Divergences 📚

A meme or a powerful tool? It depends on how you use it.

▪️ What it is?

▪️ What type of divergences are there?

▪️ Indicator Divergence

▪️ Intermarket Divergence

▪️ The best way to use them?

1/15

A meme or a powerful tool? It depends on how you use it.

▪️ What it is?

▪️ What type of divergences are there?

▪️ Indicator Divergence

▪️ Intermarket Divergence

▪️ The best way to use them?

1/15

▪️ What it is?

Divergence is when the price of an asset is moving in the opposite direction of a technical indicator or is moving contrary to other data

Divergence warns that the current price trend may be weakening & in some cases may lead to the price changing direction

2/15

Divergence is when the price of an asset is moving in the opposite direction of a technical indicator or is moving contrary to other data

Divergence warns that the current price trend may be weakening & in some cases may lead to the price changing direction

2/15

▪️ What type of divergences are there?

There are two types:

1) Classic

2) Hidden

Classic bullish divergence usually occurs at the end of a bearish trend & vice versa

Hidden bullish divergence usually occurs in a bullish trending environment & vice versa

3/15

There are two types:

1) Classic

2) Hidden

Classic bullish divergence usually occurs at the end of a bearish trend & vice versa

Hidden bullish divergence usually occurs in a bullish trending environment & vice versa

3/15

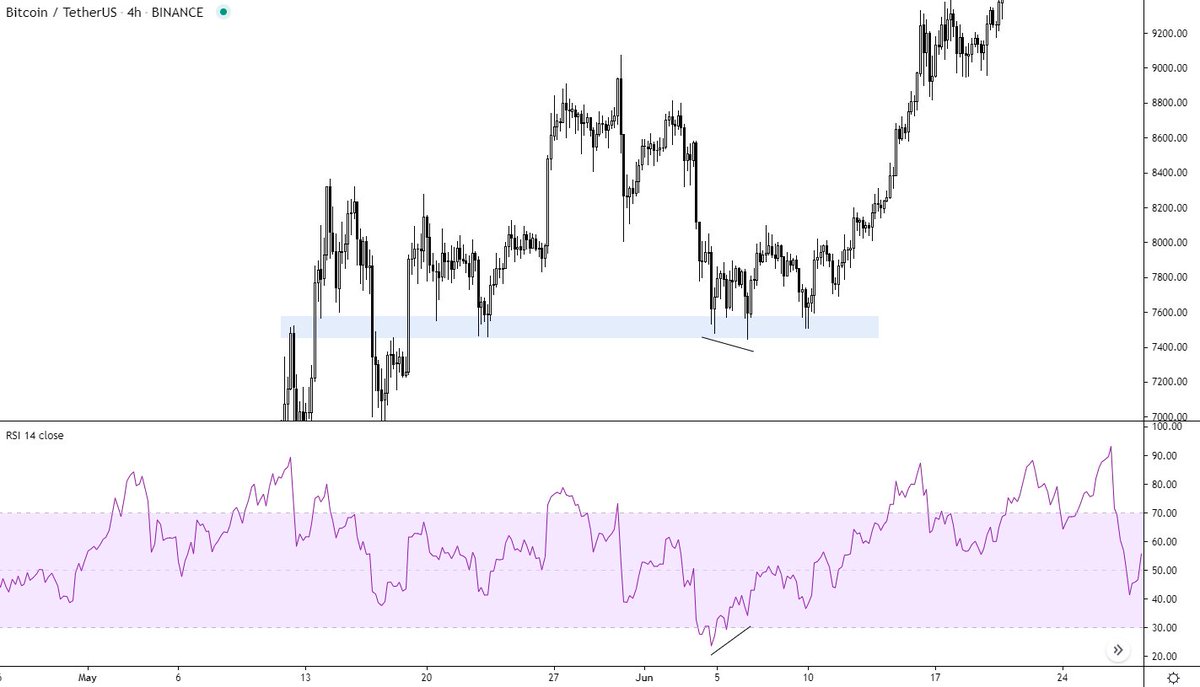

▪️ Indicator Divergence

The most common one is a divergence with an indicator. The most common ones are RSI, Stochastic, MACD

Here we see a classic one at the bottom of a trend.

