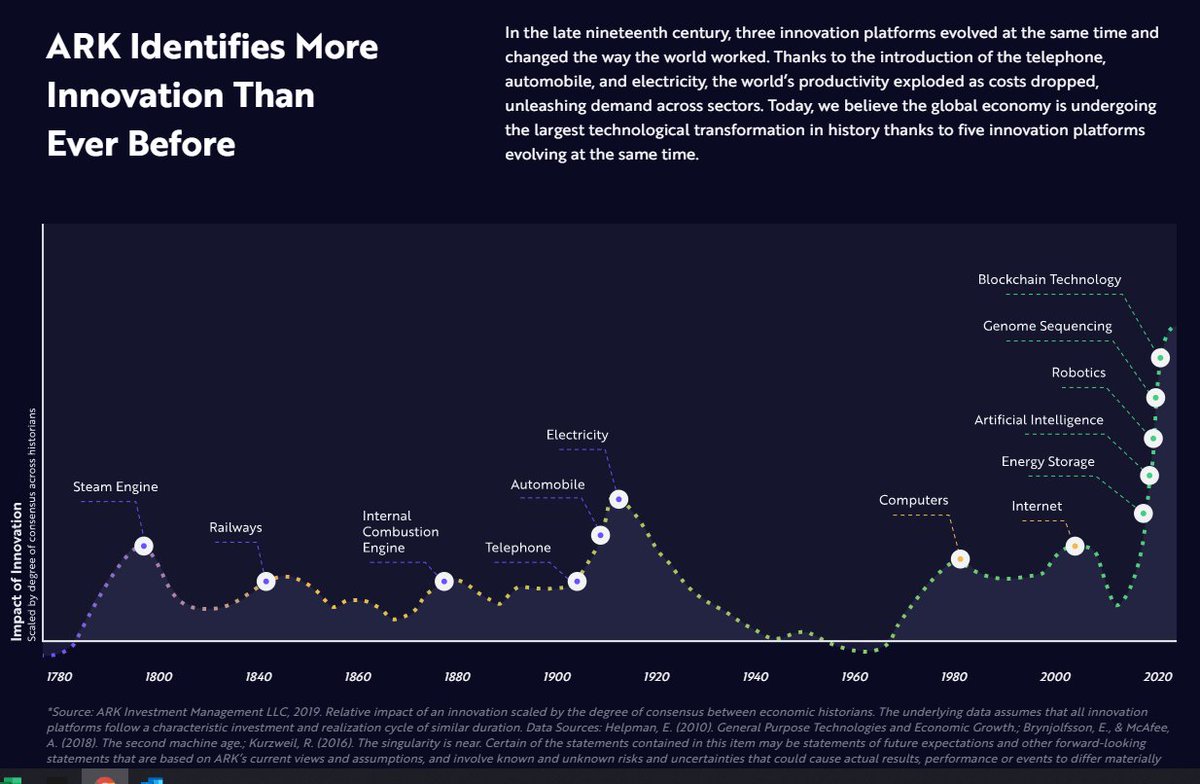

This is the third edition of my tweetstorms on #GeneTherapy #CellTherapy #GeneEditing. This one compares $SGMO to $CRSP and attempts to look at #GenomeMedicine from the perspectives laid out by C.Woods at ARK This is part one of the series. Pt 2 tomorrow AM 1/20

The charts of both are attached and useful context. $CRSP went public in 2016. The weekly chart is attached and notes the pct ownership of $ARKG $ARKK since CY18. Prior the stock was stagnant below the support/resistance levels show. 2/20

I'm including two charts for $SGMO. Wkly and Mthly. The weekly shows they were pulled along with the #geneediting group The monthly shows this rally/bust cycle is not unique. Compare the SGMO 2017-2018 to CRSP. Pretty similar. More later. 3/20

Cash activity is always important for precommercial bios so here's a snapshot of both $CRSP and $SGMO. Note cash runways of 5.1 and 3.4 yrs. Both in strong positions. More on equity and cash outlook later. 4/20

Technology is positioned as a key differentiator by both $CRSP and $SGMO. See ASGCT definition of #GeneTherapy (global). Bottom line: both are attempting to cure diseases safely introducing, removing, or changing a person's genetic code. 5/20

