🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮

Global Macro Review 01/23/2022

1/13

US equity distribution ↘️ continued with a vengeance into Friday’s #OPEX

VIX ↗️ to ~30 ahead of Wednesday’s #FOMC event risk, leading to vol backwardation - a SHORT-TERM ♉️ signal

Let’s dig into the week's 🧮!

Global Macro Review 01/23/2022

1/13

US equity distribution ↘️ continued with a vengeance into Friday’s #OPEX

VIX ↗️ to ~30 ahead of Wednesday’s #FOMC event risk, leading to vol backwardation - a SHORT-TERM ♉️ signal

Let’s dig into the week's 🧮!

2a/13

High correlation between the UST2Y crossing the 1.0% Rubicon on Tuesday night’s open and acceleration ↘️ in US equity markets

How pathetic is it that the equity market cannot tolerate a 1% 2Y?

High correlation between the UST2Y crossing the 1.0% Rubicon on Tuesday night’s open and acceleration ↘️ in US equity markets

How pathetic is it that the equity market cannot tolerate a 1% 2Y?

https://twitter.com/tdarling1/status/1483255486568968200?s=20

2b/13

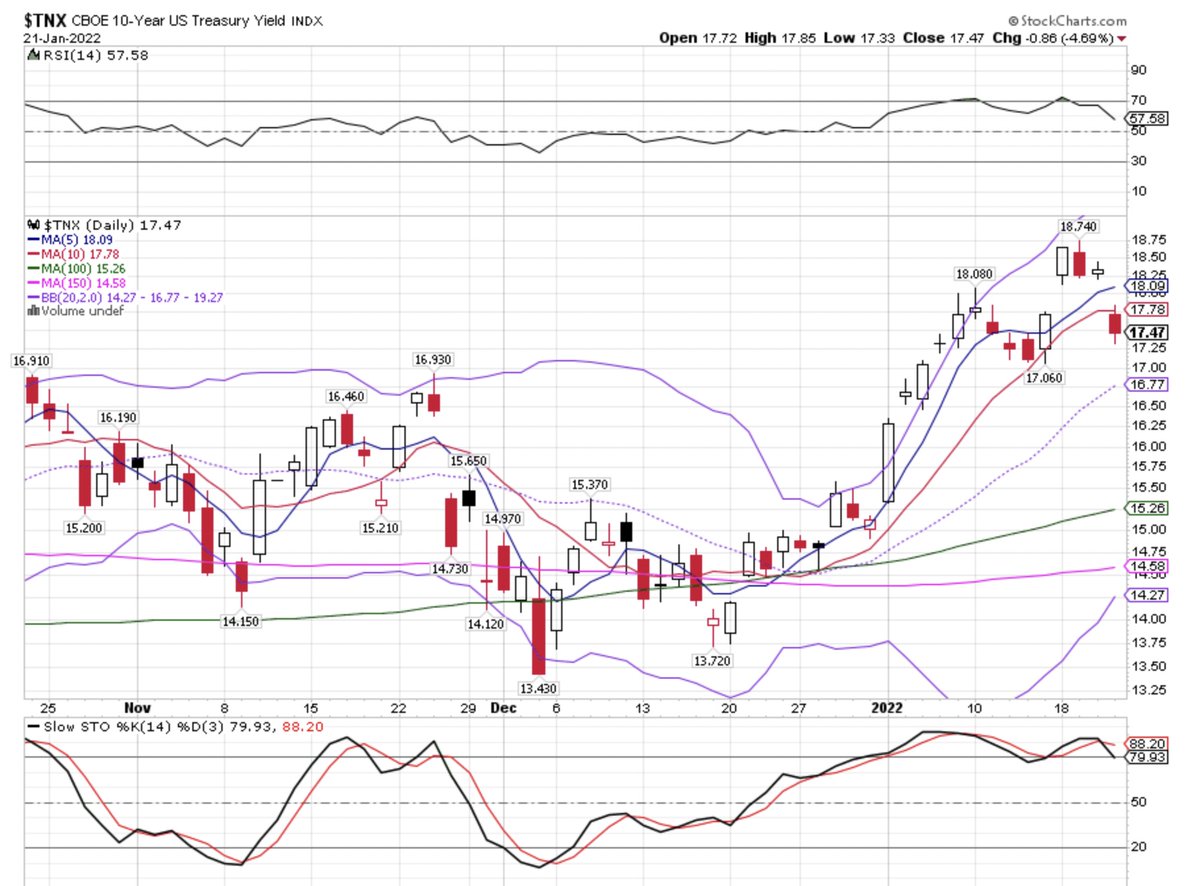

Nonetheless, $TNX turned on a dime Wednesday leading to a further flattering of the yield curve with 10/s to 75.5 BPS -36% over the past 3 months (T = Trend) and 30/5s to 51.3 BPS -41% over T duration.

Chart: TNX daily

Nonetheless, $TNX turned on a dime Wednesday leading to a further flattering of the yield curve with 10/s to 75.5 BPS -36% over the past 3 months (T = Trend) and 30/5s to 51.3 BPS -41% over T duration.

