We upgraded from DeFi 1.0 to DeFi 2.0. What does that mean for the economics?

Here's Tokenomics 2.0 🧵

TLDR: economic balance.

Here's Tokenomics 2.0 🧵

TLDR: economic balance.

DeFi 1.0 was to build the infrastructure and tools in finance. Think of it as the basic foundation in your skyscraper.

DeFi 2.0 is to use that existing foundation and built that skyscraper.

E.g. stablecoin for transaction.

Interest-bearing stablecoin for capital leverage.

DeFi 2.0 is to use that existing foundation and built that skyscraper.

E.g. stablecoin for transaction.

Interest-bearing stablecoin for capital leverage.

Tokenomics 1.0 is to realise the existence of the tokens to create value. To look at bootstrapping your community with tokens, gov tokens, native incentives.

Tokenomics 2.0 is to leverage the community and start looking at long-term value growth.

Tokenomics 2.0 is to leverage the community and start looking at long-term value growth.

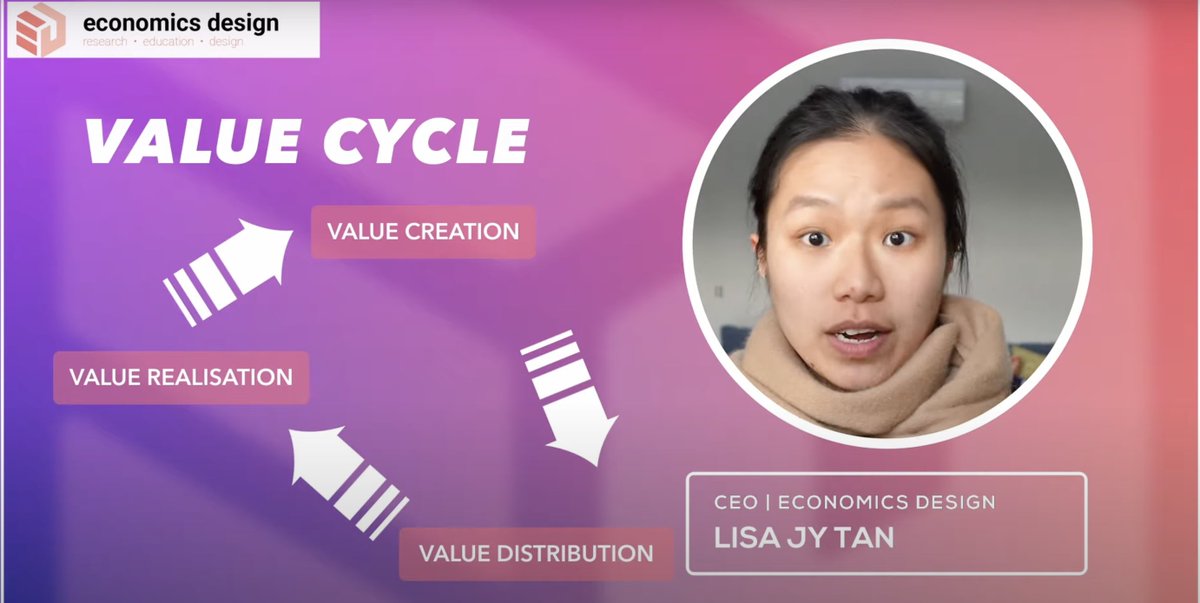

We look at general cycle flow: value creation -> value distribution -> value realisation

(FYI: That is the basic core definition of #economics)

(FYI: That is the basic core definition of #economics)

What is that?

Value creation = long-term growth

Value distribution = short-term growth and asset inflation

Value realisation = real value growth to your active users

Value creation = long-term growth

Value distribution = short-term growth and asset inflation

Value realisation = real value growth to your active users

In Tokenomics 1.0, we focused a lot on yield farming, short-term growth, token inflation, and hopefully real value to your users.

The conversation now is to move towards creating a sustainable long-term growth in your market.

That could be to leverage the existing community and protocol infrastructure to think more long-term.

That could be to leverage the existing community and protocol infrastructure to think more long-term.

You don't build an anti-fragile market without thinking more long-term.

Okay, that is nice. But how does that look like IRL?

We partnered with @VesperFi to look at their long-term growth strategy.

We partnered with @VesperFi to look at their long-term growth strategy.

1. Reduce withdrawal fees

2. Increase yield fee for long-term growth

3. Fee revenue allocation

4. Replenish VSP reserves

5. Multi-currency treasury

6. New treasury maintenance

2. Increase yield fee for long-term growth

3. Fee revenue allocation

4. Replenish VSP reserves

5. Multi-currency treasury

6. New treasury maintenance

Check out this video to understand this macro economic balance that you need to do, as an economist.

Long-term growth or short-term rewards. I hope you choose the former.

Long-term growth or short-term rewards. I hope you choose the former.

@VesperFi proposal: github.com/vesperfi/doc/i…

• • •

Missing some Tweet in this thread? You can try to

force a refresh