How to trade Futures on @FTX_Official (not financial advice, obvs)

1/n

I only learned about futures a year ago. There are dangers to be aware of, but they're a great way to leverage your capital and multiply your earning potential.

I'mma run you through "buying" some...

1/n

I only learned about futures a year ago. There are dangers to be aware of, but they're a great way to leverage your capital and multiply your earning potential.

I'mma run you through "buying" some...

2/n

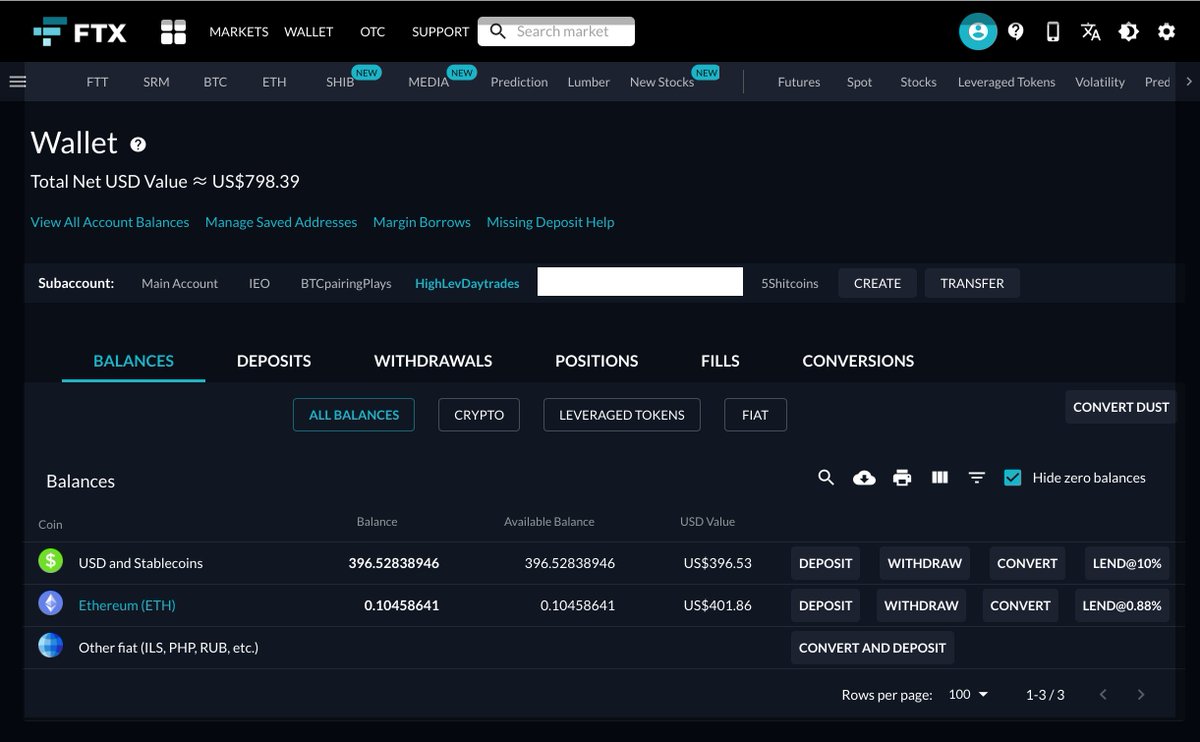

I've got a few subaccounts on FTX. Highly recommend you do this, because each one is isolated. If you mess up and lose it all in one subaccount, the rest aren't impacted.

In this account I've got some $ETH and some USD.

You will need something there as collateral.

I've got a few subaccounts on FTX. Highly recommend you do this, because each one is isolated. If you mess up and lose it all in one subaccount, the rest aren't impacted.

In this account I've got some $ETH and some USD.

You will need something there as collateral.

