Thread on how much money clubs have already received after the Champions League 2021/22 last 16. Also includes estimates for English clubs in the Europa League and Europa Conference League. Some assumptions made about the TV pool, but figures should be reasonably accurate.

My calculations suggest that 9 clubs have already earned more than €75m from the 2021/22 Champions League. Bayern Munich lead the way with €111m, followed by Real Madrid €106m, #MCFC €99m, Atletico Madrid €96m, #CFC €94m, PSG €94m, #LFC €92m, #MUFC €81m & Juventus €79m.

Looking at how Champions League revenue is distributed, the importance of the UEFA coefficient is clearly evident with the TV pool being much less significant than it was before. This rewards historically successful clubs rather than those with larger national TV rights deals.

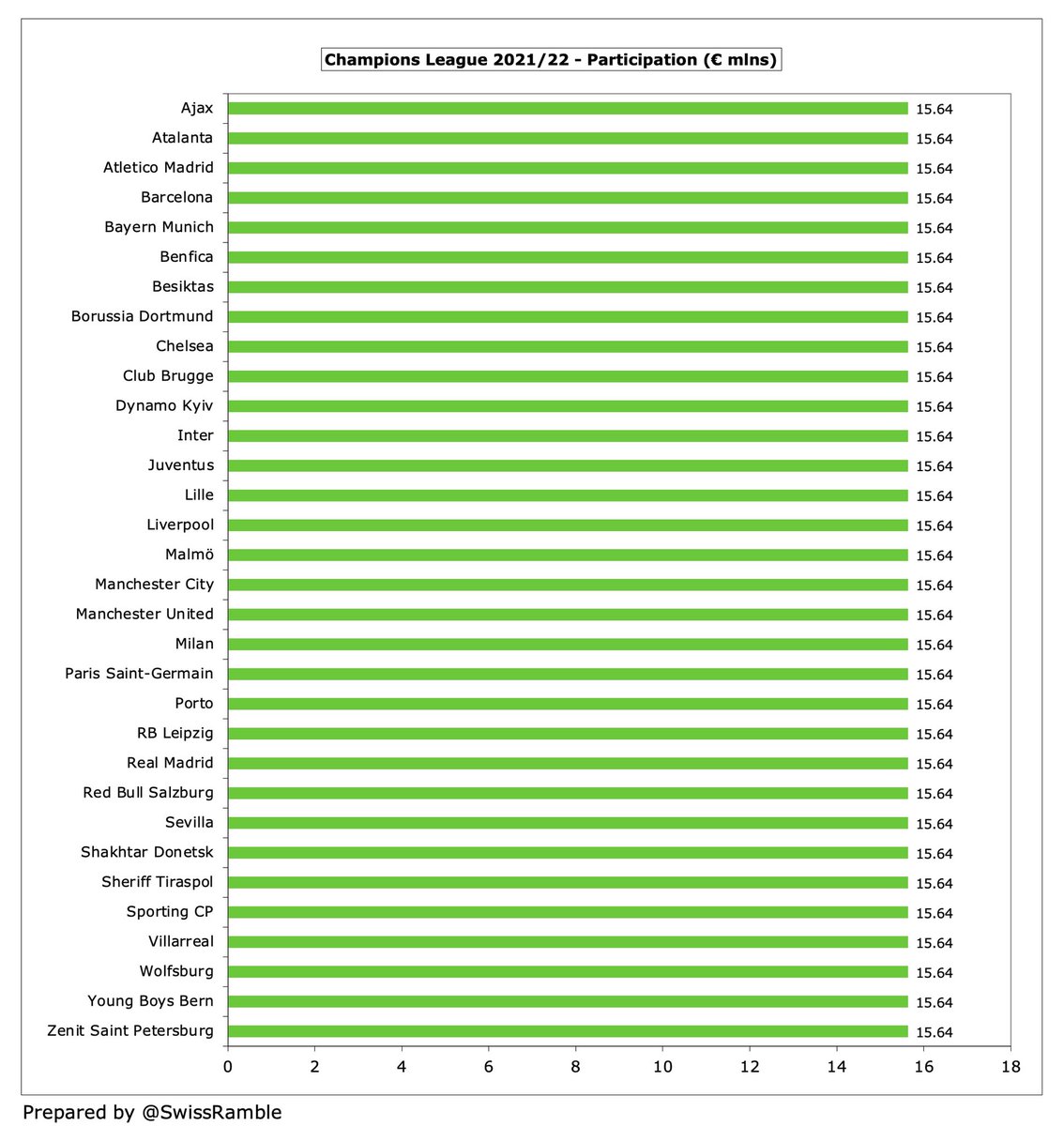

Right off the bat, each of the 32 clubs that qualified for the Champions League group stage received a participation fee of €15.64m, which is up 3% from the previous cycle’s €15.25m.

Bayern Munich and #LFC have earned most prize money with €38.3m, as they won all 6 games in the group stage, worth €16.8m (€2.8m for each win), plus €1.3m for their share of money left on the table after draws, €9.6m for reaching the last 16 and €10.6m for quarter-final.

Coefficient payment is based on performances in UEFA tournaments over past 10 years, including bonus for winning trophies. so benefits traditional big clubs like Real Madrid €36m, Bayern €35m and Barcelona €34m. English clubs: #CFC €33m, #MCFC €28m, #MUFC €27m & #LFC €23m.

Highest TV pool payment is Lille €31m, followed by PSG €28m and #MCFC €22m. Lille benefit from the French TV pool only being divided between 2 clubs with their share being higher than PSG as they won Ligue 1 last season. In contrast, Spain’s money is split between 5 clubs.

#MCFC €96m is highest revenue of English clubs, as TV pool is boosted by winning previous season’s Premier League. Followed by #CFC €91m, due to their high UEFA coefficient, then #LFC €89m (most prize money after winning all group games). #MUFC “only” €78m after last 16 exit.

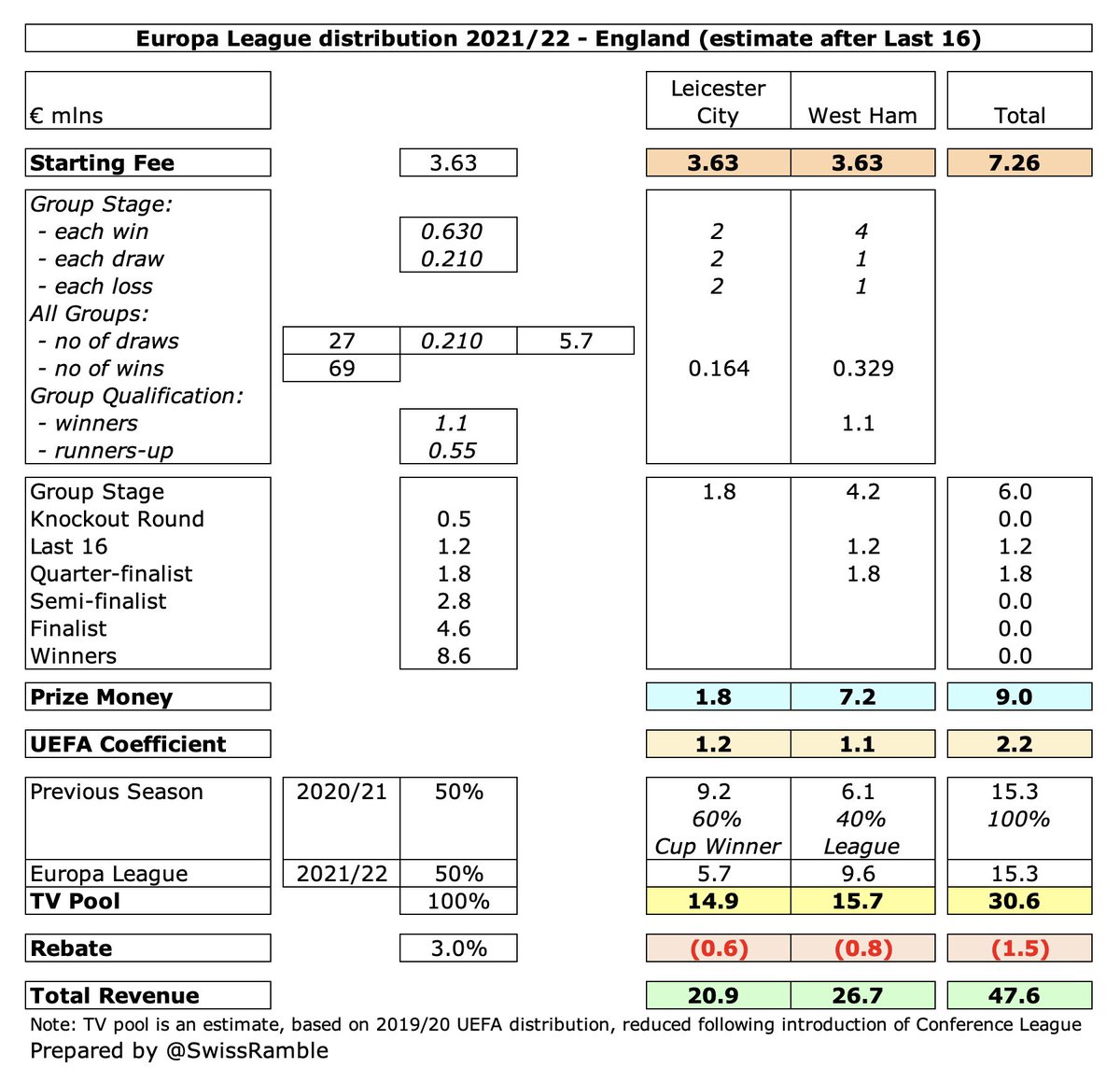

Revenue is much smaller in the Europa League, but #WHUFC have earned €27m for reaching the quarter-finals, including €1.1m bonus for winning their group, while #LCFC get €21m. The high English TV pool is very important to earnings here (this is a modeled figure).

Similarly, I estimate that #THFC will receive €9m from the Europa Conference League after they went out at the group stage (UEFA having awarded victory to Rennes for a match postponed due to COVID). #LCFC have earned €3m for reaching QF after dropping down from Europa League.

Comparing English clubs across the European competitions highlights the massive disparity. Champions League representatives have earned between €78m and €96m, at least €50m more than Europa League clubs, who in turn get more than twice as much as those in Europa Conference.

Real Madrid have highest Spanish clubs’ Champions League 2021/22 revenue to date with €102m, due to the best UEFA coefficient (highest in Europe) and most prize money, followed by Atletico Madrid €96m (highest TV pool after winning La Liga last season).

Spain benefit from the UEFA coefficient payment, thanks to successful record in Europe with their clubs filling 3 of the top 5 rankings. Despite reaching last 16, Villareal only get €65m, as receive nothing from first half of TV pool, after qualifying by winning Europa League.

