-- #BTC HFT Range Parabola --

🔹This could take a bit to explain what i am seeing

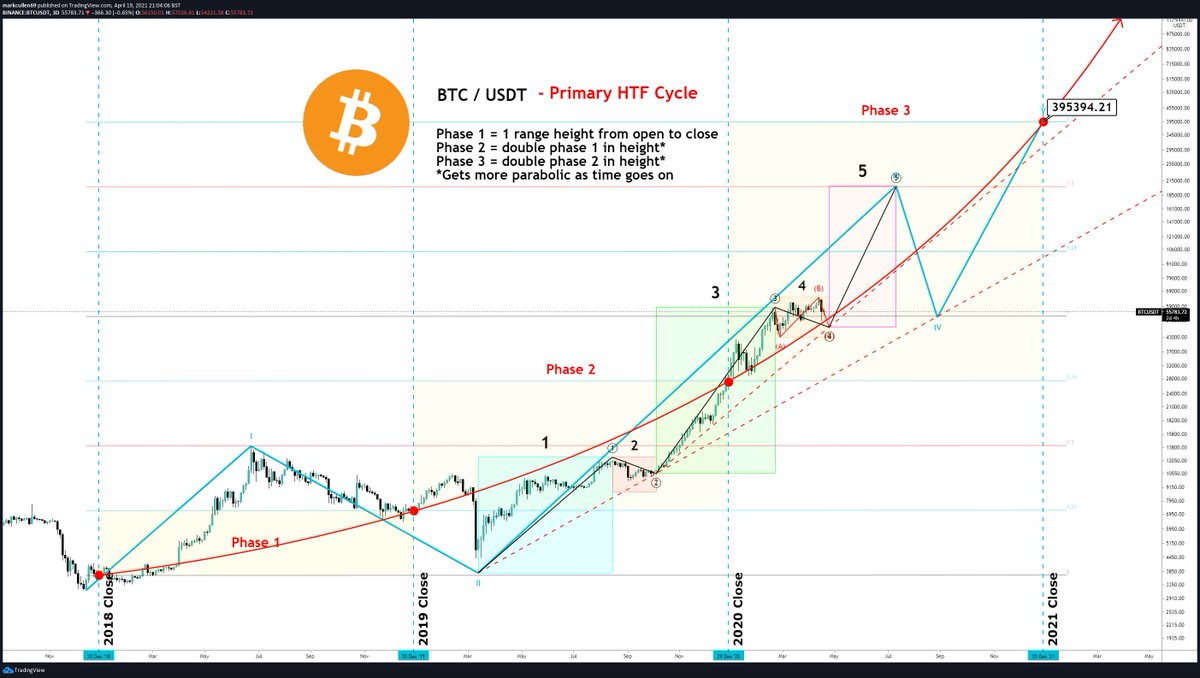

🔹I am using:

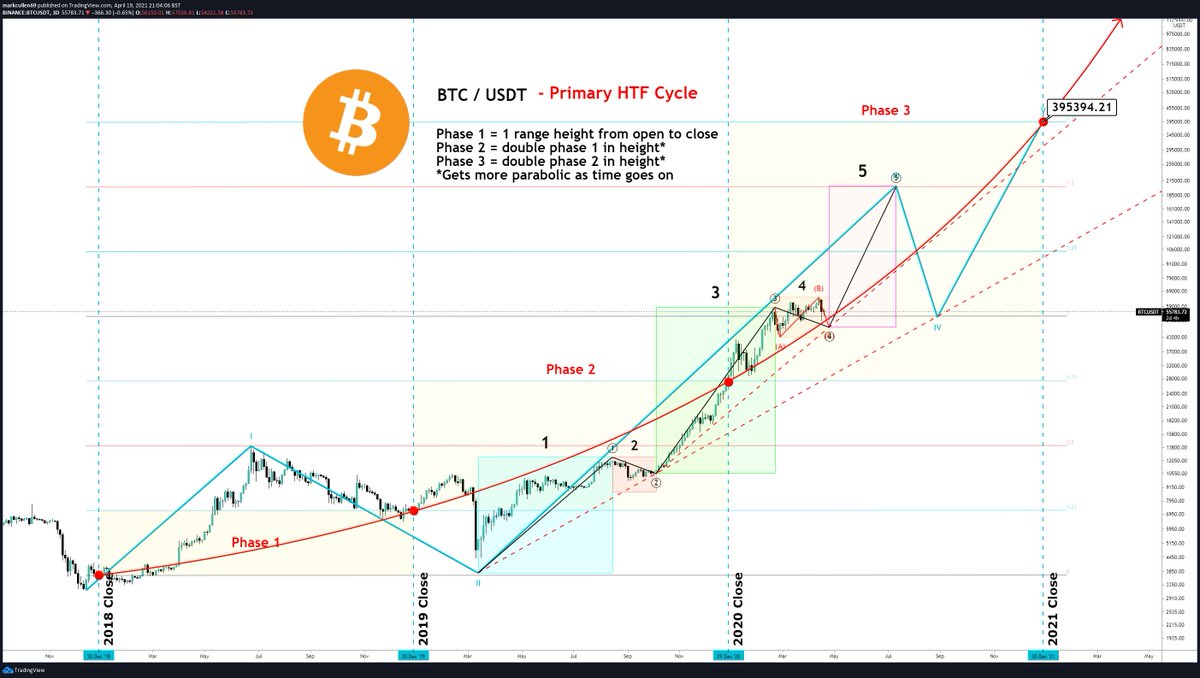

🔸Yearly closes (Red Dots)