3/n

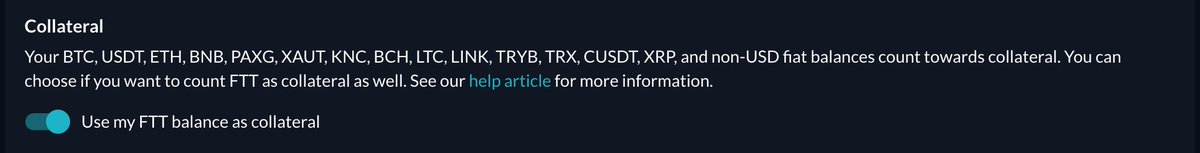

In Settings, then Margin, you can see what is accepted as collateral. My understanding is that the USD in my subaccount is a stablecoin, not FIAT. So it counts, along with the $ETH. Someone correct me if I'm wrong pls.

You might want your collateral to be non-volatile...

In Settings, then Margin, you can see what is accepted as collateral. My understanding is that the USD in my subaccount is a stablecoin, not FIAT. So it counts, along with the $ETH. Someone correct me if I'm wrong pls.

You might want your collateral to be non-volatile...

4/n

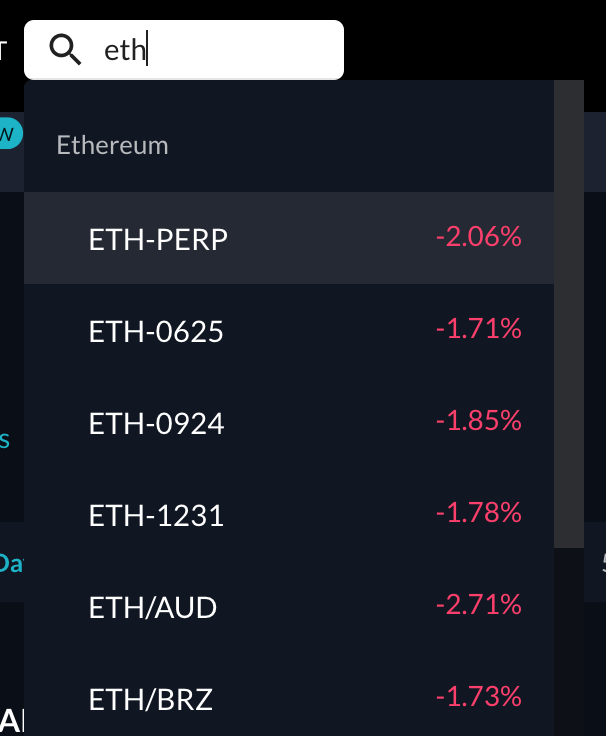

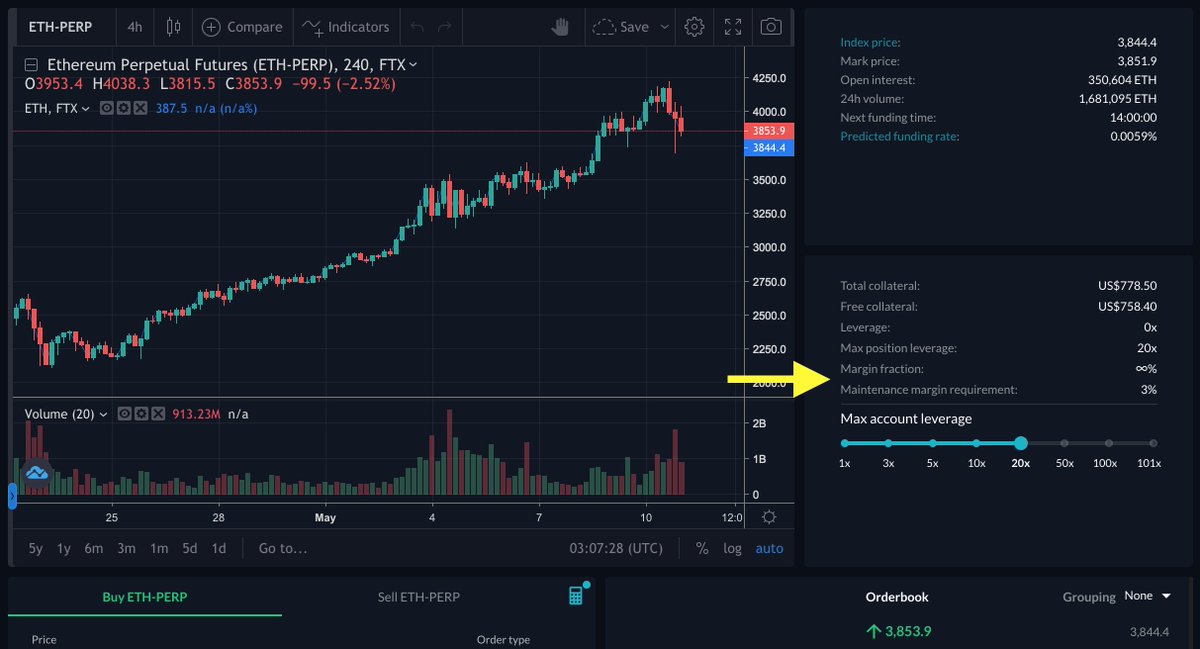

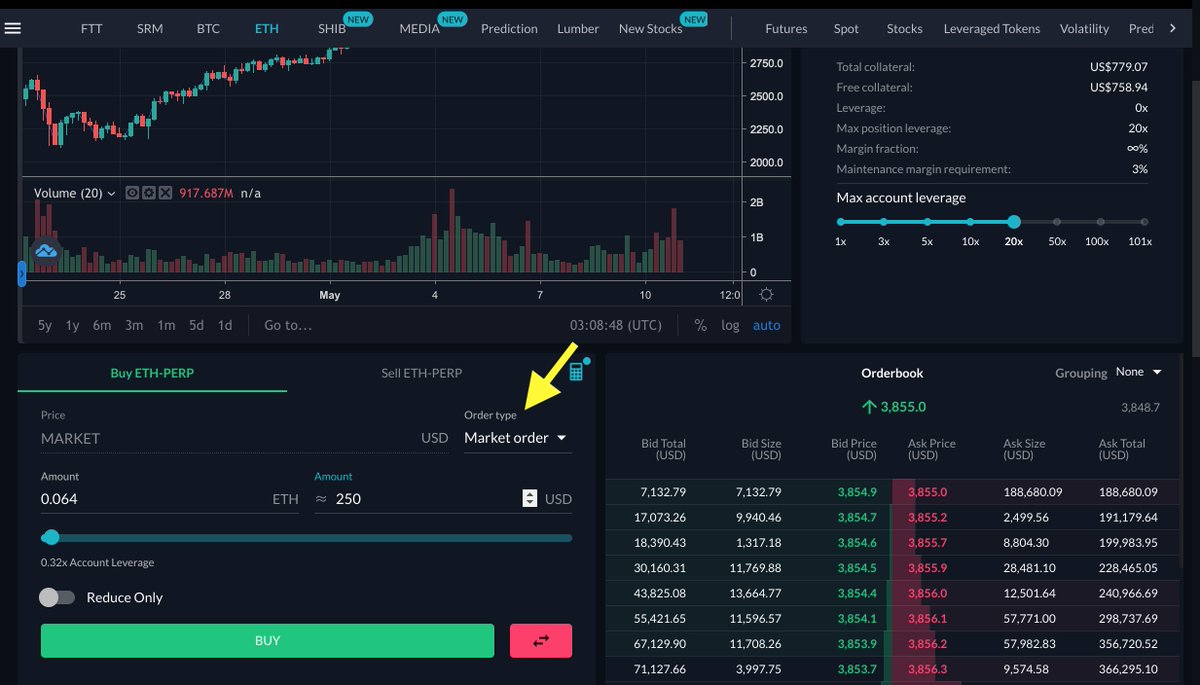

Search for $ETH-PERP(etual) Futures. This one here.

Once selected, you'll see it looks the same as if you were buying ETH-USD, except for some extra details on the right. You'll wanna pay particular attention to the two %s that the arrow is pointing to.