Bayern Munich €107m is highest German clubs’ Champions League 2021/22 revenue, as earned the most prize money, have best UEFA coefficient and highest TV pool. Big gap to other clubs, all eliminated at group stage: Borussia Dortmund €61m, RB Leipzig €44m and Wolfsburg €35m.

Bayern were boosted by winning all 6 games in the group stage (worth €2.8m each), and being the only German club to reach the QF. Low UEFA coefficients for RB Leipzig and Wolfsburg. TV pool reportedly up 70% following new deals with DAZN, Amazon and ZDF (replacing Sky).

Juventus’ €76m is the highest Italian clubs’ Champions League 2021/22 revenue to date, due to having the best UEFA coefficient and earning the most prize money, followed by Inter €63m (highest TV pool after winning Serie A last season), Milan €45m and Atalanta €33m.

Atalanta’s €33m revenue is relatively small, mainly due to a low €5m UEFA coefficient, which shows how this distribution model protects the traditional large clubs against the up-and-coming teams. TV pool is reportedly down from €50m to €40m in this cycle.

Despite their disappointing exit, Paris Saint-Germain have highest French clubs’ Champions League 2021/22 revenue with €90m, due to earning most prize money and the best UEFA coefficient, followed by Lille €67m, boosted by highest TV pool after winning Ligue 1 last season.

Both French clubs were boosted by reaching the last 16 and high TV pool, as this is only split between 2 clubs, whereas other countries have to share between 4-5 clubs. Lille earnings dampened by only receiving €2m from their UEFA coefficient, compared to a hefty €30m for PSG.

Benfica’s €64m is the highest Portuguese clubs’ Champions League 2021/22 revenue to date. Their achievement in reaching the quarter-final means a large gap to Sporting €45m (last 16) and Porto €43m (eliminated at group stage, but best UEFA coefficient).

Portuguese clubs suffer from having a very low TV pool (unless this has been increased since 2019/20). On the other hand, this means that they have benefited from the introduction of the UEFA coefficient: Porto €24m, Benfica €22m and Sporting €11m.

Apart from the Big Six leagues, I have also estimated Champions League earnings for Netherlands, Ukraine, Russia and Turkey: Ajax €63m, Shakhtar Donetsk €36m, Dynamo Kyiv €31m, Zenit Saint Petersburg €39m and Besiktas €28m.

It should be emphasised that these are only estimates, including assumptions around TV pools, and final revenue distribution will depend on further progress in this season’s competition, but the analysis does give a good idea of the money earned in the Champions League.

• • •

Missing some Tweet in this thread? You can try to

force a refresh