Here's a thread of thoughts to demystify complexity and quantitatively display how interest rates impact the value of future cash flows: 🧵👇

#Markets #InterestRates #stocks

#Markets #InterestRates #stocks

1) Recently and especially after yesterday's FOMC announcements about monetary policy updates, several investors are discussing the role of changing interest rates and their impact on financial assets, particularly "growth stocks" and "value stocks".

2) Definitions:

1. DCF = Discounted cash flow analysis

2. Discount rate = The rate used to discount future cash flows back to their present value when determining the time value of money. Some investors consider this rate to be the opportunity cost of their investment.

1. DCF = Discounted cash flow analysis

2. Discount rate = The rate used to discount future cash flows back to their present value when determining the time value of money. Some investors consider this rate to be the opportunity cost of their investment.

3) Definitions, continued:

3. Present Value = Current value of an investment based on the investment's future set of cash flows, discount rate, and ending value at the end of the investment period.

4. Future Value = Future value of an investment

5. NPV = Net Present Value

3. Present Value = Current value of an investment based on the investment's future set of cash flows, discount rate, and ending value at the end of the investment period.

4. Future Value = Future value of an investment

5. NPV = Net Present Value

4) Let's please have a walk-through of 5 sample scenarios that illustrate DCF calculations and market commentary regarding changes in discount rates and changes in the timing of cash flows.

5) Scenario 1: You buy a business for $5,000, and the business earns a static $100 in cash flow per year for the next 10 years, for a total of $1,000 in cash flows. The discount rate is 5%. At the end of 10 years, let's assume that the business is worth $10,000 (terminal value).

6) Scenario 2: All assumptions from Scenario 1 carry over to Scenario 2, except the business earns declining and non-static cash flows per year for the next 10 years for a total of $1,000 in cash flows.

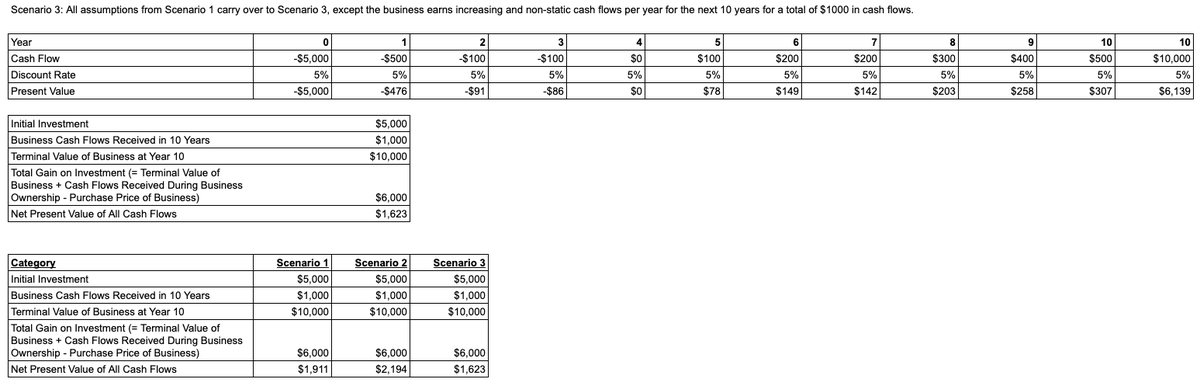

7) Scenario 3: All assumptions from Scenario 1 carry over to Scenario 3, except the business earns increasing and non-static cash flows per year for the next 10 years for a total of $1,000 in cash flows.

8) Reviewing the differences between Scenario #1-3, the net present values (NPVs) of these scenarios are different, even when total cumulative cash flows, total $ gain on investment, discount rate, initial investment amount, and ending $ value are all assumed to be equivalent.

9) Key Insight: The timing of earned cash flows matter in financial modeling. When discount rates increase (which is often the case with rising interest rates), many investors prefer cash generation today compared to waiting for cash generation in the future.

10) Also, many investors in a rising interest rate environment would prefer certainty (via stable and immediate cash flows) versus uncertainty (varying cash flows over time or hoping for higher future cash flows).

11) Now, let's compare and contrast Scenario 4 and Scenario 5.

12) Scenario 4: You buy a business for $5,000, and the business earns a static $100 in cash flow per year for the next 10 years for a total of $1,000 in cash flows. The discount rate is 5%. At the end of 10 years (terminal value), the business is assumed to be worth $10,000.

13) Scenario 5: All assumptions from Scenario 4 carry over to Scenario 5, except the discount rate is now 10% instead of 5%.

14) Key Insight: The opportunity cost in investing matters. As interest rates rise, the discount rate increases, which causes NPV to decrease. While the total gain on investment in Scenarios 4 & 5 are equal, the NPV of Scenario 4 is higher than the NPV for Scenario 5.

15) Long duration assets are assets where their cash flows are assumed to be earned for years out into the future. As a result, long duration assets are more sensitive to changes in interest rates compared to short duration assets.

16) To counterbalance a decrease in NPV, an investor may be willing to pay lower prices (not higher prices) for the same stocks and other financial assets in a rising interest rate environment (unless future cash flows increase) to potentially earn their target rate of return.

17) Generally speaking, investors enjoy "upside volatility" and dislike "downside volatility" in their investments.

Said differently, investors enjoy sharp upward spikes in the stock prices for the stocks that they own and dislike large drawdowns in their portfolios.

Said differently, investors enjoy sharp upward spikes in the stock prices for the stocks that they own and dislike large drawdowns in their portfolios.

18) As interest rates rise, investors re-calibrate and re-assess their financial models. During this recalibration phase, volatility exists in asset prices (particularly in growth stocks and long duration assets), which is exactly what we are seeing over the past several weeks.

19) Therefore, financial modeling & theory match with the recent realities seen today in public equity markets.

Hope you enjoyed this thread of thoughts to describe the current state of growth investing, the importance in the timing of cash flows, and the impact of changing interest rates.

Any additional thoughts, questions, and feedback are welcome! 😃

Any additional thoughts, questions, and feedback are welcome! 😃

• • •

Missing some Tweet in this thread? You can try to

force a refresh