Search for $ETH-PERP(etual) Futures. This one here.

Once selected, you'll see it looks the same as if you were buying ETH-USD, except for some extra details on the right. You'll wanna pay particular attention to the two %s that the arrow is pointing to.

5/n

I'm about to "buy" some now. It's not actually buying though, like with Spot.

With futures, we say we open a position. I am essentially buying, hoping price goes up, so I am opening a Long position.

I selected Market Order to just buy right now at the best price.

I'm about to "buy" some now. It's not actually buying though, like with Spot.

With futures, we say we open a position. I am essentially buying, hoping price goes up, so I am opening a Long position.

I selected Market Order to just buy right now at the best price.

6/n

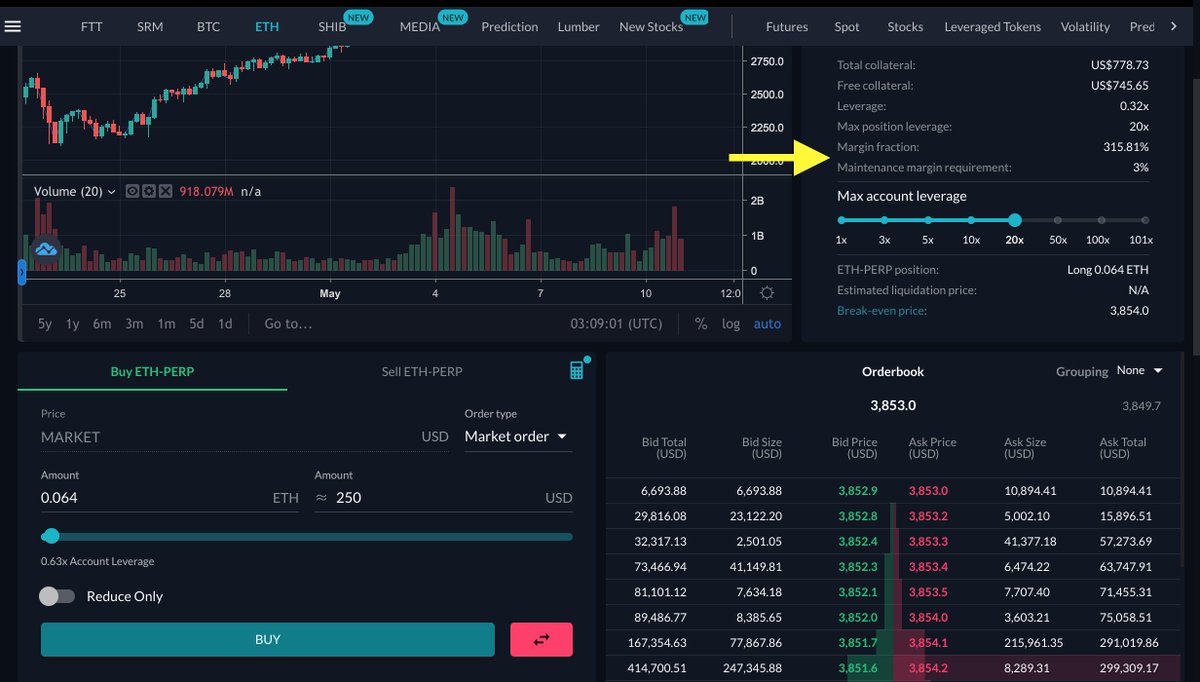

Done. Now I have a Long Position open.

See the Margin Fraction? The larger my positions, the smaller this number gets. If it ever gets down to the Maintenance Margin Requirement (3%) then my position will be automatically closed and my collateral will be sold to cover it.

Done. Now I have a Long Position open.

See the Margin Fraction? The larger my positions, the smaller this number gets. If it ever gets down to the Maintenance Margin Requirement (3%) then my position will be automatically closed and my collateral will be sold to cover it.

7/n

That's the risk.

To open this position, I've essentially borrowed ~$250 worth of someone else's $ETH. Someone on FTX lent it to me.

