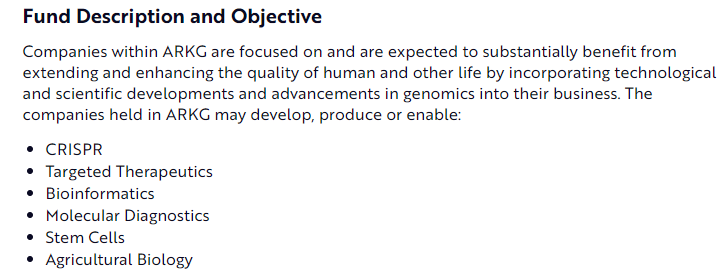

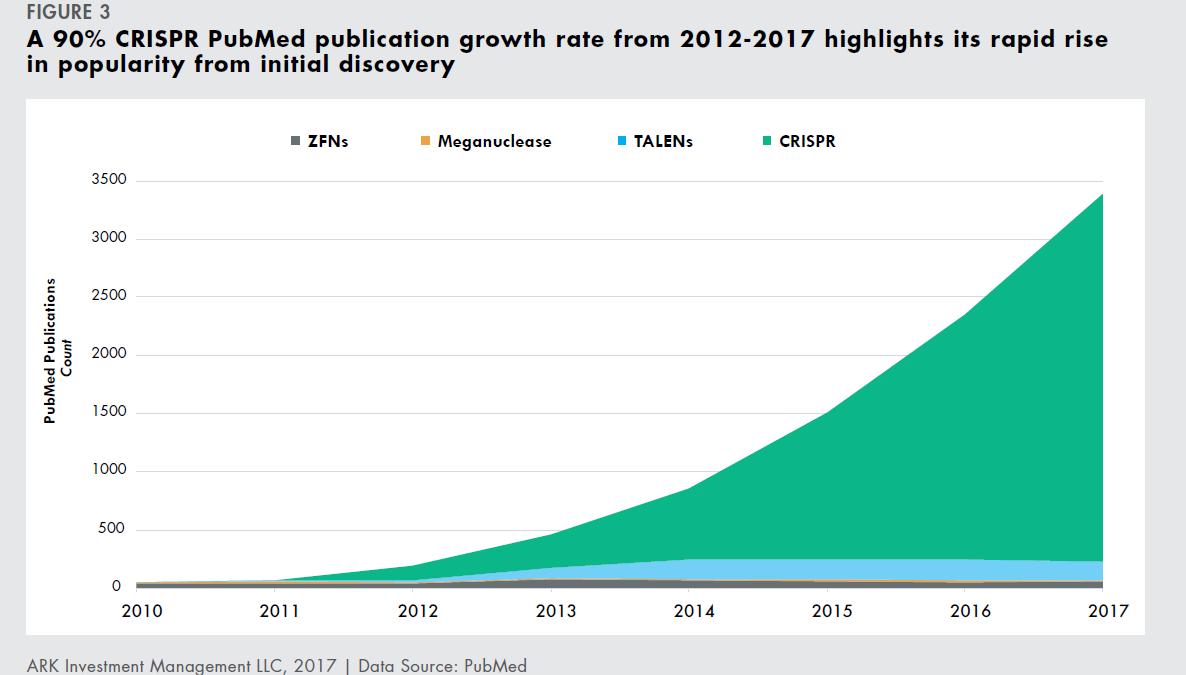

$BEAM 4Q20 results out. Valuation is crazy but they are the best of #Crispr breed in my opinion given execution to date.

#GeneTherapy

1/

#GeneTherapy

1/

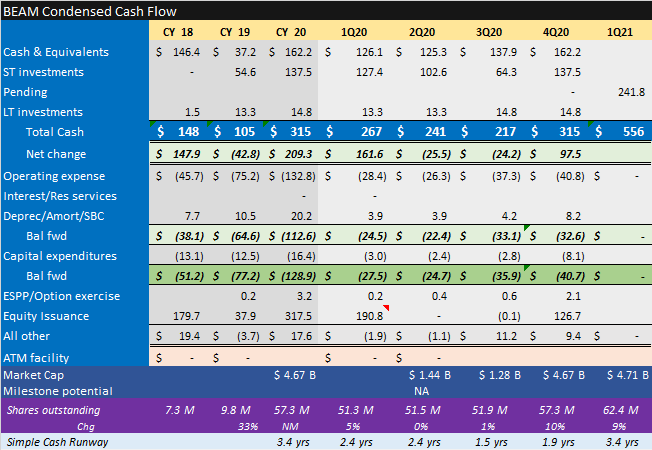

$BEAM focus on platform, delivery and manufacturing is enabled by share price and ability to source funds without huge dilution

2/

2/

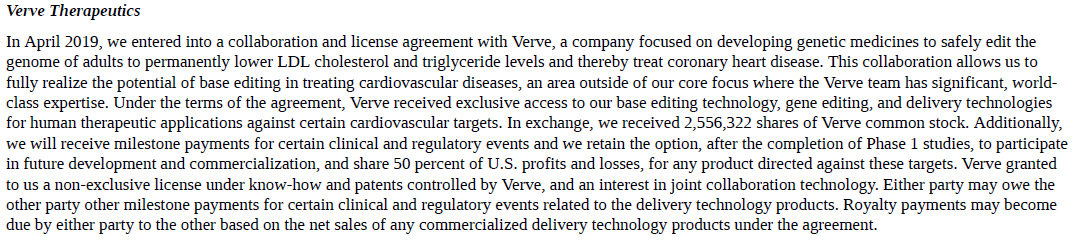

$BEAM is both in-licensing and out-licensing which makes sense given funding ability and fields of interest

4/

4/

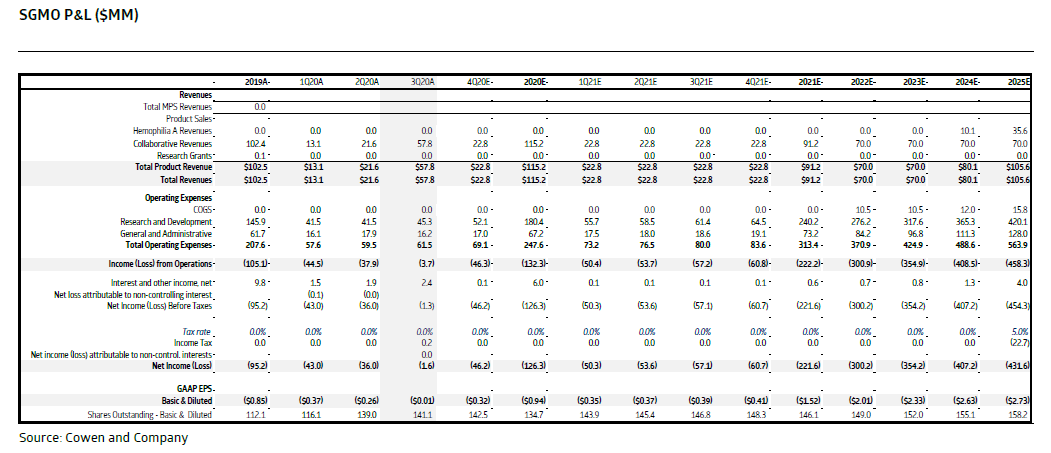

$BEAM ties to Broad and Harvard are more costly given valuation ties to agreements. Derivative liability increase in C20 show impacts.

5/

5/

Feb $BEAM acquisition of Guide and private placement only drove 9% dilution. Nice to be able to extend runway by 1.5 years and bring in delivery capabilities for relatively low cost

6/6

6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh