1/ You keep hearing about these "#Ethereum killers".

But instead, most competitors show systemic failures, whereas #ETH has scaled to hundreds of billion on its chain (with only one downside, high fees).

Lets dive deeper. A thread...👇

But instead, most competitors show systemic failures, whereas #ETH has scaled to hundreds of billion on its chain (with only one downside, high fees).

Lets dive deeper. A thread...👇

2/ I present you #Solana or #SOL (pictured).

The network FAILED during this crash. Stuck transactions... People could NOT move coins on #SOL network and some got liquidated because... they could not move their funds to cover for their loan in time... Not the user fault. 👇

The network FAILED during this crash. Stuck transactions... People could NOT move coins on #SOL network and some got liquidated because... they could not move their funds to cover for their loan in time... Not the user fault. 👇

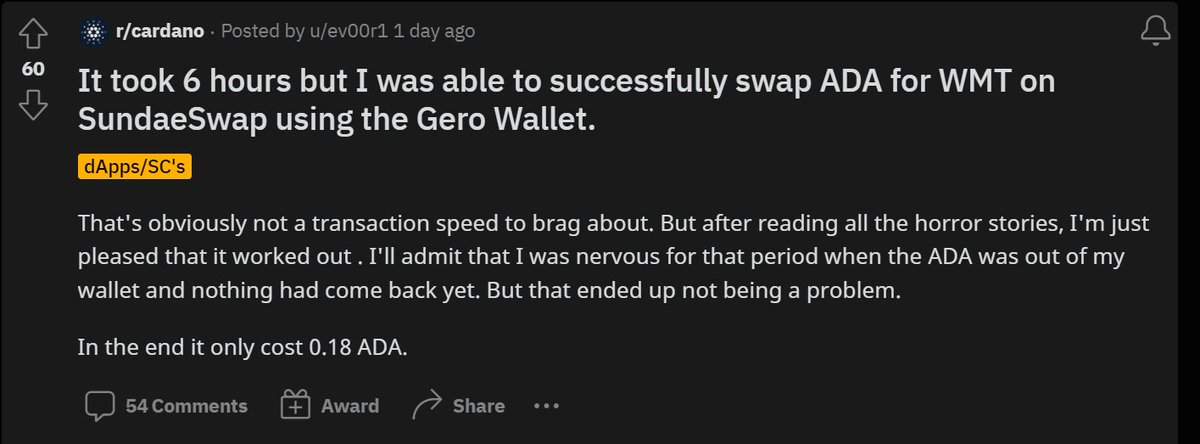

3/ Next #Cardano or #ADA (pictured)

It managed to implement the first AMM this year and barely has ANY DEFI ecosystem... Transactions stuck, coins vanishing... #SundaeSwap was a fiasco. This will kill #ETH? LOL... or waiting 6h for a swap... 👇

It managed to implement the first AMM this year and barely has ANY DEFI ecosystem... Transactions stuck, coins vanishing... #SundaeSwap was a fiasco. This will kill #ETH? LOL... or waiting 6h for a swap... 👇

4/ According to CMC, #ADA (ranked 6th) and #SOL (7th) are the top competitors to #ETH, yet they appear most fragile and unable to scale properly.

Competition is good, but #ETH is so far ahead, it's barely a fair fight. However, there are some good chain out there... 👇

Competition is good, but #ETH is so far ahead, it's barely a fair fight. However, there are some good chain out there... 👇

5/ #Terra (#LUNA / #UST) and #Fantom (#FTM) seem to be doing well & growing without the pains of #ADA or #SOL. But...

Terra's ecosystem has 87% of TVL into 3 protocols = highly centralized (pictured).

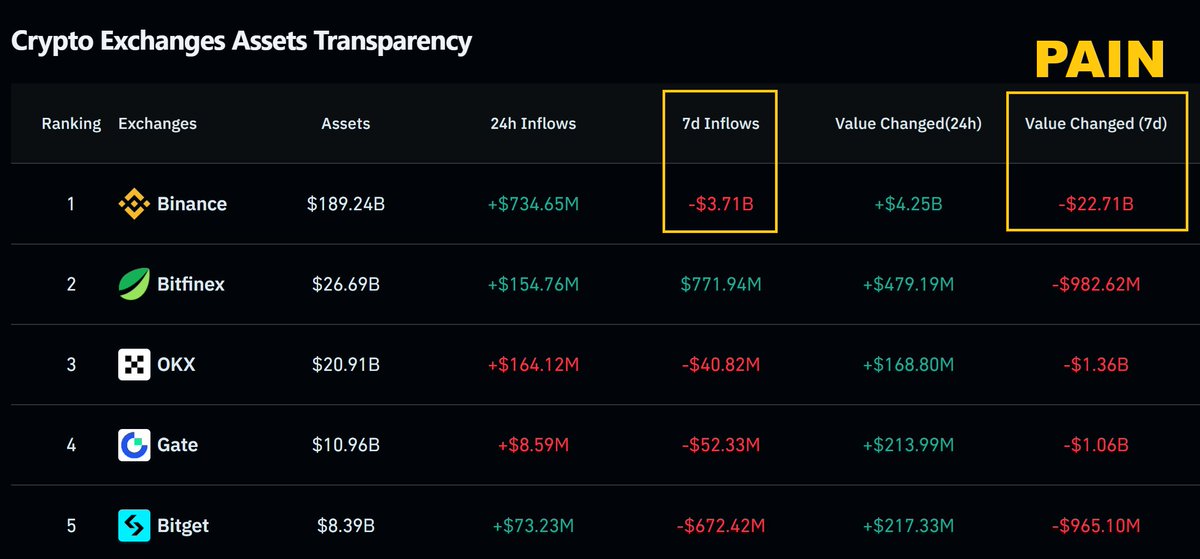

#BSC or Binance chain, while working well its also highly centralized. 👇

Terra's ecosystem has 87% of TVL into 3 protocols = highly centralized (pictured).

#BSC or Binance chain, while working well its also highly centralized. 👇

6/ As we can see, calling any of these chains #ETH killers sound more like a marketing gimmick.

Don't fall for an inferior product! If #ETH 2.0 can scale this year and reduce fees, all these "ETH killers" will become history.

The most robust #DEFI is on #ETH for a reason.👇

Don't fall for an inferior product! If #ETH 2.0 can scale this year and reduce fees, all these "ETH killers" will become history.

The most robust #DEFI is on #ETH for a reason.👇

7/ If you liked this thread, hit a like, follow, retweet! 😊

You can also find me at:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

You can also find me at:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

• • •

Missing some Tweet in this thread? You can try to

force a refresh