Chart: TNX daily

3/13

USTs and bonds have been a 🐻’s playground since January. That may change soon

Weekly delta

$BNDD +1.46%

$TLT +1.08%

$IEF +0.28%

$BND +0.1%

$TIP +0.06%

$BNDX -0.2%

$LQD -0.2%

$IVOL-0.27%

$HYG -0.76%

$CWB -4.14%

Chart: $BNDD +4.09% (T) is your friend with #deflation

USTs and bonds have been a 🐻’s playground since January. That may change soon

Weekly delta

$BNDD +1.46%

$TLT +1.08%

$IEF +0.28%

$BND +0.1%

$TIP +0.06%

$BNDX -0.2%

$LQD -0.2%

$IVOL-0.27%

$HYG -0.76%

$CWB -4.14%

Chart: $BNDD +4.09% (T) is your friend with #deflation

4/13

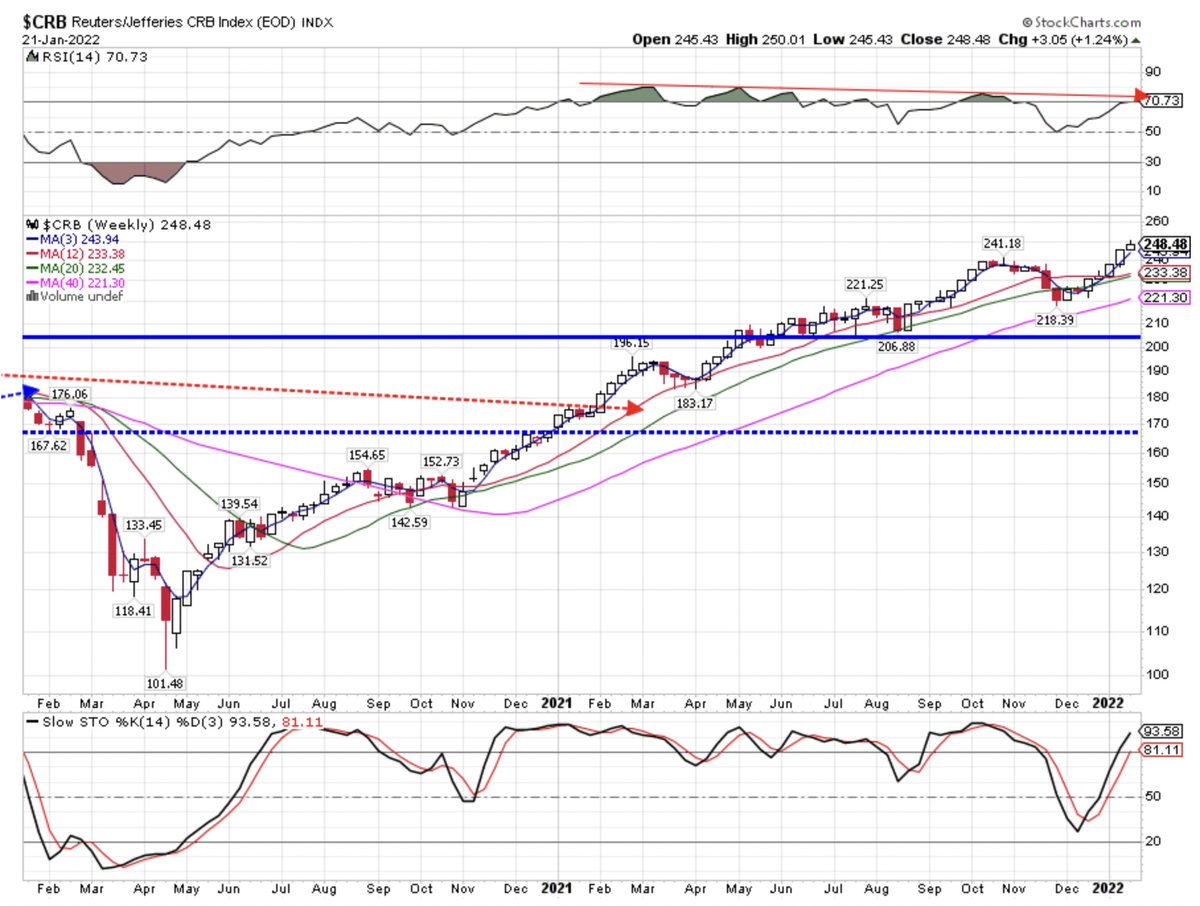

Commodities said 🖕🖕 to #deflation and the $CRB +1.24% put in a new cycle high.

Chart: $CRB weekly

Commodities said 🖕🖕 to #deflation and the $CRB +1.24% put in a new cycle high.

Chart: $CRB weekly

5/13

Led by $PLAT, metals ripped ↗️ on the week

$PLAT +7.25% (w), -1.62% (T)

$SILVER +6.11% (w), -0.53% (T)

$COPPER +2.26% (w), +0.44% (T)

$GOLD +0.84% (w), +1.97% (T) - $GVZ 15.20

Chart: $DBB +1.76% (w), +5.28% (T)

Led by $PLAT, metals ripped ↗️ on the week

$PLAT +7.25% (w), -1.62% (T)

$SILVER +6.11% (w), -0.53% (T)

$COPPER +2.26% (w), +0.44% (T)

$GOLD +0.84% (w), +1.97% (T) - $GVZ 15.20

Chart: $DBB +1.76% (w), +5.28% (T)

6/13

Hydrocarbons, ex-Natty, continued the ♉️ ↗️

$WTIC +2.18% (w) +1.65% (T) - $OVX 42.57

$BRENT +1.82% (w) +2.56% (T)

$GASO +1.06% (w) +1.24% (T)

$NATGAS -11.27% (w), -30.77% (T) 🐻

Chart: $WTIC put in a nominal new cycle high. Potential #momo #RSI divergence in play

Hydrocarbons, ex-Natty, continued the ♉️ ↗️

$WTIC +2.18% (w) +1.65% (T) - $OVX 42.57

$BRENT +1.82% (w) +2.56% (T)

$GASO +1.06% (w) +1.24% (T)

$NATGAS -11.27% (w), -30.77% (T) 🐻

Chart: $WTIC put in a nominal new cycle high. Potential #momo #RSI divergence in play

7/13

Grains ♉️ ↗️

$WHEAT +5.19% (w) +3.17% (T)

$CORN +3.35% (w) +14.54% (T)

$SUGAR +3.28% (w), -0.94% (T)

$SOYB +3.25% (w), +15.87% (T)

Chart: Are you really shorting $WHEAT??

Grains ♉️ ↗️

$WHEAT +5.19% (w) +3.17% (T)

$CORN +3.35% (w) +14.54% (T)

$SUGAR +3.28% (w), -0.94% (T)

$SOYB +3.25% (w), +15.87% (T)

Chart: Are you really shorting $WHEAT??

8/13

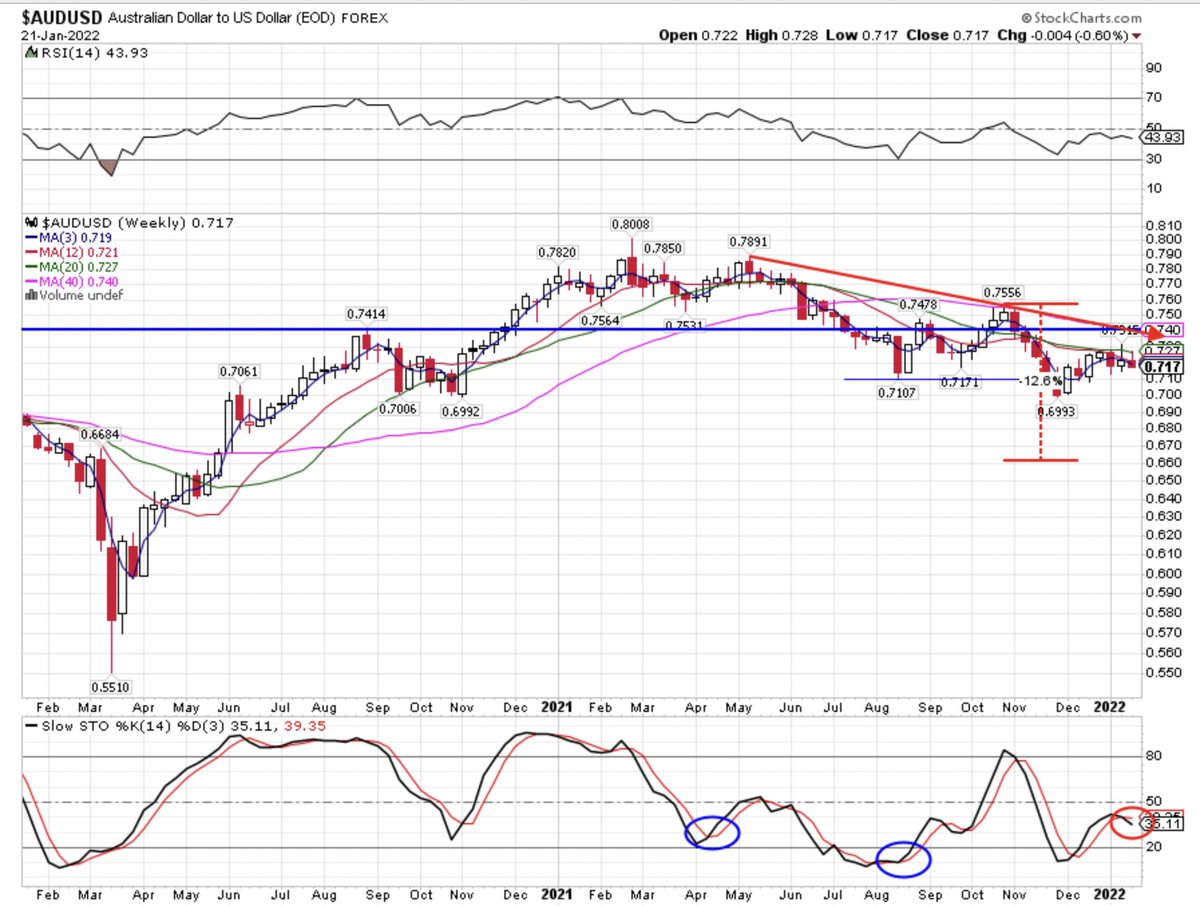

Safety trades led in #FX

$USD +0.5% (w) +2.15% (T)

$USDCHF -0.2% (w) -0.46% (T)

$USDJPY -0.48% (w) +0.19% (T)

$USDCAD +0.32% (w) +1.7% (T)

$EURUSD -0.59% (w) -2.56% (T)

$AUDUSD -0.69% (w) -4.02%% (T)

$GBPUSD -0.95% (w) -1.53% (T)

Chart: Measured move to $AUDUSD .665

Safety trades led in #FX

$USD +0.5% (w) +2.15% (T)

$USDCHF -0.2% (w) -0.46% (T)

$USDJPY -0.48% (w) +0.19% (T)

$USDCAD +0.32% (w) +1.7% (T)

$EURUSD -0.59% (w) -2.56% (T)

$AUDUSD -0.69% (w) -4.02%% (T)

$GBPUSD -0.95% (w) -1.53% (T)

Chart: Measured move to $AUDUSD .665

9/13

Long US equities has been an absolute 🤕 trade since the start of the new year.

All major indices now 🐻 (T = Trend)

$IWM -8.08% (w) -13.38% (T) - $VIX 28.85

$COMPQ -7.55% (w) -8.76% (T) - $VXN 34.06

$SPX -5.68% (w), -3.23% (T) - $RVX 26.25

Chart: $IWM with more ↘️

Long US equities has been an absolute 🤕 trade since the start of the new year.

All major indices now 🐻 (T = Trend)

$IWM -8.08% (w) -13.38% (T) - $VIX 28.85

$COMPQ -7.55% (w) -8.76% (T) - $VXN 34.06

$SPX -5.68% (w), -3.23% (T) - $RVX 26.25

Chart: $IWM with more ↘️

10/13

US sectors

Here’s where you lost less 💰

$XLU -0.81% (w) +2.36% (T)

$XLP -1.39% (w) +6.55% (T)

XLRE -2.9% (w) -1.68% (T) ⬅️ ⚠️

Where you lost more ↘️ 💰

$XLY -8.19% (w) -6.4% (T)

$XLK -6.9% (w) -2.58% (T)

$XLF -6.44% (w) -5.96% (T)

Chart: $XLY - discretion advised 😬

US sectors

Here’s where you lost less 💰

$XLU -0.81% (w) +2.36% (T)

$XLP -1.39% (w) +6.55% (T)

XLRE -2.9% (w) -1.68% (T) ⬅️ ⚠️

Where you lost more ↘️ 💰

$XLY -8.19% (w) -6.4% (T)

$XLK -6.9% (w) -2.58% (T)

$XLF -6.44% (w) -5.96% (T)

