Part II of the $CRSP $SGMO comparison will hopefully be a bit less dry now that Part I updates are in place. This thread will focus more on valuation, outlook and why the valuation cycle should matter to investors.

1/

1/

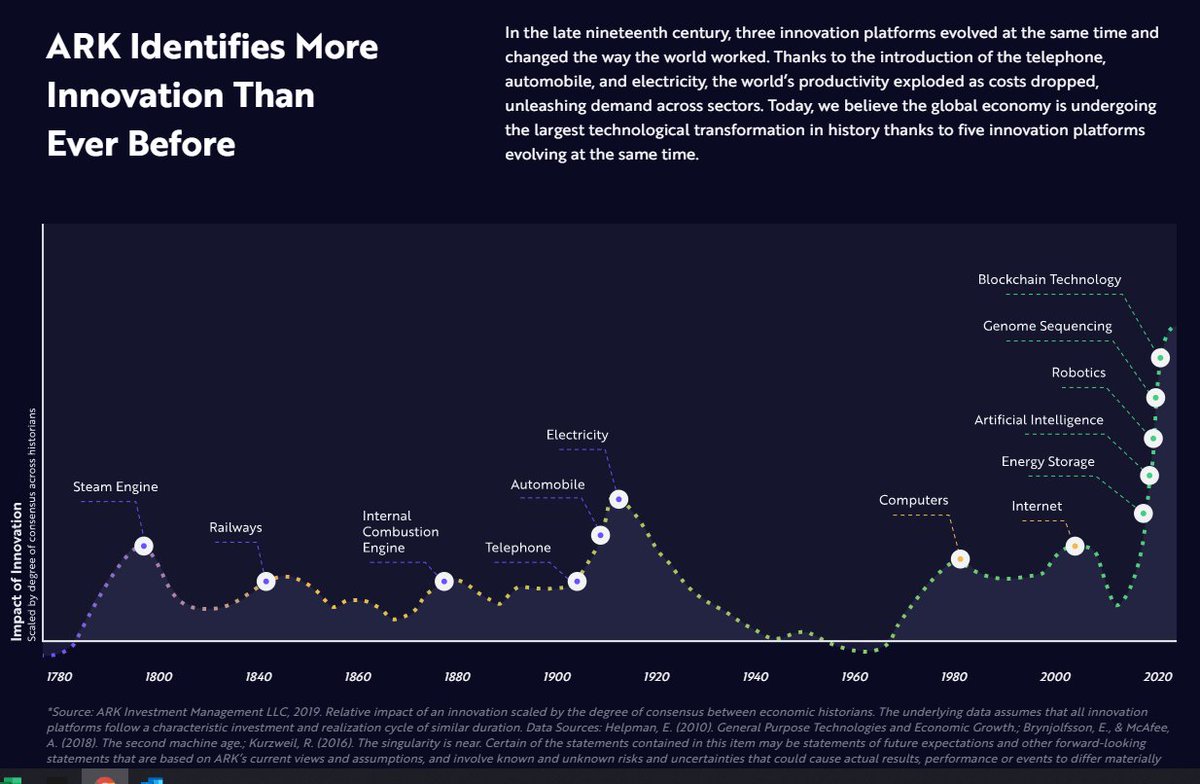

Let's start with the concept of #Disruptive technologies. The originator of disruptive innovation theory, Clayton Christensen worked with HBR in 2015 to revisit the past 20 years.

2/

hbr.org/2015/12/what-i…

2/

hbr.org/2015/12/what-i…

#GenomicMedicine is disrupting Big Pharma who has begun to respond by spinning off old product lines and jumping into #GeneTherapy.

