With #DeFi options ever expanding, many investors are turning to #yieldfarming as an alternative to trading with safer and often higher returns!

But what is yield farming and how can you get involved? 👀

🧵 #Thread🧵 (1/6)

But what is yield farming and how can you get involved? 👀

🧵 #Thread🧵 (1/6)

Just like a bank 🏦 giving you interest on your savings, you can earn interest on your #crypto by lending your tokens to a #cryptocurrency project such as @CurveFinance, @BalancerLabs, @AmpleforthOrg and more!

(2/6)

(2/6)

Lending your #tokens is trustless, meaning you always control your funds and can access them at any time. The whole process is open and #permissionless, with the rules determined by computer code 🖥️ instead of a centralised gatekeeper - like a bank.

(3/6)

(3/6)

So where does “farming” come into play?🤔

Protocols such as @CompoundFinance launched a liquidy mining program that launched a token - $COMP, and gave it to all borrowers and lenders on the platform. The higher amount of lending/borrowing used, the more #COMP tokens earned

(4/6)

Protocols such as @CompoundFinance launched a liquidy mining program that launched a token - $COMP, and gave it to all borrowers and lenders on the platform. The higher amount of lending/borrowing used, the more #COMP tokens earned

(4/6)

You can check out our latest detailed blog below to read much more about yield farming, and the different places to earn the best rate of return for you assets 👇 (5/6)

blog.deversifi.com/what-is-yield-…

blog.deversifi.com/what-is-yield-…

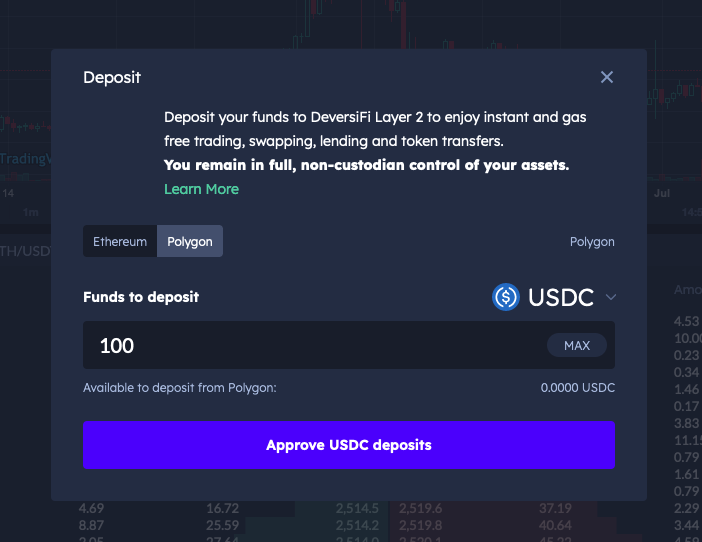

So now that you know all about yield farming, why not get started? Right now you can put your $USDC hard at work on our platform and soon will have many more options for all of your different tokens 🙌

Get earning now! 👇 (6/6)

app.deversifi.com/yield

Get earning now! 👇 (6/6)

app.deversifi.com/yield

• • •

Missing some Tweet in this thread? You can try to

force a refresh