sell your jpgs now.

👇🧵

👇🧵

gonna get lots of hate.

A camp - hodl, why sell when #coinbase is launching. can't time the market. buy the dip. bull bull bull.

B camp - fud fud fud, bear bear bear.

A camp - hodl, why sell when #coinbase is launching. can't time the market. buy the dip. bull bull bull.

B camp - fud fud fud, bear bear bear.

these comments are alllll flawed b/c

1st - they provide no context.

2nd - they are indeed correct, in their own specific situation.

to understand what you should really do, you need to understand the CONTEXT, b/c everyones situation is different.

so...

1st - they provide no context.

2nd - they are indeed correct, in their own specific situation.

to understand what you should really do, you need to understand the CONTEXT, b/c everyones situation is different.

so...

ill break it down into 3 tiers for you, so if you hold these tiers, ask yourself these questions so you can act accordingly.

no, i will not name projects.

my intent for this thread is to spread knowledge so u can make your own decisions..

+ what do i know?

lets dive in 👇

no, i will not name projects.

my intent for this thread is to spread knowledge so u can make your own decisions..

+ what do i know?

lets dive in 👇

1. bluechip (~10-30E+)

these are projects that can withstand the test of time. have they proven themselves? zoom out and see whether they have gone through the bears/bulls.

why?

these are projects that can withstand the test of time. have they proven themselves? zoom out and see whether they have gone through the bears/bulls.

why?

either the project itself has enough significance (#cryptopunks) or the team is committed enough to storm through the winters and are serious in building.

keep in mind - majority of these founding teams netted millions. they technically can just retire and never work again.

keep in mind - majority of these founding teams netted millions. they technically can just retire and never work again.

i hold some of these - my strategy?

hodl

- continue to hodl as i don't need to swing trade and hope to get a lower entry

- don't want to trigger capital gains tax by selling either

- time in market is better than timing the market

- very comfy as im bullish on #NFT

hodl

- continue to hodl as i don't need to swing trade and hope to get a lower entry

- don't want to trigger capital gains tax by selling either

- time in market is better than timing the market

- very comfy as im bullish on #NFT

2. midcaps (~2-10E+)

these are the projects that have great promise. team is solid. have some hardcore fans/clout aka strong communities. haven't been around for too long.

(keep in mind, majority of the projects are only couple mths odd - still high risk involved)

these are the projects that have great promise. team is solid. have some hardcore fans/clout aka strong communities. haven't been around for too long.

(keep in mind, majority of the projects are only couple mths odd - still high risk involved)

reality is, u don't know whether what their promise roadmap will actually work.

ALL ideas can sound great and revolutionary.

team can be trying everything, but still doesn't work.

it all comes down to two things.

execution + product/market fit.

ALL ideas can sound great and revolutionary.

team can be trying everything, but still doesn't work.

it all comes down to two things.

execution + product/market fit.

i hold some of these - my strategy?

50/50

- hodl the ones that i love and connect with

(theres no right or wrong - no one knows for certain)

- sell those which i feel iffy abt

(will they be ard 3/6mths from now?)

50/50

- hodl the ones that i love and connect with

(theres no right or wrong - no one knows for certain)

- sell those which i feel iffy abt

(will they be ard 3/6mths from now?)

3. lowcaps (<2E)

they are low cap for a reason. inherently lots of risks.

amongst many variables these two are the biggest.

team - legit or not? long haul or rug pull

community - true believer? or flippers?

they are low cap for a reason. inherently lots of risks.

amongst many variables these two are the biggest.

team - legit or not? long haul or rug pull

community - true believer? or flippers?

with low caps, we aren't looking for a moonshot anymore in the short term.

we are banking on whether

1. these projects will even be around in the next 2-3mths of winter (if its indeed winter)

2. enough believers will stick ard to rally behind the project

we are banking on whether

1. these projects will even be around in the next 2-3mths of winter (if its indeed winter)

2. enough believers will stick ard to rally behind the project

i hold some of these - my strategy?

90/10

- hodl the ones that can check the boxes above. + be prepared with it all going to 0.

- hodl the ones that are technically worthless. more of a lottery. no point selling now.

- sold 90% when there is still value now.

90/10

- hodl the ones that can check the boxes above. + be prepared with it all going to 0.

- hodl the ones that are technically worthless. more of a lottery. no point selling now.

- sold 90% when there is still value now.

thats why i made the move a couple days ago.

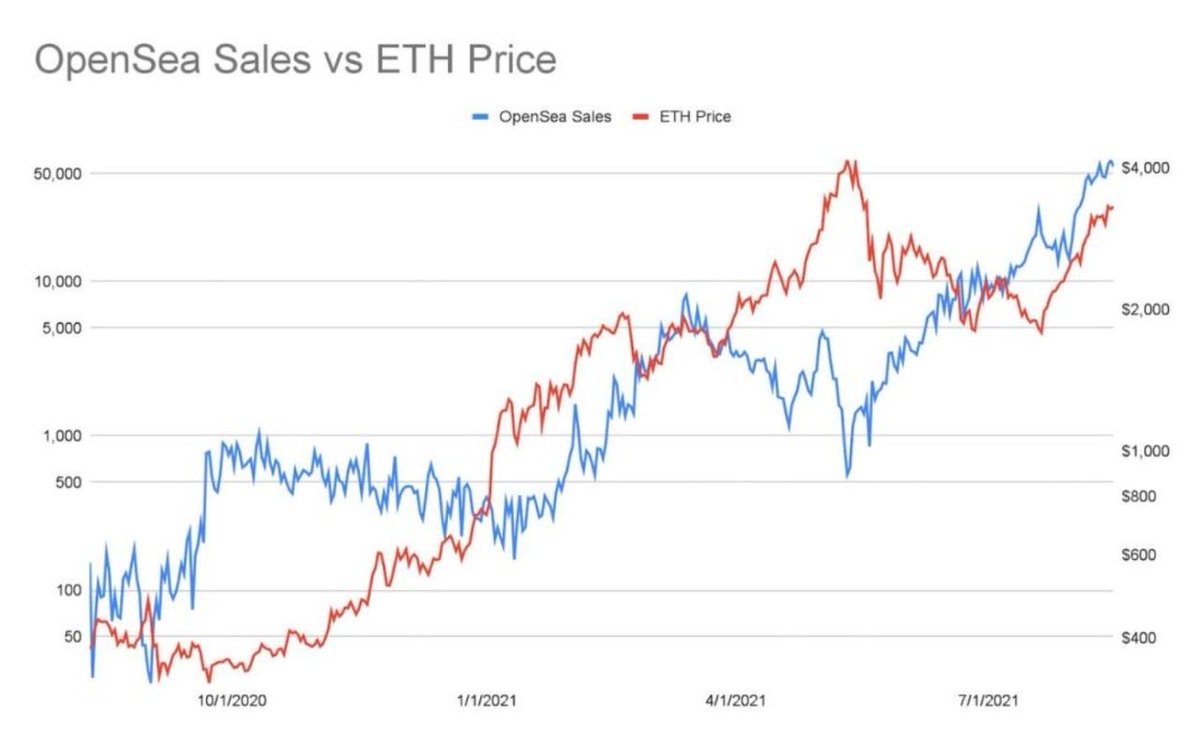

market has proceed to tank more than +40% after 👇

market has proceed to tank more than +40% after 👇

https://twitter.com/wilxlee/status/1449176999893766146?s=20

so what am i doing with the liquid now?

i can wait - the opportunity cost of investing it now, is not that much anymore.