3/

3/

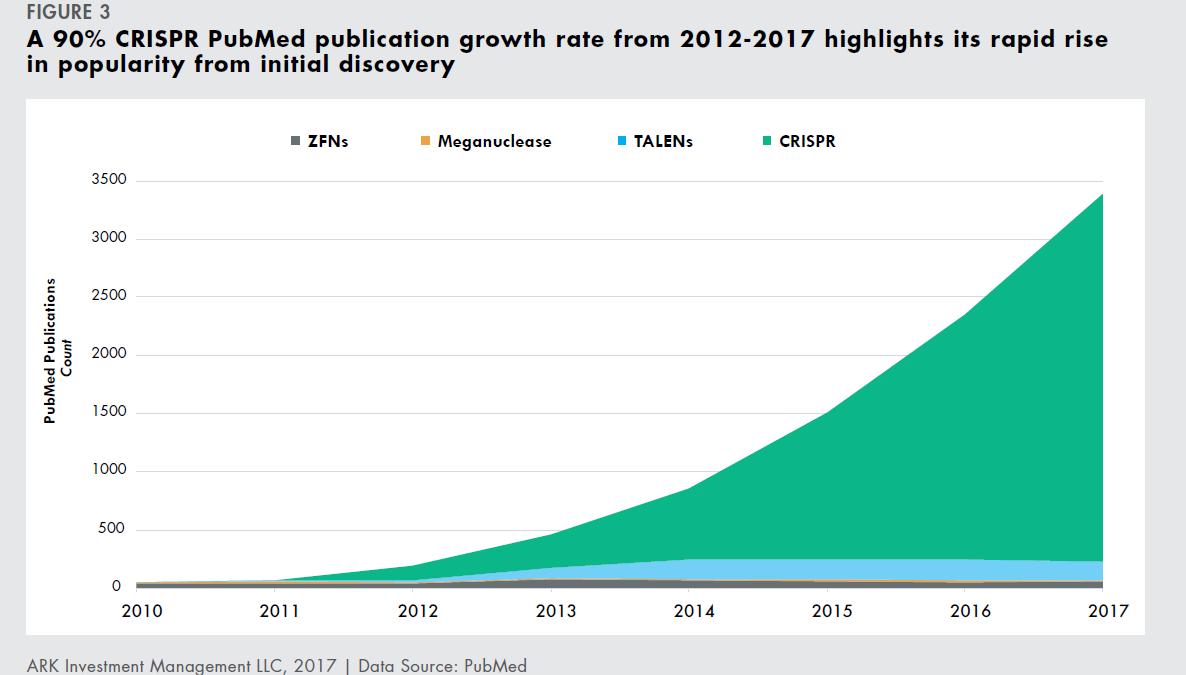

#Disruption occurs in waves which are commonly depicted as S Curves. Some believe that #CRISPR is disrupting #ZFN but this concept is a business model economics disruption.

