$SNY looks like they are ready for a Genomic Medicine Unity #GMU coming out year in C21. Many hires. Many open reqs. Building on Ablynx, Bioverativ and Kiadis M&A

#GeneTherapy

1/

#GeneTherapy

1/

$SNY #GMU head of Rare and Neurologic Disease Research is Christian Mueller. Video into is pretty good

Addl heads include Bruno Figueroa (CMC) and Cate O'Riordan (translational unit)

2/

Addl heads include Bruno Figueroa (CMC) and Cate O'Riordan (translational unit)

2/

$SNY #GMU Principal Scientist Robert Jackson profile says he is working on: Huntingtin's, MLD, PKU, Neurophathies, T1Diabetes Hypertension, Nephrophaty, vascular disease, Rheumatoid Arthritis and sensorineural hearing loss

3/

3/

$SNY John Reed has been pointing at #GeneTherapy for 3 yrs after saying they were just "dabbling" in 2018 and needed to make this a cornerstone of the future.

4/

biopharmadive.com/news/sanofi-jo…

4/

biopharmadive.com/news/sanofi-jo…

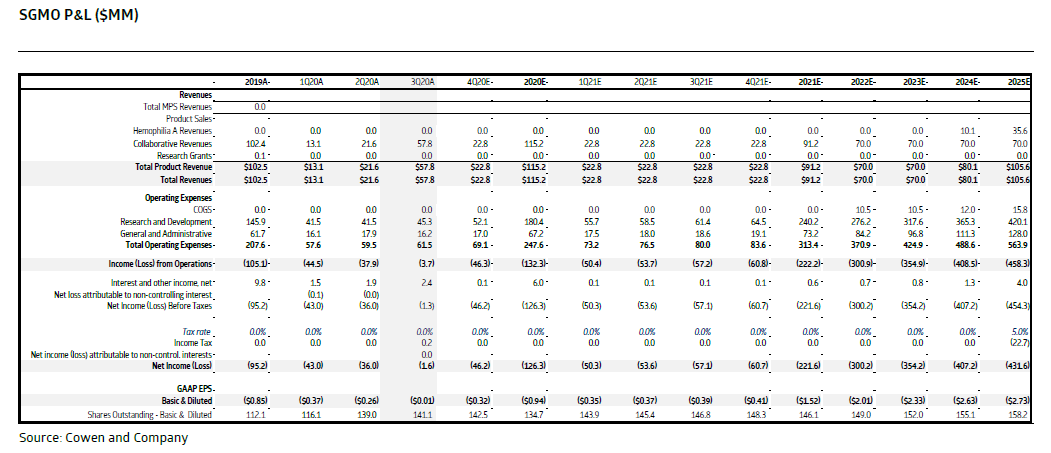

Notable in the BiopharmaDive interview with Reed was the lack of a pipeline - especially after jettison a couple including the collab with $VYGR. Only 2 #Celltherapy programs in clinic with a few others in preclinic. The 2 in clinic are collabs with $SGMO for SCD BetaT

5/

5/

$SNY clearly needs to show expertise with these 2 clinical programs. The EMA minute notes are the first real indication that it may be happening which sets up for a dataset rollout later this year....ASH?

ema.europa.eu/en/documents/m…

6/

ema.europa.eu/en/documents/m…

6/

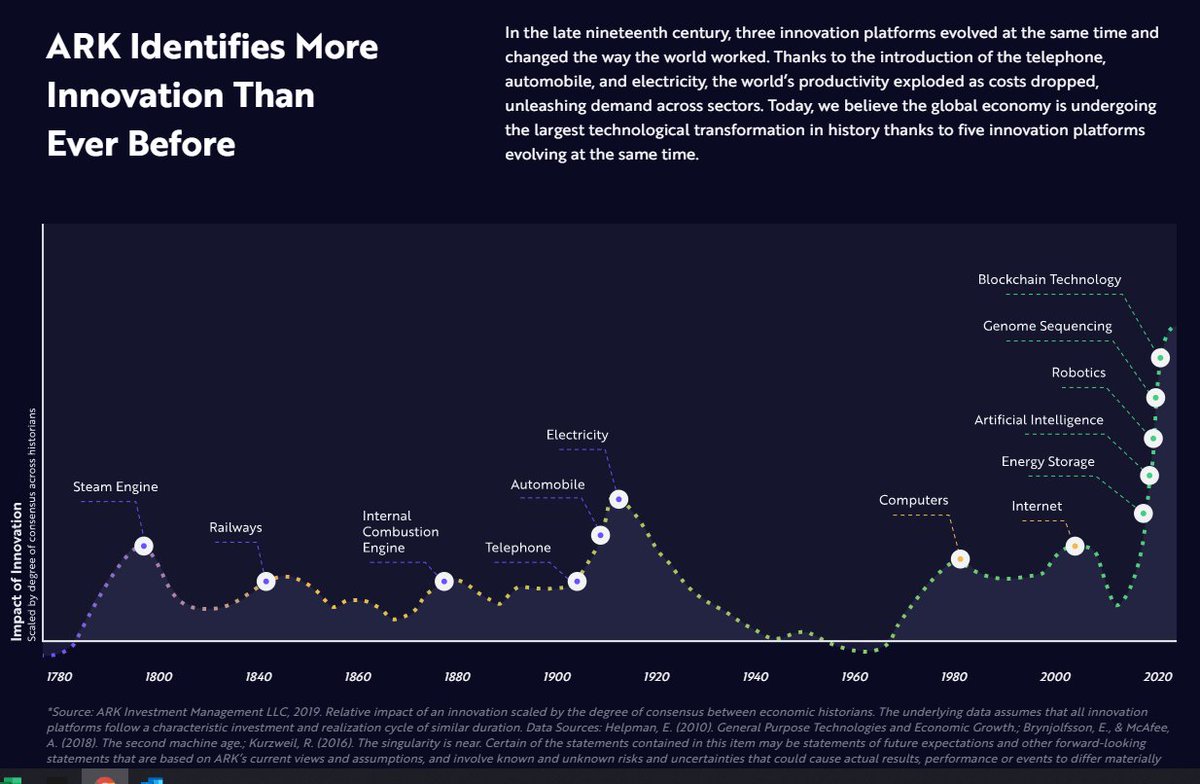

Notable is the reference in $SNY Mueller video. 'Beginning to work on capsid evolution'. Sounds like they are clearly aware that the work by Shaffer at $FDMT and Ojala at $SGMO are the future. They signed a collab agreement with Sirion in Feb but vaccine background is key

7/

7/

$SNY has said they are open to large M&A to accelerate. Still think it is a year away but don't be surprised if they pursue $SGMO. Picks up at least a half dozen programs of interest, 3 yrs of AAV evolution research and platform leverage in Neuro

seekingalpha.com/article/439595…

8/

seekingalpha.com/article/439595…

8/

Can't help but wonder what the heck all these development milestone events are for $SNY $SGMO hemoglobinopathy programs. BT/SCD/Other? 10 events and 34 total triggers? Hope they at least round up to nearest $1k

$SNY has been re-engineering their pipeline to focus on best/first in class potential and gene therapy. The Rare Blood Disorders is one of the cornerstones. Hemoglobinopathies are viewed as an emerging growth area per their website.

9/

9/

The $SNY R&D pipeline last fall showed the upcoming data for $SGMO programs were considered POC internally. The updated list last month shows these have been removed - coincidentally after the EMA Orphan designation and minutes showed strong data

11/

11/

This morning $SNY announced they were exclusively out-licensing two small molecule #SCD programs to $GBT. The dots connect themselves. $SGMO collab programs are now the focus in hemoglobinopathies and #CellTherapy

12/

streetinsider.com/Corporate+News…

12/

streetinsider.com/Corporate+News…

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh