1/ When I first looked at $LYXE I wasn't blown away. Big mistake, this #metaverse and #NFT crypto is an absolute gem. Now I have my second chance and I won't waste it.

I've shared my LYXE entries already, I've gone bigger at 17. This one is a 3-6 month hold.

@lukso_io

I've shared my LYXE entries already, I've gone bigger at 17. This one is a 3-6 month hold.

@lukso_io

2/ Lukso is a #blockchain for #NFTs using ETH 2.0 proof of stake. At least it will be when the mainnet comes out. It is dipping right now because the mainnet was delayed. Delays are good, it means they aren't rushing out something that doesn't work to keep people happy.

3/ It also means that paperhands have gifted me prices I thought I would never see again, thanks 😘

Why is Lukso so good?

First, it gives you an identity in the metaverse that you can take from MV to MV, even on different blockchains. Some other cryptos do this.

Why is Lukso so good?

First, it gives you an identity in the metaverse that you can take from MV to MV, even on different blockchains. Some other cryptos do this.

4/ Lukso uses what they call "virtualization" to turn physical assets into NFTs. This means you can bring something physical onto the blockchain as an NFT. This also means that you could bring physical objects into the metaverse.

5/ Lukso says it allows brands to create tokenized communities. Honestly, I find this statement confusing. So I did some digging for examples, and I found a few.

Lukso enables fashion brands to create and sell digital clothing that can be used in the metaverse.

Lukso enables fashion brands to create and sell digital clothing that can be used in the metaverse.

6/ At first this sounded weird, but think about it. Nike wants to release sneakers that you can wear in the metaverse. People are crazy about sneakers, ever heard of sneaker heads? Nike could create and sell those sneakers on Lukso because it provides the infrastructure to do so.

7/ Fashion is a $1.4 trillion industry, so when it moves into the metaverse, I want to be ready. I believe Lukso is the on-ramp for fashion to the MV. In fact, it has already started with this digital fashion piece selling for 100 ETH on Lukso

https://twitter.com/lukso_io/status/1441072043227680770

8/ Fashion in the metaverse will be huge. Look at all the people showing of Rolex's and Lambos on twitter. Crypto people are new money, and if there is anything new money likes, its flashing gaudy stuff to show off how rich they are. There is certainly a market for it here.

9/ The tokenomics are great, a tiny 15m supply until mainnet. 30% was sold in private sale, will be unlocked at mainnet launch. Which means things could dip at launch, but that is 6 months away according to the article below. Until then, no VCs to dumps!

medium.com/lukso/an-updat…

medium.com/lukso/an-updat…

10/ The team for Lukso is absolutely amazing. @feindura author of ERC 20 and ERC 725 and lead dapp developer of Ethereum. @m_h_d_v co-founder of Dematerialized, creator of EY Innovation Lab. Along with expert advisors

lukso.network/about

lukso.network/about

11/ I've shared my plan for LYXE before. I bought a big bag at 17 today. I have some reserves to buy at 12, but I am not convinced it reaches there.

Do your own research, none of this is financial advice. I am sharing my plan and that is all.

Do your own research, none of this is financial advice. I am sharing my plan and that is all.

https://twitter.com/LadyofCrypto1/status/1462717427247206400

12/ I also heard that @RaoulGMI is looking into LYXE which is big. He is the reason I got into RFOX, another metaverse project I am in that is giving huge returns.

reddit.com/r/lukso/commen…

reddit.com/r/lukso/commen…

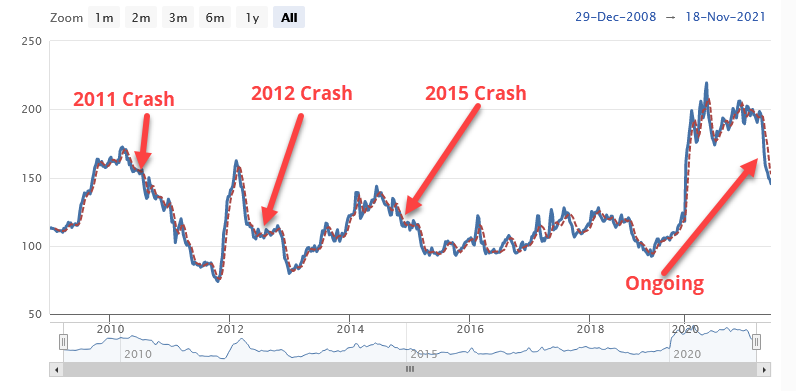

13/ Lukso is dipping, so after you do your research, if you like it, just consider that it can go lower than where its at now. I am ready to average down.

14/ Clarification. 3-6 month is minimum hold. I plan for this one to be held for years!

Wish tweets had an edit button

• • •

Missing some Tweet in this thread? You can try to

force a refresh