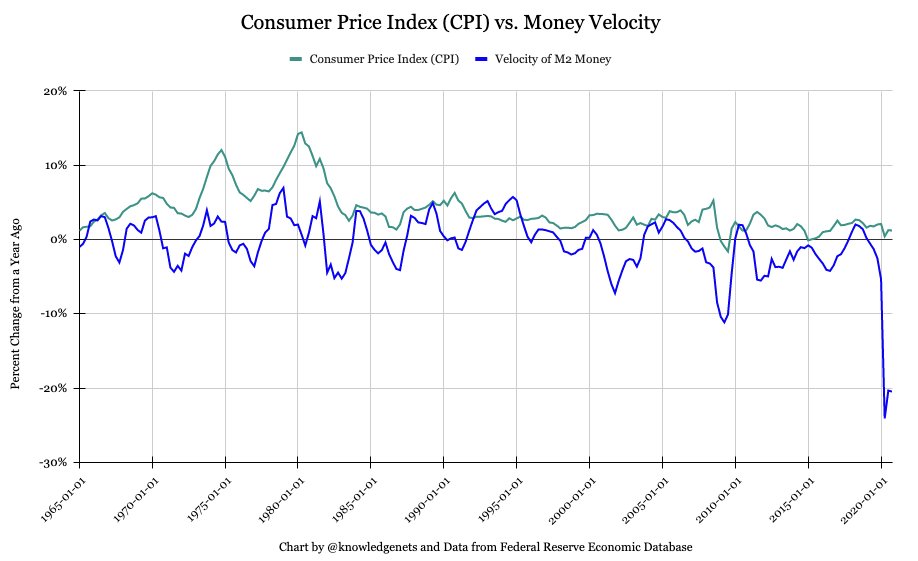

Given the rising concerns and thoughts about the links between expansionary monetary policy, money supply, and inflation, I wanted to share a few opinions on the topic of inflation and the velocity of money:

#inflation #deflation #moneysupply #economics

#inflation #deflation #moneysupply #economics

1) M2 money supply is up about 25% from last year’s levels, which indicates both the massive money creation and the high degree of expansionary monetary policy that was needed to help stabilize America’s economy and financial markets after the outbreak of the coronavirus crisis.

2) Typically, there are 2 reasons why money velocity can rise:

1. Rising consumer and business confidence drives higher spending.

2. Rising money velocity (not rising money supply) has historically been a leading indicator of future consumer price inflation.

1. Rising consumer and business confidence drives higher spending.

2. Rising money velocity (not rising money supply) has historically been a leading indicator of future consumer price inflation.

3) Looking at this chart, money velocity has recently been falling while money supply has recently sharply risen.

4) When the central bank engages in QE programs and buys Treasuries, it becomes a long term owner of bonds. As a result, this is an asset swap/trade, and the created money isn’t flooding into the general economy.

5) If the increased money supply from quantitative easing and other expansionary monetary policies remains in the financial system, this inflates financial asset prices and doesn’t necessarily inflate consumer prices (as measured by CPI).

6) Therefore, there exists a difference between financial asset inflation versus consumer price inflation.

7) Price multiples is an informal proxy for financial asset inflation (paying higher prices for the same financial asset), and CPI or the Chapwood Index are proxies for measuring consumer price inflation.

8) One method of having the increased money supply lead to increased CPI is if the increased money supply leaves the financial system and enters into the hands of consumers and businesses for productive economic purposes, where the money can be circulated, used, and spent.

9) Many people understand the worries about inflation, which focuses on the decrease in purchasing power over time. On the other hand, there are also notable worries about deflation.

10) Deflation that is not driven by technological innovation can lead to several economic concerns.

Technological innovation creates more value at cheaper prices via the advancement of technologies and processes.

Technological innovation creates more value at cheaper prices via the advancement of technologies and processes.

11) In a financially leveraged economy, the value of debt would increase over time in deflationary periods, making it more difficult to repay debt.

In a financially leveraged economy, the value of debt would decrease over time ("inflates away") in inflationary periods.

In a financially leveraged economy, the value of debt would decrease over time ("inflates away") in inflationary periods.

12) If consumers believe deflation exists, they can delay their spending patterns in discretionary products in hopes of making purchases at lower future prices.

13) From an investing perspective, the rapid growth in money supply is a significant market update that differentiates 2019 from 2021.

14) Monetary debasement and rapid expansion in money supply has increased investor demand for inflation-hedges, stocks, alternative investments, Bitcoin & digital assets, real estate, physical assets, and scarce assets.

Hope you enjoyed reading this thread of thoughts about inflation, money velocity, and economic perspectives! 😃

• • •

Missing some Tweet in this thread? You can try to

force a refresh