A Thread🧵on various #IncomeTax #Deductions.

Must read for everyone.

A simple & legitimate way to to save taxes every year!

(RT to maximize reach.)

Money Saved is Money Earned !

#IncomeTax #Tax #ELSS #TaxSaving #Investing #TaxPlanning

Images Courtesy : Internet.

Must read for everyone.

A simple & legitimate way to to save taxes every year!

(RT to maximize reach.)

Money Saved is Money Earned !

#IncomeTax #Tax #ELSS #TaxSaving #Investing #TaxPlanning

Images Courtesy : Internet.

When the month of March starts or is about to end suddenly everyone remembers one thing #TaxSaving ...

This is where #TaxDeductions come into picture.

Deductions allowed under #IncomeTax act help you reduce your taxable income.

This is where #TaxDeductions come into picture.

Deductions allowed under #IncomeTax act help you reduce your taxable income.

People normally know a bit about Section 80C Deduction which allows a person to claim a deduction of Rs 1.5 lakh on total income.

But there are various other common deductions which anyone can claim.

This thread is about such common deductions.

But there are various other common deductions which anyone can claim.

This thread is about such common deductions.

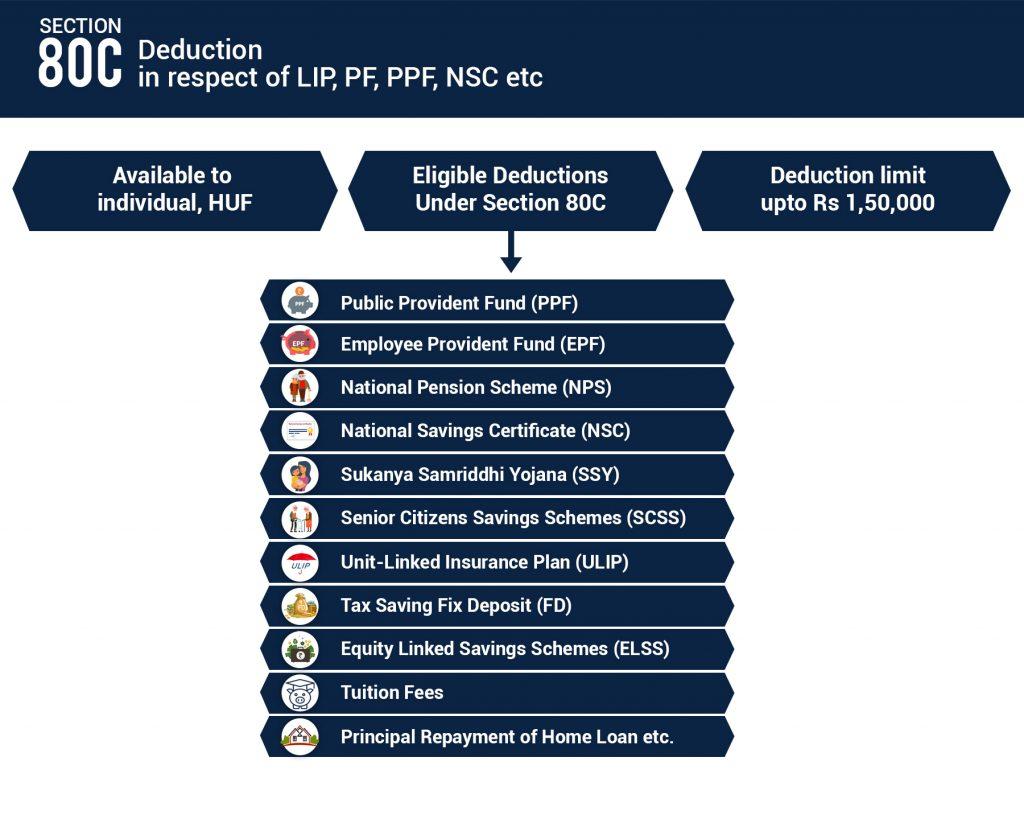

Section 80C: for #TaxSaving #Investments & Payments.

A deduction up to Rs 1,50,000 is allowed under #Section80C of Income Tax Act 1961 in respect of eligible investments or expenditures.

* See Note Ahead

Discussed in detail 👉 bit.ly/3ctJO6N

#TaxSaving #TaxPlanning

A deduction up to Rs 1,50,000 is allowed under #Section80C of Income Tax Act 1961 in respect of eligible investments or expenditures.

