1/13 A few thoughts on nuclear energy as the white knight of European energy security and independence against the background of Russian fossil fuel dependence.

Not really...

#Nuclear

#EU

#electricity

Not really...

#Nuclear

#EU

#electricity

2/13 Let me say upfront that I am not against nuclear energy but it has to make sense. For example Germany made a mistake in shutting down nuclear energy quickly for political reasons. A better approach would have been to sweat the nuclear assets as long as reasonably possible.

3/13 Go for the shut down of the most expensive/dirty power sources first & built up alternative energy sources & storage in parallel. Less (Russian) gas used for electricity generation in that scenario as well. However it is what it is & the clock can't be turned back a decade.

4/13 a.) I question the obsession with base load power in general and base load nuclear power in particular. If I were to design a energy system from scratch I would be interested in a much more decentralized system as it is simply more robust.

5/13 Current nuclear tech is concentrated on massive reactors who cover 5 % or more of electricity needs of a country/region. SMR (small nuclear reactors) are in the planning stage & work on a demonstration plant is to start in Wyoming in 2024 (to be finished in 2028).

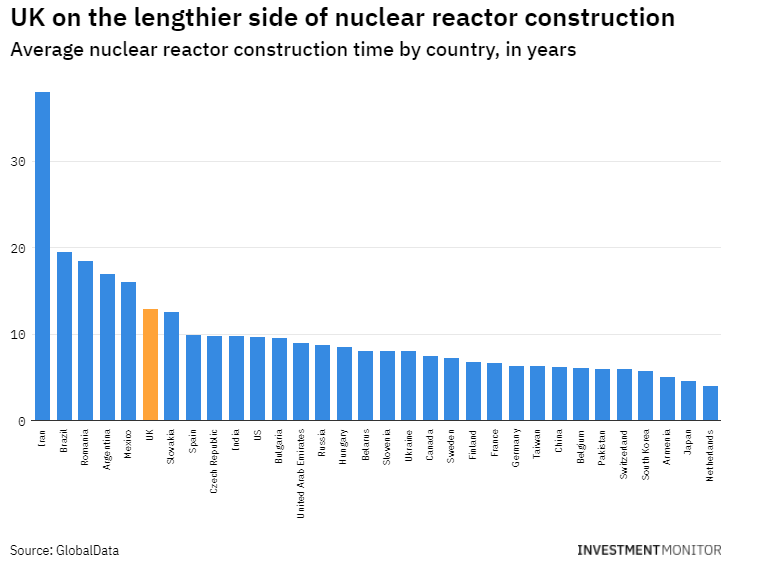

6/13 b.) Construction time: The graph below speaks for itself. It only describes construction time. Planning and permission need to be added. Can Europe wait a minimum 10 years before new reactors go online?

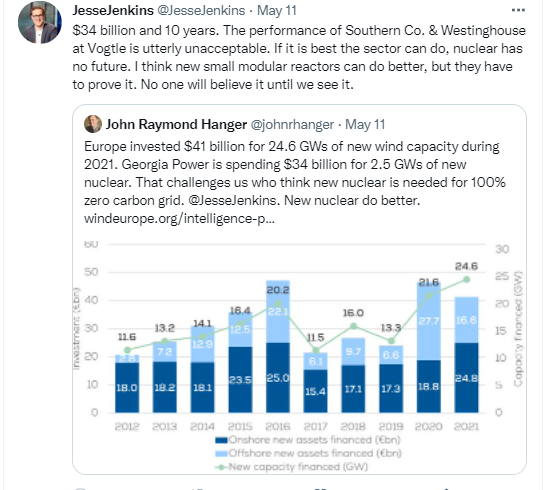

7/13 c.) Cost: Hinkley Point C (3.2 GW) in England received a nuclear site license in 2012. Planned commission date 2027. In 2012 a strike price of Sterling 89.50 per megawatt hour (MWh) was agreed with EDF France to build and run the plant. In 2012 cheaper than wind power.

8/13 Nowadays offshore wind power in the UK clears for around Sterling 40 MWh. That is a lot of room to add storage and still be vastly more competitive.

The tweet below describes an example from the US.

The tweet below describes an example from the US.

9/13 d.) Technology lock in: Hinkley Point C is a new type of PWR (pressurized water ) reactor. Assuming the new technology works fine, it is nevertheless locked in for the next 50 - 60 years. All the time renewables/storage technology keeps innovating & getting cheaper.

10/13 e.) Politics: Nuclear power creates lots of emotions which make the politics tricky for governments who want to stay in power. The article below is a great summary from the UK.

energymonitor.ai/policy/market-…

energymonitor.ai/policy/market-…

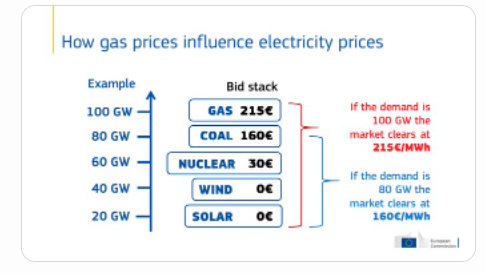

11/13 f.) Market pricing system in the EU: The market clearing price is determined by the last bid of the power generator to satisfy total demand. Do double/triple nuclear generation but as long as the last bid is provided by expensive gas, the market clears at that price.

12/13 g.) Uranium sources: EU uranium sources vary. Around 40% come from Russia & Kazakhstan. France gets most of its mined uranium from Canada and Niger. Only small deposits of uranium exist in Poland, Romania, Czech Rep & Germany. Not exactly future energy independence.

13/13 Europe is in a hurry to get off Russian fossil fuels and achieve energy independence.

Small decentralized nuclear reactors might offer some promise long term but are non existent as of now.

Costs, planning & construction time, sourcing & politics don't add up.

Small decentralized nuclear reactors might offer some promise long term but are non existent as of now.

Costs, planning & construction time, sourcing & politics don't add up.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh