-- Educational - Good & Bad trading habits --

Formatted as follows:

1⃣ 7 habits of a highly effective #Crypto trader

2⃣ 7 habits of a Rekt #Crypto trader

I hope you like it. If you do I would appreciate a like ♥️ retweet, so others can also benefit

#Bitcoin #tradingpsychology

Formatted as follows:

1⃣ 7 habits of a highly effective #Crypto trader

2⃣ 7 habits of a Rekt #Crypto trader

I hope you like it. If you do I would appreciate a like ♥️ retweet, so others can also benefit

#Bitcoin #tradingpsychology

--7 habits of a highly effective #Crypto trader--

TLDR:

1⃣ Develop a trading plan

2⃣ Manage risk

3⃣ Start with a demo trading account

4⃣ Be proactive, adapt to the market

5⃣ Control your emotions / Never FOMO

6⃣ Keep a trading journal

7⃣ Trading / Life balance

+Personal habits

TLDR:

1⃣ Develop a trading plan

2⃣ Manage risk

3⃣ Start with a demo trading account

4⃣ Be proactive, adapt to the market

5⃣ Control your emotions / Never FOMO

6⃣ Keep a trading journal

7⃣ Trading / Life balance

+Personal habits

-- 1⃣ Develop a trading plan --

🔥Failing to plan is planning to fail🔥

A trading plan is a back tested guide with criteria to enter & exit a trade

🔸Entry and exit levels

🔸Position size

🔸Stop-loss level

🔸Take profit level

🔸Indicators to use to confirm your entry and exit

🔥Failing to plan is planning to fail🔥

A trading plan is a back tested guide with criteria to enter & exit a trade

🔸Entry and exit levels

🔸Position size

🔸Stop-loss level

🔸Take profit level

🔸Indicators to use to confirm your entry and exit

-- 2⃣ Manage risk --

🔥Focus on managing risk & protecting capital🔥

🔸Define your risk per trade up front

🔸Have a min risk-return trade-off i.e. 3:1

🔸Observe strict rules & discipline

Long term it's a disciplined trader who wins & lasts through the #Bitcoin / #Crypto cycles

🔥Focus on managing risk & protecting capital🔥

🔸Define your risk per trade up front

🔸Have a min risk-return trade-off i.e. 3:1

🔸Observe strict rules & discipline

Long term it's a disciplined trader who wins & lasts through the #Bitcoin / #Crypto cycles

-- 3⃣ Start with a demo trading account --

🔥Don't rush into losing your money🔥

🔸Familiarise yourself with the trading platform & different order types

🔸Back test different trading strategies without committing real money

🔸Gain confidence in entering & exiting trades

🔥Don't rush into losing your money🔥

🔸Familiarise yourself with the trading platform & different order types

🔸Back test different trading strategies without committing real money

🔸Gain confidence in entering & exiting trades

-- 4⃣ Be proactive, adapt to the market --

🔥ONLY UP isn't a trading strategy🔥

🔸Stay up to date with news, upcoming FED meetings, rate changes, economic events...

🔸#Crypto market conditions change RAPIDLY, don't hold a bias!

🔸Be prepared to switch strategy or exit

🔥ONLY UP isn't a trading strategy🔥

🔸Stay up to date with news, upcoming FED meetings, rate changes, economic events...

🔸#Crypto market conditions change RAPIDLY, don't hold a bias!

🔸Be prepared to switch strategy or exit

-- 5⃣ Control your emotions / Never FOMO --

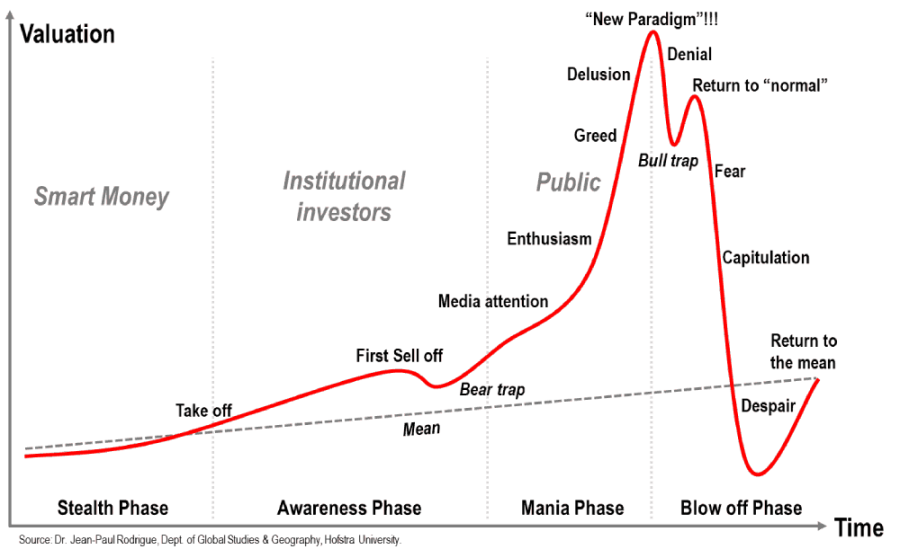

🔥Fear & Greed are not your friend🔥

🔸FOMO drives you to jump into a trade without prior validation and fail to follow your plan

🔸Greed can cause you to over trade or to allocate too much of your capital in a single trade.

🔥Fear & Greed are not your friend🔥

🔸FOMO drives you to jump into a trade without prior validation and fail to follow your plan

🔸Greed can cause you to over trade or to allocate too much of your capital in a single trade.

-- 6⃣ Keep a trading journal --

🔥Learn from your mistakes🔥

🔸Not just a summary of your trades, but also a tool where you write your observations & notes which help you to identify your strengths and weaknesses

🔸Analyze why trades were & weren’t successful & improve

🔥Learn from your mistakes🔥

🔸Not just a summary of your trades, but also a tool where you write your observations & notes which help you to identify your strengths and weaknesses

🔸Analyze why trades were & weren’t successful & improve

-- 7⃣ Trading / Life balance --

🔥Trade to live, understand why you do it🔥

🔸Burnout can be a killer

🔸Take time away from the screens, set trading times & use alerts to allow you to step away

🔸If your on edge watching a trade, then you have added too much risk, scale out

🔥Trade to live, understand why you do it🔥

🔸Burnout can be a killer

🔸Take time away from the screens, set trading times & use alerts to allow you to step away

🔸If your on edge watching a trade, then you have added too much risk, scale out

-- EXTRA - Personal GOOD habits --

🔥Understand what works for you🔥

🔸Exercise daily

🔸Have a hobby outside of #Crypto

🔸Have a long term goal i.e. financial freedom by age X

🔸Make time for others & support each other

🔸Find your edge & stick to it

🔸Live & enjoy life!

🔥Understand what works for you🔥

🔸Exercise daily

🔸Have a hobby outside of #Crypto

🔸Have a long term goal i.e. financial freedom by age X

🔸Make time for others & support each other

🔸Find your edge & stick to it

🔸Live & enjoy life!

-- The 7 habits of a Rekt #Crypto trader --

TLDR:

1⃣ Blaming others for your loses

2⃣ Straying from your plan

3⃣ Emotional attachment to a trade

4⃣ Repeating mistakes

5⃣ Revenge trading

6⃣ No risk management

7⃣ Over Trading

+ Personal bad habits

TLDR:

1⃣ Blaming others for your loses

2⃣ Straying from your plan

3⃣ Emotional attachment to a trade

4⃣ Repeating mistakes

5⃣ Revenge trading

6⃣ No risk management

7⃣ Over Trading

+ Personal bad habits

-- 1⃣ Blaming others for your loses --

🔥Its not my fault, i was following X influencers tweets🔥

🔸Be responsible for your own actions

🔸Did you test the strategy or have a plan?

🔸Did the trade meet your criteria?

Its your money, you are responsible for your trades

🔥Its not my fault, i was following X influencers tweets🔥

🔸Be responsible for your own actions

🔸Did you test the strategy or have a plan?

🔸Did the trade meet your criteria?

Its your money, you are responsible for your trades

-- 2⃣ Straying from your plan --

🔥I know what i'm doing, its ok🔥

🔸Discipline is key, biggest mistakes come when traders don’t stick to their rules

🔸Set a max loss amount & if you hit it, walk away

🔸If you have consecutive loses step away and come back later / the next day

🔥I know what i'm doing, its ok🔥

🔸Discipline is key, biggest mistakes come when traders don’t stick to their rules

🔸Set a max loss amount & if you hit it, walk away

🔸If you have consecutive loses step away and come back later / the next day

-- 3⃣ Emotional attachment to a trade --

🔥I know I'm right, its such a good project🔥

🔸Don't let emotions dictate your trade

🔸A small lose now is better than a big one later

🔸Traders can be profitable with a < 50% win rate if you use good money management

🔥I know I'm right, its such a good project🔥

🔸Don't let emotions dictate your trade

🔸A small lose now is better than a big one later

🔸Traders can be profitable with a < 50% win rate if you use good money management

-- 4⃣ Repeating mistakes --

🔥It will be different this time🔥

🔸Impatience or stretching losses are some of the mistakes that traders tend to repeat

🔸Evaluate your performance regularly / at the end of each session

🔸Keep a trading diary, its key to success long term

🔥It will be different this time🔥

🔸Impatience or stretching losses are some of the mistakes that traders tend to repeat

🔸Evaluate your performance regularly / at the end of each session

🔸Keep a trading diary, its key to success long term

-- 5⃣ Revenge trading --

🔥If i double down this time, i will make it back & more🔥

🔸Revenge trading, is an emotionally driven response to a loss

🔸Control your emotions with discipline and sticking to your plan

🔸Set a rule not to trade for X mins after each loss

🔥If i double down this time, i will make it back & more🔥

🔸Revenge trading, is an emotionally driven response to a loss

🔸Control your emotions with discipline and sticking to your plan

🔸Set a rule not to trade for X mins after each loss

-- 6⃣ No risk management --

🔥I don't need a stop, there's no way it'll drop > 10%🔥

🔸Don't kid yourself buy trading an unproven strategy

🔸Work out your trade invalidation points

🔸Set hard or soft stops, that you stick to

🔸Know your trading odds / Risk : Reward

🔥I don't need a stop, there's no way it'll drop > 10%🔥

🔸Don't kid yourself buy trading an unproven strategy

🔸Work out your trade invalidation points

🔸Set hard or soft stops, that you stick to

🔸Know your trading odds / Risk : Reward

-- 7⃣ Over Trading --

🔥Just 1 more hr, i am on a role🔥

🔸24x7 in front of the screen is unnecessary

🔸Being tired can cause you to think irrationally and FOMO breaking your rules

🔸Set a routine and chose your trading sessions

🔸Know your limits, your not super human

🔥Just 1 more hr, i am on a role🔥

🔸24x7 in front of the screen is unnecessary

🔸Being tired can cause you to think irrationally and FOMO breaking your rules

🔸Set a routine and chose your trading sessions

🔸Know your limits, your not super human

-- EXTRA - Personal BAD habits --

🔥None i am perfect 😁🔥

🔸I, at one time or another, have been victim to all the previously mentioned BAD habits

🔸I am sure my wife would tell you many more

BUT currently i am trying to work on spending less time in front of the screens

🔥None i am perfect 😁🔥

🔸I, at one time or another, have been victim to all the previously mentioned BAD habits

🔸I am sure my wife would tell you many more

BUT currently i am trying to work on spending less time in front of the screens

-- Conclusions --

A lot of what is mentioned boils down to 2 things

1⃣ Emotions

2⃣ Discipline

Master your emotions and foster a solid base for a disciplined trading plan, and you will be well on your way to being a successful trader!

Pls like ♥️ & retweet, its appreciated

A lot of what is mentioned boils down to 2 things

1⃣ Emotions

2⃣ Discipline

Master your emotions and foster a solid base for a disciplined trading plan, and you will be well on your way to being a successful trader!

Pls like ♥️ & retweet, its appreciated

• • •

Missing some Tweet in this thread? You can try to

force a refresh