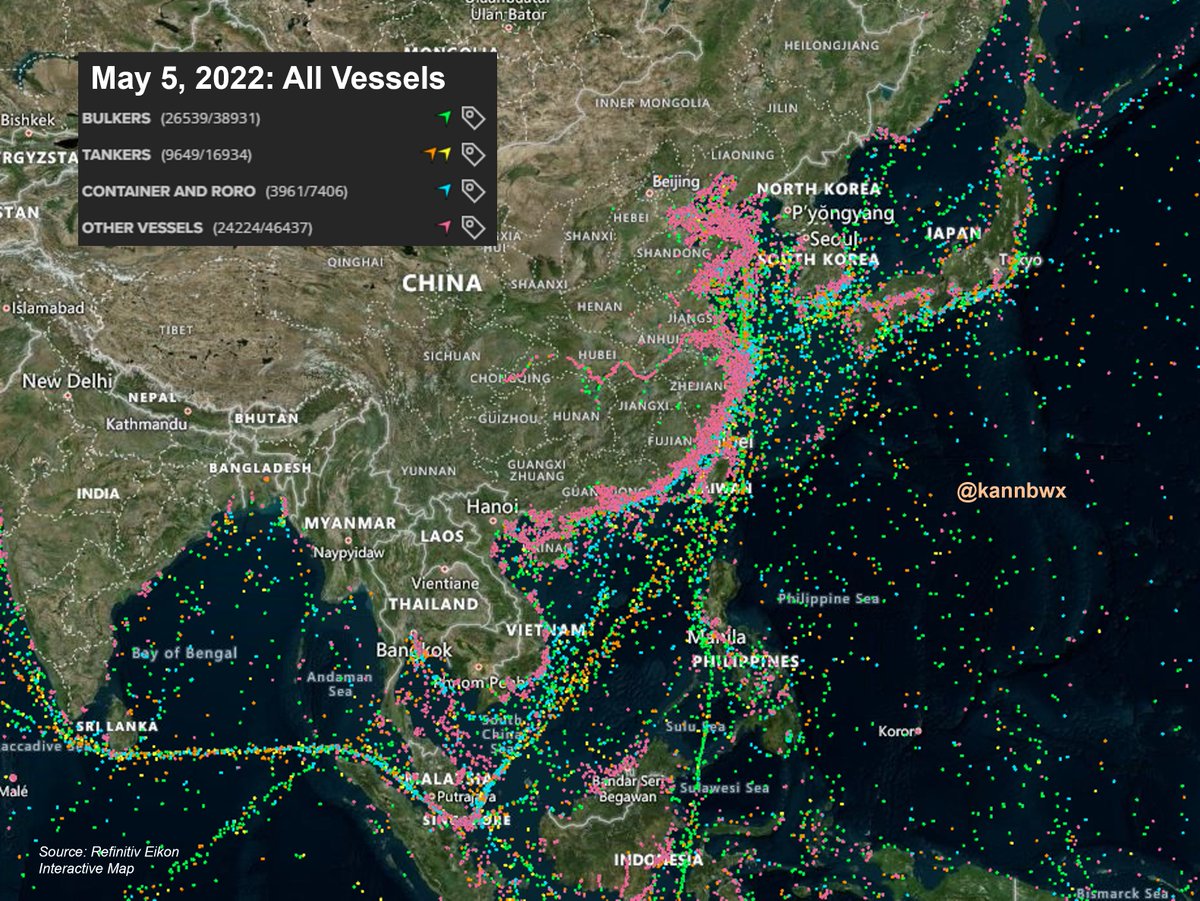

#China's COVID lockdowns have worsened global supply chain woes. One-fifth of the world's container ship fleet is estimated to be stuck in port congestion (not just in China), and the number of ships awaiting berth at Shanghai are up 34% from last month.

Here's a look at Shanghai. Zooming in on that one clump of vessels shows they are mostly stationary (at anchor) waiting for their turn. Shipping something from a warehouse in #China to one in the USA now takes 74 days longer than usual.

In March, the average global delay of a ship's arrival was 7.26 days. Anything over 4.5 days is very rare. These stats and more are from this Reuters article from this week:

reuters.com/business/snarl…

reuters.com/business/snarl…

Beijing, #China's second most populous city, has tightened COVID restrictions this week as cases spread. That follows extended restrictions in most populated Shanghai in place for more than a month. Other large cities have also adopted measures.

reuters.com/world/china/be…

reuters.com/world/china/be…

But #China as of Thursday remained committed to its COVID response, vowing to fight any comments and actions against it. Beijing has targeted a zero-COVID policy.

Disclaimer: Unfortunately I do not have a "normal" view since I cannot go back in time on this map. China's seaboard is always extremely busy and will probably look clogged normally. But pay attention to the data.

Also peep the #soybeans coming out of the bottom left corner 👀

Also peep the #soybeans coming out of the bottom left corner 👀

• • •

Missing some Tweet in this thread? You can try to

force a refresh