Awesome new IMF working paper exploring the connection between crypto and equity markets, comparing pre- and post-pandemic period - we just had to write a Hive Deep Dive summary!

Here are some key takeaways 🧵

Here are some key takeaways 🧵

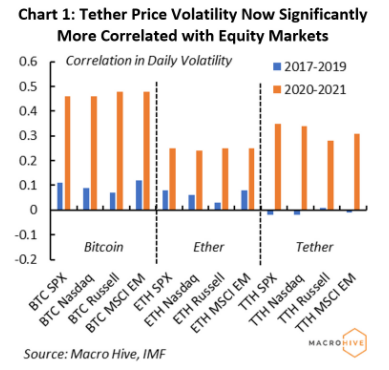

[1] Starting with simple correlations, the intra-day price #Bitcoin and #Ether, is now about 4-8 times more correlated with the volatility of the main US equity market indices (the S&P 500, Nasdaq, and Russell 2000) versus 2017-19.

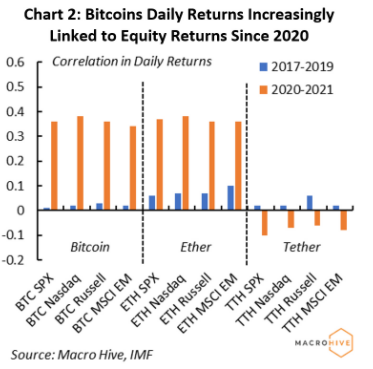

[2] Intra-day returns have also become more correlated, particularly $BTC. While the correlation between Tether & equities also strengthened, it turned negative during the pandemic – implying people used it as a risk diversification asset in that period.

[3] The rise in correlations between crypto assets and equities has been much bigger than for other key asset classes, such as the 10-year US Treasury ETF, gold, and selected currencies (euro, renmibi and the dollar).

[4] However, the correlation between Bitcoin returns and high-yield bonds (HY CDX), and investment-grade bonds (IG CDX), has strengthened notably – as tends to be the case for risky asset classes.

[5] On more complex correlations, the author (Tara Iyer) runs a VAR model to capture bi-directional correlations. Tara calls these correlations ‘spillovers’.

Bottom line: volatility in Bitcoin prices now explains 17% of the volatility in the S&P500.

Bottom line: volatility in Bitcoin prices now explains 17% of the volatility in the S&P500.

[6] But volatility in S&P500 prices also now explains 15% of the volatility in Bitcoin prices. This shows a strengthening bi-directional correlation, so increased spillovers.

[7] The pandemic appears to have accelerated the integration of decentralised markets into centralised ones. As such, investors, regulators and policymakers can no longer trivialise the importance of #crypto within the global macro landscape!

For our full Deep Dive and access to the paper, see below.

If you're not yet a Macro Hive member, you can get access to the Deep Dive on a one-time basis. Click through to our website to find out how:

macrohive.com/deep-dives/how…

If you're not yet a Macro Hive member, you can get access to the Deep Dive on a one-time basis. Click through to our website to find out how:

macrohive.com/deep-dives/how…

• • •

Missing some Tweet in this thread? You can try to

force a refresh