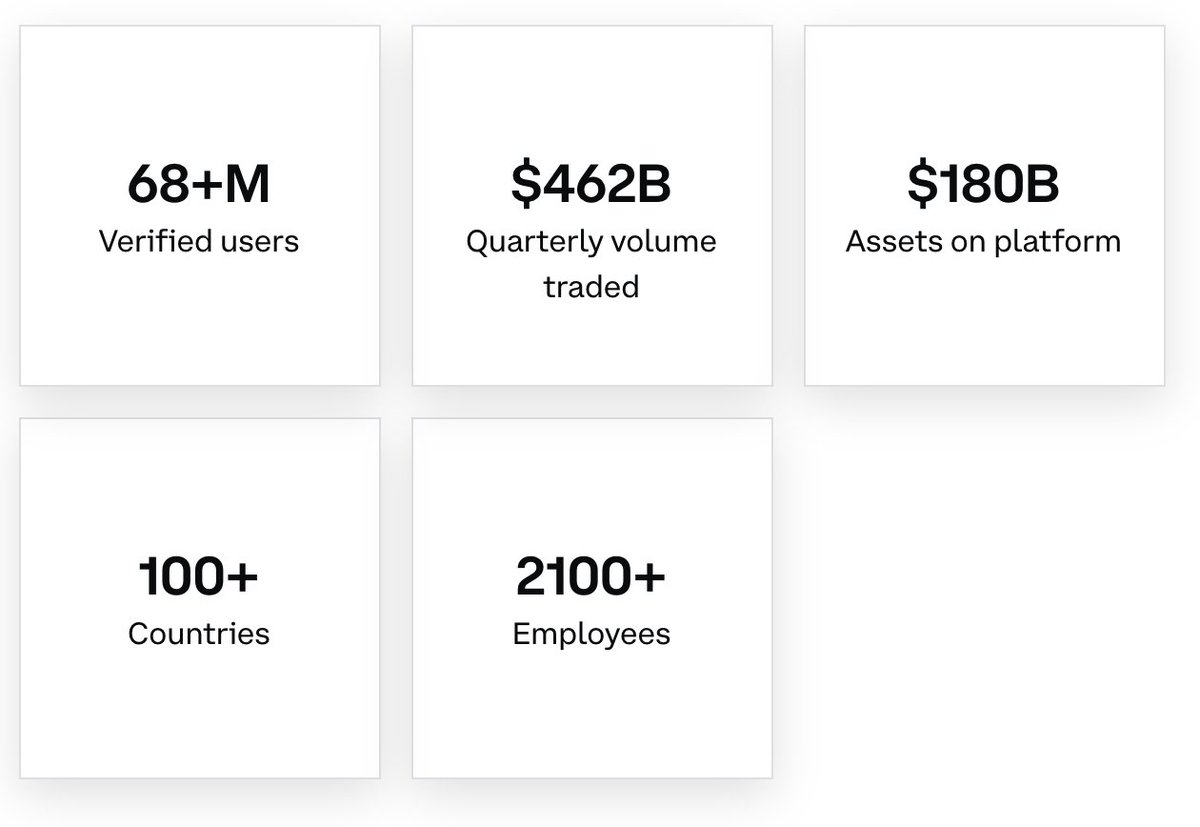

we are not seeing the x10-20 anytime soon. #coinbase nft isn't happening till end of year

+ with high % eth hitting ath 👇

i can wait - the opportunity cost of investing it now, is not that much anymore.

we are not seeing the x10-20 anytime soon. #coinbase nft isn't happening till end of year

+ with high % eth hitting ath 👇

https://twitter.com/wilxlee/status/1446009711355064320?s=20

right now - the narrative in the market -

smart money is shifting into alts in preparation of btc/eth ath. then after, coinciding with #coinbase launch to move gains back into #nfts for that leg up.

so thats my play.

smart money is shifting into alts in preparation of btc/eth ath. then after, coinciding with #coinbase launch to move gains back into #nfts for that leg up.

so thats my play.

if you don't know what you are doing, know that:

its ok to take a lost for now.

its ok to just hold ETH.

its ok to not buy anything.

its ok to watch.

its ok to ape.

seek to learn, not to flip.

$$$ will follow.

its ok to take a lost for now.

its ok to just hold ETH.

its ok to not buy anything.

its ok to watch.

its ok to ape.

seek to learn, not to flip.

$$$ will follow.

Final thoughts:

so if you CHOOSE to sell your jpegs, now that you have CONTEXT, then GREAT! you've learnt to develop your own conviction, your own thesis.

if you CHOOSE to ape, now that you have CONTEXT, then GREAT! you can sleep well at night.

but if u still don't know..

so if you CHOOSE to sell your jpegs, now that you have CONTEXT, then GREAT! you've learnt to develop your own conviction, your own thesis.

if you CHOOSE to ape, now that you have CONTEXT, then GREAT! you can sleep well at night.

but if u still don't know..

how to choose or rather to use your brain and think, hey just follow me and retweet this 🤣

ill think for you and manage your funds.

oh make sure you send me ur seed phrase so i can help you buy the dip and sell the highs 🤣🤣🤣

(jk, please don't dm me)

ill think for you and manage your funds.

oh make sure you send me ur seed phrase so i can help you buy the dip and sell the highs 🤣🤣🤣

(jk, please don't dm me)

ps: please don't ask me to name projects. im just a regular dude and i really don't know shit. + im really not into pumping + dumping. if i am, you won't be following me

pss: not financial advise, i just share with u my thinking process so that we can all win together.🌟🌟🌟

pss: not financial advise, i just share with u my thinking process so that we can all win together.🌟🌟🌟

• • •

Missing some Tweet in this thread? You can try to

force a refresh