Charlton Athletic’s 2019/20 accounts covered a season in the Championship following promotion from League One, but they were then relegated after finishing 22nd. New owner Tomas Sandgaard said it was “a difficult one for fans, as they feared for the future of the club.” #CAFC

#CAFC have faced many ownership issues, starting with the deeply unpopular Roland Duchâtelet, who bought the club in 2014. Six years later he sold Charlton to East Street Investments Limited, though it was not long before their owners, Tahnoon Nimer and Matt Southall, fell out.

EFL said that the ESI takeover was not approved and imposed a transfer embargo due to funding issues. In June 2020 ESI was taken over by a consortium led by Paul Elliott, but they failed the Owners and Directors test, leading to Thomas Sandgaard acquiring #CAFC in September 2020.

Following promotion to the Championship, #CAFC reduced their loss from £10.1m to just £1.1m, as revenue increased £7.5m (95%) from £7.9m to £15.4m and profit on player sales rose £1.5m to £4.4m, partly offset by expenses growing £3.3m (17%). Boosted by £1.5m loan waiver.

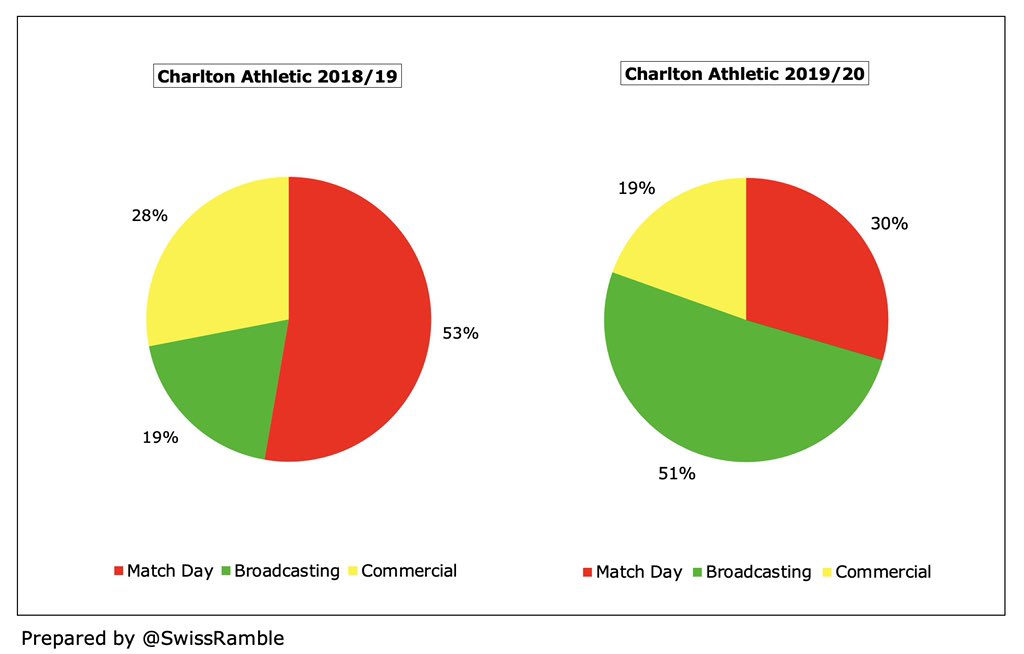

#CAFC revenue increase mainly driven by broadcasting income rising £6.3m from £1.5m to £7.8m, due to higher TV distributions in the Championship, while commercial increased £0.8m (36%) to £3.0m and match day grew £0.4m (9%) to £4.5m. Other income included £634k furlough grant.

However, #CAFC had some cost growth, as wages rose £1.8m (17%) from £10.4m to £12.2m, other expenses increased £1.9m (37%) from £5.3m to £7.2m and depreciation was up £0.6m. On the other hand, player amortisation fell £1.1m to £0.7m and interest payable was down £0.8m to £0.3m.

Although a loss is rarely good news, #CAFC £1.1m deficit was actually one of the best results in the Championship. Only 3 clubs made a (small) profit in 2020, while some huge losses were reported: Stoke City £88m, #LUFC £62m and #FFC £48m (latter two included promotion bonuses).

#CAFC figures have obviously been hit by the pandemic, which has resulted in money lost from a rebate to broadcasters and games played behind closed doors, while revenue for games played after the 30th June accounting close has been deferred to 2020/21 accounts.

I estimate that COVID led to £1.6m reduction in #CAFC revenue, split between £1.2m lost (match day £0.9m, TV rebate £0.3m) and £0.5m broadcasting deferred to 2020/21, offset by £0.7m furlough income under government job retention scheme, leading to a net £1.0m adverse impact.

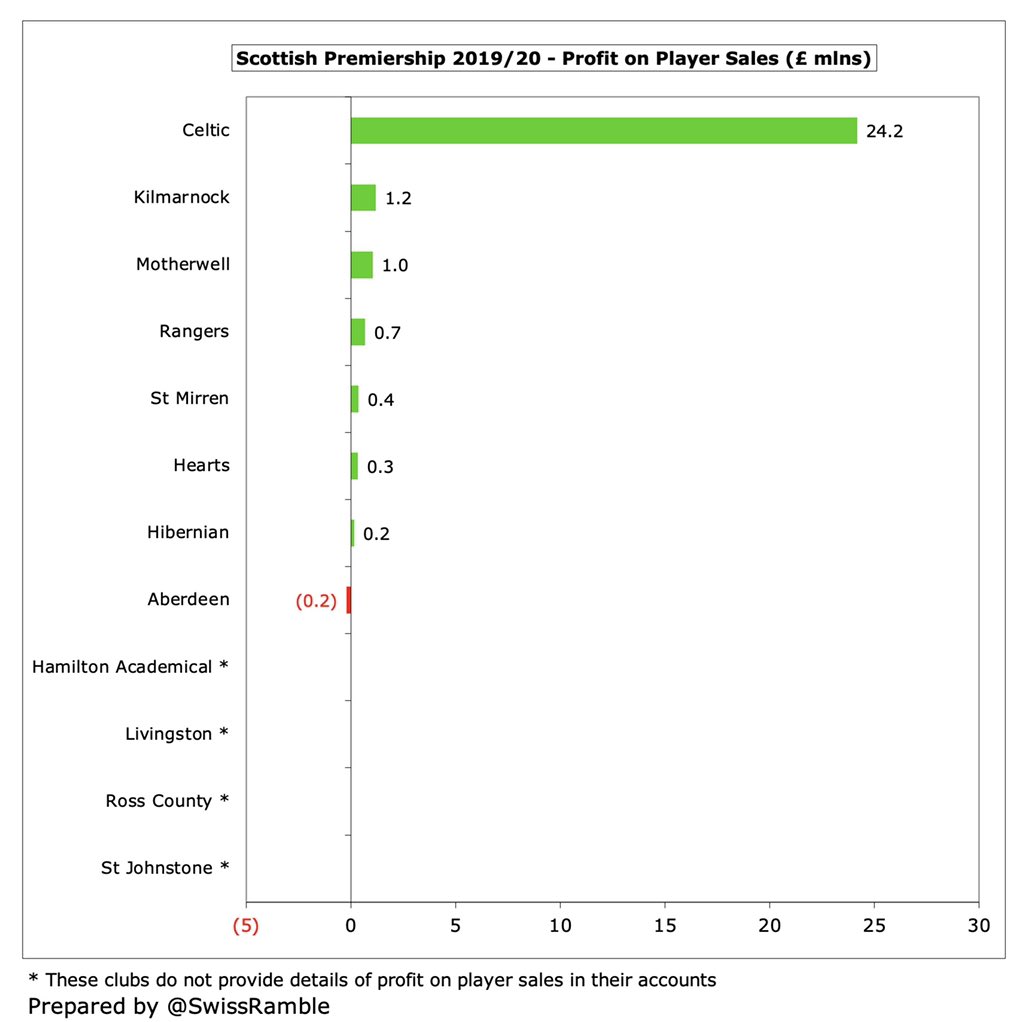

#CAFC profit on player sales rose £1.5m to £4.4m, including Dijksteel to #Boro plus contingent payments on previous sales (Lookman, Gomez, Palmer, Pope & Grant). That’s a solid improvement, but still a fair bit lower than WBA £29m, Bristol City £26m, Fulham £25m & Brentford £25m.

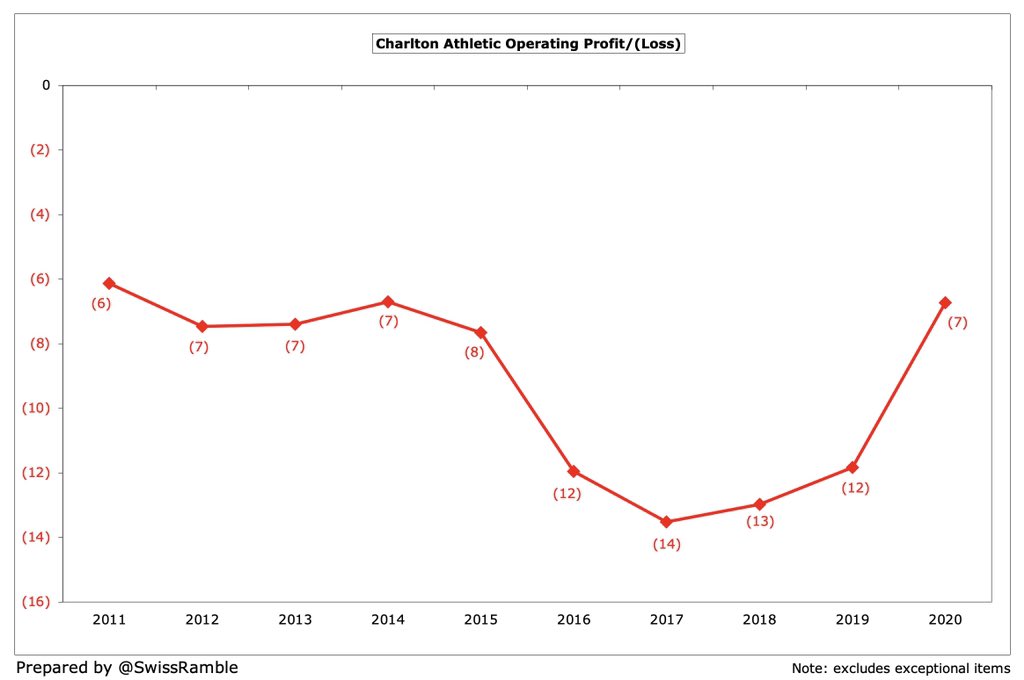

#CAFC are no strangers to a loss, having only reported a profit once in the last decade – and that was just £1.2m in 2017. Their total losses amounted to £60m over this period. As Sandgaard wryly observed, “It is expensive to run a football club.”

The profit posted by #CAFC in 2017 was largely due to £16m from player sales, including Lookman to #EFC. Otherwise, they did not manage to make more than £5m in any other year in last decade. The 2020/21 season will include £5.6m income, mainly Bonne to QPR and Doughty to Stoke.

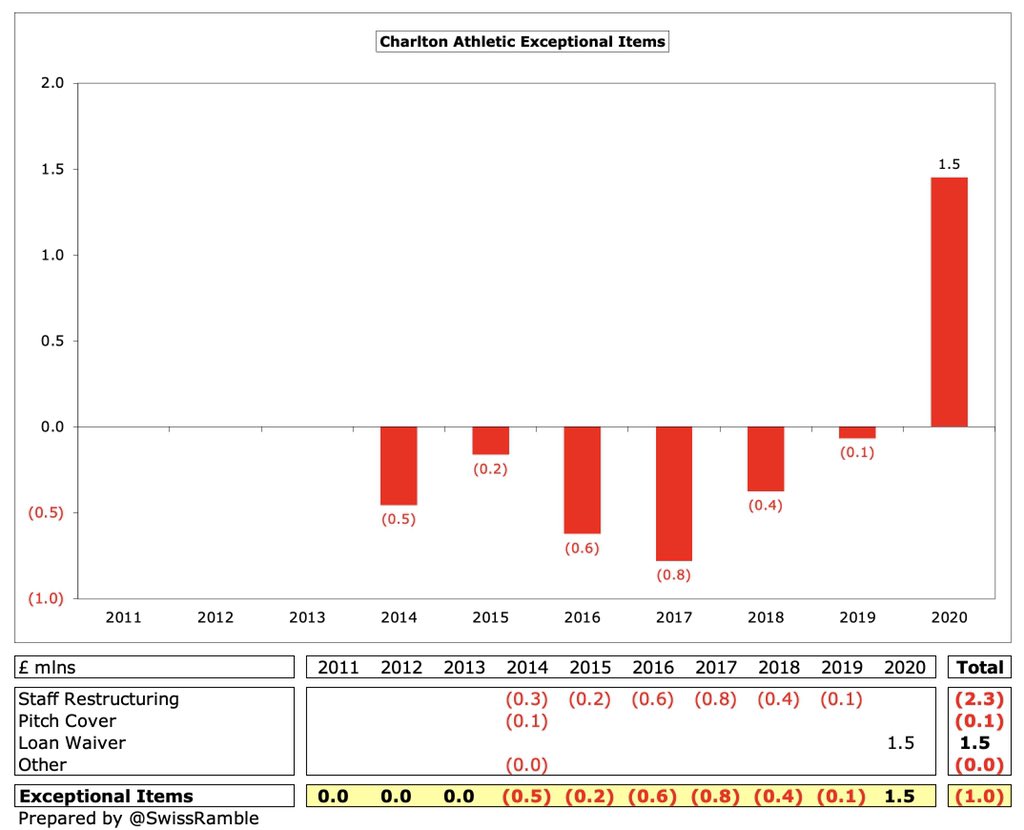

Since 2014 #CAFC have been hit by a total of £2.3m staff restructuring charges, but the 2020 results instead benefited from their holding company writing-off a £1.5m loan.

#CAFC operating loss (excluding player sales, exceptional items & interest) improved from £12m to £7m, which was actually one of the best performances in the Championship. Nearly every club in this division posts substantial operating losses, i.e. almost half were above £30m.

Despite COVID impact, #CAFC £15.4m revenue was £3.3m (27%) higher than the last time they were in the Championship in 2016. Promotion from League One was worth £7.5m. Broadcasting is the most important revenue stream with 51%, followed by match day 30% and commercial 19%.

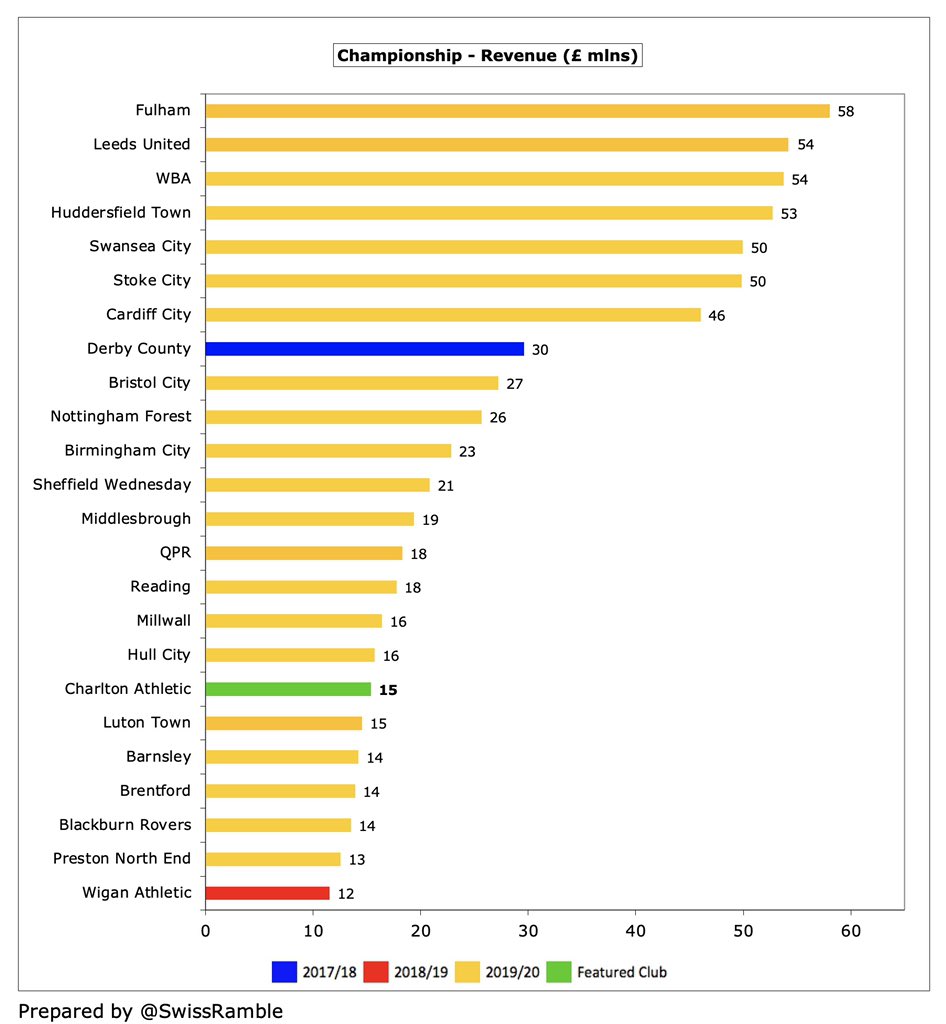

Even after the growth in 2019/20, #CAFC £15m revenue was still one of the lowest in the Championship. Their financial challenge in this division was highlighted by the fact that this was around a quarter of #FFC £58m, #LUFC £54m, WBA £54m and #HTAFC £53m.

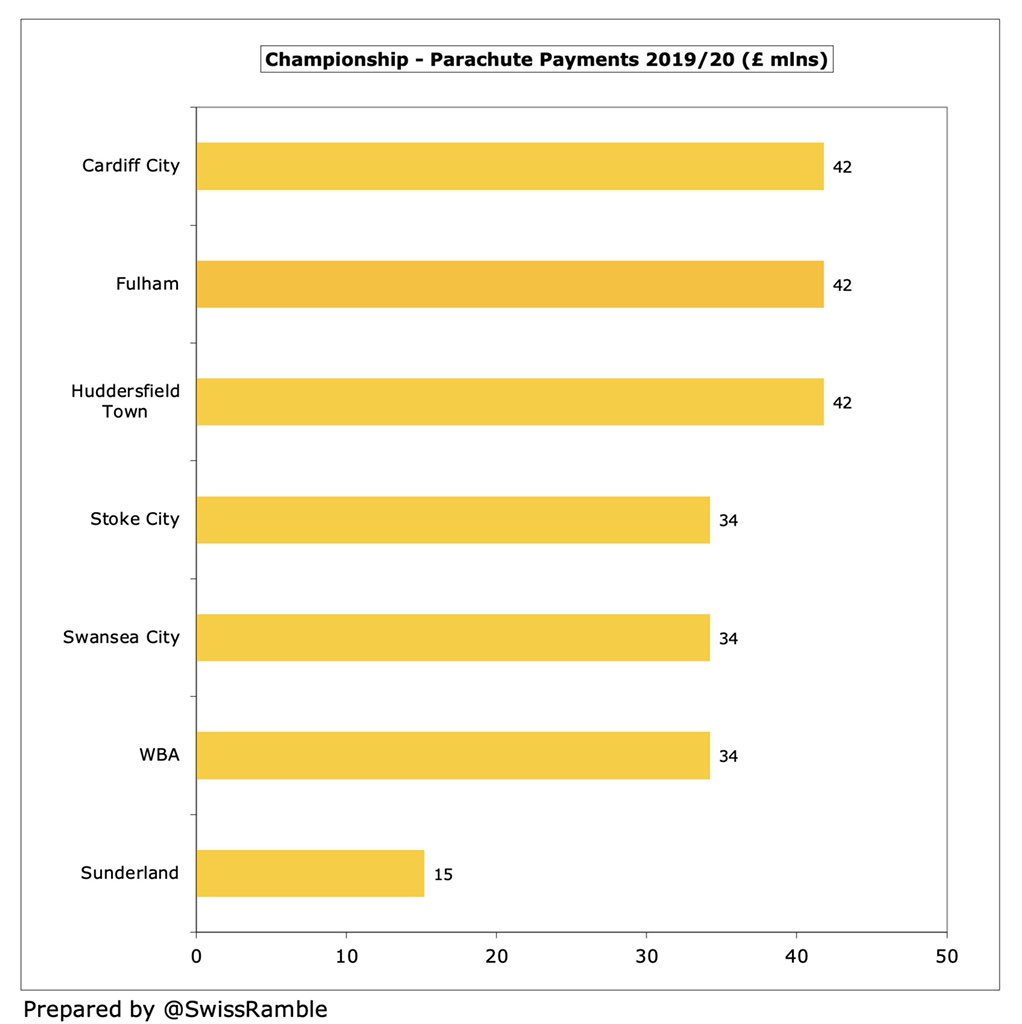

Championship revenue is hugely influenced by Premier League parachute payments with 6 clubs benefiting in 2019/20, led by Cardiff City, #FFC and #HTAFC (£42m), then Stoke City, Swansea City and WBA (£34m). This makes life really difficult for clubs like #CAFC.

However, if parachute payments were excluded, #CAFC would still have only had the 17th highest revenue in the Championship with the gap to Leeds United £54m (due to massive commercial income) being a chunky £39m.

#CAFC TV income increased from £1.5m to £7.8m, due to higher EFL distribution (£0.8m to £3m) and PL solidarity payment (£0.7m to £4.5m) in the Championship. Most clubs earn £7-10m, but significant gap to those with parachute payments, e.g. over £40m for those recently relegated.

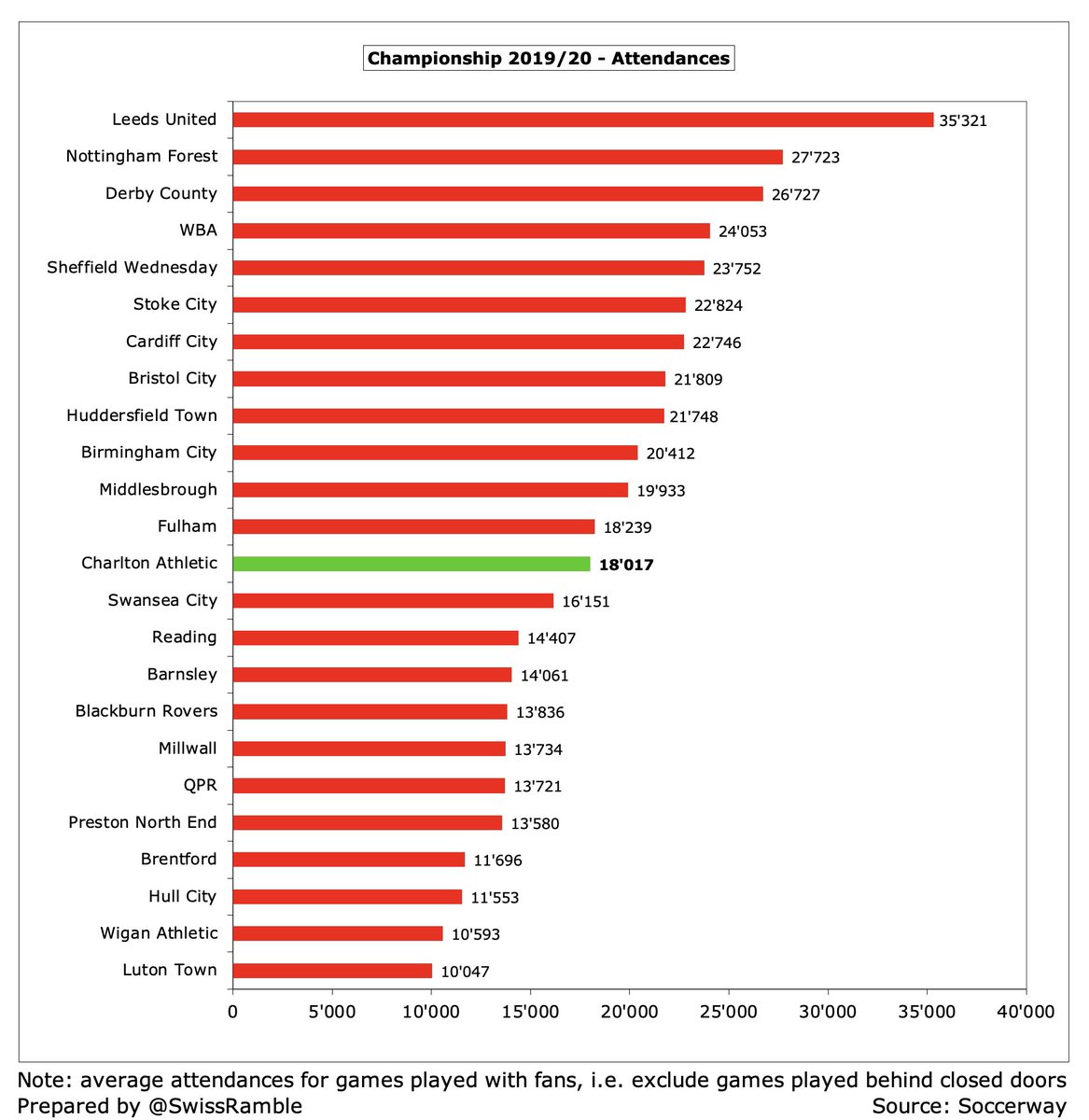

#CAFC match day income rose £0.4m (9%) to £4.5m, despite playing 4 home games behind closed doors because of the pandemic, as attendances rose following promotion. Revenue mid-table in the Championship, less than half of #LUFC £11m.

#CAFC average attendance (for games played with fans) increased 52% from 11,827 to 18,017, the club’s highest since 2013. Mid-table in the Championship, but Charlton’s potential was highlighted by their highest home crowd of 25,363 against Blackburn Rovers.

#CAFC total commercial income rose £0.8m (36%) from £2.2m to £3.0m, partly due to more streaming on Charlton TV. This was the club’s highest since 2008, but still firmly in the bottom half of the Championship, far below likes of #LUFC £34m, Bristol City £14m and Stoke City £14m.

#CAFC shirt sponsor in 2019/20 was Children with Cancer, replacing BETDAQ. From 2020 KW Holdings have sponsored the home short; away shirt sponsor was Vitech Services in 2020/21 and Walker Mower in 2021/22. Hummel have been the kit supplier since 2017.

#CAFC wage bill increased £1.8m (17%) from £10.4m to £12.2m, “primarily reflecting the increased cost of player wages in the Championship”. That said, this was £1.2m (9%) lower than the last time Charlton were in this division in 2016.

Despite the increase, #CAFC £12m wage bill is one of the lowest in the Championship, only above Barnsley £11m (#LTFC did not divulge wages), so it was perhaps unsurprising they were relegated. Miles behind #LUFC £78m, #FFC £73m and WBA £67m (all included hefty promotion bonuses).

#CAFC wages to turnover ratio improved from 133% to 80%, their lowest since 2009 (when they had a parachute payment). The vast majority of clubs in the Championship have (unsustainable) ratios over 100% with Reading “leading the way” at 211%.

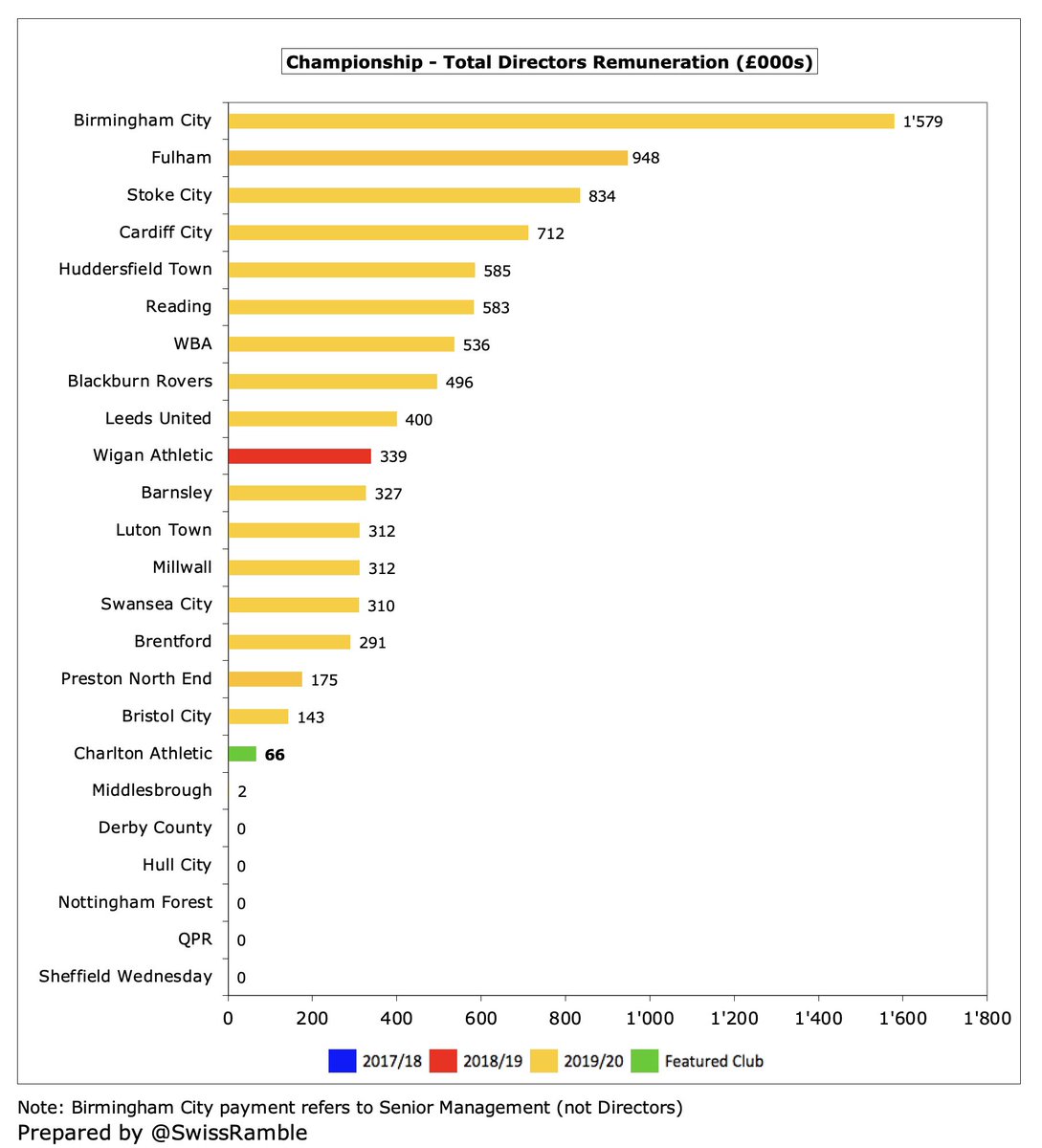

#CAFC directors’ remuneration was reported as only £66k, but the notes to the accounts list plenty of additional payments: “key management personnel” £1.7m, consultancy services £150k, property leases £77k, car leases £26k, promotion party £15k and credit card £4k.

In fact #CAFC spent £522k on motor vehicles, i.e. twice as much as £262k on new players. Agreements terminated after year-end at a cost of £261k. Sandgaard highlighted previous ownership’s profligacy by giving away one of the infamous Range Rovers in “Our Club Your Car” campaign.

This contributed to the £0.9m “increase in spending committed to by East Street Investments Ltd”, which was one of the reasons why #CAFC other operating expenses climbed £1.9m (37%) from £5.3m to £7.2m, the club’s highest since 2010.

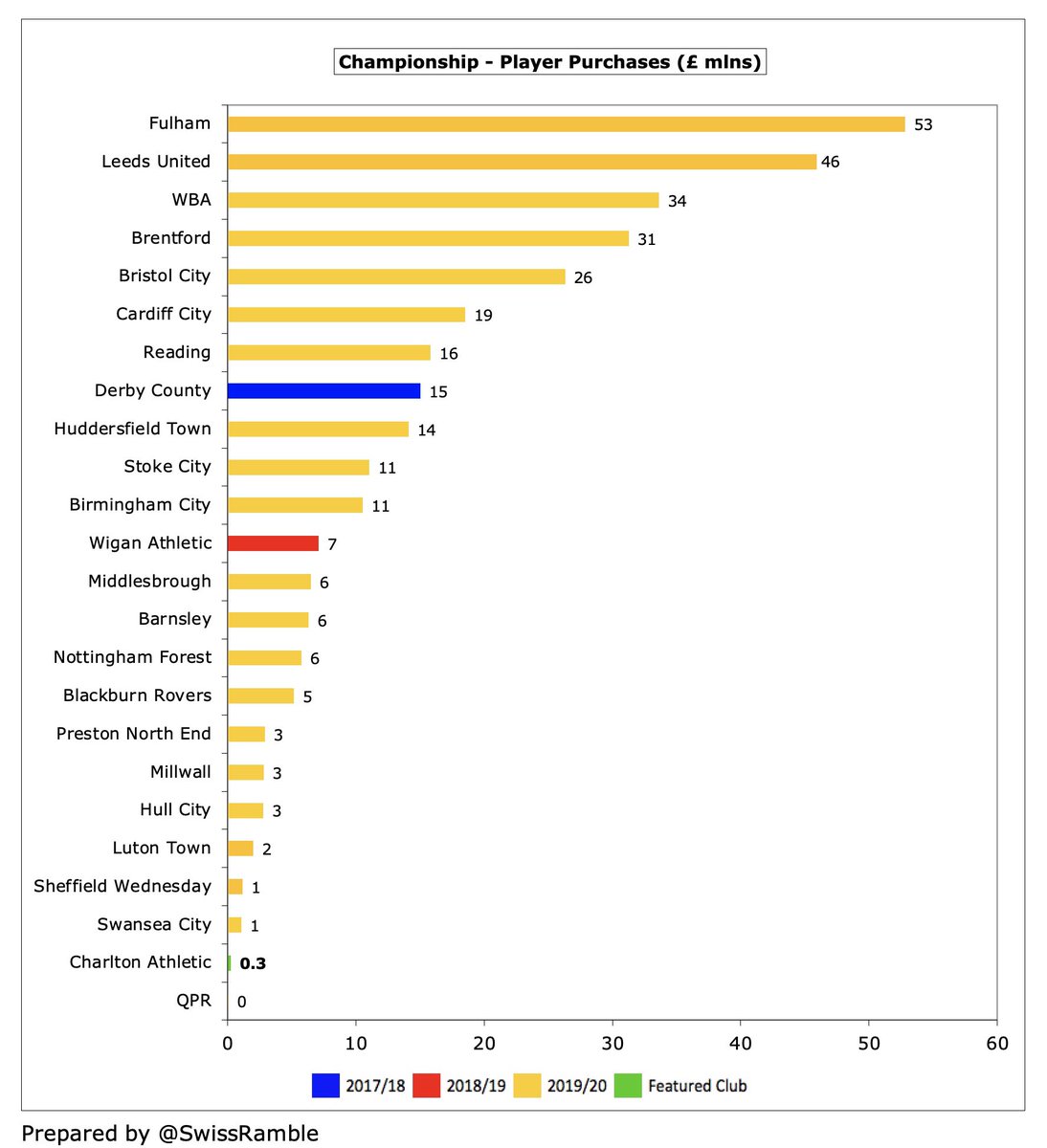

#CAFC player amortisation, the annual charge to write-off transfer fees over a contract, fell £1.1m (59%) from £1.8m to £0.7m, reflecting low investment in players. Unsurprisingly, this is one of the lowest in the Championship, only ahead of QPR, and miles below #FFC £40m.

#CAFC only spent £262k on new players in 2020, partly due to a transfer embargo imposed by EFL. This was the second lowest in the Championship, only ahead of QPR £55k, but miles below #FFC £53m, #LUFC £46m, #WBA £34m, Brentford £31m and Bristol City £26m.

#CAFC have hardly spent any money on new players in recent times, averaging only £0.4m in the last four years, compared to £3.4m in the preceding 3-year period. In fact, they averaged net sales of £6.7m in this period. Transfer embargo now lifted, so £1.4m outlay since year-end.

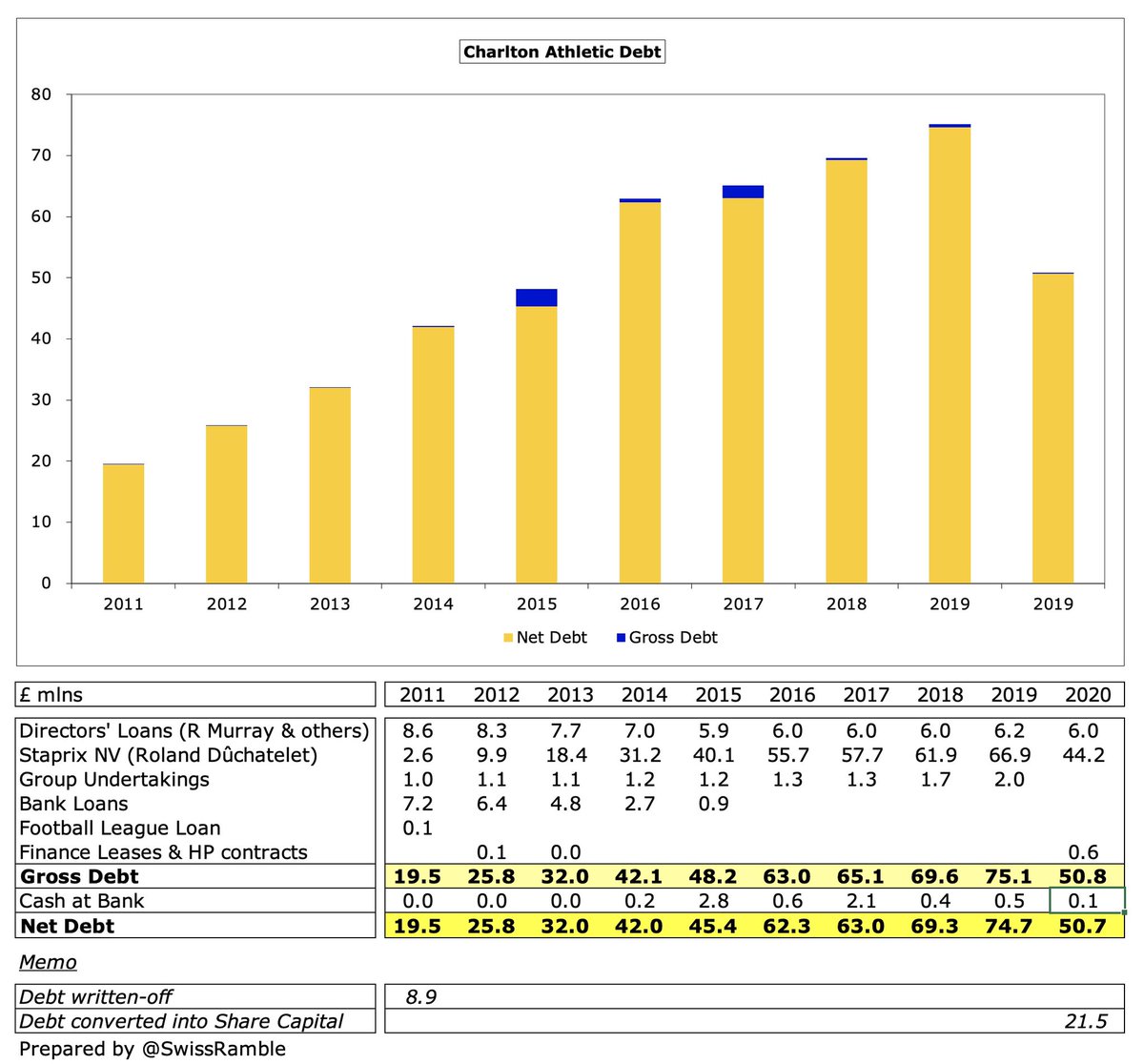

#CAFC gross debt decreased by £24m from £75m to £51m, thanks to £21.5m being converted to equity. Mainly £44m from Duchâtelet, though this was waived after the accounts. Also included £6m from R Murray and other former directors. Sandgaard put in £10.5m interest-free loan Sep 20.

Following the decrease, #CAFC £51m debt was 13th highest in the Championship, a fair way below the likes of Stoke City £187m, #BRFC £156m, Birmingham City £116m and #Boro £116m. Until the £21.5m conversion into capital in 2021, it had been steadily rising from £20m in 2011.

That said, most debt in the Championship is provided interest-free by club owners with only 5 clubs in this division paying more than £1m interest. No cash flow statement in #CAFC accounts, but £435k interest payable in the profit and loss account in 2019/20.

Although it is good that Duchâtelet’s remaining £44m debt was waived after year-end, #CAFC are not completely free of the Belgian, as this was in exchange for ownership of the stadium and training ground. Rent has increased from £188k to £500k per annum.

In addition, #CAFC would have to pay Duchâtelet contingent consideration “if the club is promoted to the Premier League before 25 September 2030”. The details of the amount have not been disclosed, as this would apparently be “prejudicial” to the September 2020 transaction.

#CAFC don’t separately report transfer debt, but assuming this is 90% of Trade Creditors, it was only £1.5m, which reflects the limited transfer spend in the last few years. This was one of the lowest in the Championship, far below Fulham £86m, and Leeds United £49m.

#CAFC cash balance dropped from £478k to £138k. This was the lowest in the Championship, but in fairness most clubs in this division have less than £2m cash in the bank. Invested £400k in facilities (improvement in changing rooms and ground landscaping).

This has been a tough few years for #CAFC, but fans will hope for a period of stability under Thomas Sandgaard. The club just missed out on the League One play-offs in 2020/21, so will hope to challenge for promotion this season under manager Nigel Adkins.

• • •

Missing some Tweet in this thread? You can try to

force a refresh