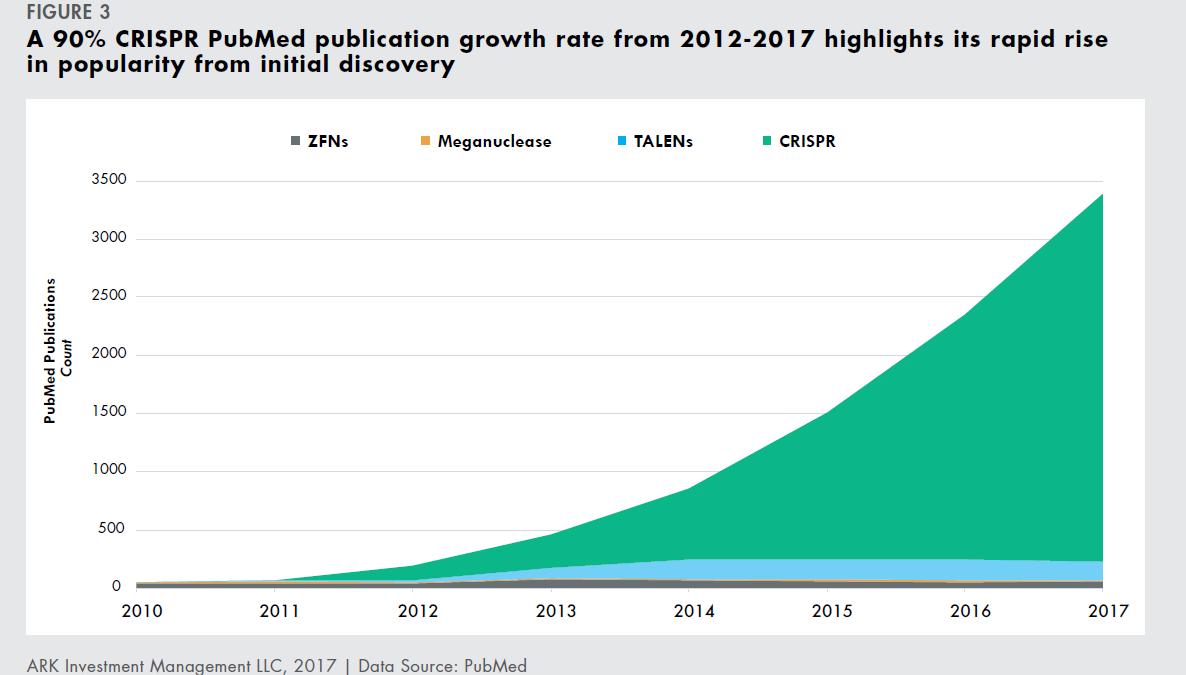

There are four classes of engineered nucleases which are common in #GeneEditing. #ZFN has been around for much longer while #CRISPR is relatively new. 6/20

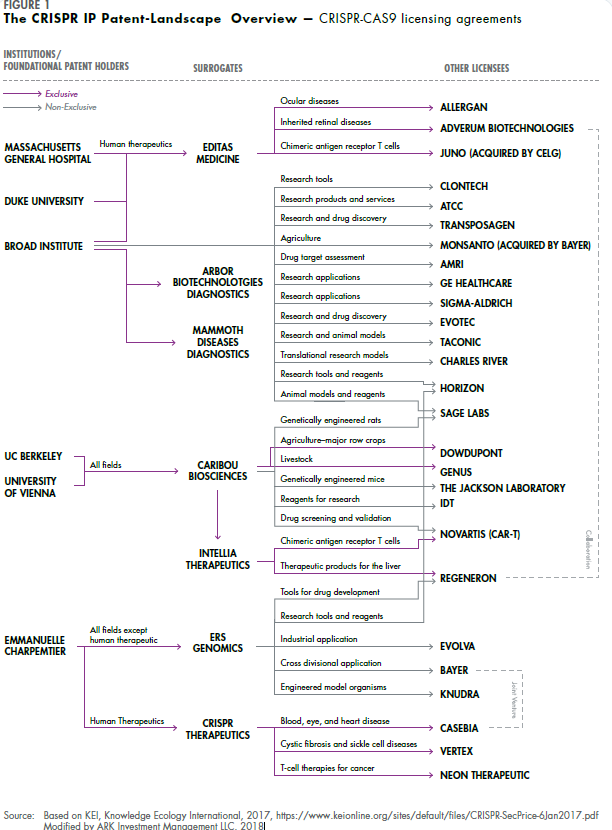

In any emerging new technology, Intellectual Property IP is critical. $SGMO has a virtual monopoly on #ZFN #ZFP. $CRSP is one of several companies with competing IP claims that are under dispute. More later. 7/20

Controlling spend and burn is critical for cos with no short window to comm. Pts on their approaches is useful. $CRSP has a narrow focus on #CellTherapy + primarily owned or co-owned prods. $SGMO is far more broadly focused. Big neg at CRSP is IP costs/legal def 8/20

The focus difference leads to higher risk/reward at $CRSP. They spent $71m per clinical program in C20 vs $50m More on programs later but note decline for SGMO vs increase for CRSP. 9/20

Employees adds context to spend. $CRSP has 410 ees (in US) of which most (354) are R&D. Strong allocation of resources. $SGMO has a similar ee count of 413 but they have fewer R&D employees with a global presence in UK/France and 34% of staff in mfg/TechOps. 10/20

Quick look at Cap Equip spending for each. Note $SGMO intangible assets from acquistion of TxCell for CAR Treg assets. 11/20

Not only is $CRSP on the hook for defense of IP that they are licensing and and paying commercial royalties for, they are in licensing more to accelerate development which costs more on backend. 12/20

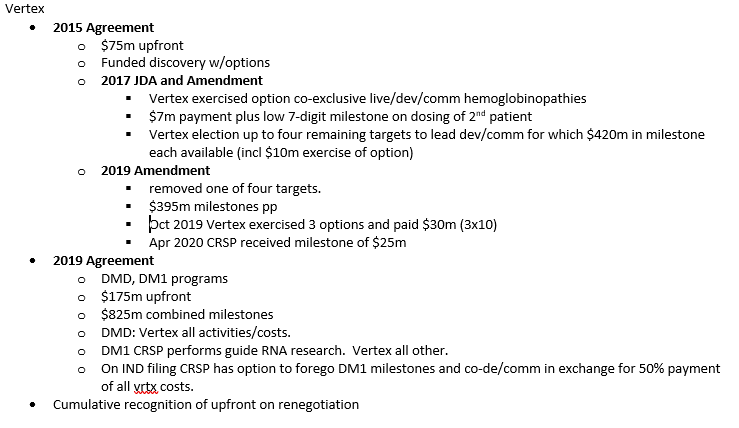

A look at current revenues before we move on. $CRSP had a number of amendments to their $VRTX agreement with resulted in a complete recognition of the upfront. Historical revenues are tied to upfronts with some milestone more later. 13/20

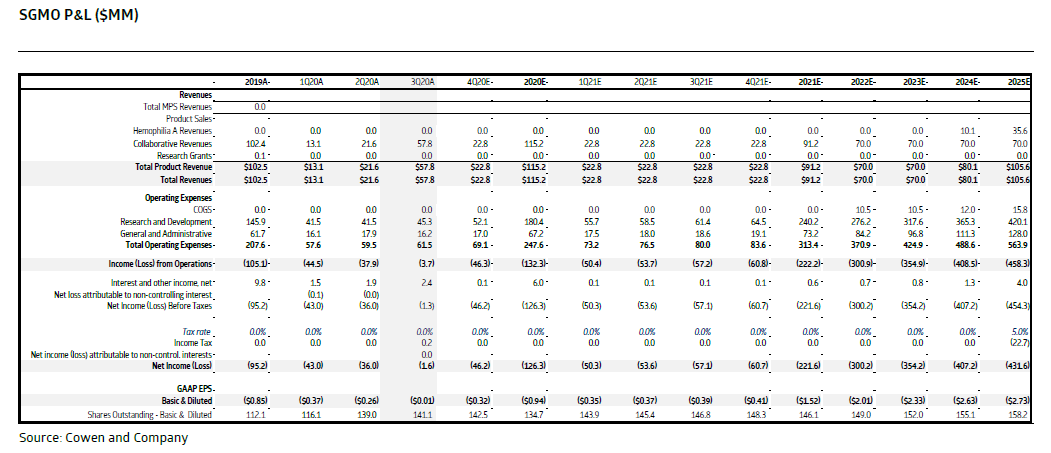

$SGMO upfront revenues are recognized over the period of their involvement (like most). They have a layered collab structure which funds and informs progress. 14/20

The respective pipelines come next as we get more into value and expectations. $CRSP has 5 clinical programs and one preclinical program. $SGMO has 4 clinical (not incl HIV) and 13 preclinical programs. 15/20

More importantly, $CRSP is only focused on #CellTherapy while $SGMO has programs in all modalities. This is important to my valuation perspectives later 16/20

Both $CRSP and $SGMO are pursuing ex vivo edited hemoglobinopathy and oncology Cell Therapies. stem cell programs have significant undefined risk due to multiple issues surrounding ex vivo editing and the use of preconditioning ablation treatment. 17/20

We don't yet know why $CRSP so far has better data than what $SGMO has published on Hemoglobinopathies. SGMO claims they have about the same editing efficiency but additional data needs to be released 18/20

CAR-T cell therapy is a very popular arena driven by the enormous existing #oncology revenue base to disrupt. 19/20

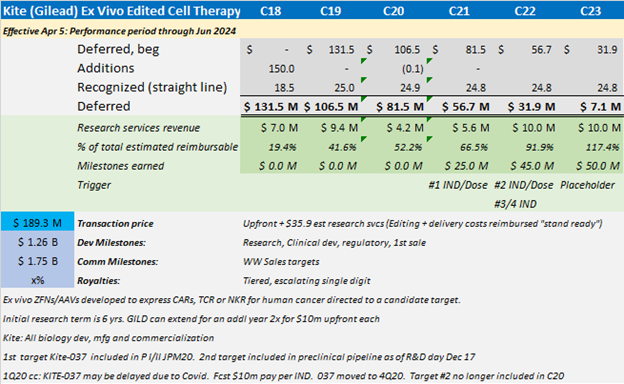

$CRSP has 3 owned programs while $SGMO is collaborating with $GILD. The SGMO collab appears stalled which is problematic given the growing base of competitive products being pushed forward in the field. 20/20

That's enough for tonight and mostly housekeeping. Tomorrow I'll turn to valuation perspectives and whatever I forgot tonight. The outlook for this sector is a couple decades so don't think anyone has missed any opps yet regardless of views on ultimate winners. GL

• • •

Missing some Tweet in this thread? You can try to

force a refresh