Hey!

In this thread, I’ll take a closer look at @QredoNetwork’s Qredo ($QRDO), a layer 2 decentralized custodian protocol.

Gather round, there’s a lot of interesting stuff to unpack!

#crypto #blockchain #defi #crosschain #dao

In this thread, I’ll take a closer look at @QredoNetwork’s Qredo ($QRDO), a layer 2 decentralized custodian protocol.

Gather round, there’s a lot of interesting stuff to unpack!

#crypto #blockchain #defi #crosschain #dao

Before we start, here are the things I will cover about this project:

• Website

• Team & Partners

• Whitepaper

• $QRDO Token Use Case & Distribution

• Social Media

• Website

• Team & Partners

• Whitepaper

• $QRDO Token Use Case & Distribution

• Social Media

Let's begin with some numbers.

• #Qredo was founded in Q4 2018.

• As of now, the project has raised $50 million from investors.

• In late 2021, the network had 11.000 monthly users and $8 bn assets under management.

• #Qredo was founded in Q4 2018.

• As of now, the project has raised $50 million from investors.

• In late 2021, the network had 11.000 monthly users and $8 bn assets under management.

Nice. But what is Qredo?

It’s a protocol enabling institutions to manage and swap their assets with seamless access to #defi.

Main features:

• Decentralized MPC (more on that later)

• Cross-chain settlement

• Cross-platform liquidity

Now, let’s dig deeper!

It’s a protocol enabling institutions to manage and swap their assets with seamless access to #defi.

Main features:

• Decentralized MPC (more on that later)

• Cross-chain settlement

• Cross-platform liquidity

Now, let’s dig deeper!

Qredo’s website is great. Not much copy on the homepage but it's on point. You quickly understand what it's all about and what the main features are.

Also good: the whitepaper and important docs (lite paper, token paper, etc.) are prominently placed.

qredo.com

Also good: the whitepaper and important docs (lite paper, token paper, etc.) are prominently placed.

qredo.com

There’s also detailed info on reached milestones, future roadmap, fundraising history, partners, and investors.

This makes a lot of things that interest me as a potential investor immediately visible and accessible. Well done!

This makes a lot of things that interest me as a potential investor immediately visible and accessible. Well done!

What stands out is that Qredo’s website offers a lot of information material. There is a FAQ section, videos, press releases, product descriptions... All of this makes it very convenient to research the platform.

Other #crypto projects should take this as an example!

Other #crypto projects should take this as an example!

The site also features the leading people behind #Qredo including links to social profiles on LikenIn.

I like what I am seeing here.

The team around @foy_anthony, @bspector, and @JoshGoodbody brings together people with years of experience in different fields and companies.

I like what I am seeing here.

The team around @foy_anthony, @bspector, and @JoshGoodbody brings together people with years of experience in different fields and companies.

This doesn’t only apply to the c-suite. Also the programmers, cryptographers and business developers have a lot of expertise in their fields.

Good prerequisites for long-term success.

Next up: partners.

Good prerequisites for long-term success.

Next up: partners.

Qredo builds on partnerships with well-known companies such as Deribit, coinbase and MetaMask Institutional.

In addition, the project attracted funds from crypto VCs such as Kenetic, Spartan and 1kx.

You only get such big names and funding on board if you know your business.

In addition, the project attracted funds from crypto VCs such as Kenetic, Spartan and 1kx.

You only get such big names and funding on board if you know your business.

What does Qredo’s cooperation with its partners look like?

Let’s take their partnership with @MMInstitutional as an example.

MMI gives institutions access to #defi with 15.000+ protocols on Ethereum mainnet and compatible chains. They also connect users to custodial partners.

Let’s take their partnership with @MMInstitutional as an example.

MMI gives institutions access to #defi with 15.000+ protocols on Ethereum mainnet and compatible chains. They also connect users to custodial partners.

MMI relies on providers like Qredo so that institutional users don’t have to compromise on their requirements for safety, compliance & security.

For Qredo that means access to thousands of MetaMask's 10 M users.

How does that work in detail?

Let’s check out the whitepaper!

For Qredo that means access to thousands of MetaMask's 10 M users.

How does that work in detail?

Let’s check out the whitepaper!

Qredo’s #whitepaper provides info about the project's background and which market needs it wants to fulfill.

Qredo's focus is on traditional financial institutions.

Why?

Because existing #defi solutions are optimized for individuals, not corporations.

qredo.com/qredo-white-pa…

Qredo's focus is on traditional financial institutions.

Why?

Because existing #defi solutions are optimized for individuals, not corporations.

qredo.com/qredo-white-pa…

To better understand this, let's look at the hurdles institutional users face.

Generally, existing #crypto infrastructure lacks the controls for businesses to legally operate in #defi.

Some of the issues:

• Centralized custody poses a risk for access to digital assets.

Generally, existing #crypto infrastructure lacks the controls for businesses to legally operate in #defi.

Some of the issues:

• Centralized custody poses a risk for access to digital assets.

• On some chains, transaction confirmation times are too slow & transaction fees are too high.

• There are security issues & trading insecurities such as front-running bots.

• The fractured infrastructure makes reporting a challenge.

• Poor cross-chain interoperability.

• There are security issues & trading insecurities such as front-running bots.

• The fractured infrastructure makes reporting a challenge.

• Poor cross-chain interoperability.

How does Qredo solve these problems?

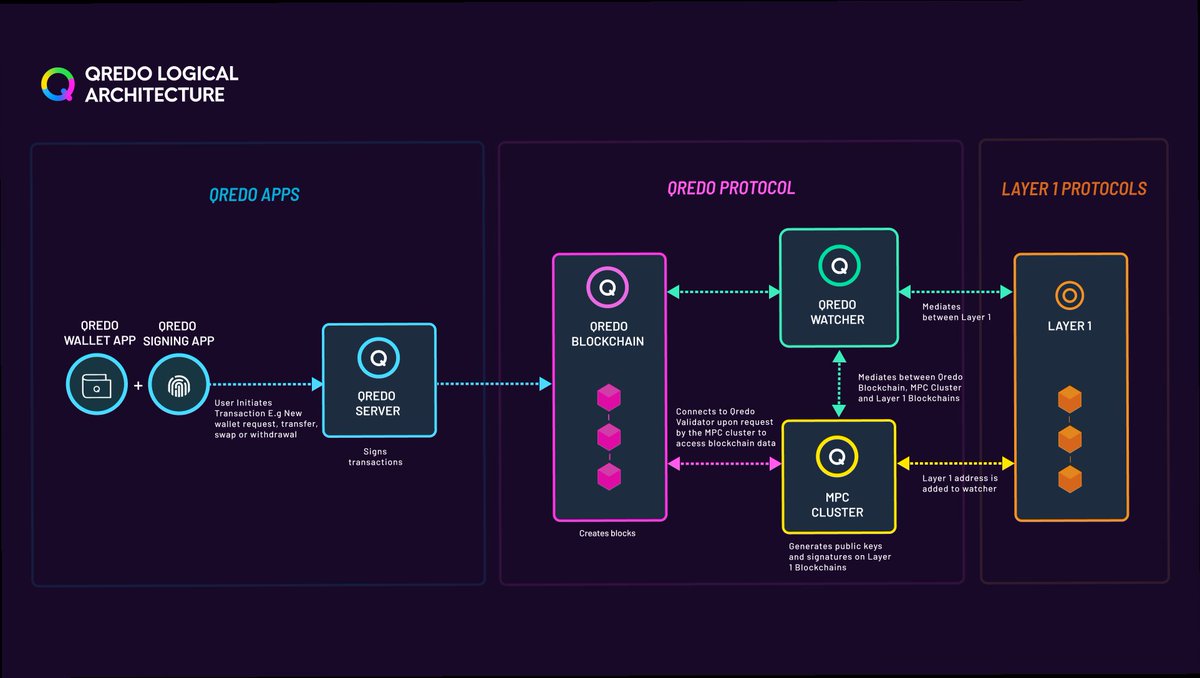

To decentralize custody, the network utilizes multi party computation (MPC). Parts of keys are distributed among different nodes. A certain number of the key holders need to approve in order to sign a transaction.

