Natural gas will not be a ‘transition fuel’

I’m amazed at the number of people attempting to sell us on this utter bullshit.

Natural gas isn’t ‘clean’ and we are now likely to simply transition to depending on it more and more.

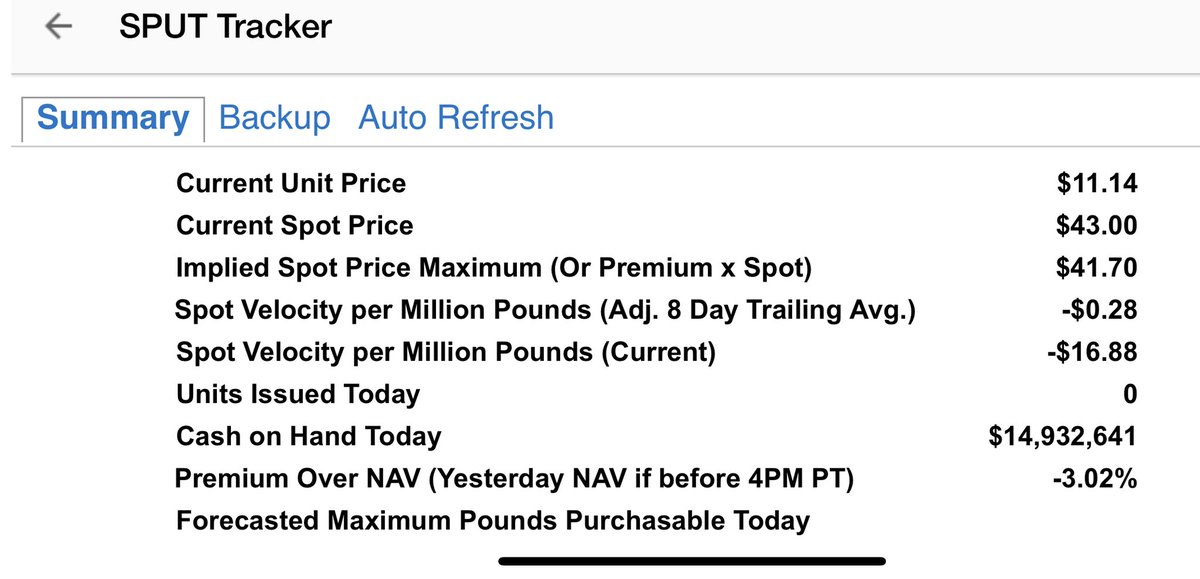

See chart

#oil #gas #coal #uranium #nuclear

I’m amazed at the number of people attempting to sell us on this utter bullshit.

Natural gas isn’t ‘clean’ and we are now likely to simply transition to depending on it more and more.

See chart

#oil #gas #coal #uranium #nuclear

As you can see from the chart above natural gas is already nearly a top source of our co2 output even though it burns cleaner than coal and produces about 1/2 as much co2 per btu.

#climatecrisis

#climatecrisis

Take note greens… Solar wind etc currently produces basically fuck all of our global energy mix. It also only operates during the day when the wind blows strong and the sunshine’s bright.

#greendreams vs #math #science

#greendreams vs #math #science

All the major vehicle manufacturers have stated they plan to keep ramping up electric vehicle production with a target of being 100% EV only by around ~2035 (some estimate a little longer, reality will be it takes much longer)

When you consider size of the power consumption to feed this growing fleet of electric vehicles the numbers get mind boggling. Estimates are we need to double the global power grid or at least 60% increase by 2040. Massive if amounts of copper and other metals will be needed

Some estimate more copper consumption will occur between now and 2040 then all the copper produced in the planets history! Wire for increased transmission, for vehicles, metals for batteries, wiring out to solar and wind farms to tie them into the grid. The numbers are so huge

Most resource experts I know that have actually done some basic math say this will not happen cause we simply can’t ramp up metal production quick enough. Plus also consider the power / energy demand to produce all this stuff. Mine, refine, fabricate, ship, install.

It’s all massively energy extensive. The entire supply chain!

Another key point both wind and solar require a huge amount of energy to even add them to the grid. Energy must be invested in the materials to make them, plus the manufacturing process, shipping, installation..

Another key point both wind and solar require a huge amount of energy to even add them to the grid. Energy must be invested in the materials to make them, plus the manufacturing process, shipping, installation..

Installation often means roads, cement, steel etc. There are numbers all over the place but I personally think at best we invest 5x the yearly output that most solar and wind projects produce.

And remember economic wise we are able to get modest ROI currently only because turbines and solar panels have been manufactured/installed the last few years using cheap oil and coal. (Note roi is still absolutely shit in for low wind regimes, or low sun light regions)

Some people (greens) will have you believe that we can transition to solar and wind eventually as our primary power. But I promise you it would take many many decades and consume huge amounts of power in the process to even make a reasonable dent in global power output

It will also require ‘storage’ if we want to use it for baseload. Massive energy, time and money investment in more mega Comercial battery systems that will need to be added to the grid, or pump storage. Etc. Storage creation and maintenance will require huge amounts of energy

But we will also lose energy as while we store. Be it batteries or pump storage, we lose energy in the process of trying to store it for later use. As batteries age we lose more and more. ROE get worse and then we also have to factor recycling / disposal

So rest assured, without a massive build of of nuclear power, the limitations and time to build out solar and wind with storage will mean we will require fossil fuels in ever increasing amounts for decades to come. If we shut down coal and try to use less oil and gas in cars

We will just require dramatically more natural gas. Because of emerging market still have massive growing demand for electricity for home heating, cooling, fresh water, home appliances, and manufacturing. Plus computers, internet and with crypto currency mining.

The ‘greens’ along with anyone who actually wants us to reduce co2 output need to sober up and look at reality. We need to make a major choice and make it NOW! Nuclear power must be ramped up with a global effort. We can’t simply bullshit ourselves abojt natural gas.

The investment being made in natural gas fired power plants will not be ‘transitional’. This is a complete lie. We cannot simply invest in wind, solar and storage to cover our planets growing energy demands.

Shut down nuclear plants like Germany is doing is preposterous.

Shut down nuclear plants like Germany is doing is preposterous.

With out a big move into nuclear the world or will not only be materially stuck on coal for the next 50 years. We will be consuming insanely higher amounts of natural gas and still pushing out greater and greater amounts of c02.

What should be completely obvious that if this the path we are going to go down we should scrap the electric car and be producing ones that run on natural gas as it will save us a pile of energy. Burning natural gas at a power plant, suffering line loss transmitting..

that power through the grid, then losing more power in the charging of a battery that also takes a lot of energy to make and recycle. Is plain stupid. Nothing green about this. Just a way less efficient way to power cars vs a modern efficient natural gas burning engine.

Current car batteries lose half their range after about 7-8 years. Costly and hugely energy consuming to replace and recycle. It’s truly such a load of crap. I some times wonder why hardly anyone talks about the reality’s of this.

I can only assume it’s a combination of laziness to educate oneself and politicians and mainstream media being bought off by the fossil fuel industry. It could just be mostly just ignorance and arrogance.

When you look at the average age of our elected officials it’s probably also a bit of senility as well. For the last 5 years the USA which should be leader has being split down the middle in gridlock. Fighting over which 70+ year-old should decide our future.

I’m 51. So Trump and Biden are my parents age. Think about that! These guys have spent most of the last 20 years reading only briefs, talking points and teleprompters. And the info contained in those docs are produced by teams that are bought and paid for.

I was an IT guy in the late 90’s. I know the people in this age group very well as I would consult and assist them to get on the internet. When I was very young I would also have to program their ‘VCR’ clocks for them cause they couldn’t figure out how to stop the flashing 12:00

These guys haven’t taken a university level course since the 1960’s. Its time to elect some people that actually read and think. Not ones that just pretend to on TV.

• • •

Missing some Tweet in this thread? You can try to

force a refresh