#Crude down 5% in the last few days. Crude prices have been correcting over the last few days by around 5% from its recent high of $75.4 on Wednesday. This comes on the back of press reports quoting #OPEC+ sources that the #UAE had reached a compromise. UAE's baseline...(1/4)

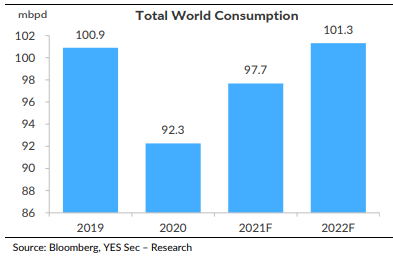

...output is expected to be increased to 3.65mbpd from the current 3.17mmbpd. This is broadly in line with recent market expectations. This eases the markets' read of a tight supply situation and helps soften the demand-supply balance, especially given the...(2/4)

...expectation of a demand pickup in H2 of 2021. Further on the Iranian wildcard we had written about in an earlier tweet, Iran is not expected to return to the negotiating table with the #US until it forms a new government, that is expected to take office...(3/4)

...in Aug'21. Note here that this is important because Iran's current output stands at 2.5mbpd, compared to a level of 3.8mbps of production before sanctions were imposed by the US.(4/4)

• • •

Missing some Tweet in this thread? You can try to

force a refresh