The price must make a new Lower Low (LL), while an indicator makes a Higher Low (HL)

4/15

The most common one is a divergence with an indicator. The most common ones are RSI, Stochastic, MACD

Here we see a classic one at the bottom of a trend.

The price must make a new Lower Low (LL), while an indicator makes a Higher Low (HL)

4/15

The one with more probability is a divergence in a trend.

In this case a hidden bullish divergence.

Price makes Higher Low while indicator makes Lower Low

5/15

In this case a hidden bullish divergence.

Price makes Higher Low while indicator makes Lower Low

5/15

Vice versa a classic bearish counter trend divergence

Price makes Higher High (HH) while indicator makes Lower High (LH)

6/15

Price makes Higher High (HH) while indicator makes Lower High (LH)

6/15

Vice versa a bearish hidden trend divergence

Price makes Lower High (LH) while indicator makes Higher High (HH)

7/15

Price makes Lower High (LH) while indicator makes Higher High (HH)

7/15

▪️ Intermarket Divergence

Now that we understand what a divergence is let's use the divergence in a way almost nobody does

We find two closely correlated markets

Examples:

Crypto:

#BTC / $USD vs #ETH / $USD

Forex:

$EUR / $USD vs $GBP / $USD

Equities:

$DJI vs $SPX

8/15

Now that we understand what a divergence is let's use the divergence in a way almost nobody does

We find two closely correlated markets

Examples:

Crypto:

#BTC / $USD vs #ETH / $USD

Forex:

$EUR / $USD vs $GBP / $USD

Equities:

$DJI vs $SPX

8/15

You can sync the chart so they look like this.

If you are using @tradingview click on the top right corner, set the chart layout this way, and choose your preference.

I highly recommend syncing crosshair so you see it on both charts simultaneously

9/15

If you are using @tradingview click on the top right corner, set the chart layout this way, and choose your preference.

I highly recommend syncing crosshair so you see it on both charts simultaneously

9/15

Here are the divergences in the current range and you can see the advantages it brings.

If #BTC makes HL, while #ETH makes a LL that's the confirmed divergence and shows strength for the coin that made HL. In this example, it's #Bitcoin

And vice versa

10/15

If #BTC makes HL, while #ETH makes a LL that's the confirmed divergence and shows strength for the coin that made HL. In this example, it's #Bitcoin

And vice versa

10/15

▪️ The best way to use them?

From my experience, the best way to use this tool is when the price is trending, it provides the best results.

However, when we align HTF (Higher TimeFrame) support in HTF trend with LTF counter-trend divergence even that can be very useful.

11/15

From my experience, the best way to use this tool is when the price is trending, it provides the best results.

However, when we align HTF (Higher TimeFrame) support in HTF trend with LTF counter-trend divergence even that can be very useful.

11/15

But the absolutely best results come in a trending market.

You can use EMA 50 to clearly divide the trend and whenever you see the divergence you can go long in the trending market, in this case, #Bitcoin

Works decently with oscillators as well.

12/15

You can use EMA 50 to clearly divide the trend and whenever you see the divergence you can go long in the trending market, in this case, #Bitcoin

Works decently with oscillators as well.

12/15

Many examples such as this. Go & find out yourself

I know personally a trader who has built a trading system just upon this simple thing. And he doesn't trade anything else ;)

Once again is it 100% thing? No, nothing is, but it provides a nice edge/confluence

13/15

I know personally a trader who has built a trading system just upon this simple thing. And he doesn't trade anything else ;)

Once again is it 100% thing? No, nothing is, but it provides a nice edge/confluence

13/15

The thread was inspired by @CryptoRobotETH suggestion and we thank you for it!

14/15

https://twitter.com/CryptoRobotETH/status/1406710800849514497

14/15

Hope you have found this thread once again valuable & it will serve you well.

Please consider liking & sharing it with your friends. It's gonna help me create more of these educational threads & help your friends to get better at this game. Thank you 🙌

15/15

Please consider liking & sharing it with your friends. It's gonna help me create more of these educational threads & help your friends to get better at this game. Thank you 🙌

15/15

• • •

Missing some Tweet in this thread? You can try to

force a refresh