The 🧵is here ↓↓↓

🔸What is Web3?

#Web3 is the next major phase in the evolution of the internet.

• A decentralized form of the internet.

• Users become owners.

• They will be able to participate in the creation, operation, and governance of any protocols themselves.

🔸What is Web3?

#Web3 is the next major phase in the evolution of the internet.

• A decentralized form of the internet.

• Users become owners.

• They will be able to participate in the creation, operation, and governance of any protocols themselves.

https://twitter.com/thedefimetro/status/1513994017343787012

🔸 What is #Web3 Token?

When it comes to Web3, you'll find that cryptocurrency is frequently mentioned. This is because many of the Web3 protocols rely heavily on cryptos.

Web 3.0 tokens are digital assets that are associated with the vision of creating a decentralized Internet.

When it comes to Web3, you'll find that cryptocurrency is frequently mentioned. This is because many of the Web3 protocols rely heavily on cryptos.

Web 3.0 tokens are digital assets that are associated with the vision of creating a decentralized Internet.

🔸 How to understand Web3 🤷

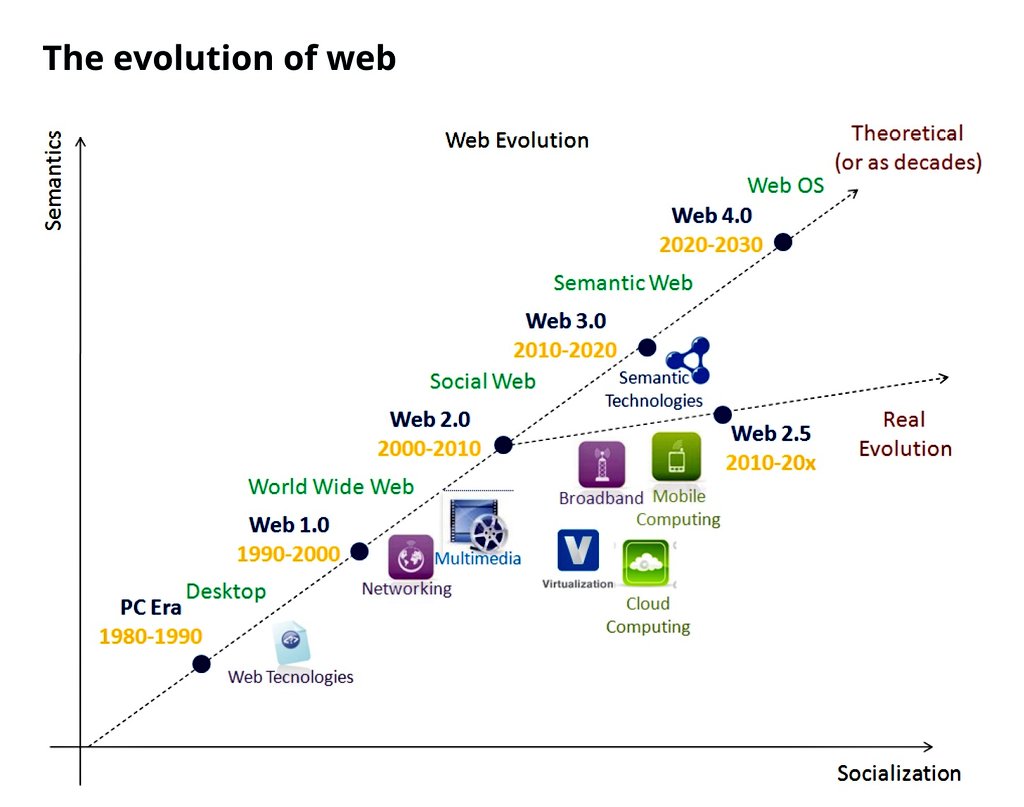

To better understand #Web3, it can be helpful to review current and past phases of the internet.

Web 1.0 → Web 2.0 → Web 3.0

Let's observe the tables below ↓↓↓

To better understand #Web3, it can be helpful to review current and past phases of the internet.

Web 1.0 → Web 2.0 → Web 3.0

Let's observe the tables below ↓↓↓

🔸Web 2.0 Vs Web 3.0

The move from Web 2.0 to 3.0 is happening slowly and unnoticed by the general public. Web 3.0 applications have the same look and feel as 2.0 applications, but the back-end is fundamentally different.

The move from Web 2.0 to 3.0 is happening slowly and unnoticed by the general public. Web 3.0 applications have the same look and feel as 2.0 applications, but the back-end is fundamentally different.

🔸 What are the properties of Web 3.0?

• Semantic Web

• Artificial Intelligence

• 3D Graphics

• Connectivity

• Ubiquity

• Blockchain

• Decentralized data Network

• Edge Computing

• Semantic Web

• Artificial Intelligence

• 3D Graphics

• Connectivity

• Ubiquity

• Blockchain

• Decentralized data Network

• Edge Computing

🔸 As a company/brand owner, how do you get your brand ready for the Web 3.0 revolution?

1. Issuing a native asset:

These native assets are required for the network's operation and derive their value from the security they provide.

1. Issuing a native asset:

These native assets are required for the network's operation and derive their value from the security they provide.

2. Building a network/ecosystem by holding the native asset.

@Blockstream, one of the largest #Bitcoin Core maintainers, relies on its BTC balance sheet to generate value.

@Blockstream, one of the largest #Bitcoin Core maintainers, relies on its BTC balance sheet to generate value.

Similarly,

@ConsenSys has grown to a thousand workers, constructing crucial infrastructure for the Ethereum (ETH) ecosystem to boost the worth of the #ETH it owns.

This is a business model that results in "growing their native asset treasury"

@ConsenSys has grown to a thousand workers, constructing crucial infrastructure for the Ethereum (ETH) ecosystem to boost the worth of the #ETH it owns.

This is a business model that results in "growing their native asset treasury"

🔸Payment tokens

In respect to the rise of the token sale, new wave of #blockchain initiatives are building their business models around payment tokens within networks.

👉 Forming two-sided marketplaces and requiring the usage of a native token for all payments.

In respect to the rise of the token sale, new wave of #blockchain initiatives are building their business models around payment tokens within networks.

👉 Forming two-sided marketplaces and requiring the usage of a native token for all payments.

🔸Burn tokens

The idea of buybacks/token burns sparked a lot of interest as one of the aspects of the #Binance (BNB) and #MakerDAO (MKR) tokens.

This would result in decrease in the supply of tokens and a price increase 🚀📈

The idea of buybacks/token burns sparked a lot of interest as one of the aspects of the #Binance (BNB) and #MakerDAO (MKR) tokens.

This would result in decrease in the supply of tokens and a price increase 🚀📈

Would be stopping here for now 🥱

If you found these threads educative, kindly Like & Retweet to reach out to Newbies.

NB: Beware of Impostors, i would never ask you for Funds!

Next 🧵:

🔹 Pros & Cons of #Web3

If you found these threads educative, kindly Like & Retweet to reach out to Newbies.

NB: Beware of Impostors, i would never ask you for Funds!

Next 🧵:

🔹 Pros & Cons of #Web3

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh