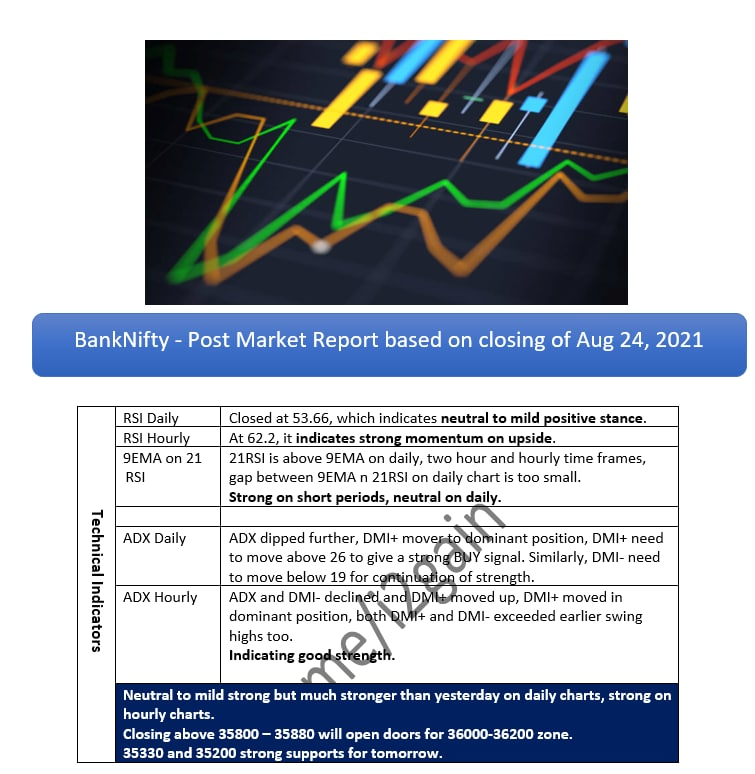

#BankNifty outperformed broader #Nifty after a long time, looking at the momentum today, we may see it touching much higher levels in next few days. Please refer to following quantitative and technical post market reports for details.

#HDFCBank #icicibank and #SBIN led the rally today, look at #KOTAKBANK #AXISBANK & #indusind too.

Important levels are mentioned in following note.

Subscribe for Free : t.me/i2gain

@vivbajaj

Important levels are mentioned in following note.

Subscribe for Free : t.me/i2gain

@vivbajaj

@threadreaderapp "unroll"

• • •

Missing some Tweet in this thread? You can try to

force a refresh