4/

4/

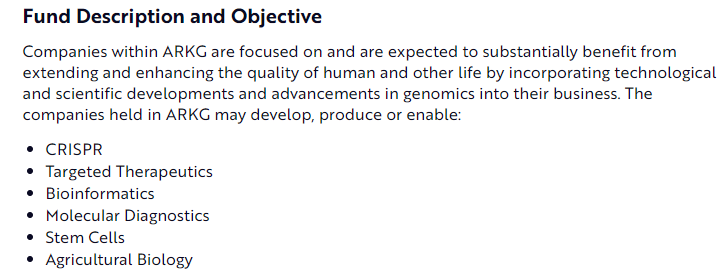

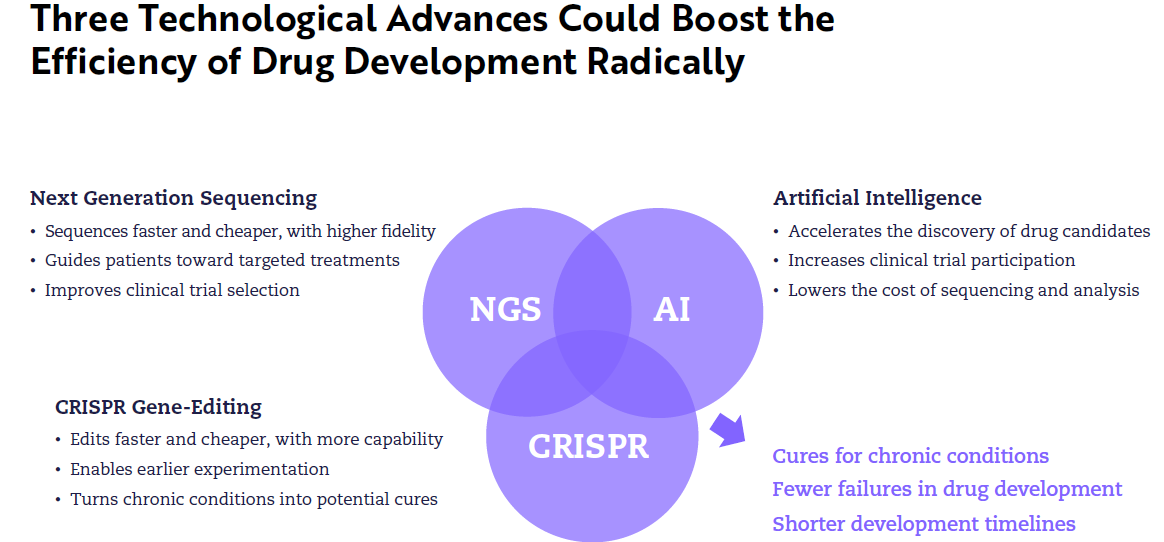

C Wood at $ARKK $ARKG has built a successful ETF strategy around #Disruption. Some thoughts on their white paper Three Advances slide. Some equate $CRSP with #Crispr but the accelerant is not the company. Editing costs are snapshots in time.

5/

5/

The valuation difference is being driven not by the #Disruption S Curve. It is being driven by investor awareness of it or what Gartner calls the #HypeCycle. $BLUE tried to leverage this but picked the wrong time to update their slides

6/

6/

The Hype cycles are influenced but not the same as S Curves. You can see a little of that with the social media followers of $CRSP and $SGMO. Note the 40% increase in SA vs 15% in Linkedin. SA = investor awareness. Linkedin = ASH updates.

7/

7/

Consider the wkly charts and ARK ownership in the big 3 #CRISPR companies $CRSP $EDIT $NTLA. Pretty similar action because investors became aware which was partially from being noticed by #Reddit #wallstreetbets. $ARKK in their top 100 stocks

8/

8/

Now compare to a longer window into the cycles at $SGMO by using the monthly chart. Investor psychology greed/fear cycles. The hope is that ARK doesn't get derailed when the inevitable cycle hits the #CRISPR components and forced liquidations result.