To decentralize custody, the network utilizes multi party computation (MPC). Parts of keys are distributed among different nodes. A certain number of the key holders need to approve in order to sign a transaction.

How does #Qredo support #crosschain interoperability?

The L2 network acts as an immutable asset registry that enables instant cross-chain functionality on supported L1 blockchains. Swaps happen between addresses on the Qredo blockchain at a low cost.

The L2 network acts as an immutable asset registry that enables instant cross-chain functionality on supported L1 blockchains. Swaps happen between addresses on the Qredo blockchain at a low cost.

This works by a process which Qredo calls crystallization, where underlying L1 assets are mapped to the L2 wallets on the network. This mapping gives Qredo the ability to make a “proof of funds claim” at all times and enables frictionless and fast cross-chain atomic swaps.

$QRDO is a utility and governance token for the Qredo network.

In total, there are 2 billion tokens (hard cap).

The first 1 billion is issued over the course of two years. The other tokens will be distributed to network users over the next 50 years to drive network usage.

In total, there are 2 billion tokens (hard cap).

The first 1 billion is issued over the course of two years. The other tokens will be distributed to network users over the next 50 years to drive network usage.

What’s special about Qredo’s tokenomics?

They don’t just reward miners and validators but all users. Anyone holding $QRDO in the network will automatically earn a staking yield of 10.1% APY.

The goal is to get a lot of users on board which results in greater network security.

They don’t just reward miners and validators but all users. Anyone holding $QRDO in the network will automatically earn a staking yield of 10.1% APY.

The goal is to get a lot of users on board which results in greater network security.

This is needed so the project can fully decentralize.

Qredo’s plan is for the community to eventually govern itself through a Decentralized Autonomous Organization (#DAO). Once the transition is made, #QRDO will be a governance token where one token counts as one vote.

Qredo’s plan is for the community to eventually govern itself through a Decentralized Autonomous Organization (#DAO). Once the transition is made, #QRDO will be a governance token where one token counts as one vote.

