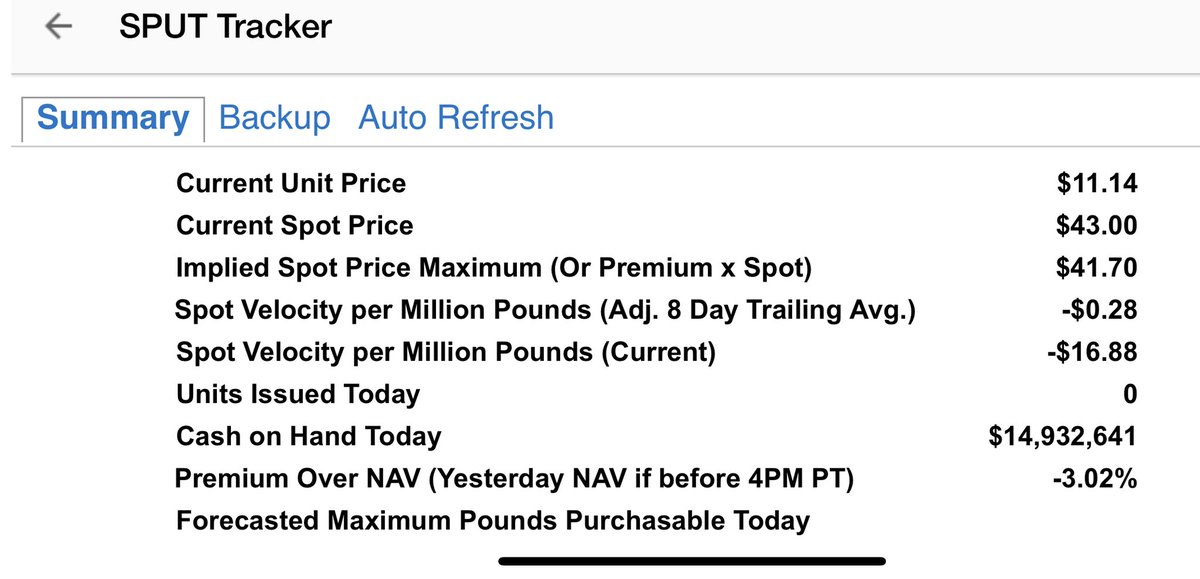

@theAlexW provides a very valuable daily (nightly) update. You can also approximate it yourself intraday based on the % change from the previous days close.

What #uranium investors should appreciate is the entire uranium trading world now looks to $u.un as the leading spot indicator. When SPUT trades up and is doing volume at a premium to nav all potential spot sellers consider ‘what SPUT can afford to pay’ and sets offers close

When SPUT flips to a discount to NAV, would be spot sellers know the fund flow tap is turned off and will lower offers in an attempt to get filled by Sprott. As well would be buyers lower bids with confidence that they can put bid Sprott at a given level

$u.un sput trades like an equity as a well as a commodity. I personally don’t think major financial players are particularly interested in bidding the price of #uranium higher than the marginal cost of production yet. We are waiting for the utilities to do that or some #wsb types

I could, I’d play this game forever. Buy sput sub $40/lb and sell as it nears $50/lb. compound at 15-20% a month. But, I know this game will end soon enough. I think we will coil up for a bit now. Higher lows and perhaps lower highs. Slowly feeding sput and draining spot supply

At some point there will be enough extensions, restarts and new builds uranium demand to drive the price higher. Utilities are content it seems for now to line up and ask $KAP and $CCO for long term contracts. Since $cco has stated they are willing to give 60/40 upside to them

They 100% are most interesting in lock in 10 year deals for millions of lbs rather than buying some at spot which will take the price higher and also cost them money on the spot based contracts they currently have.

It’s not a complicated chess game for them and I can only imagine how much they appreciate the timid nature of $cco’s marketing team. I just wonder who pays for the dinner and the wine when they dine together. :)

Anyhow. I don’t flip through piles of charts and do a lot of complicated calculations to make predictions. I just look at the chart of sput $u.un and decide to take profits at extremes / resistance. Let some one else break that billion $ juggernaut out to a new high. I can’t..

But, when I’d drops to a good risk to reward range and is at a premium I’ll feed the atm with everything I got . Eventually I’m 100% certain the the fundamental supply demand shortage will force the utilities to take the price higher so that marginal supply is incentivized

At that point we can be certain that the spot market is drained and the market is extremely tight. That is went the aggressive traders will swarm in and play the squeeze. It’s coming, it’s certain. Have no fear.

• • •

Missing some Tweet in this thread? You can try to

force a refresh