* See Note Ahead

Discussed in detail 👉 bit.ly/3ctJO6N

#TaxSaving #TaxPlanning

Section 80CCC: for Contribution to #PensionFund

A deduction up to Rs 1,50,000 is available under Section 80CCC of #IncomeTax Act 1961 in respect of contributions made by an individual towards specified pension funds.

* See Note Ahead

#TaxSaving #TaxPlanning #Investing

A deduction up to Rs 1,50,000 is available under Section 80CCC of #IncomeTax Act 1961 in respect of contributions made by an individual towards specified pension funds.

* See Note Ahead

#TaxSaving #TaxPlanning #Investing

Section 80CCD: for Contribution to #PensionFund of Central Govt

A deduction up to Rs 1,50,000 is available under Section 80CCD of Income Tax Act 1961 in respect of contributions made towards National Pension Scheme (NPS) or Atal Pension Yojana (APY)

* See Note Ahead

#TaxSaving

A deduction up to Rs 1,50,000 is available under Section 80CCD of Income Tax Act 1961 in respect of contributions made towards National Pension Scheme (NPS) or Atal Pension Yojana (APY)

* See Note Ahead

#TaxSaving

*

Note : The deduction limit of Rs 1.5 lakh deduction of Section 80C includes Section 80C, Section 80CCC & Section 80CCD.

#TaxSaving #TaxPlanning #Investing

Note : The deduction limit of Rs 1.5 lakh deduction of Section 80C includes Section 80C, Section 80CCC & Section 80CCD.

#TaxSaving #TaxPlanning #Investing

Section 80CCD (1B): for contribution to National Pension Scheme (NPS)

An additional deduction of Rs 50,000 is made available in Budget 2015 through sub-section 1B, thereby raising maximum deduction available under Section 80CCD to Rs. 2,00,000

#TaxSaving #TaxPlanning #Investing

An additional deduction of Rs 50,000 is made available in Budget 2015 through sub-section 1B, thereby raising maximum deduction available under Section 80CCD to Rs. 2,00,000

#TaxSaving #TaxPlanning #Investing

Section 80CCF: for Contributions to Long-term Infrastructure Bonds.

A deduction up to Rs 20,000 is available under Section 80CCF of Income Tax Act 1961 in respect of subscription to long-term infrastructure bonds.

#TaxSaving #TaxPlanning #Investing

A deduction up to Rs 20,000 is available under Section 80CCF of Income Tax Act 1961 in respect of subscription to long-term infrastructure bonds.

#TaxSaving #TaxPlanning #Investing

Section 80TTA: for Savings Interest

A deduction up to Rs 10,000 is available under Section 80TTA of Income Tax Act 1961 in respect of interest on deposits in savings account.

#TaxSaving #TaxPlanning #Investing

A deduction up to Rs 10,000 is available under Section 80TTA of Income Tax Act 1961 in respect of interest on deposits in savings account.

#TaxSaving #TaxPlanning #Investing

Section 80TTB: Interest Deduction on deposits for Senior Citizens

A deduction up to Rs 50,000 is available (only for senior citizens) under Section 80TTA of Income Tax Act 1961 in respect of interest on both deposits in savings account and fixed deposits in banks.

#TaxSaving

A deduction up to Rs 50,000 is available (only for senior citizens) under Section 80TTA of Income Tax Act 1961 in respect of interest on both deposits in savings account and fixed deposits in banks.

#TaxSaving

Section 80D: for Medical Insurance Premium

A deduction up to Rs 25,000 (50,000 for senior citizens) is available under #Section80D of #IncomeTax Act 1961 in respect of health insurance premium for self, spouse and dependent children and parents.

#TaxSaving #TaxPlanning

A deduction up to Rs 25,000 (50,000 for senior citizens) is available under #Section80D of #IncomeTax Act 1961 in respect of health insurance premium for self, spouse and dependent children and parents.

#TaxSaving #TaxPlanning

Section 80DD: for Differently abled Dependant

A deduction of Rs 75,000 (Rs 1,25,000 for severe disabilities) is allowed under #Section80DD of Income Tax Act 1961 in respect of maintenance including medical treatment of a dependant who is a person with disability.

#TaxSaving

A deduction of Rs 75,000 (Rs 1,25,000 for severe disabilities) is allowed under #Section80DD of Income Tax Act 1961 in respect of maintenance including medical treatment of a dependant who is a person with disability.

#TaxSaving

Section 80DDB: for Treatment of Specified Diseases

A deduction up to Rs 40,000 (1,00,000 for senior citizens) is available under #Section80DDB of #IncomeTax Act 1961 in respect of medical treatment of certain specified ailments for self or dependent.

#TaxSaving #TaxPlanning

A deduction up to Rs 40,000 (1,00,000 for senior citizens) is available under #Section80DDB of #IncomeTax Act 1961 in respect of medical treatment of certain specified ailments for self or dependent.

#TaxSaving #TaxPlanning

Section 80U: for Individuals with Disability

A deduction of Rs 75,000 (Rs 1,25,000 for severe disabilities) is allowed under #Section80U of Income Tax Act 1961 for people suffering from certain disabilities.

#TaxSaving #TaxPlanning #Investing

A deduction of Rs 75,000 (Rs 1,25,000 for severe disabilities) is allowed under #Section80U of Income Tax Act 1961 for people suffering from certain disabilities.

#TaxSaving #TaxPlanning #Investing

Section 80GG: for Rent paid

A deduction up to Rs 60,000 per year is allowed under #Section80GG of #IncomeTax Act 1961 in respect of rents paid when HRA is not received.

#IncomeTaxIndia #TaxSaving #TaxPlanning

A deduction up to Rs 60,000 per year is allowed under #Section80GG of #IncomeTax Act 1961 in respect of rents paid when HRA is not received.

#IncomeTaxIndia #TaxSaving #TaxPlanning

Section 80E: for Interest on Education Loan

A deduction (without any maximum limit) is available under #Section80E of #IncomeTax Act 1961 in respect of interest paid for a period of 8 years on loan taken for higher education.

#TaxSaving #TaxPlanning #Investing

A deduction (without any maximum limit) is available under #Section80E of #IncomeTax Act 1961 in respect of interest paid for a period of 8 years on loan taken for higher education.

#TaxSaving #TaxPlanning #Investing

Section 80EE: for First Time Home Buyer

A deduction up to Rs 50,000 is available under #Section80EE of Income Tax Act 1961 in respect of interest on loan taken for residential house property.

#TaxSaving #TaxPlanning #investing

A deduction up to Rs 50,000 is available under #Section80EE of Income Tax Act 1961 in respect of interest on loan taken for residential house property.

#TaxSaving #TaxPlanning #investing

Section 80EEB: for Purchase of Electric Vehicle

A deduction up to Rs 1,50,000 is available under #Section80EEB of Income Tax Act 1961 in respect of interest paid on loan taken for purchase of an electric vehicle for personal or business use.

#EV #ElectricVehicle #TaxSaving

A deduction up to Rs 1,50,000 is available under #Section80EEB of Income Tax Act 1961 in respect of interest paid on loan taken for purchase of an electric vehicle for personal or business use.

#EV #ElectricVehicle #TaxSaving

Section 80G: for Donation to Charitable Organisations

A 50% or 100% deduction (without any maximum limit) is available under #Section80G of #IncomeTax Act 1961 in respect of donations to certain funds, charitable institutions, etc.

#TaxSaving #TaxPlanning #Investing

A 50% or 100% deduction (without any maximum limit) is available under #Section80G of #IncomeTax Act 1961 in respect of donations to certain funds, charitable institutions, etc.

#TaxSaving #TaxPlanning #Investing

Section 80GGB: for Donation to Political Parties (deduction for companies)

A deduction (without any maximum limit) is available to companies under Section 80GGB in respect of contributions given by companies to political parties.

A deduction (without any maximum limit) is available to companies under Section 80GGB in respect of contributions given by companies to political parties.

Section 80GGC: for Donation to Political Parties (deductions for individuals)

A deduction (without any maximum limit) is available to individuals under #Section80GGB of #IncomeTax Act 1961 in respect of contributions given by individuals to political parties.

#TaxSaving

A deduction (without any maximum limit) is available to individuals under #Section80GGB of #IncomeTax Act 1961 in respect of contributions given by individuals to political parties.

#TaxSaving

🌟Important Note & Disclaimer 🌟

I am not a qualified C.A. This thread is to provide only basic idea about common tax deductions.

For more details, it is advisable to contact your C.A and discuss with C.A about various #TaxDeductions whose benefit you can claim.

#TaxPlanning

I am not a qualified C.A. This thread is to provide only basic idea about common tax deductions.

For more details, it is advisable to contact your C.A and discuss with C.A about various #TaxDeductions whose benefit you can claim.

#TaxPlanning

• • •

Missing some Tweet in this thread? You can try to

force a refresh