🔸Ranges taken from the closes, broken into Phases

🔸A Parabola linking the yearly closes

🔸Elliot Wave for wave structure

Cont...

#Bitcoin

🔹This could take a bit to explain what i am seeing

🔹I am using:

🔸Yearly closes (Red Dots)

🔸Ranges taken from the closes, broken into Phases

🔸A Parabola linking the yearly closes

🔸Elliot Wave for wave structure

Cont...

#Bitcoin

-- #BTC HFT Range Parabola --

🔹The Phases double in Height each year. i.e.

🔸Phase 1 = 1 range height from open to close

🔸Phase 2 = double phase 1 in height*

🔸Phase 3 = double phase 2 in height*

*Gets more parabolic as time goes on

#Bitcoin

🔹The Phases double in Height each year. i.e.

🔸Phase 1 = 1 range height from open to close

🔸Phase 2 = double phase 1 in height*

🔸Phase 3 = double phase 2 in height*

*Gets more parabolic as time goes on

#Bitcoin

-- #BTC HFT Range Parabola --

🔹The EW count puts us in the 4th wave of the 3rd

🔹The 4th is looking like a big running flat correction

🔹The 5th if taken as a 1:1 of wave 1, would take us to ~$200K

🔹The W4 correction will be a killer and make every think its over. BUT its NOT!

🔹The EW count puts us in the 4th wave of the 3rd

🔹The 4th is looking like a big running flat correction

🔹The 5th if taken as a 1:1 of wave 1, would take us to ~$200K

🔹The W4 correction will be a killer and make every think its over. BUT its NOT!

-- #BTC HFT Range Parabola --

🔥Its not over, you BTFD at the previous w4 and #Bitcon MOONs!

🔥The Ranges and the Parabola meet perfectly

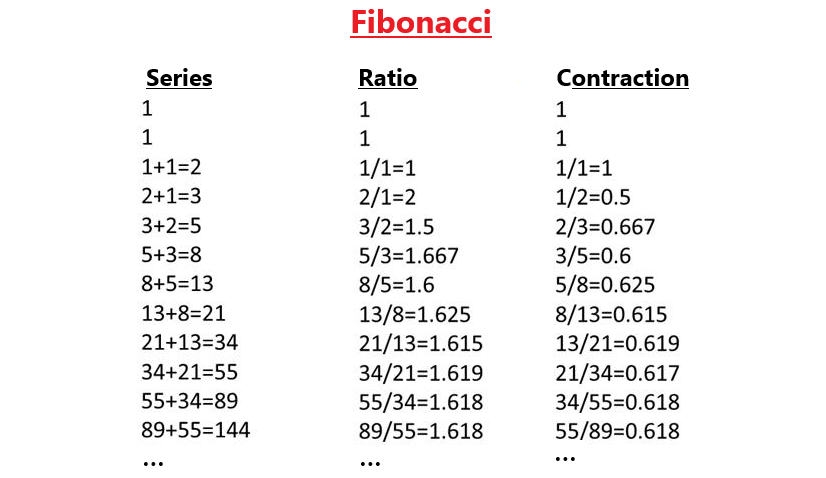

🔥The Fibonacci levels for the EW count fit nicely

🔥The End of Phase 3 and the Macro cycle at the end of 2021 will give us a:

🚀$400K #BTC

🔥Its not over, you BTFD at the previous w4 and #Bitcon MOONs!

🔥The Ranges and the Parabola meet perfectly

🔥The Fibonacci levels for the EW count fit nicely

🔥The End of Phase 3 and the Macro cycle at the end of 2021 will give us a:

🚀$400K #BTC

-- #BTC HFT Range Parabola --

🔹Tell me i'm mad bullish

🔹Say it won't happen

🔹BUT its not out of the realms of possibility

♥️Please like and Retweet if you think there is something to this and others would also benefit from seeing it, or even just having a laugh♥️

Play Safu!

🔹Tell me i'm mad bullish

🔹Say it won't happen

🔹BUT its not out of the realms of possibility

♥️Please like and Retweet if you think there is something to this and others would also benefit from seeing it, or even just having a laugh♥️

Play Safu!

• • •

Missing some Tweet in this thread? You can try to

force a refresh