-- #Crypto 101 - Beginners guide (Part 2) /2 --

Content in Part 2:

🔹What are STO's ICO's & IEO/IDO's?

🔹Crypto Regulations at a glance

🔹How do i get started buying my first Crypto?

🔹Basic day 1 Crypto investment strategy

🔹Is #BTC/Crypto a Bubble?

🔹Crypto Slang

🔹What next?

Content in Part 2:

🔹What are STO's ICO's & IEO/IDO's?

🔹Crypto Regulations at a glance

🔹How do i get started buying my first Crypto?

🔹Basic day 1 Crypto investment strategy

🔹Is #BTC/Crypto a Bubble?

🔹Crypto Slang

🔹What next?

-- What are STO's ICO's & IEO/IDO's?? /18--

🔹#STO - Security Token Offering

🔸 An investment contract which is backed by the security token

🔸 Token is asset-backed and represents ownership

🔸 Like a digital certificate much like the real-world stocks and bonds

🔹#STO - Security Token Offering

🔸 An investment contract which is backed by the security token

🔸 Token is asset-backed and represents ownership

🔸 Like a digital certificate much like the real-world stocks and bonds

-- What are STO's ICO's & IEO/IDO's?? Cont'd /19--

🔹#ICO - Initial Coin Offering

🔸 Used to launch a service or product like a new #cryptocurrency token or an app

🔸 Similar to IPO (Initial Public Offering) which is used by a company to raise funds on the stock market

🔹#ICO - Initial Coin Offering

🔸 Used to launch a service or product like a new #cryptocurrency token or an app

🔸 Similar to IPO (Initial Public Offering) which is used by a company to raise funds on the stock market

-- What are STO's ICO's & IEO/IDO's?? Cont'd /20--

🔹#IEO / #IDO - Initial Exchange / #DEX Offering

🔸 Companies directly sell their tokens on the exchange to individual participants

🔸 IDO's avoid the KYC on exchanges

🔸 Liquidity can be low so price movements can be large

🔹#IEO / #IDO - Initial Exchange / #DEX Offering

🔸 Companies directly sell their tokens on the exchange to individual participants

🔸 IDO's avoid the KYC on exchanges

🔸 Liquidity can be low so price movements can be large

-- #Crypto Regulations at a glance /21--

🔹In a nutshell new regulations are emerging globally all the time

🔹New rules for #KYC/#AML continue to emerge

🔹Most new regulations concern identity and investments

🔹You need to keep up to date, check your government website

🔹In a nutshell new regulations are emerging globally all the time

🔹New rules for #KYC/#AML continue to emerge

🔹Most new regulations concern identity and investments

🔹You need to keep up to date, check your government website

--How do i get buy my first #Crypto? /22--

🔹NOTE: This is a very basic explanation for a beginner investor

🔹This could be a 50 tweet thread on its own, so is just to illustrate that it isn't as difficult as many make out

Cont...

🔹NOTE: This is a very basic explanation for a beginner investor

🔹This could be a 50 tweet thread on its own, so is just to illustrate that it isn't as difficult as many make out

Cont...

--How do i get buy my first #Crypto? Cont'd/23--

1/ Select a crypto exchange that offers a Fiat gateway open to your region i.e. #Binance or #Coinbase

2/ Setup an account on the exchange, this will create a digital wallet on the exchange to store your crypto

1/ Select a crypto exchange that offers a Fiat gateway open to your region i.e. #Binance or #Coinbase

2/ Setup an account on the exchange, this will create a digital wallet on the exchange to store your crypto

--How do i get buy my first #Crypto? Cont'd/24--

3/ Transfer some Fiat currency to the exchange. Tutorials can be found on the exchange websites

4/ Select he Crypto you want to purchase i.e. #Bitcoin

3/ Transfer some Fiat currency to the exchange. Tutorials can be found on the exchange websites

4/ Select he Crypto you want to purchase i.e. #Bitcoin

--How do i get buy my first #Crypto? Cont'd/25--

5/ Most exchanges let you "Buy Now" via market orders

6/ Place your order and execute, the Crypto should now appear in your exchange digital wallet

5/ Most exchanges let you "Buy Now" via market orders

6/ Place your order and execute, the Crypto should now appear in your exchange digital wallet

--How do i get buy my first #Crypto? Cont'd/26--

7/ It is just as simple to sell the Crypto back to Fiat

8/ If you want to hold onto the crypto for a while, it is advisable that you purchase a hardware wallet like a ledger and move the crypto off the exchange for safety.

7/ It is just as simple to sell the Crypto back to Fiat

8/ If you want to hold onto the crypto for a while, it is advisable that you purchase a hardware wallet like a ledger and move the crypto off the exchange for safety.

-- Basic day 1 #Crypto investment strategy /27--

🔹Diversify - Buy the top 2 cryptos from each of the different areas of utility (of which there are many)

🔸 Platform tokens $ADA $ETH

🔸 Payment tokens $BTC $LTC

🔸 Media & Ent $BAT

etc...

🔹Hold and wait for mass adoption

🔹Diversify - Buy the top 2 cryptos from each of the different areas of utility (of which there are many)

🔸 Platform tokens $ADA $ETH

🔸 Payment tokens $BTC $LTC

🔸 Media & Ent $BAT

etc...

🔹Hold and wait for mass adoption

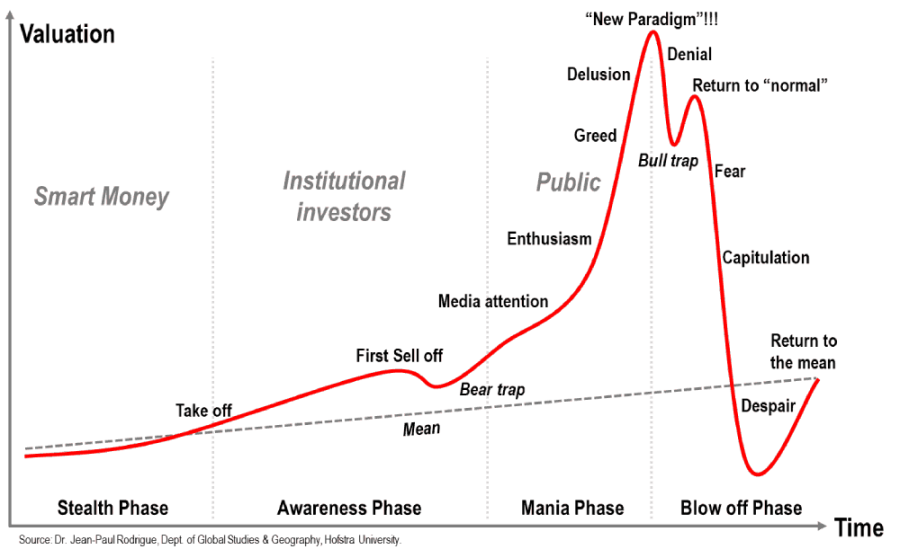

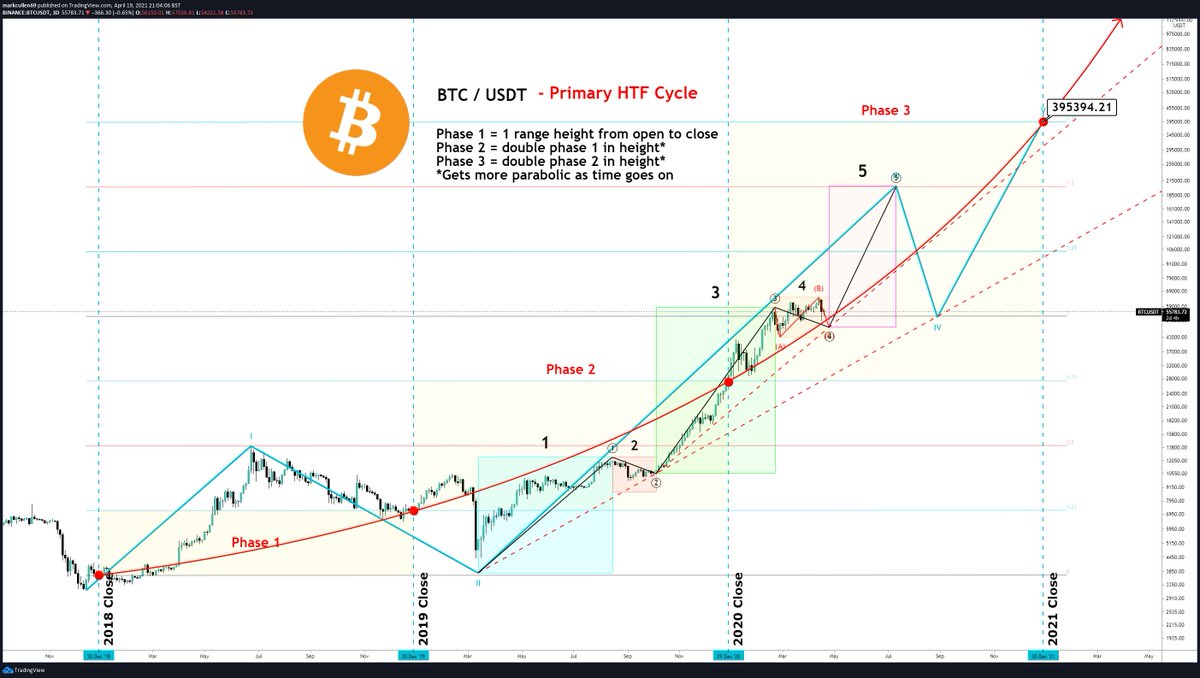

-- Is #BTC/#Crypto a Bubble? /28 --

🔹Short answer NO! bitcoin is not a bubble nor is it a Ponzi scheme

🔹Bitcoin is now right behind Amazon and Google as the 6th biggest organisation by market cap

🔹Bitcoin is also the biggest bank on earth

🔹Short answer NO! bitcoin is not a bubble nor is it a Ponzi scheme

🔹Bitcoin is now right behind Amazon and Google as the 6th biggest organisation by market cap

🔹Bitcoin is also the biggest bank on earth

-- Crypto Slang /29 --

🔹Rekt, “wrecked,” lost a large sum or been liquidated

🔹HODL, "hold on for dear life", to hold on to your asset and not sell it.

🔹FUD, or "fear, uncertainty and doubt" occurs when someone spreads misinformation

🔹Rekt, “wrecked,” lost a large sum or been liquidated

🔹HODL, "hold on for dear life", to hold on to your asset and not sell it.

🔹FUD, or "fear, uncertainty and doubt" occurs when someone spreads misinformation

-- Crypto Slang /30 Cont'd --

🔹FOMO, or "fear of missing out", might influence you to buy a coin or not cash out on some profits from that coin

🔹"Pump" refers to artificially inflating the price of a crypto so you can sell it at a profit. ("dump it")

🔹FOMO, or "fear of missing out", might influence you to buy a coin or not cash out on some profits from that coin

🔹"Pump" refers to artificially inflating the price of a crypto so you can sell it at a profit. ("dump it")

-- #Crypto Slang /31 Cont'd --

🔹"Wen moon" is asking something all crypto-enthusiasts are dying to know: "when will bitcoin's price hit all time highs?"

🔹#Shitcoin - everything other than Bitcoin is a shitcoin

🔹#Safu, "Secure Asset Fund for Users" your assets are safe

🔹"Wen moon" is asking something all crypto-enthusiasts are dying to know: "when will bitcoin's price hit all time highs?"

🔹#Shitcoin - everything other than Bitcoin is a shitcoin

🔹#Safu, "Secure Asset Fund for Users" your assets are safe

-- What next? /32 THE END! --

🔹If you haven't already, take this opportunity to start your journey into #Crypto

🔹Next I will do a separate thread with more detail on some of the common / useful technical aspects of Crypto

Hope it was useful, Play #Safu!

🔹If you haven't already, take this opportunity to start your journey into #Crypto

🔹Next I will do a separate thread with more detail on some of the common / useful technical aspects of Crypto

Hope it was useful, Play #Safu!

• • •

Missing some Tweet in this thread? You can try to

force a refresh