A lot has been made of the death of the #petrodollar system.

This has massive implications from #equities to #crypto. From the #US to #China.

I agree its time will come. But not anytime soon.

Stick with me for 8 tweets👇🧵

This has massive implications from #equities to #crypto. From the #US to #China.

I agree its time will come. But not anytime soon.

Stick with me for 8 tweets👇🧵

USD is EXTREMELY entrenched

USDs are 50%+ of int. loans and 60% of reserves (below).

That bottom green bar 2%? Thats the Yuan

USDs are 50%+ of int. loans and 60% of reserves (below).

That bottom green bar 2%? Thats the Yuan

But oil is priced in $ that's why countries hold it in their reserves? Can't they just switch to the Yuan?

Sure to support the world PetroYuan system China would have to:

-Run trade deficits

-Allow foreigners property rights

-Eliminate the soft peg to the $

-Un due cap controls

Sure to support the world PetroYuan system China would have to:

-Run trade deficits

-Allow foreigners property rights

-Eliminate the soft peg to the $

-Un due cap controls

To have the world's reserve currency, you need to trust the country issuing it.

People have reduced trust in the US the last few weeks but they have even less in China.

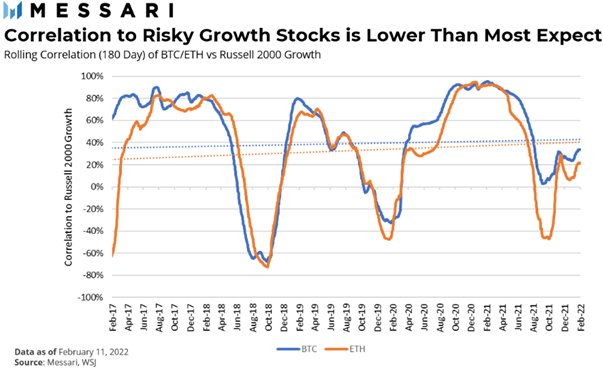

TINA (maybe crypto?)

People have reduced trust in the US the last few weeks but they have even less in China.

TINA (maybe crypto?)

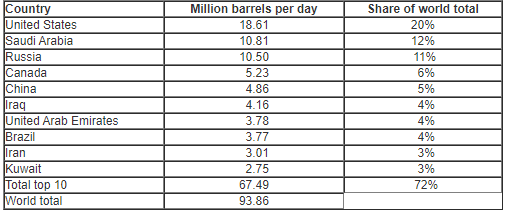

The news the Saudis are thinking of pricing some of their oil in Yuan is concerning BUT guess who produces the most oil. The US. Guess whos currency is pegged to the dollar. SA. Any oil sales just effectively get converted back into dollars to maintain the peg.

The Petrodollar system is based on the US assertion they will protect these "allies" to price oil in USD.

China isn't protecting the Saudis from Iran.

China isn't protecting the Saudis from Iran.

Ok we get it reserves may not move but what about trade?

Via the BIS 90% of trades across the $6.6 trillion-a-day foreign-exchange market still involve the dollar.

Thats going to be an even harder system to disrupt

Via the BIS 90% of trades across the $6.6 trillion-a-day foreign-exchange market still involve the dollar.

Thats going to be an even harder system to disrupt

TLDR

Buy Gold. Buy Crypto.

But not because the dollar is going anywhere.

Buy Gold. Buy Crypto.

But not because the dollar is going anywhere.

Interested what @LynAldenContact or @CryptoHayes think here

• • •

Missing some Tweet in this thread? You can try to

force a refresh