#THORChain 101: the bridge between the multi chain universe ⛓️

Here is everything you need to know about THORchain and $RUNE, the cross chain AMM that is positioned to change world of crypto.

A thread 🧵👇

Here is everything you need to know about THORchain and $RUNE, the cross chain AMM that is positioned to change world of crypto.

A thread 🧵👇

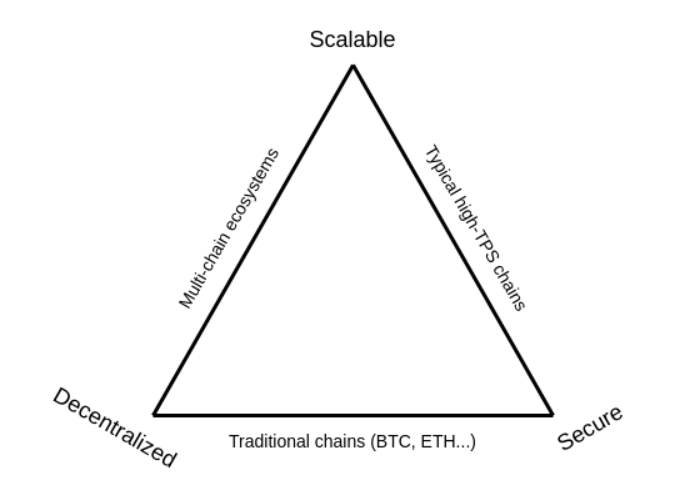

2. The entire ethos of the #crypto world rests upon decentralization and immutability. In the past few years, we’ve seen the rise of many chains. It’s become very clear, the future of crypto is multi chain.

3.Every chain has its pros and cons and the most optimized world is multi chain. We’ve seen this being built already with #COSMOS.

However, despite the strides we’ve taken towards decentralization, many crucial entities have remained centralized, like Coinbase and Binance.

However, despite the strides we’ve taken towards decentralization, many crucial entities have remained centralized, like Coinbase and Binance.

4. While I do not think the entire world will ever become truly centralized, having a centralized exchange means that they are forced to collect data, are slow and obey the rules of the State.

Due to this, the crypto’s immutability was handicapped.

Due to this, the crypto’s immutability was handicapped.

5. The solution to this was Dexs, like Uniswap. While these are great, they are limited to the functionality of each blockchain. Uniswap on #ETH would be limited to ETH.

6. #THORChain aims to go beyond this and be an chain exchange that bridges the gaps in the multi chain, immutable world.

THORChain is revolutionary because it supports native tokens across many chains, and fulfills the role of a decentralized exchange

THORChain is revolutionary because it supports native tokens across many chains, and fulfills the role of a decentralized exchange

7. This has many functions and benefits.

A big one is that protocol teams can build on any #THORChain supported blockchain and easily fuel liquidity from other ecosystems.

Currently, a huge reason to choose ETH is because they can use Dexs like Uniswap to bring in liquidity.

A big one is that protocol teams can build on any #THORChain supported blockchain and easily fuel liquidity from other ecosystems.

Currently, a huge reason to choose ETH is because they can use Dexs like Uniswap to bring in liquidity.

8. However, if the team thinks #AVAX or #Terra is better suited for their needs, they can use #THORChain and bring in liquidity from ETH. This is HUGE benefit.

It will allow for better allocation of resources and a more optimized experience.

It will allow for better allocation of resources and a more optimized experience.

9. THORchain has actually delivered on this vision and it works in a super interesting way.

It utilizes liquidity pools along with special THORnodes and $RUNE tokens to make this happen.

It utilizes liquidity pools along with special THORnodes and $RUNE tokens to make this happen.

https://twitter.com/Cov_duk/status/1501104658323963907

10. Like DEXs like Uniswap, #THORChain has liquidity pools containing other users’ deposits.

THORnodes are like individual parts of the larger treasury in a centralized exchange. The keys to the treasury are held in a multi sig arrangement of THORchain nodes.

THORnodes are like individual parts of the larger treasury in a centralized exchange. The keys to the treasury are held in a multi sig arrangement of THORchain nodes.

11. The Liquidity pools are controlled by the node operators (in a decentralized manner) instead of a centralized exchange.

If a user wished to trade ETH for BTC, the validating nodes will first detect and agree that ETH has been received in the ETH vault .

If a user wished to trade ETH for BTC, the validating nodes will first detect and agree that ETH has been received in the ETH vault .

12. They then collectively sign the BTC transaction to the user from their Bitcoin nodes. 2/3 of the nodes have to approve any outbound transaction.

Additionally, each transaction is signed by a random group of operators, which makes sure that it is anonymous and unpredictable.

Additionally, each transaction is signed by a random group of operators, which makes sure that it is anonymous and unpredictable.

13. The native token $RUNE is key for making sure the operators act truthfully. To become a node validator, nodes must put up money as a bond.

Nodes are strongly incentivized to put up 2x the value of all native assets in the liquidity pools in $RUNE as bond.

Nodes are strongly incentivized to put up 2x the value of all native assets in the liquidity pools in $RUNE as bond.

14. This is to ensure that they do not act maliciously. If they do, it penalizes them severely.

If validators do not put up 2x the amount, trading fees from LPs is directed away from them.

If validators do not put up 2x the amount, trading fees from LPs is directed away from them.

15. $RUNE has other uses - transaction fees are paid in $RUNE, governance and every LP has to add in an equal amount of $RUNE to the deposited assets.

The system ensure that the amount is equal. @ErikVoorhees showcases it really well

The system ensure that the amount is equal. @ErikVoorhees showcases it really well

16. By combining each token like ETH with $RUNE, #THORChain breaks up all the different tokens it supports into huge piles.

So 10 assets are supported, there will exists only 10 liquidity pools. The fewer the pools, the deeper the pools, lesser the slippage and better the rates

So 10 assets are supported, there will exists only 10 liquidity pools. The fewer the pools, the deeper the pools, lesser the slippage and better the rates

17. The total $RUNE supply is 500,000,000.

Uniswap and other DEXs use paid one token with another, ETH and Dai, this causes many fragmented pools.

Despite this, Uniswap has done incredibly well. This showcases how large the potential for #THORChain is

Uniswap and other DEXs use paid one token with another, ETH and Dai, this causes many fragmented pools.

Despite this, Uniswap has done incredibly well. This showcases how large the potential for #THORChain is

18. Another huge feature that #THORChain unlocks is that for the first time users can earn yield of real bitcoin.

Users who stake bitcoin in THORchain will get the money earned through trading the bitcoin in the pool.

Users who stake bitcoin in THORchain will get the money earned through trading the bitcoin in the pool.

19. This yield is way higher than that of the measly yields centralized exchanges give users on #BTC. This gives #THORChain to have the deepest BTC pool.

20. The more I looked into #THORChain , the more bullish I’ve got.

We are moving towards a multi chain decentralized world. For that to happen we need easy swapping between chains. #THORChain makes this possible, making the whole crypto world more efficient.

We are moving towards a multi chain decentralized world. For that to happen we need easy swapping between chains. #THORChain makes this possible, making the whole crypto world more efficient.

21. Devs can now choose the chain thats best suited for them and bring in liquidity from big players like ETH. #THORChain also allows for earning yield on true bitcoin, which has far greater returns than other centralized exchanges.

22. This is huge and could lead #THORChain to become the largest BTC pool, making it very well positioned to explode.

Lastly, #THORChain is based on the #Cosmos Tendermint consensus and is connected to the cosmos ecosystem.

Lastly, #THORChain is based on the #Cosmos Tendermint consensus and is connected to the cosmos ecosystem.

23. Accounts you need to follow for #THORChain insights:

@ErikVoorhees @Rewkang @RyanWatkins_ @HighCoinviction @THORChain @redphonecrypto @larry0x @Bitcoin_Sage @Jatinkkalra @JKendzicky @JamesTodaroMD @JosephTodaro_

Spent a lot of time writing this, a RT would mean a lot!

@ErikVoorhees @Rewkang @RyanWatkins_ @HighCoinviction @THORChain @redphonecrypto @larry0x @Bitcoin_Sage @Jatinkkalra @JKendzicky @JamesTodaroMD @JosephTodaro_

Spent a lot of time writing this, a RT would mean a lot!

24. Follow for #THORChain insights:

@TusharJain_ @SpencerApplebau @THORNOOBs @DCA_Cryptoz @CBarraford @CryptosBatman @youssef_amrani @runebase_org @THORChainLPU @thorstarter @ninerealms_cap @BrokkrFinance @0xSaigon

Spent a lot of time writing this, a RT would mean a lot!

@TusharJain_ @SpencerApplebau @THORNOOBs @DCA_Cryptoz @CBarraford @CryptosBatman @youssef_amrani @runebase_org @THORChainLPU @thorstarter @ninerealms_cap @BrokkrFinance @0xSaigon

Spent a lot of time writing this, a RT would mean a lot!

25. Follow for #THORChain insights:

@Mastermined710 @THORChadsDAO @TehSlaw @Jonbros01 @Cryptofriendlyy @flyacro @GrassRootsio @xSonyaD @0xSmith @CosmoGandalf @RuneMaxi @m0nkey_space @THORChadsDAO @THORSwap @JaneDButterfly

Spent a lot of time writing this, a RT would mean a lot

@Mastermined710 @THORChadsDAO @TehSlaw @Jonbros01 @Cryptofriendlyy @flyacro @GrassRootsio @xSonyaD @0xSmith @CosmoGandalf @RuneMaxi @m0nkey_space @THORChadsDAO @THORSwap @JaneDButterfly

Spent a lot of time writing this, a RT would mean a lot

@Mastermined710 @THORChadsDAO @TehSlaw @Jonbros01 @Cryptofriendlyy @flyacro @GrassRootsio @xSonyaD @0xSmith @CosmoGandalf @RuneMaxi @m0nkey_space @THORSwap @JaneDButterfly Hope this was insightful. I do 101s and breakdowns. Follow to keep up.

Check out my past 101s here:

Check out my past 101s here:

https://twitter.com/Cov_duk/status/1500714387417436168

Update: This is BIG news. #THORChain launched synthetic assets

Here's @CBarraford's thread on why it's HUGE:

Here's @CBarraford's thread on why it's HUGE:

https://twitter.com/CBarraford/status/1501620810003656706

• • •

Missing some Tweet in this thread? You can try to

force a refresh