If the price of ETH goes up, then my position will be worth more than $250. I could then Close it, and pocket the difference/profit.

That's the risk.

To open this position, I've essentially borrowed ~$250 worth of someone else's $ETH. Someone on FTX lent it to me.

If the price of ETH goes up, then my position will be worth more than $250. I could then Close it, and pocket the difference/profit.

8/n

I changed the chart to 15min for clarity.

See my Long position? That's where I bought it, so that's the breakeven price. If, once I open it, the price goes down, I could choose to buy more. That would make my position larger, and bring the breakeven price down a bit.

I changed the chart to 15min for clarity.

See my Long position? That's where I bought it, so that's the breakeven price. If, once I open it, the price goes down, I could choose to buy more. That would make my position larger, and bring the breakeven price down a bit.

9/n

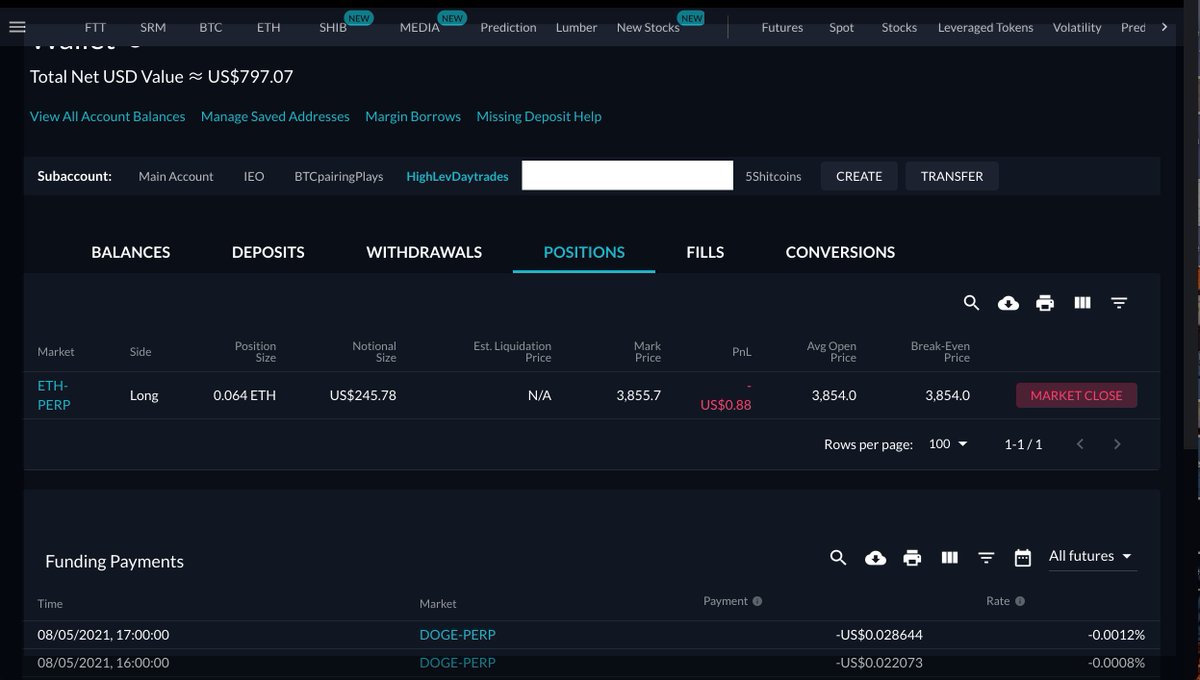

Scroll down to see your open positions at the bottom of the page. Price has moved up since I opened the Long, so I am 35c in profit right now. But that is just a number on the screen until I choose to close it. I could press Market Close now and be done with it.

Scroll down to see your open positions at the bottom of the page. Price has moved up since I opened the Long, so I am 35c in profit right now. But that is just a number on the screen until I choose to close it. I could press Market Close now and be done with it.

10/n

Back in Wallet, if you click Positions, you can see it here too. Since taking the previous screenshot, price has now gone down (#Crypto amirite). So my position is 88c in the red.

See Funding Payments down the bottom?

Back in Wallet, if you click Positions, you can see it here too. Since taking the previous screenshot, price has now gone down (#Crypto amirite). So my position is 88c in the red.

See Funding Payments down the bottom?

11/n

This is what it costs to have a position open. Each hour, a funding payment occurs. You might have to pay, or you might get paid. It depends on what the majority of people are doing. If the majority wants to long $ETH, the people lending it out essentially charge a premium.

This is what it costs to have a position open. Each hour, a funding payment occurs. You might have to pay, or you might get paid. It depends on what the majority of people are doing. If the majority wants to long $ETH, the people lending it out essentially charge a premium.

12/n

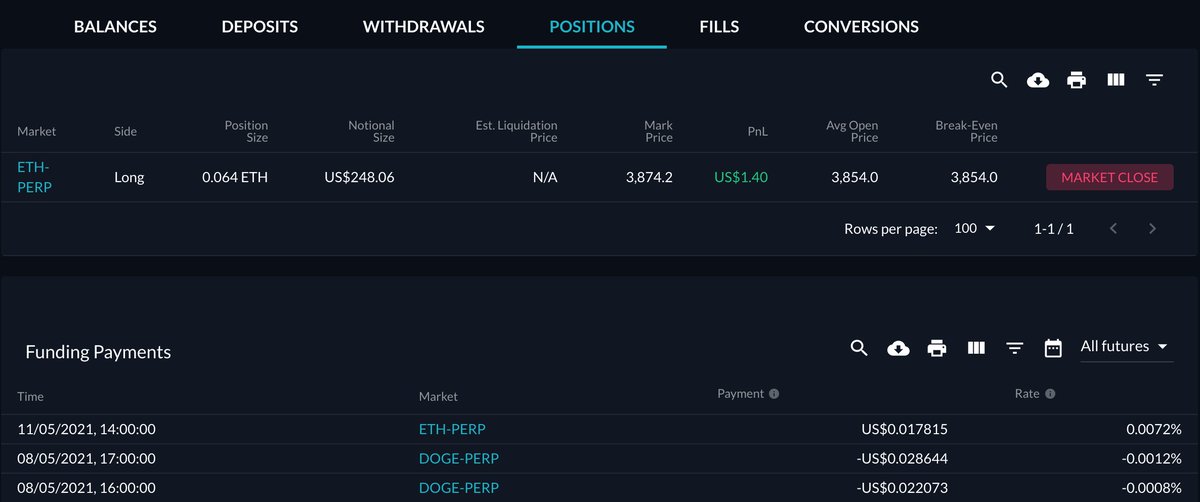

Now some time has passed. The position is in profit again (lol), and a payment has occurred. The number is positive, so I paid people who have Shorts open... I believe. Someone correct me if I'm wrong. I know I paid, just not sure exactly who gets the money.

Now some time has passed. The position is in profit again (lol), and a payment has occurred. The number is positive, so I paid people who have Shorts open... I believe. Someone correct me if I'm wrong. I know I paid, just not sure exactly who gets the money.

