$SGMO status going into C22

Two synthetic gene transfer programs:

- HemA now run by $PFE P3. Hold for protocol amendment. Expect timing update for full analysis in next couple months.

- #Fabry owned program good data potential first/best in class

No further programs.

1/

Two synthetic gene transfer programs:

- HemA now run by $PFE P3. Hold for protocol amendment. Expect timing update for full analysis in next couple months.

- #Fabry owned program good data potential first/best in class

No further programs.

1/

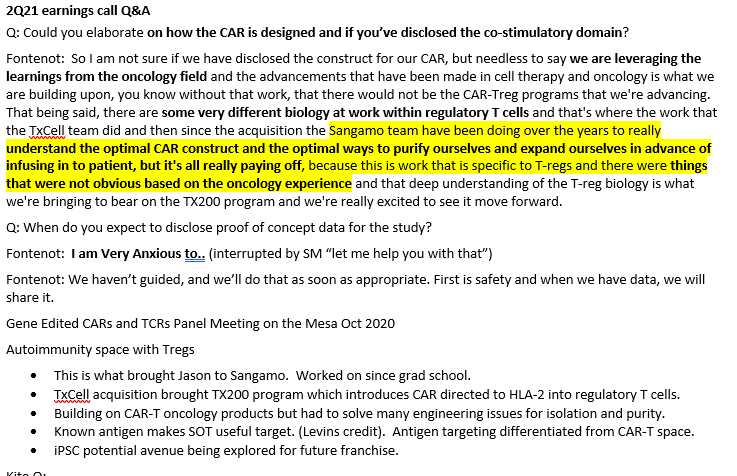

$SGMO development focus leveraging ZF technology shows evolution from old four platforms to new integrated tech message. ZF tech facilitates both ex vivo and in vivo genomic medicines. Examples are CAR Tregs cell therapy and ZFP-TF CNS regulation.

2/

2/

Cell therapy pipeline:

-Sickle cell collab with $SNY lead indication (see next)

-$GILD collab programs on hold. No update for a while but likely tied to durability issues seen at $ALLO $CRSP $DTIL

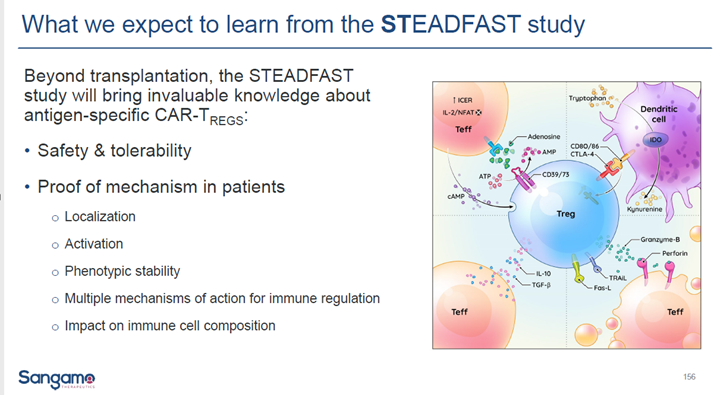

-Steadfast study is #POC for CAR Tregs with significant pipeline to follow

3/

-Sickle cell collab with $SNY lead indication (see next)

-$GILD collab programs on hold. No update for a while but likely tied to durability issues seen at $ALLO $CRSP $DTIL

-Steadfast study is #POC for CAR Tregs with significant pipeline to follow

3/

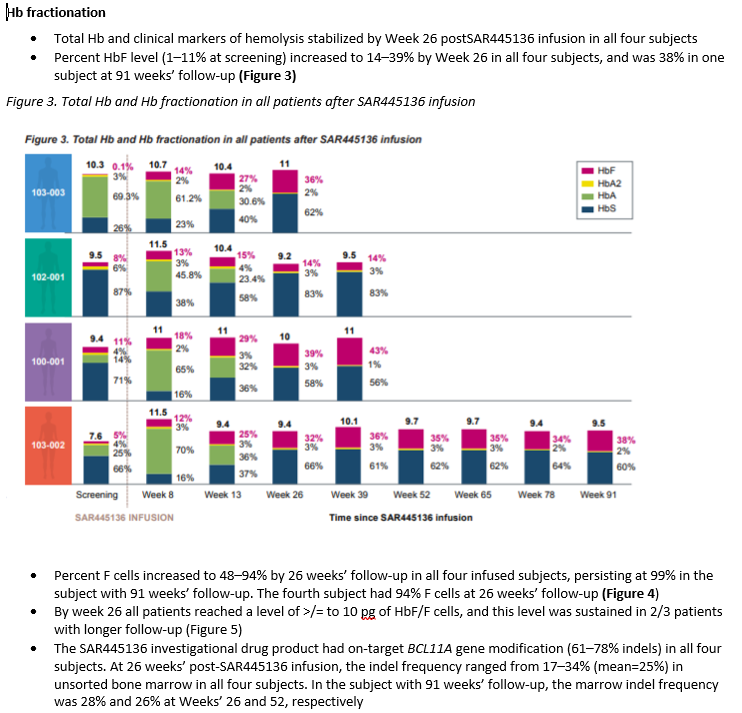

$SNY concluded that their preliminary POC efficacy and safety results confirm the potential tx value. Appears headed for registrational study in next 12-18 months. $SGMO

4/

4/

Reminder to look at previous tweet figure 6 showing number of #SCD vaso-occlusive crises (VOC) dropped from 44 to 1.

5/

5/

ZFP-TF initial in vivo. Partners progressing but appear delivery hurdle remains

$TAK -686 clinical trial being planned for huntington’s

ALS subject of breakthrough article on $PFE website

$NVS 2 VPs joined Sangamo

$BIIB working on 4 selected programs. Waiting for updates

6/

$TAK -686 clinical trial being planned for huntington’s

ALS subject of breakthrough article on $PFE website

$NVS 2 VPs joined Sangamo

$BIIB working on 4 selected programs. Waiting for updates

6/

Gene regulation pipeline:

- Owned #Prion and one undisclosed preclinic.

- $BIIB has selected four programs (2 preclinic) w/ 8 optional targets which $SGMO likely working on

- $NVS has three active programs

- $PFE ALS ZFP-TF selected and in animal testing

- $TAK see prior

7/

- Owned #Prion and one undisclosed preclinic.

- $BIIB has selected four programs (2 preclinic) w/ 8 optional targets which $SGMO likely working on

- $NVS has three active programs

- $PFE ALS ZFP-TF selected and in animal testing

- $TAK see prior

7/

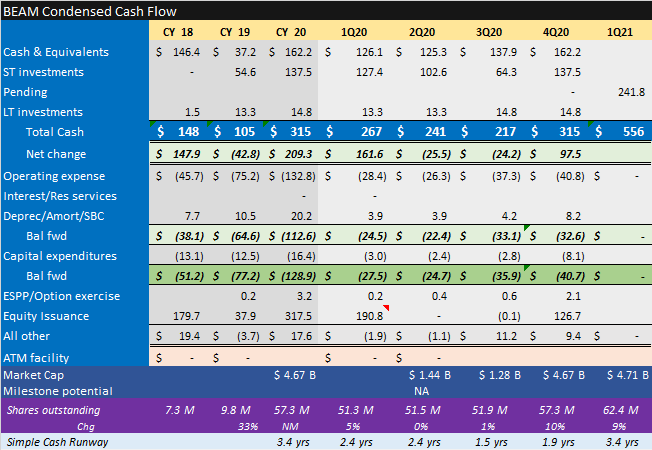

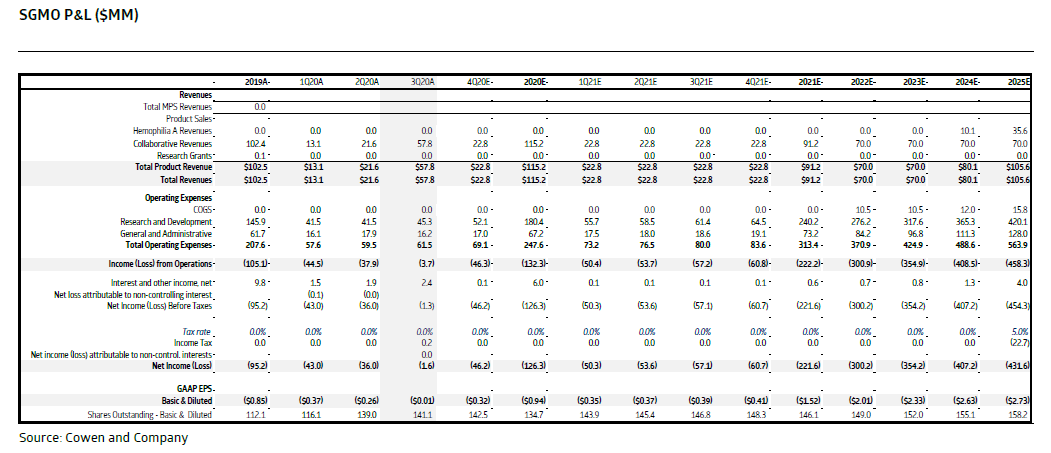

Key for all bios in this kind of market is cash runway IMO. $SGMO relies on collaboration partners to fund opex thru reimbursed research and #milestones. Impact of HemA hold on forecast is key. No change yet to prior fcst: will update once we get more clarity.

8/

8/

@threadreaderapp Unroll please

• • •

Missing some Tweet in this thread? You can try to

force a refresh