9/

9/

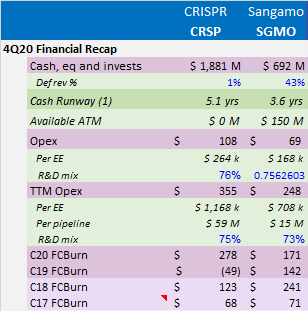

Now a looks at relative valuations

- $CRSP is valued at $1.4b EV/pipeline

- $SGMO is valued at $62m EV/pipeline

EV=Enterprise Value

Pipeline = clinical plus preclinical programs

More on editor difference later

10/

- $CRSP is valued at $1.4b EV/pipeline

- $SGMO is valued at $62m EV/pipeline

EV=Enterprise Value

Pipeline = clinical plus preclinical programs

More on editor difference later

10/

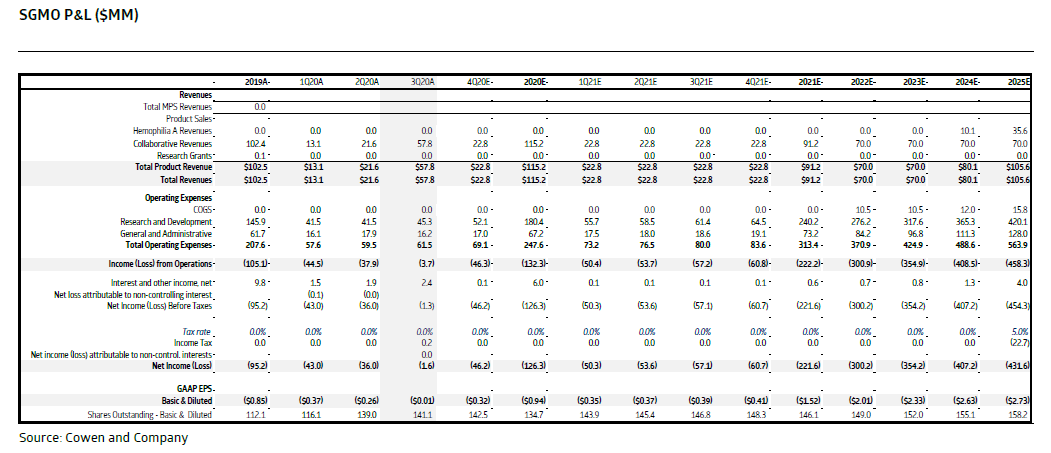

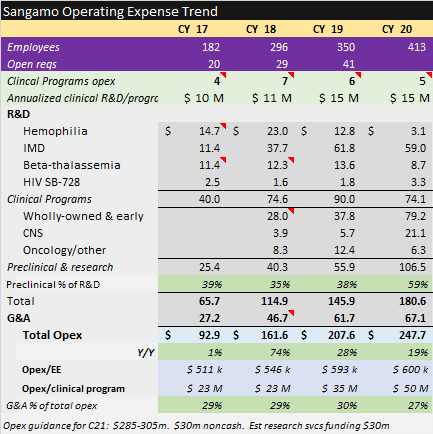

A couple notes on the difference between a business model built through collaborations which is what $SGMO is doing. They offload indication risk to partners. This has pros and cons. The concentrated costs for specific programs can be seen by looking Hem and $BMRN

11/

11/

The economic returns for $SGMO are still compelling but far less if successful than if the owned the indication outright. That can be seen in $ION valuation over time which took a similar approach to building the bus.

12/

12/

By leveraging collab partners $SGMO has been able to focus on a much broader portfolio, bring manufacturing in house and fund operations in the UK and France. $CRSP just starting

13/

13/

Both $CRSP and $SGMO have sizable potential "biobucks" but CRSP has opted to co-develop and co-commercialize which results in higher R&D spend, less reimbursement and progress funding (milestones). That in turn has led to #CellTherapy concentration.

14/

14/

Long term success though comes on the back of owned programs. Consider the ramp in $SGMO R&D for owned programs over the past 2 yrs now that initial collabs are moving to partners. See "wholly owned"

16/

16/

One of the biggest valuation risks in both companies is their #CellTherapy pipeline. Concerns over myeloablative regimens and oncognesis are building. These programs already have long study periods but will likely see future delays

genengnews.com/insights/viral…

17/

genengnews.com/insights/viral…

17/

While both $CRSP and $SGMO have potential issues with #CellTherapy pipelines, the collaborative approach moved most of SGMO risk on $SNY $GILD. The first #Treg clinical program TX200 though using LV delivery which is not laid off.

18/

18/

Will close with another look at whether $CRSP is a "boy band" or if #ZFN is obsolete. but need another cup of coffee first. Another chart on valuation cycles to consider as you wait...

19/

19/

The ability to make site-specific modifications to the human genome has been a goal since the gene was recognized as the basic unit of heredity. That brings us back to editors, delivery, targeting etc.

20/

20/

We know $CRSP is a disruptor but is $SGMO disrupting or being disrupted? The evidence is pretty clear. There are pros/cons and unknowns with respect to the different editors. Biopharma have done their due diligence and are aligned with $SGMO.

21/

21/

$SGMO has moved from #GeneTherapy with hundreds of clinical competitors and a durability profile of 5-10 years. They are now intent on being first in class for #GeneRegulation where no one else has shown allele-specific capability.

genengnews.com/insights/hunti…

22/

genengnews.com/insights/hunti…

22/

The funding outlook for both companies is very strong. $CRSP has smartly raised cash in the equity market leveraging the recent over-valuation. $SMGO raised money with $BIIB and in the recent rally but at far less favorable prices. Preapproval milestone funding is an adv.

23/

23/

Closing with why I'm investing in $SGMO vs $CRSP. - Valuation matters

Investing in where the puck is going Tregs/CNS

inhouse mfg matters

lower risk profile

Many more shots on goal

Hope this was helpful!

24/24

Investing in where the puck is going Tregs/CNS

inhouse mfg matters

lower risk profile

Many more shots on goal

Hope this was helpful!

24/24

• • •

Missing some Tweet in this thread? You can try to

force a refresh