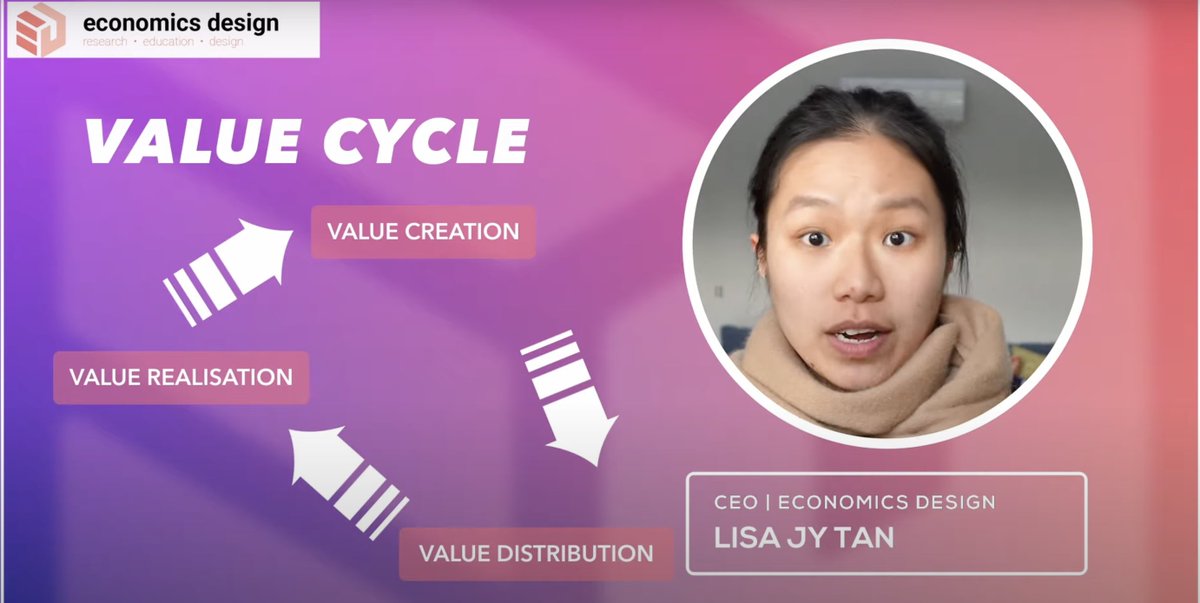

Providing creative, expert consultation in designing business models, monetisation, token design, economic modelling, and go-to-market strategies.

How to get URL link on X (Twitter) App

Once you see the APR, it is possible to immediately calculate how much profit will be earned at the end of the period. This profit comes from your staking or farming, so just join at the beginning to get the result for APR interest.

Once you see the APR, it is possible to immediately calculate how much profit will be earned at the end of the period. This profit comes from your staking or farming, so just join at the beginning to get the result for APR interest.