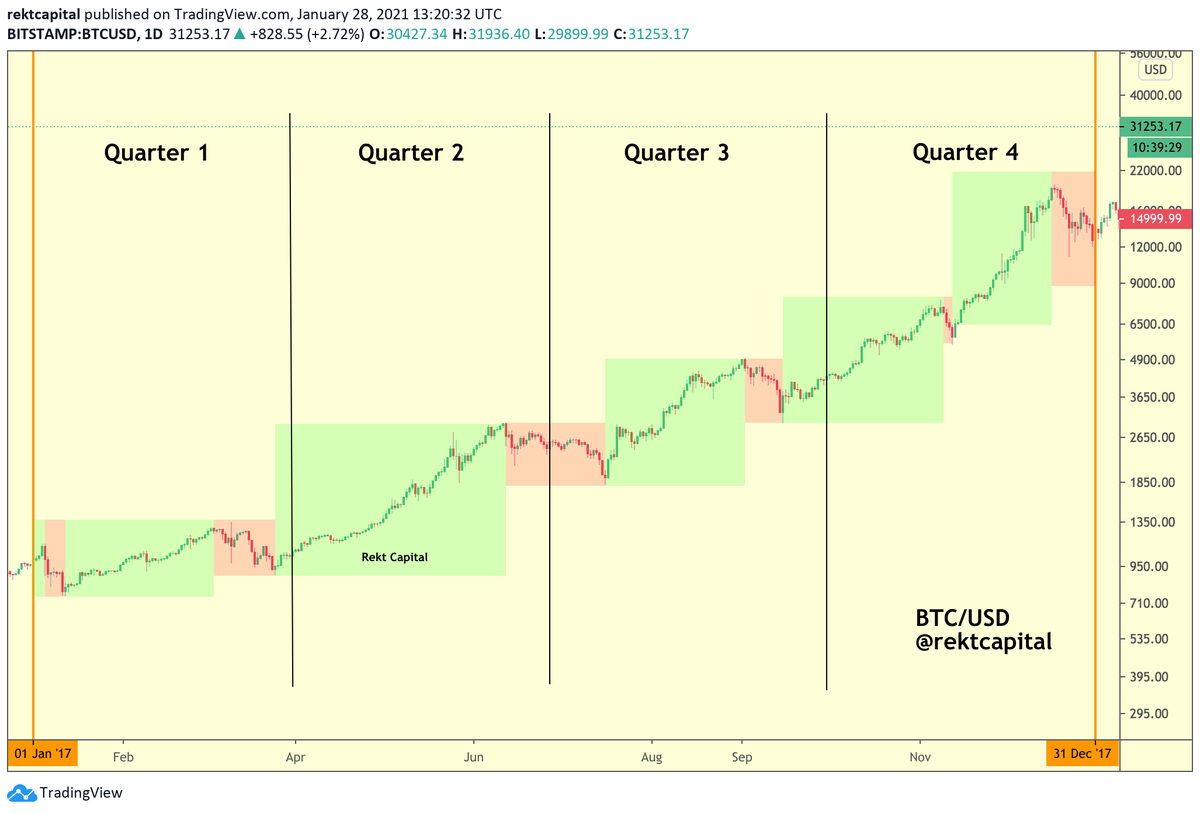

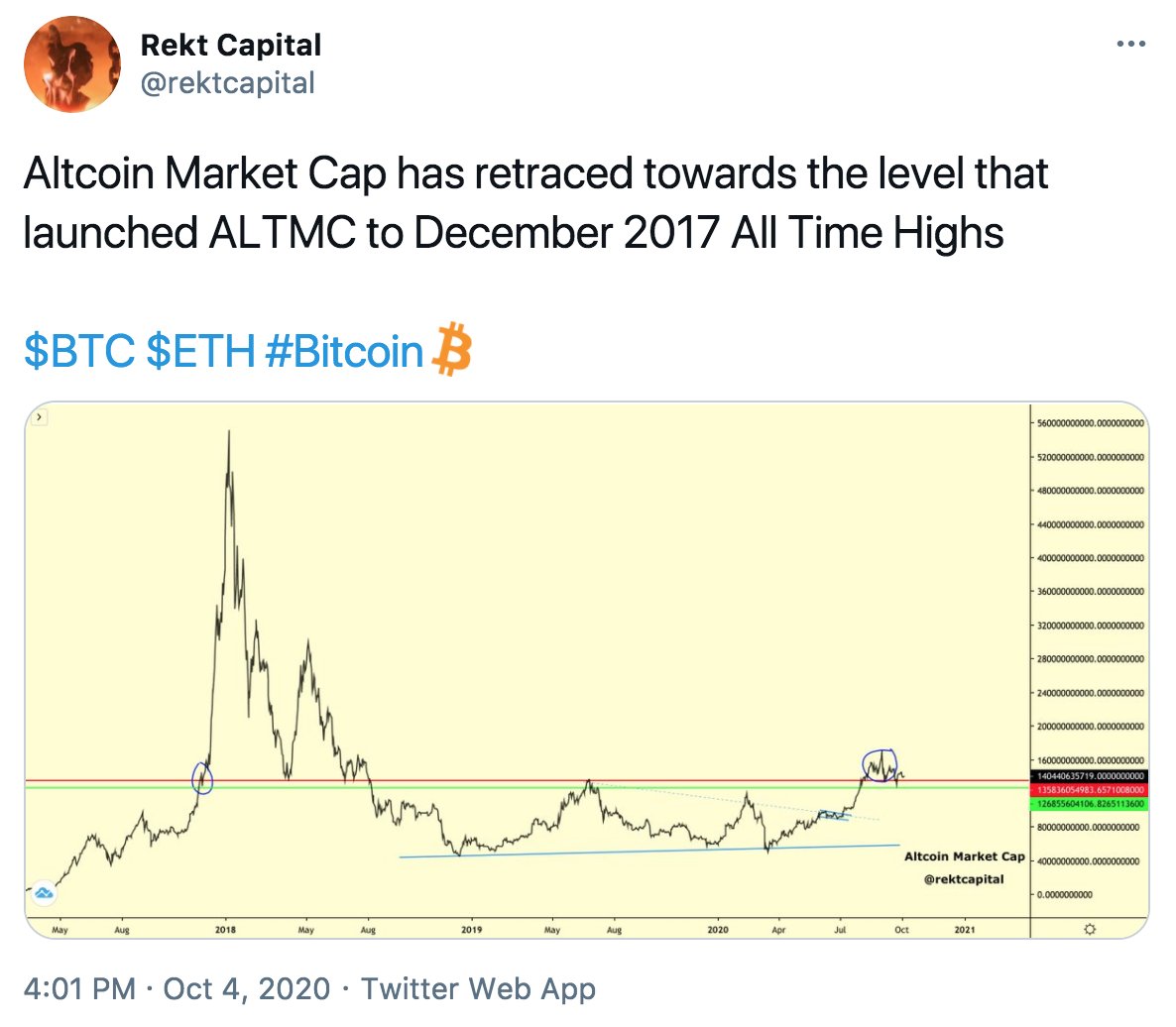

2. Back in October 2020, Altcoin Market Cap was testing the same exact area that propelled Altcoins to reach the 2017 All Time Highs...

3. In the months since, Altcoin Market Cap has simply gone vertical

Altcoin Market Cap has been growing without pause until...

Altcoin Market Cap has been growing without pause until...

4. Altcoin Market Cap finally revisited the 2017 highs...

And broke them

Altcoin Market Cap is now in Discovery mode

But why is this so important?

Let's take a look at the last time Altcoin Market Cap broke its old All Time High to appreciate why...

#ALTSEASON

And broke them

Altcoin Market Cap is now in Discovery mode

But why is this so important?

Let's take a look at the last time Altcoin Market Cap broke its old All Time High to appreciate why...

