Amid the tragedy of war, the crypto ecosystem has served as a critical lifeline for Ukraine and its citizens.

In just under two weeks, donors have sent >$45M in crypto to Ukrainian-government controlled wallets for relief and supplies.

from @kylewaters_ & @natemaddrey

⬇️

In just under two weeks, donors have sent >$45M in crypto to Ukrainian-government controlled wallets for relief and supplies.

from @kylewaters_ & @natemaddrey

⬇️

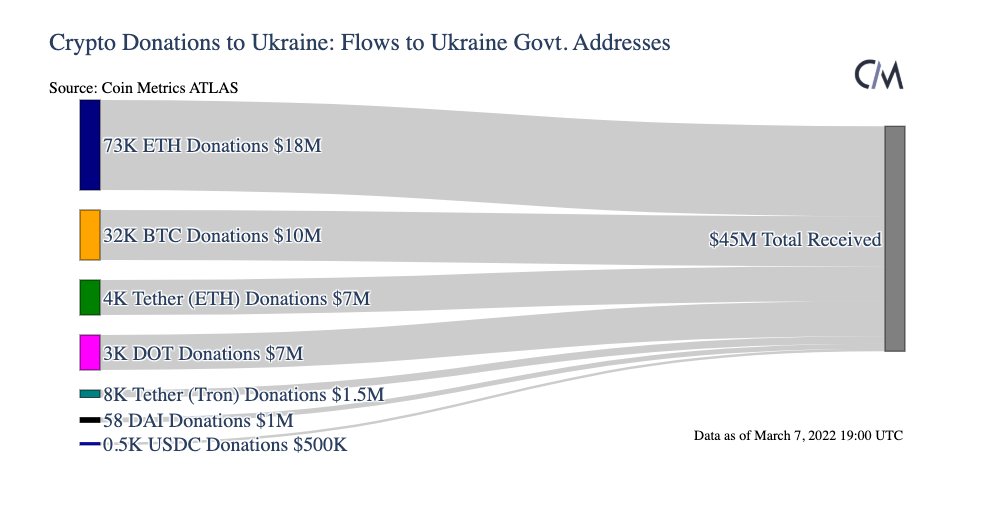

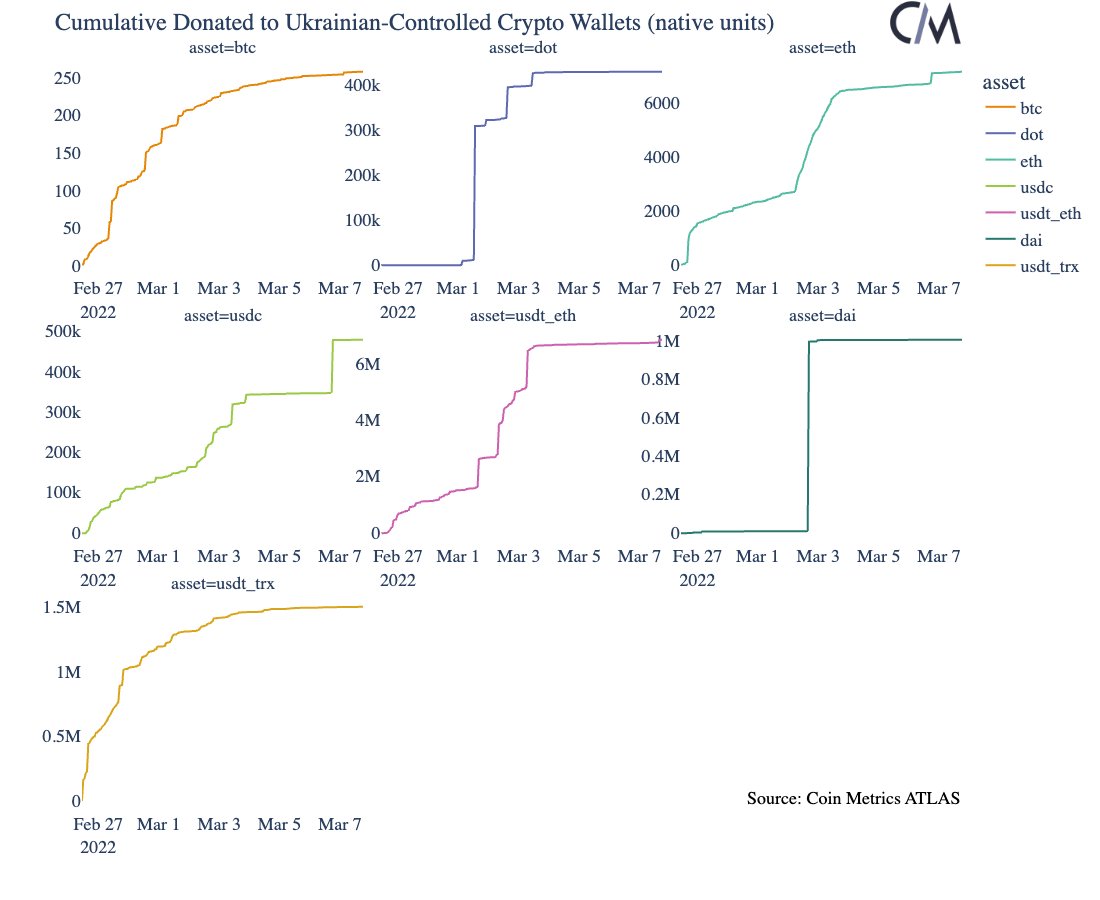

As of Monday, March 7th 19:00 UTC, Ukraine had received $18M of $ETH, $10M $BTC, $7M $DOT, and $10M of USD stablecoins composed of Tether, USDC, and DAI.

This flow chart shows the breakdown of total funds sent to Ukraine's addresses.

This flow chart shows the breakdown of total funds sent to Ukraine's addresses.

Most contributions have been sent using the largest crypto assets, BTC and ETH.

But other crypto assets and dollar-backed stablecoins have been used. Even blue-chip NFTs have been sent including 1 of the 10K CryptoPunks, worth ~$150K.

But other crypto assets and dollar-backed stablecoins have been used. Even blue-chip NFTs have been sent including 1 of the 10K CryptoPunks, worth ~$150K.

https://twitter.com/abornyakov/status/1500208402663981057?s=20&t=RHYigd0e0nmJuPSXtGA7lQ

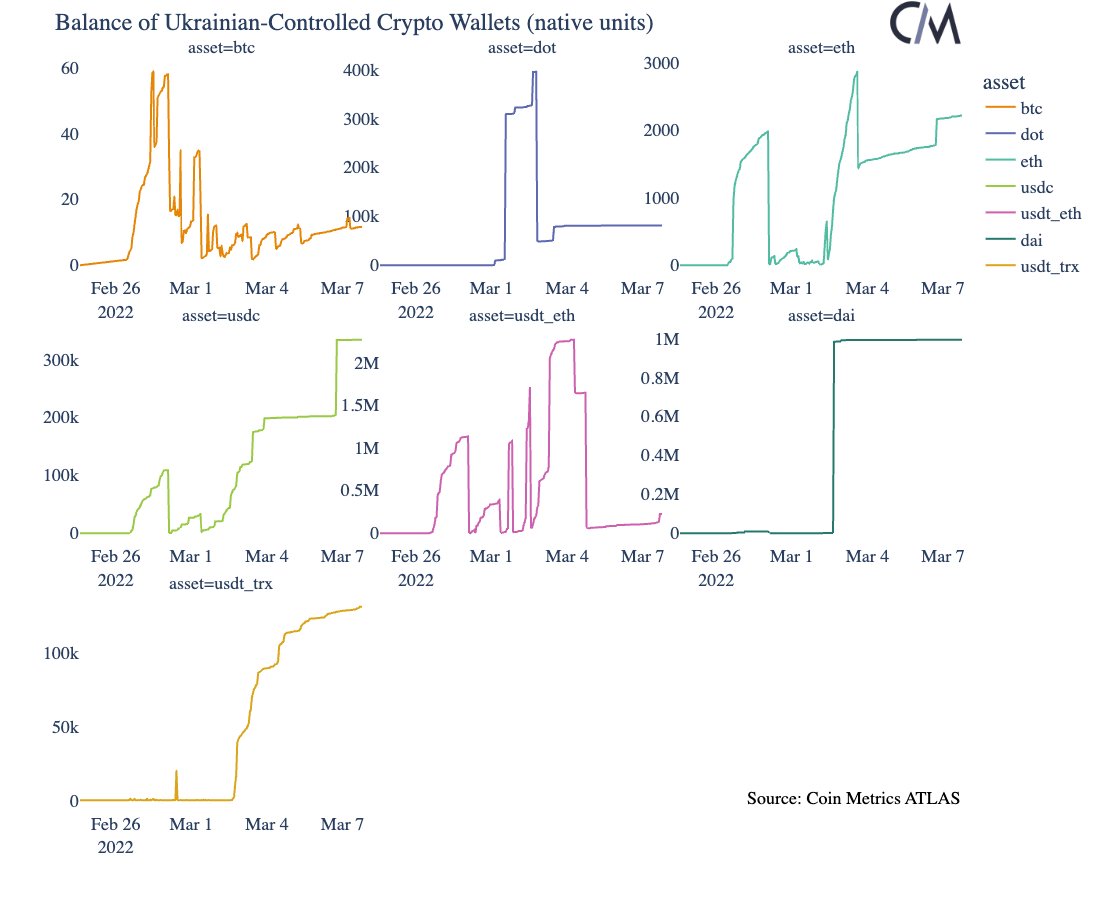

Data from our ATLAS blockchain explorer shows that the Ukrainian govt moved most of the donated funds, with ~$9M left at time of analysis.

They confirmed spending ~$15M of the funds with suppliers who are accepting crypto for food packages, night-vision devices, and other items.

They confirmed spending ~$15M of the funds with suppliers who are accepting crypto for food packages, night-vision devices, and other items.

Looking at the addresses’ balances over time, the most liquid assets are being tapped the fastest.

BTC and #Tether (ERC20) are being spent the quickest, followed by ETH / DOT. This is likely due to their good liquidity profiles or ease of trading or converting to fiat currencies

BTC and #Tether (ERC20) are being spent the quickest, followed by ETH / DOT. This is likely due to their good liquidity profiles or ease of trading or converting to fiat currencies

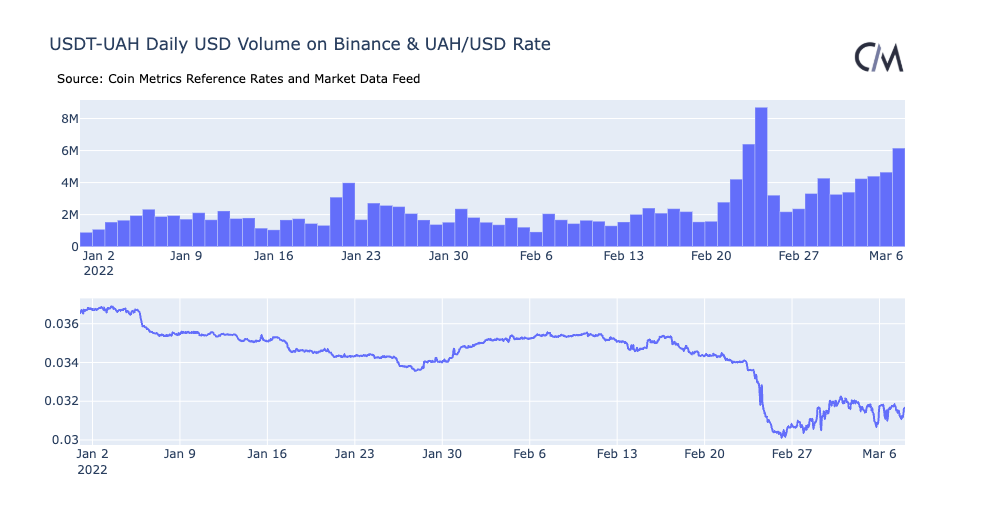

Demand for Tether in Ukraine has especially appeared strong recently.

As Ukraine’s local currency, the hryvnia, has fallen versus the US dollar, demand for USD backed assets like Tether has increased with daily volume rising in the USDT-UAH market on Binance.

As Ukraine’s local currency, the hryvnia, has fallen versus the US dollar, demand for USD backed assets like Tether has increased with daily volume rising in the USDT-UAH market on Binance.

The Ukrainian government has expressed a goal of doubling the total amount of crypto raised to $100M in the coming days.

Looking at the cumulative data, there is still a steady stream of donations coming in, albeit at a slightly slower pace.

Looking at the cumulative data, there is still a steady stream of donations coming in, albeit at a slightly slower pace.

However, there have been some big jumps with large donors making considerable contributions over the last week.

Notably, @Polkadot founder Gavin Wood donated $5M worth of $DOT on March 1st.

Notably, @Polkadot founder Gavin Wood donated $5M worth of $DOT on March 1st.

https://twitter.com/Ukraine/status/1498733635083587584

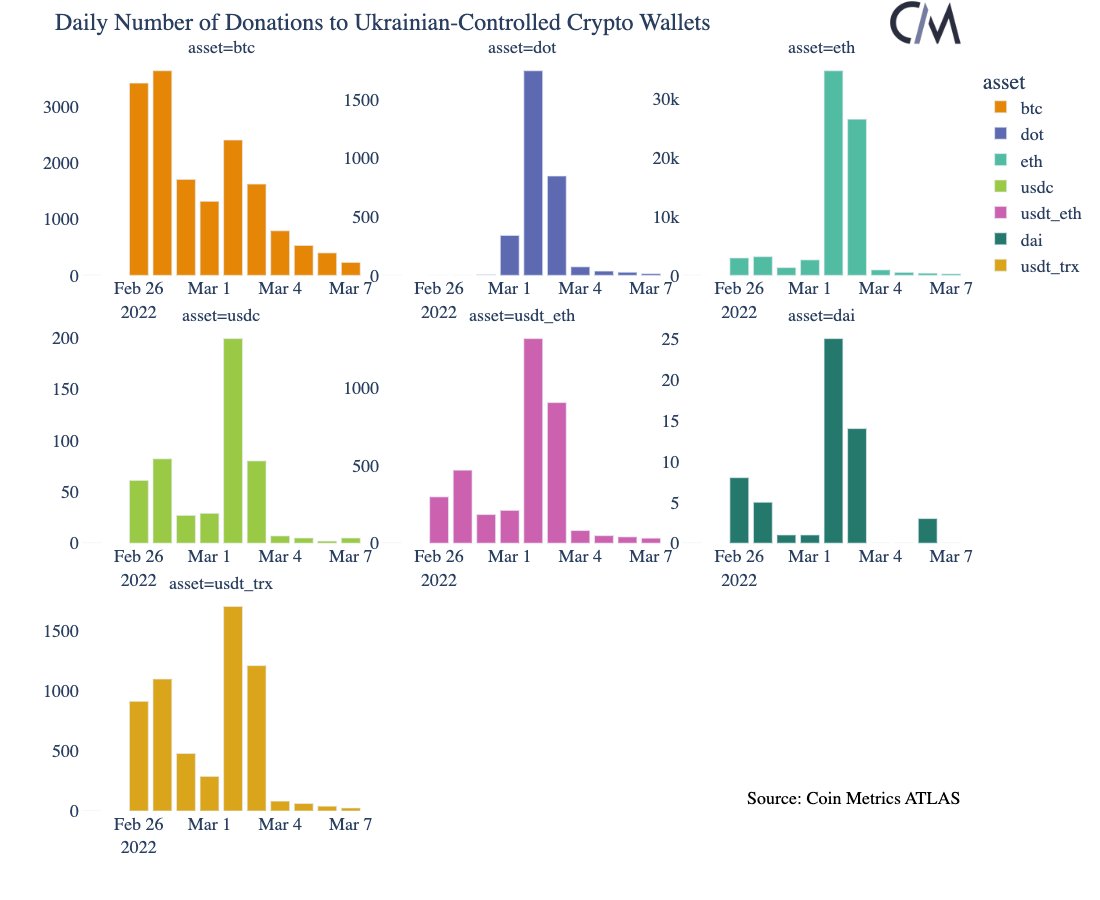

The number of $ETH donations accelerated on March 2nd with the announcement of a potential token airdrop but have slowed since the plans were reconsidered for an NFT project instead.

Despite the spikes in the data, the average contribution size is relatively low:

🔸 $BTC 0.016 BTC (~$650)

🔹 $ETH 0.01 ETH (~$250)

The large number of donations and modest average size suggests that the funds are coming from smaller contributors in addition to whales.

🔸 $BTC 0.016 BTC (~$650)

🔹 $ETH 0.01 ETH (~$250)

The large number of donations and modest average size suggests that the funds are coming from smaller contributors in addition to whales.

Crypto-financial rails together with an active crypto populace have undoubtedly helped facilitate a fast and successful Ukrainian fundraising and aid campaign.

Read the full post by @kylewaters_ and @natemaddrey here: coinmetrics.substack.com/p/state-of-the…

Read the full post by @kylewaters_ and @natemaddrey here: coinmetrics.substack.com/p/state-of-the…

• • •

Missing some Tweet in this thread? You can try to

force a refresh