13/n

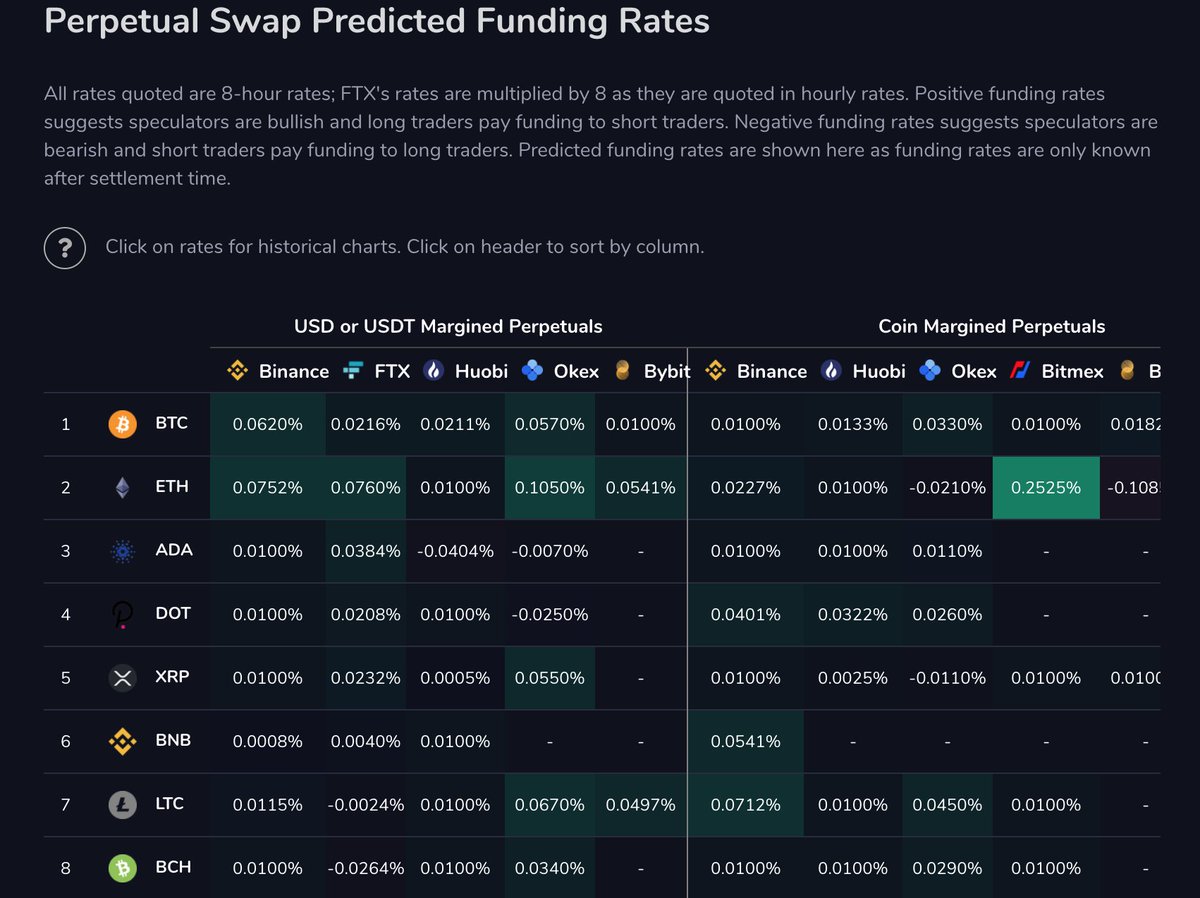

viewbase.com/funding shows the current Funding Rates across a bunch of exchanges. You can see $ETH on @FTX_Official here is slightly green. These boxes can be clear, green or red. The more green, the more people are going Long. It's a good sentiment check.

viewbase.com/funding shows the current Funding Rates across a bunch of exchanges. You can see $ETH on @FTX_Official here is slightly green. These boxes can be clear, green or red. The more green, the more people are going Long. It's a good sentiment check.

14/n

This was from a few days ago. The funding rates were high across the board. Check out $DOGE. This was in the lead up to Elon's SNL appearance.

Traders were leveraged Long here, so the opportunity for a big dump and a reset were likely. And that did end up playing out.

This was from a few days ago. The funding rates were high across the board. Check out $DOGE. This was in the lead up to Elon's SNL appearance.

Traders were leveraged Long here, so the opportunity for a big dump and a reset were likely. And that did end up playing out.

15/n

Now I'm going to close my position. I selected Market Order, and pressed Close Position.

The most important thing to know here is to click Reduce Only. I hovered over it, so this little info box appeared.

Now I press Sell.

Now I'm going to close my position. I selected Market Order, and pressed Close Position.

The most important thing to know here is to click Reduce Only. I hovered over it, so this little info box appeared.

Now I press Sell.

16/n

Remember, my position used borrowed funds. I opened a Long, but I could have opened a Short if I thought price was going to go down.

If you don't press Reduce Only, you might Close more than you have open. So FTX would open a new Short with whatever the difference is.

Remember, my position used borrowed funds. I opened a Long, but I could have opened a Short if I thought price was going to go down.

If you don't press Reduce Only, you might Close more than you have open. So FTX would open a new Short with whatever the difference is.

17/n

So that's how you open and close a Futures position. I made a cool $2, and paid 1.7c for Funding, with assets that were sitting there.

Now read on for some risks, and some ways to optimise your futures trading...

So that's how you open and close a Futures position. I made a cool $2, and paid 1.7c for Funding, with assets that were sitting there.

Now read on for some risks, and some ways to optimise your futures trading...

18/n

Risk: If you have a position open for ages and it isn't going up, you could pay more for Funding than you earn as profit.

Risk: If your position goes too far in the red, you can be Margin Called. Your position is closed and your collateral sold, to cover the loss.

Risk: If you have a position open for ages and it isn't going up, you could pay more for Funding than you earn as profit.

Risk: If your position goes too far in the red, you can be Margin Called. Your position is closed and your collateral sold, to cover the loss.

19/n

You can set Stop Losses and Trailing Stops, etc, like with Spot trading. Remember, that profit isn't locked in until you close the position. Protect the position against sudden drops so that you can lock in that profit.

You can set Stop Losses and Trailing Stops, etc, like with Spot trading. Remember, that profit isn't locked in until you close the position. Protect the position against sudden drops so that you can lock in that profit.

20/n

You can also use leverage. This is super risky. With leverage, you could open a position that is larger than the amount of collateral you actually have. Got $500 sitting there? You could open a $5000 long with 10x leverage. If you did that, the 315% might be more like 10%

You can also use leverage. This is super risky. With leverage, you could open a position that is larger than the amount of collateral you actually have. Got $500 sitting there? You could open a $5000 long with 10x leverage. If you did that, the 315% might be more like 10%

21/n

Clearly, it wouldn't take too big a move for your position to be $500 in the red- so you'd be margin called and lose it all.

IF you're CERTAIN price is moving up for the next few minutes, you could open that leveraged long. When price moves up a tiny bit, close 5% of it.

Clearly, it wouldn't take too big a move for your position to be $500 in the red- so you'd be margin called and lose it all.

IF you're CERTAIN price is moving up for the next few minutes, you could open that leveraged long. When price moves up a tiny bit, close 5% of it.

22/n

Keep closing little %s as it keeps moving up (don't forget to press Reduce Only- make it a habit).

This will move your average buy in price lower (your breakeven number).

It will increase the Margin Fraction too.

Keep going until the position is a safe size.

Keep closing little %s as it keeps moving up (don't forget to press Reduce Only- make it a habit).

This will move your average buy in price lower (your breakeven number).

It will increase the Margin Fraction too.

Keep going until the position is a safe size.

23/n

FYI, until you close your position, the profit or loss will be reflected in your USD balance. If there's profit, you can spend it (eg. on more Spot) before closing the position. This is compounding your gains, but is risky cos you're spending money you haven't secured yet.

FYI, until you close your position, the profit or loss will be reflected in your USD balance. If there's profit, you can spend it (eg. on more Spot) before closing the position. This is compounding your gains, but is risky cos you're spending money you haven't secured yet.

24/24

If you spend that USD without closing the position, and then the position goes red, your USD balance will be negative.

You'll have to sell underlying Spot tokens to bring the balance back above 0.

That's it!

Good luck and happy #trading

If you spend that USD without closing the position, and then the position goes red, your USD balance will be negative.

You'll have to sell underlying Spot tokens to bring the balance back above 0.

That's it!

Good luck and happy #trading

Oh yeah, and if you sign up to @FTX_Official with my referral code, you get 5% off transaction fees.

See how you go with futures trading!

ftx.com/#a=4536880

See how you go with futures trading!

ftx.com/#a=4536880

• • •

Missing some Tweet in this thread? You can try to

force a refresh