#ALTSEASON

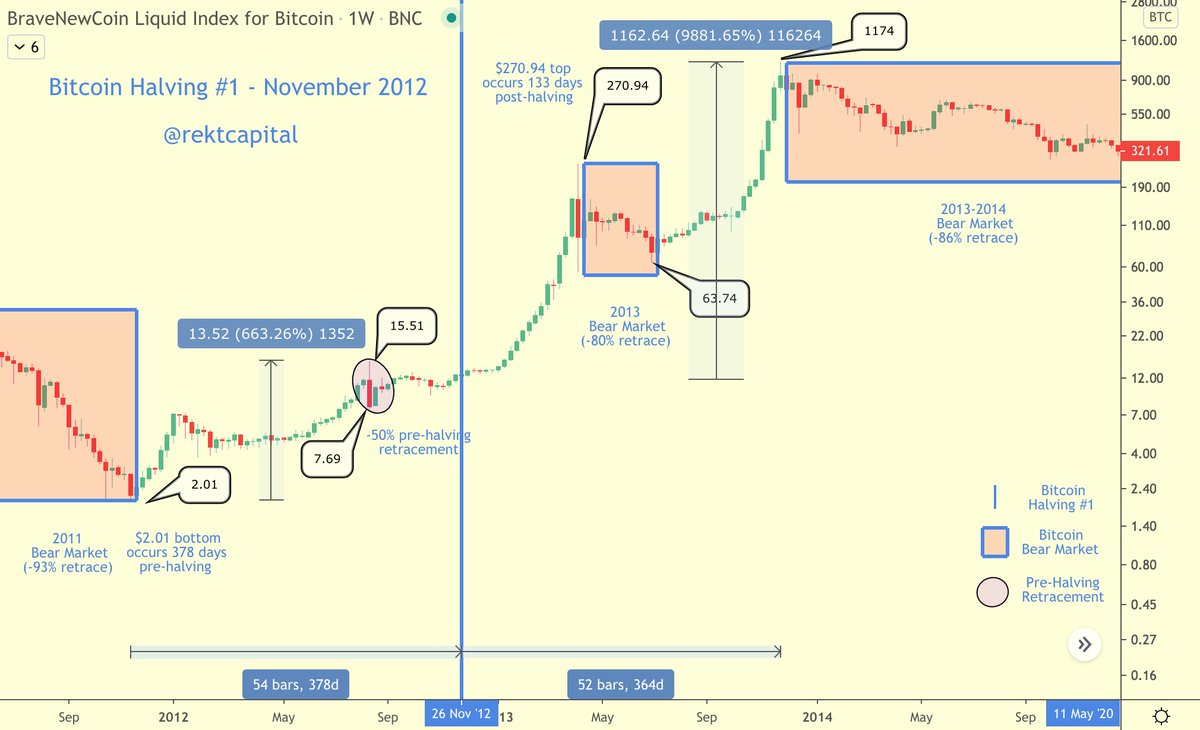

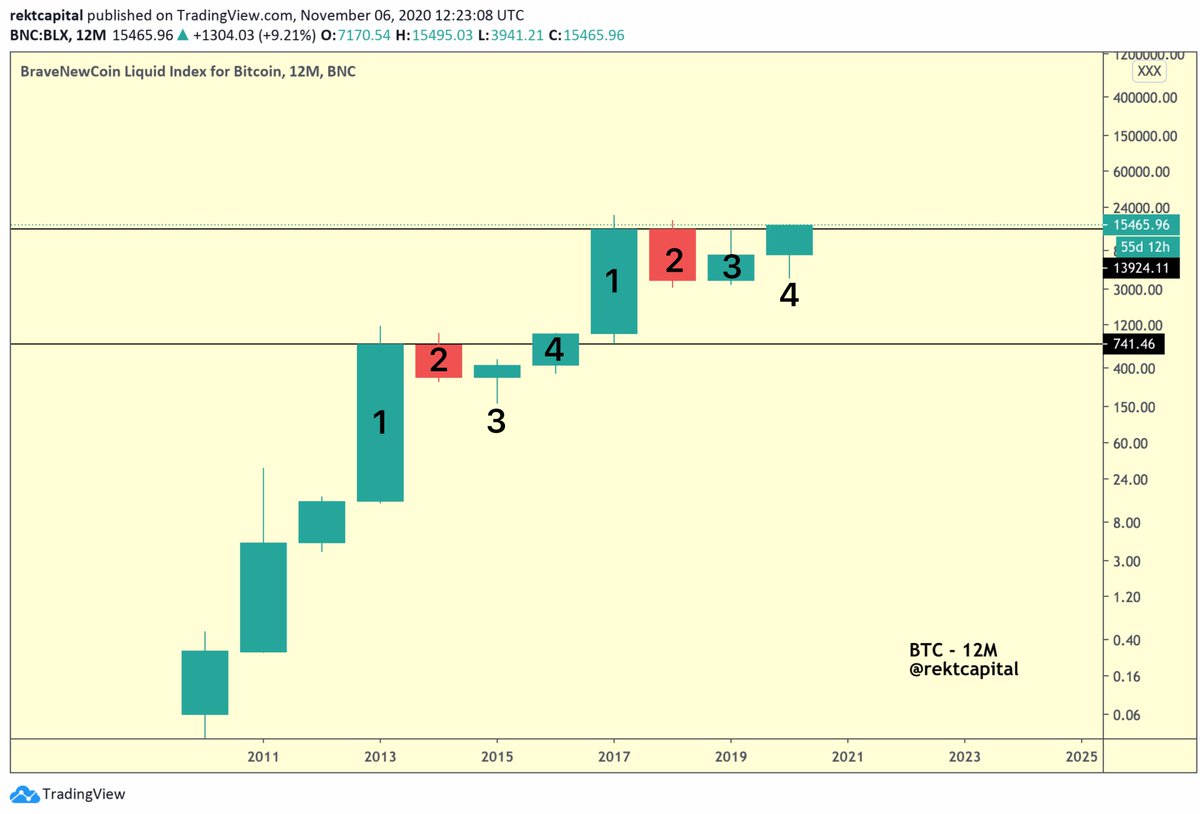

5. The last time Altcoin Market Cap broke its old All Time High (red)...

Altcoin Market Cap increased by +27,000%

Altcoin Market Cap increased by +27,000%

6. If you like this thread...

You'll really like my newsletter

Cutting-edge cryptocurrency insights, straight to your inbox three times a week

Feel free to signup:

rektcapital.substack.com

You'll really like my newsletter

Cutting-edge cryptocurrency insights, straight to your inbox three times a week

Feel free to signup:

rektcapital.substack.com

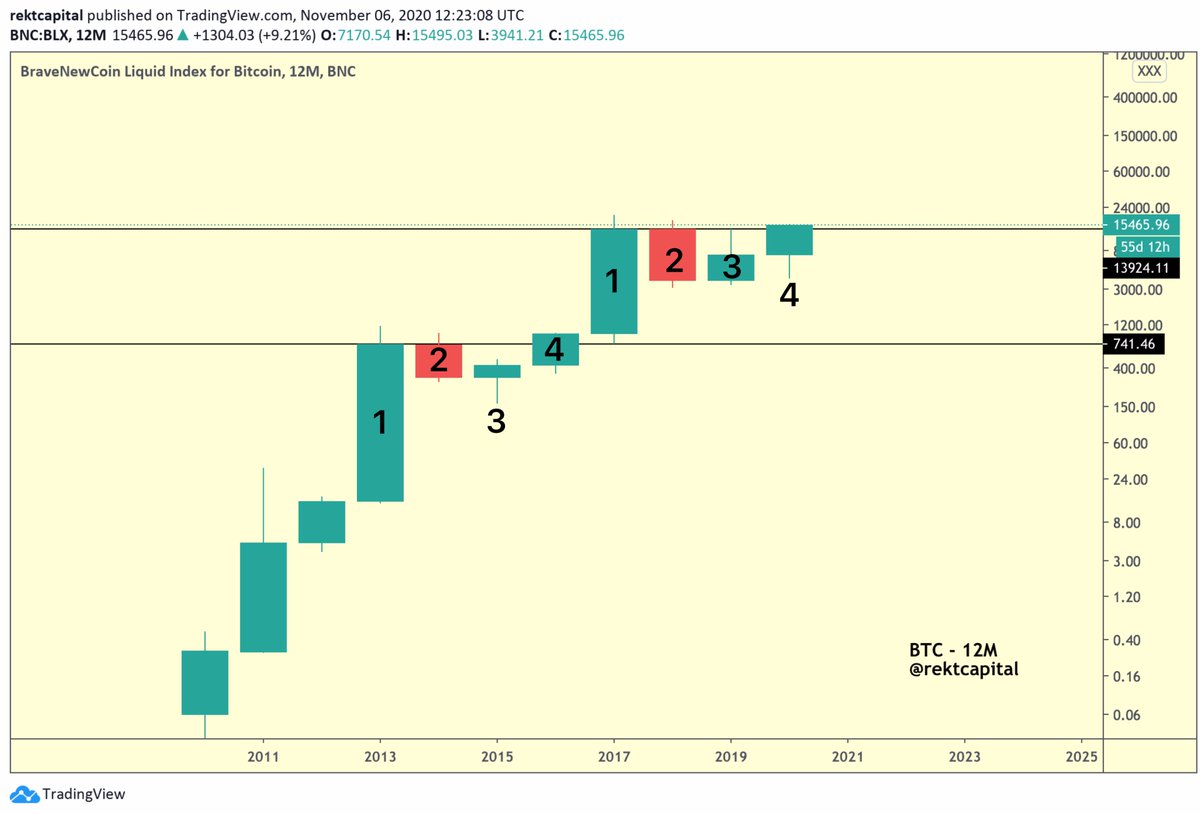

7. The first time Altcoin Market Cap rejected from its old All Time High in 2014...

It took Altcoin Market Cap over 1000 days (!) to once again revisit this very same old All Time High

And when it did - ALTMC then turned this same level into one of support (green)

It took Altcoin Market Cap over 1000 days (!) to once again revisit this very same old All Time High

And when it did - ALTMC then turned this same level into one of support (green)

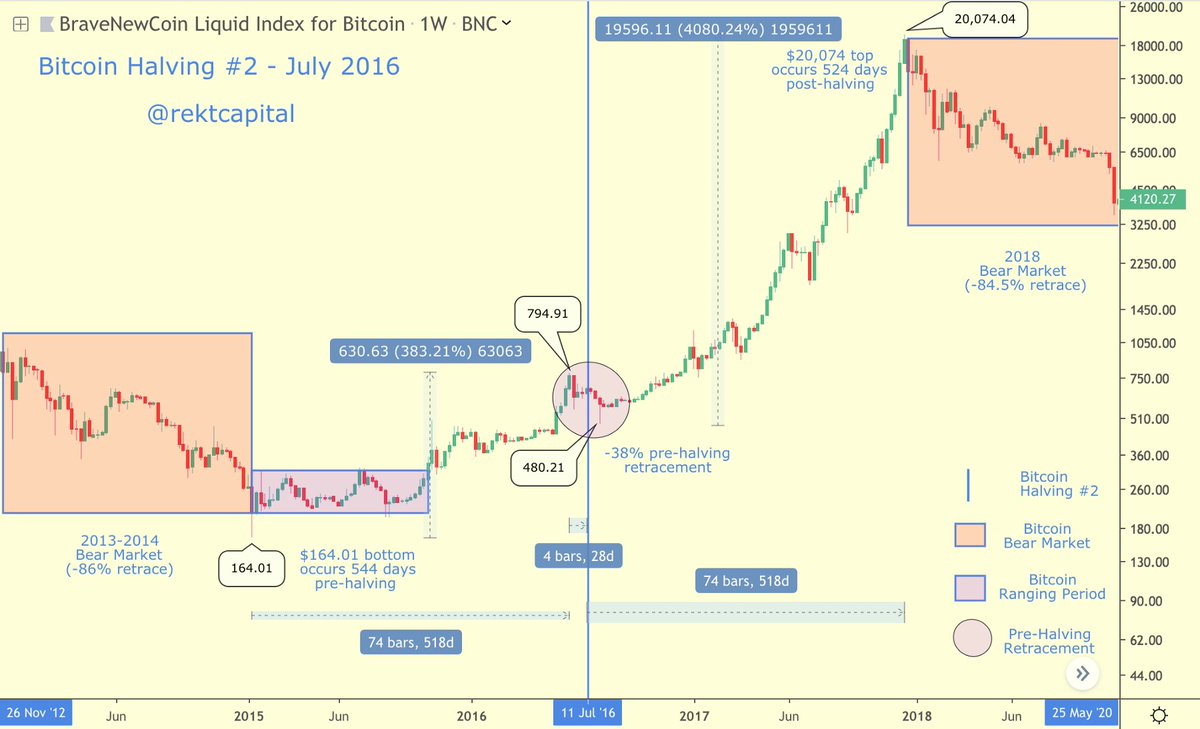

8. And once Altcoin Market Cap finally broke its old All Time High in December 2016...

It took Altcoin Market Cap just over a year to rally +27,000% to new unimaginable highs

It took Altcoin Market Cap just over a year to rally +27,000% to new unimaginable highs

9. It is remarkable how history is repeating itself as we speak:

• It took Altcoin Market Cap over 1000 days to revisit its old ATHs

• Recently broke its 2017 highs

• May be turning this level into support (green)

• On the cusp of a new exponential uptrend...

• It took Altcoin Market Cap over 1000 days to revisit its old ATHs

• Recently broke its 2017 highs

• May be turning this level into support (green)

• On the cusp of a new exponential uptrend...

10. If history continues to repeat...

Altcoin Market Cap will soon turn the 2017 highs into an area of support

And then springboard into an exponential uptrend that will see Altcoin Market Cap grow by +1000's of %

This uptrend could take up to a year to peak

Altcoin Market Cap will soon turn the 2017 highs into an area of support

And then springboard into an exponential uptrend that will see Altcoin Market Cap grow by +1000's of %

This uptrend could take up to a year to peak

11. Altcoins are still very early on in their macro Bull Market

Altcoin Market Cap breaking to new ATHs is a testament to that

If you liked this nutshell of insights, you’ll love the newsletter where I share more extensive analysis

Feel free to sign up

rektcapital.substack.com

Altcoin Market Cap breaking to new ATHs is a testament to that

If you liked this nutshell of insights, you’ll love the newsletter where I share more extensive analysis

Feel free to sign up

rektcapital.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh