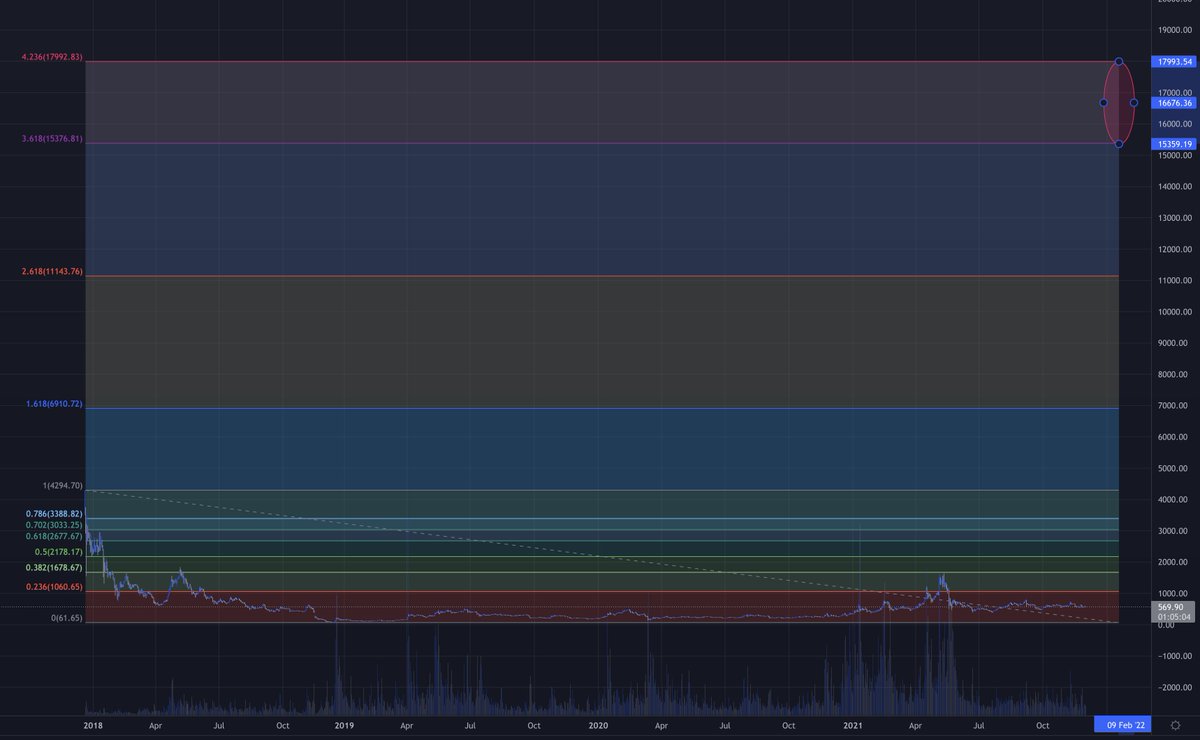

There's always a lot of talk about an economic and financial crash. While there are a few who think everything will keep going up, I think we are going to see a mix of both. Allow me to explain. It appears #Crypto is heading towards a market cycle top with a full fib extension.

This is likely to happen sometime between now & spring. There is also a lot of analysis that supports full fib extensions and market cycle tops for the #NASDAQ and the #DowJones at the same time. This is based on a fib cycle start for the NASDAQ in March of 2000 with the #Dotcom

bubble burst and for the #DowJones in Oct of 2007 with the financial crisis. I agree with the cycle start for the #NASDAQ but see the fib cycle start for the DowJones beginning a month before the #Dotcom bubble burst in Feb of 2000 and extending to the #COVID19 crash in March of

2020. The #DowJones does not reach a full #Fibonacci extension between Feb 2000 and Oct 2007. A full fib extension for the DowJones is only reached between Feb 2000 and Mar 2020. This would suggest that a new fib cycle start for the DowJones in Mar 2020 would reach a full fib

extension at $66,900 in 2030 or later. So based on a full #Fibonacci extension we have the #NASDAQ topping in March or April of 2022 at $17,869 and the #DowJones topping at $66,900 about a decade from now. #Crypto market tops with the NASDAQ in the spring and the cycle resets.

But what about all the money printing JC you may be asking? Well, we will see the #NASDAQ & fiat money take the brunt of that for the time being but here is where #CBDCs will come into play. CBDCs are designed to bridge the liquidity between the legacy system and the new digital

system. While the #NASDAQ and #crypto are crashing inflation with fiat currency will still continue. The #DowJones will have some volatility but will trade sideways for the most part. Value and liquidity will pour into #gold, #stablecoins and newly launched just-in-time #CBDCs.

Keep in mind that not all nations will be launching #CBDCs at the same time. Those first out of the gate will manage their way through the volatility a lot better than those who are late to the party. Though the #Crypto market appears to follow the bull and bear cycle of the

#DowJones it is likely it will ultimately align with the more tech-oriented #NASDAQ at the cycle end. When the cycles reset #CBDCs and #stablecoins and #DeFi will be absorbing the value and liquidity from the legacy system which will then begin to fragment away and the DowJones

and the #NASDAQ along with all other stock markets around the world will begin to be tokenized and added to the expanding pool of global liquidity. 2022 and 2023 will be big years for #CBDC and #Stablecoin adoption as well as #crypto products such as #DeFi and real-time payments.

We're early but things are about to light up as critical market cycle points are reached. I remain very optimistic overall and don't see a massive financial and economic calamity. Though it's probably a good time to exit the #NASDAQ and #Crypto in

the coming months and look for immediate entries into #stablecoin projects and #DeFi offerings (or #gold) and plan for new market entries for #Crypto and the #NASDAQ sometime in 2023. This is my working strategy at this time but will be watching to adjust as we move forward.

I've covered my #crypto #exitstrategy over the next few months in other tweets. But in summary, I'll be looking to rotate $DASH $BCH $ZEC and $EOS along with $SGB and $CSC into $XRP for the last parabolic move. Targets are included in the following tweets, starting with $XRP

It's difficult to set price target ranges for $SGB and $CSC because there's not enough trade history but I am looking for +$2.00 USD for $SGB and +$0.10 USD for $CSC. Happy trading and best of luck to all of us. The world is about to change and we are all standing on the edge. 🚀

• • •

Missing some Tweet in this thread? You can try to

force a refresh