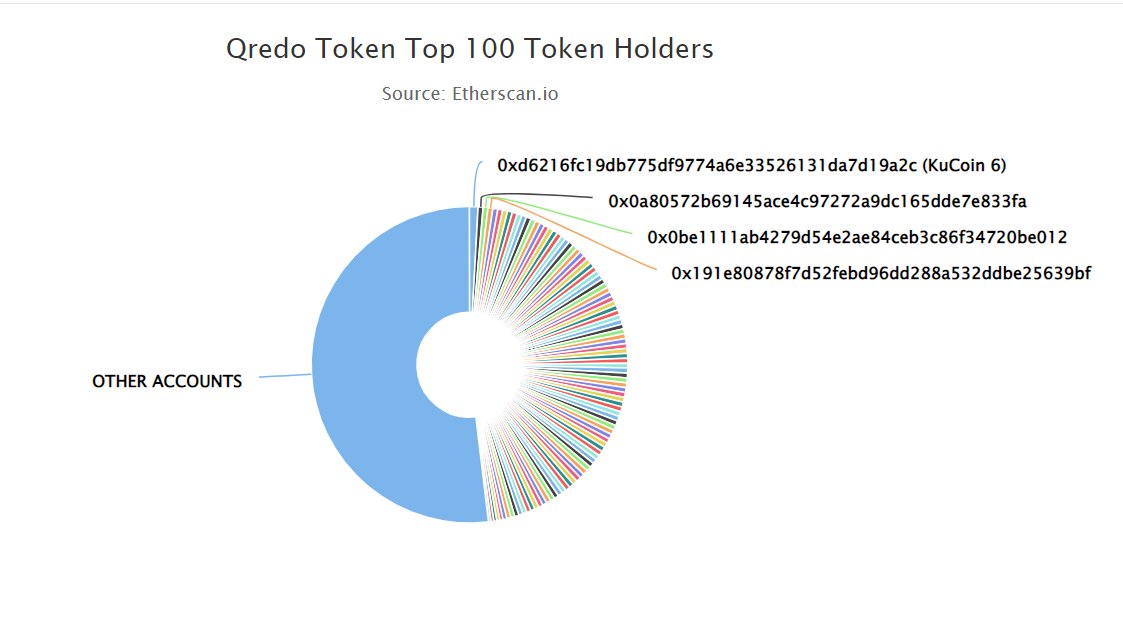

What about distribution?

According to the Qredo token paper, the team’s share is 22% while investors get 34%, mostly vested until mid 2022. Currently, 48% of $QRDO are held by the top 100 wallets, which also includes some exchanges.

qredo.com/qredo-token-pa…

According to the Qredo token paper, the team’s share is 22% while investors get 34%, mostly vested until mid 2022. Currently, 48% of $QRDO are held by the top 100 wallets, which also includes some exchanges.

qredo.com/qredo-token-pa…

#QRDO is traded on multiple exchanges including major ones such as KuCoin and Bitfinex.

Current total market cap is $100 million with a daily trading volume of $12 million.

Current total market cap is $100 million with a daily trading volume of $12 million.

Important:

$QRDO was audited by @Quantstamp and NCC Group. Their assessments found some common issues which have been resolved by Qredo.

• certificate.quantstamp.com/full/qredo-tok…

• research.nccgroup.com/wp-content/upl…

$QRDO was audited by @Quantstamp and NCC Group. Their assessments found some common issues which have been resolved by Qredo.

• certificate.quantstamp.com/full/qredo-tok…

• research.nccgroup.com/wp-content/upl…

Now, let’s take a look at their social media channels.

Qredo is active on multiple networks:

• @QredoNetwork (49k followers)

• Telegram (13k)

• Discord (3k)

• YouTube (1k)

• Medium (290)

They publish a lot of great content and there is plenty of user engagement.

Qredo is active on multiple networks:

• @QredoNetwork (49k followers)

• Telegram (13k)

• Discord (3k)

• YouTube (1k)

• Medium (290)

They publish a lot of great content and there is plenty of user engagement.

While their Twitter, Discord, and Telegram focus on real-time interaction with users, their YT and Medium channels feature in-depth content including user guides.

• t.me/qredonetwork

• medium.com/qredo

• discord.gg/bgVPvf6

• youtube.com/c/QredoNetwork

• t.me/qredonetwork

• medium.com/qredo

• discord.gg/bgVPvf6

• youtube.com/c/QredoNetwork

Here, too, Qredo performs very solidly.

I definitely recommend that you check out the different channels. There you will find a lot of information that I cannot reproduce here due to Twitter limitations.

I definitely recommend that you check out the different channels. There you will find a lot of information that I cannot reproduce here due to Twitter limitations.

Is there anything that I do not like about #Qredo?

Well, not really.

• The project seems to be very solid with a well defined target group and use case.

• The team brings a lot of expertise to the table.

• The tech is great.

• Their partners and investors are great.

Well, not really.

• The project seems to be very solid with a well defined target group and use case.

• The team brings a lot of expertise to the table.

• The tech is great.

• Their partners and investors are great.

So if you are looking for a potential #cryptoinvestment opportunity in the #defi space, you should take a closer look at this project. (NO financial advice!)

Enjoyed this thread?

Follow me for more insights in crypto research and macro trends!

Enjoyed this thread?

Follow me for more insights in crypto research and macro trends!

• • •

Missing some Tweet in this thread? You can try to

force a refresh