Chart: $XLY - discretion advised 😬

11/13

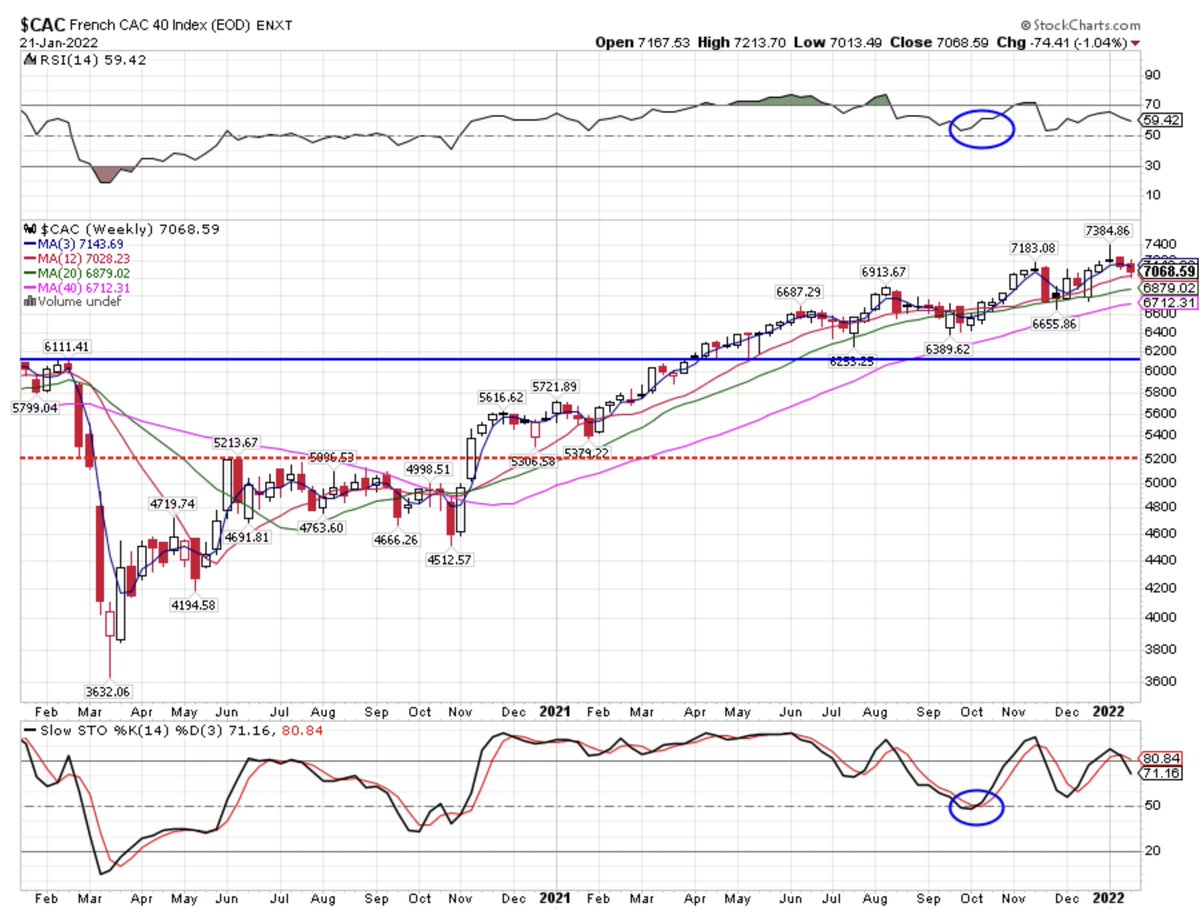

Major internat’l indices held up much better than 🇺🇸

$HSI +2.39% (w) -4.45% (T)

$SSEC +0.04% (w) -1.68% (T)

$CAC -1.04% (w) +4.97% (T)

$DAX -1.76% (w) +0.39% (T)

$NIKK -2.14% (w) -4.45% (T)

$KOSPI -3.0% (w) -5.72% (T)

Chart: $CAC 🇫🇷 the only major market holding ♉️ (T)

Major internat’l indices held up much better than 🇺🇸

$HSI +2.39% (w) -4.45% (T)

$SSEC +0.04% (w) -1.68% (T)

$CAC -1.04% (w) +4.97% (T)

$DAX -1.76% (w) +0.39% (T)

$NIKK -2.14% (w) -4.45% (T)

$KOSPI -3.0% (w) -5.72% (T)

Chart: $CAC 🇫🇷 the only major market holding ♉️ (T)

12/13

Weekly alpha earned long #HE EM shorts

$EWZ +2.78% (w) -0.53% (T)

$EWH +1.84% (w) -1.3% (T)

$FXI +0.37% (w) -9.34% (T)

Short the North?

$RSX -7.48% (w), -29.57% (T)

$EWD -5.74% (w), -13.07% (T)

$EWN -4.92% (w), -10.59% (T)

Chart: $EWZ dançar a salsa 💃🏽 ↗️

@InOkanagan

Weekly alpha earned long #HE EM shorts

$EWZ +2.78% (w) -0.53% (T)

$EWH +1.84% (w) -1.3% (T)

$FXI +0.37% (w) -9.34% (T)

Short the North?

$RSX -7.48% (w), -29.57% (T)

$EWD -5.74% (w), -13.07% (T)

$EWN -4.92% (w), -10.59% (T)

Chart: $EWZ dançar a salsa 💃🏽 ↗️

@InOkanagan

13/13

With $VIX ~ 30 and in backwardation, I am expecting a pop in deeply oversold equity markets post #FOMC event risk on Wednesday.

#STFR

Have a super profitable 💰week!

With $VIX ~ 30 and in backwardation, I am expecting a pop in deeply oversold equity markets post #FOMC event risk on Wednesday.

#STFR

Have a super profitable 💰week!

• • •

Missing some Tweet in this thread? You can try to

force a refresh