#DeFi is changing the game at a massive scale and is evolving each day💸

Here's how three cognitive biases are holding you back from realising #DeFi's full potential and how to conquer them.

A short thread🧵, that will enable you to make all the right decisions.

Here's how three cognitive biases are holding you back from realising #DeFi's full potential and how to conquer them.

A short thread🧵, that will enable you to make all the right decisions.

1/ Ever felt like your personal belongings were more valuable to you, than they're objectively worth?

That's the "endowment effect" playing tricks on your mind.

That's the "endowment effect" playing tricks on your mind.

2/ Ever doubled-down on a wrong decision from the past? Congrats, you've become a victim of the "sunk cost fallacy"⚓😳

The sunk cost fallacy makes it hard to abandon ship when you've already spent time and/or money on something. Sound familiar?

The sunk cost fallacy makes it hard to abandon ship when you've already spent time and/or money on something. Sound familiar?

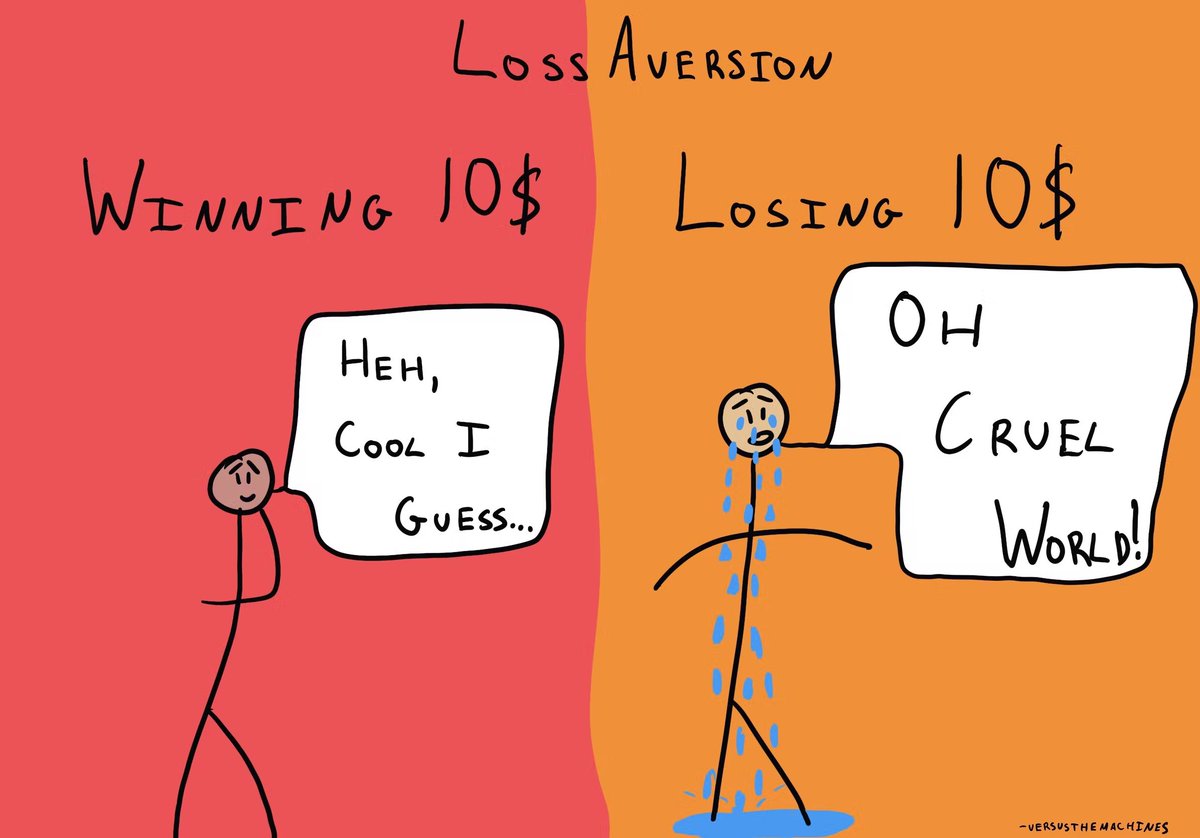

3/ Ever missed selling at the #ATH, still made profits but somehow felt bad? That's your brain showing its "loss aversion".

Its effects are present in many ways within the #DeFi and #crypto communities:

- #HODL (not always wrong!)

- "Can't lose money, if you never sell"

😢

Its effects are present in many ways within the #DeFi and #crypto communities:

- #HODL (not always wrong!)

- "Can't lose money, if you never sell"

😢

4/ What do all these cognitive biases have in common?

They can lead you to commit one of the biggest mistakes in #crypto trading: Holding on to coins or token, even though there are better opportunities out there.

They can lead you to commit one of the biggest mistakes in #crypto trading: Holding on to coins or token, even though there are better opportunities out there.

5/ Here comes the best part. Once you've identified these biases, you can beat them.

Simply take a step back and re-evaluate your #crypto holdings on a regular basis.

Simply take a step back and re-evaluate your #crypto holdings on a regular basis.

6/ If you wouldn't buy (as much) of a certain coin or token you're currently #hodling, then it's time to sell.

Feel like you don't have enough of another coin? Perfect, shift your holdings into this one.

Fell like you've struck the perfect balance? No need for action then 👌

Feel like you don't have enough of another coin? Perfect, shift your holdings into this one.

Fell like you've struck the perfect balance? No need for action then 👌

7/ It's imperative to not think of not selling as "doing nothing". It's quite the opposite: an active decision to keep holding and to not invest into a better alternative out there.

At the pace that #DeFi is moving, this can be deadly to your $$$.

At the pace that #DeFi is moving, this can be deadly to your $$$.

8/ And that's it!

Regularly take a step back. Look at your holdings. And give yourself the ability to start fresh, based on new information available to you.

Your #gains will follow, we promise 🤝

Regularly take a step back. Look at your holdings. And give yourself the ability to start fresh, based on new information available to you.

Your #gains will follow, we promise 🤝

• • •

Missing some Tweet in this thread? You can try to

force a refresh