There have been a few analyses of football club debt published recently, which are at best misleading, if not downright incorrect. So it’s once again time to wheel out my explanation of why debt figures should be treated with caution, as there are so many different definitions.

For the purpose of this review I will take the 2020/21 audited accounts of those clubs featuring in the Deloitte Money League (with the exception of Zenit St Petersburg, where I have not managed to source the details).

At the narrowest extreme, we have just bank debt, but the broadest extreme covers total liabilities, which includes all financial obligations, including transfer debt, staff payables, tax liabilities, trade creditors, provisions, accrued expenses and even deferred income.

The net debt reported in an English club’s financial statement is in line with IFRS (International Financial Reporting Standards) and essentially covers purely financial obligations, such as overdrafts, bank loans, bonds, shareholder loans and finance leases less cash.

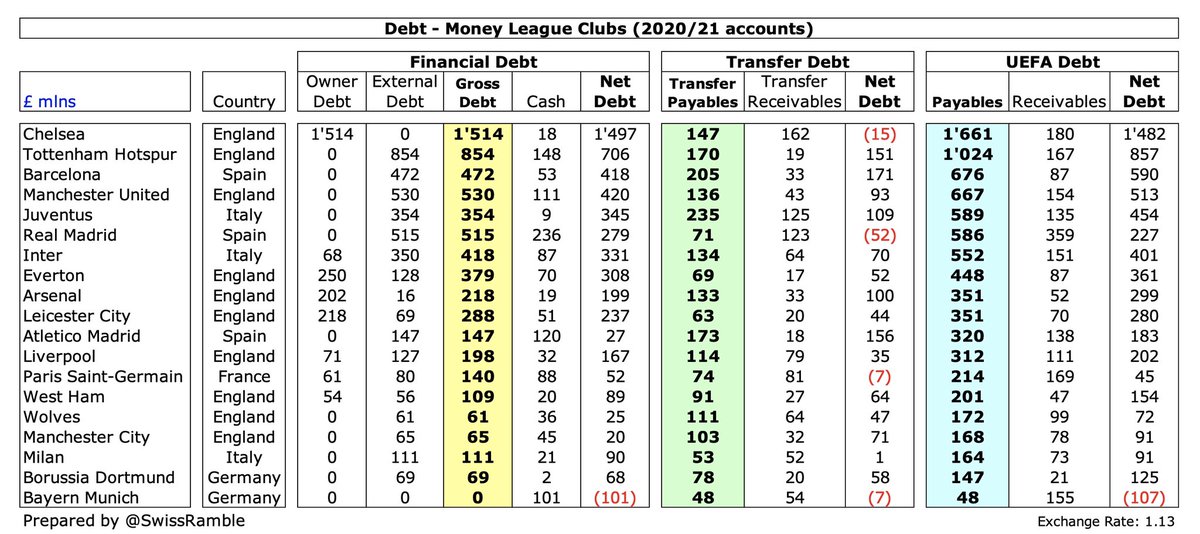

On that basis, three English clubs have the largest gross debt: #CFC £1.5 bln (Abramovich funding), #THFC £854m (new stadium) and #MUFC £530m (Glazers’ leveraged buy-out). Then come the Spanish giants: #RealMadrid £515m and #FCBarcelona £472m. #FCBayern have zero financial debt.

Even with this simple definition, it is worth understanding whether the debt has been provided by the owner, usually interest-free loans with no fixed repayment date, or by a bank, requiring annual interest payments. Large clubs normally have relatively low owner funding.

In stark contrast, as you work your way down the leagues, it is often the case that the majority of a club’s debt is provided by the owner. A good example is the EFL Championship, where over 80% of the financial debt has come from generous owners.

Leading clubs that have benefited from debt largely being provided by their owner are mainly in England, the poster child being #CFC (£1.5 bln). Other clubs with owners that have provided more than £200k loans: #EFC £250m, #LCFC £218m and #AFC £202m.

#THFC have highest external debt of £854m, though their new stadium will be a major revenue generator and it’s a long-term loan at a low interest rate. Next highest are #MUFC £530m, #RealMadrid £515m and #FCBarcelona £472m.

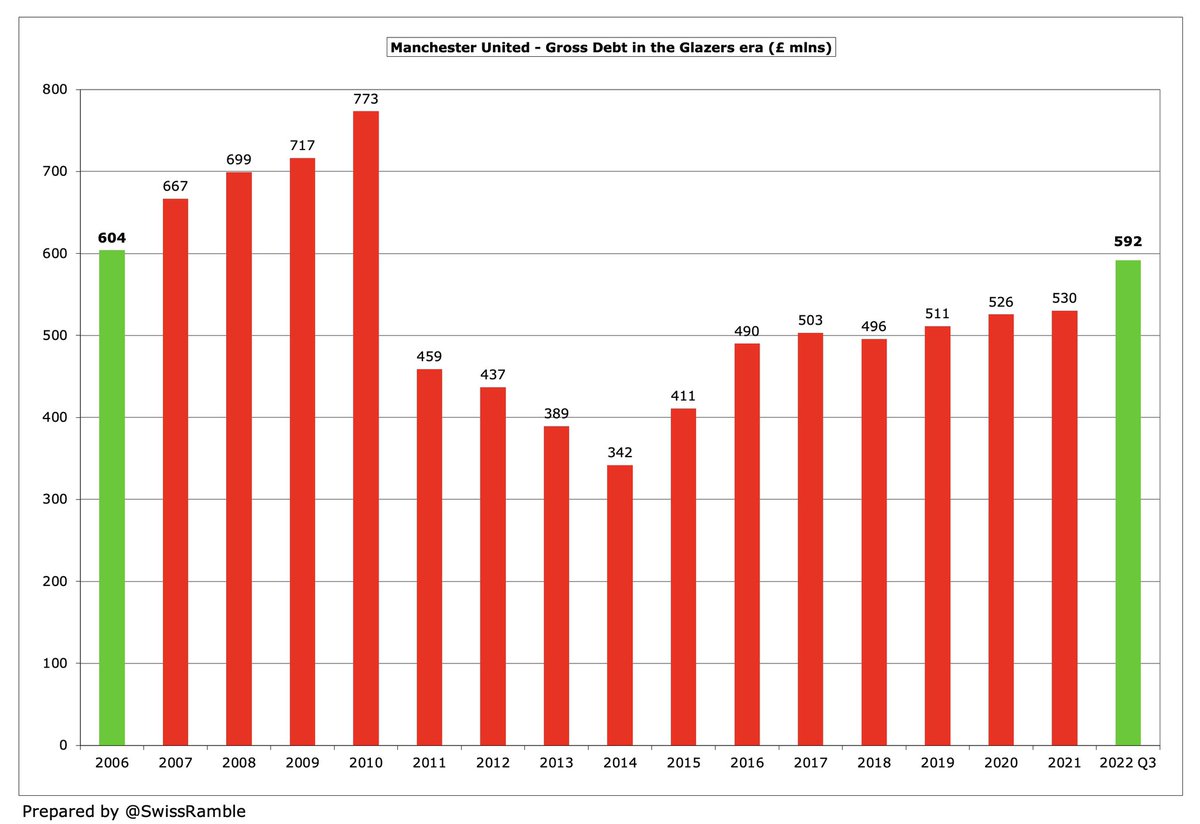

Unlike #THFC debt, which was used to invest in a state-of-the-art stadium, #MUFC debt is a very different story, being used to fund the Glazers’ purchase of the club. Incredibly, the debt is virtually unchanged since the LBO in 2006– despite paying nearly £750m interest.

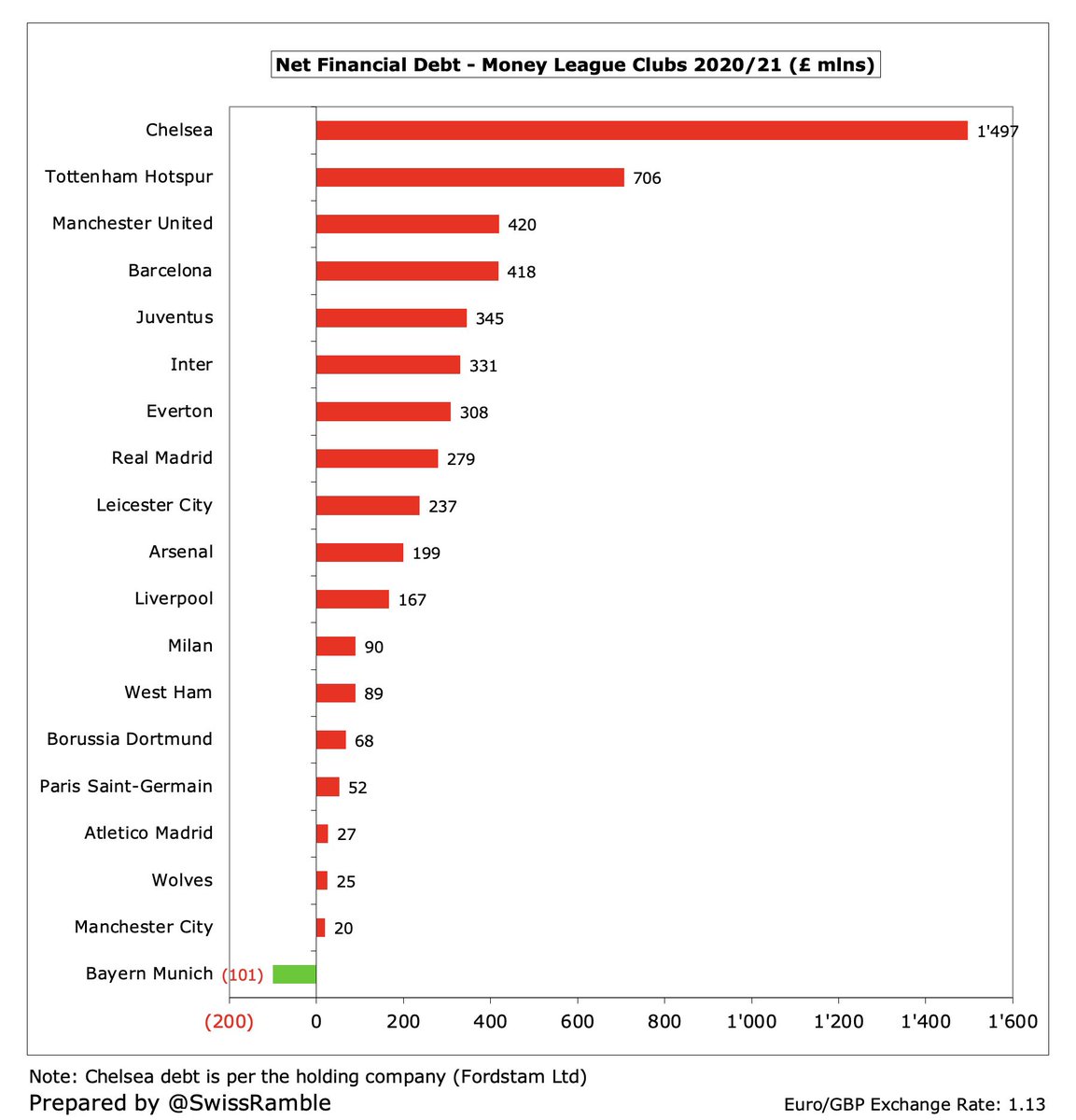

Gross debt is offset by large cash balances in some cases: #RealMadrid £236m, #THFC £148m, #Atleti £120m, #MUFC £111m and #FCBayern £101m. On the other hand, #Milan, #WHUFC, #AFC, #CFC, #Juventus and #BVB all had less than £25m. Low balances partly due to COVID impact on revenue.

However, many clubs still had significant net financial debt. Excluding #CFC (funded by owner), the highest are #THFC £706m, #MUFC £420m, #FCBarcelona £418m, #Juventus £345m and #Inter £331m. Barca don’t look terrible here, but we shall see later see why they still have issues.

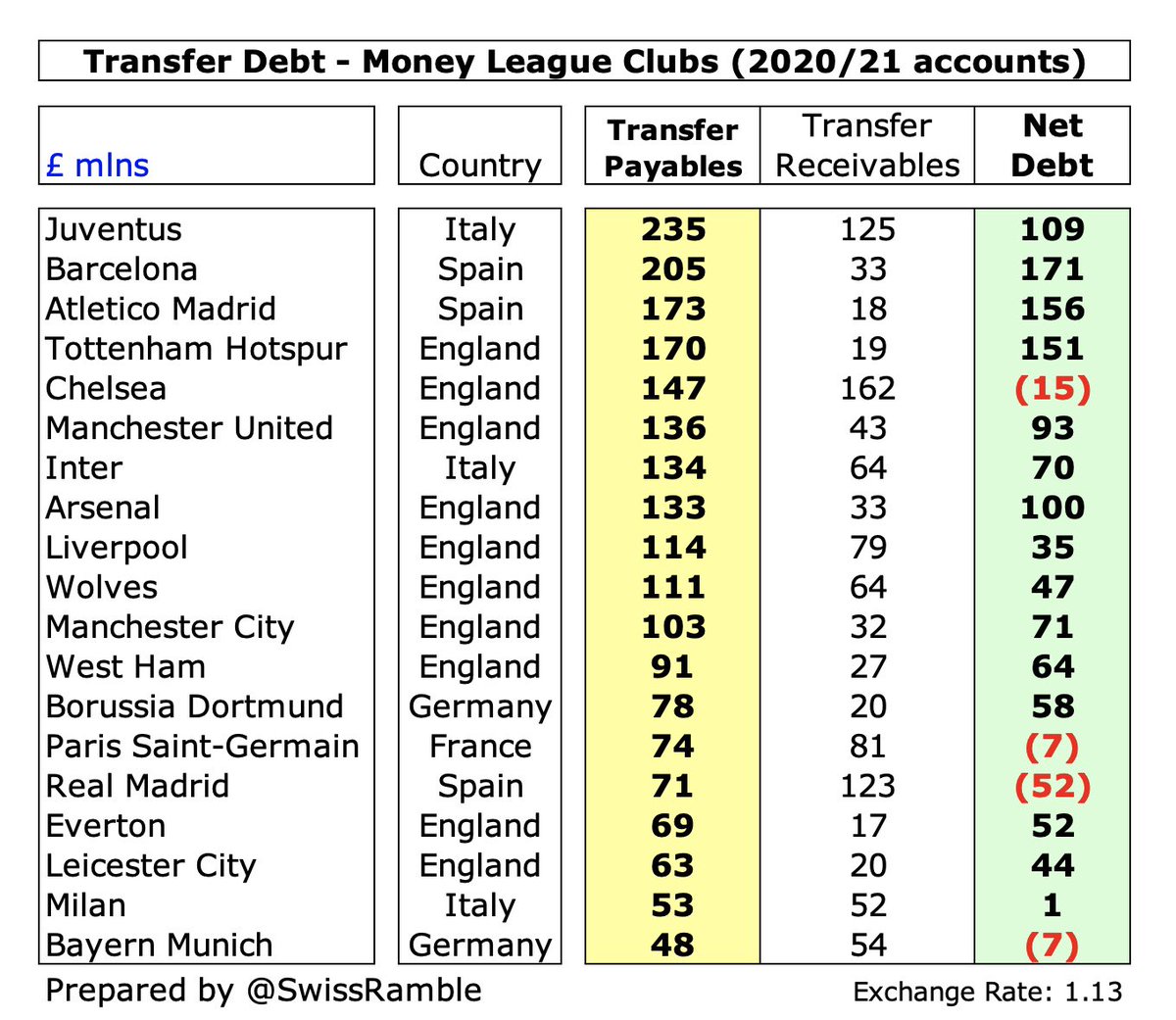

An increasingly important element in a club’s business model is transfer debt. In most cases, these payables are not overdue, but in line with the payment schedule agreed between the respective clubs for transfer fees. Clubs have payables, receivables and net transfer debt.

European clubs have been financing transfers in this way for years, so no surprise to see #Juventus £235m, #FCBarcelona £205m & #Atleti £173m at the top. Those that were puzzled how #THFC could finance player purchases with all the stadium debt, the answer is £170m transfer debt.

However, this approach to transfers works both ways. Highest receivables (amounts owed for player sales to other clubs) are at #CFC £162m, #Juventus £125m, #RealMadrid £123m and #PSG £81m.

Consequently, there are only 5 clubs here with a net transfer debt above £100m: #FCBarcelona £171m, #Atleti £156m, #THFC £151m, #Juventus £109m and #AFC £100m. #RealMadrid actually had £52m net receivables.

UEFA have introduced another definition of debt, effectively between the narrow calculation used in annual accounts and the widest possible measure of total liabilities. This includes net debt for borrowings (i.e. bank loans, overdrafts and owner loans) plus net transfer debt.

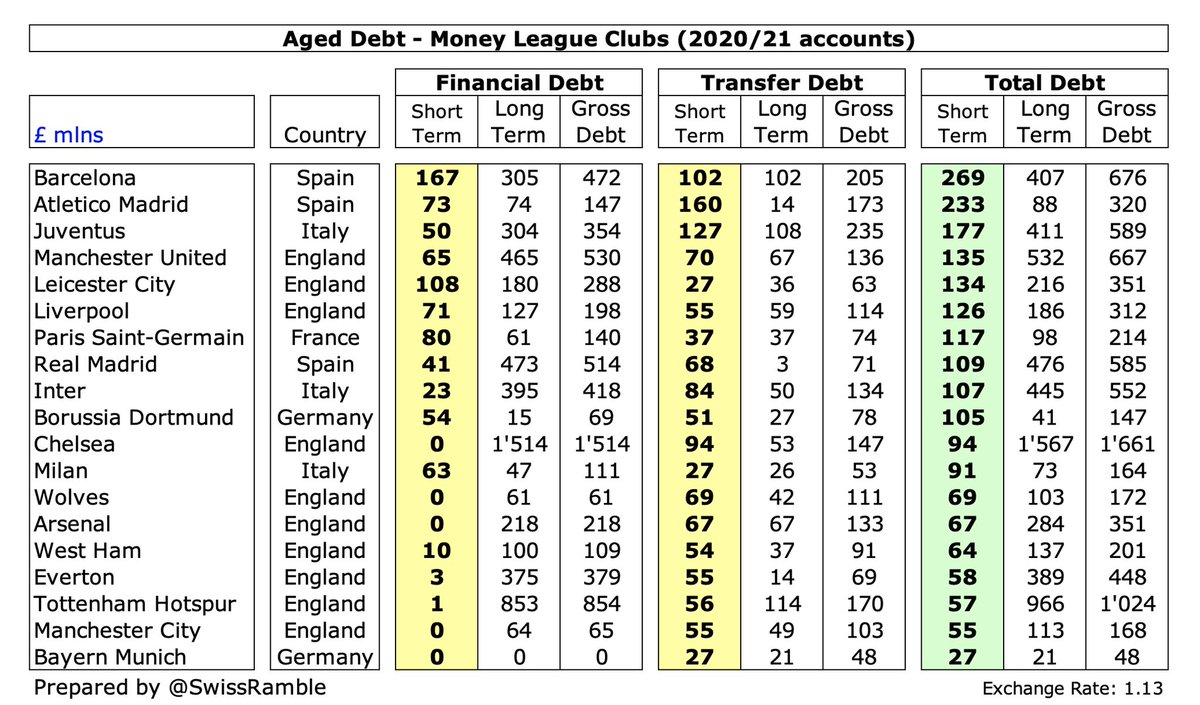

With this UEFA definition, 7 clubs have over half a billion of gross debt: #CFC £1.7 bln, #THFC £1.0 bln, #FCBarcelona £676m, #MUFC £667m, #Juventus £589m, #RealMadrid £586m and #Inter £552m. The lowest amounts owed are at the 2 German clubs: #BVB £147m and #FCBayern £48m.

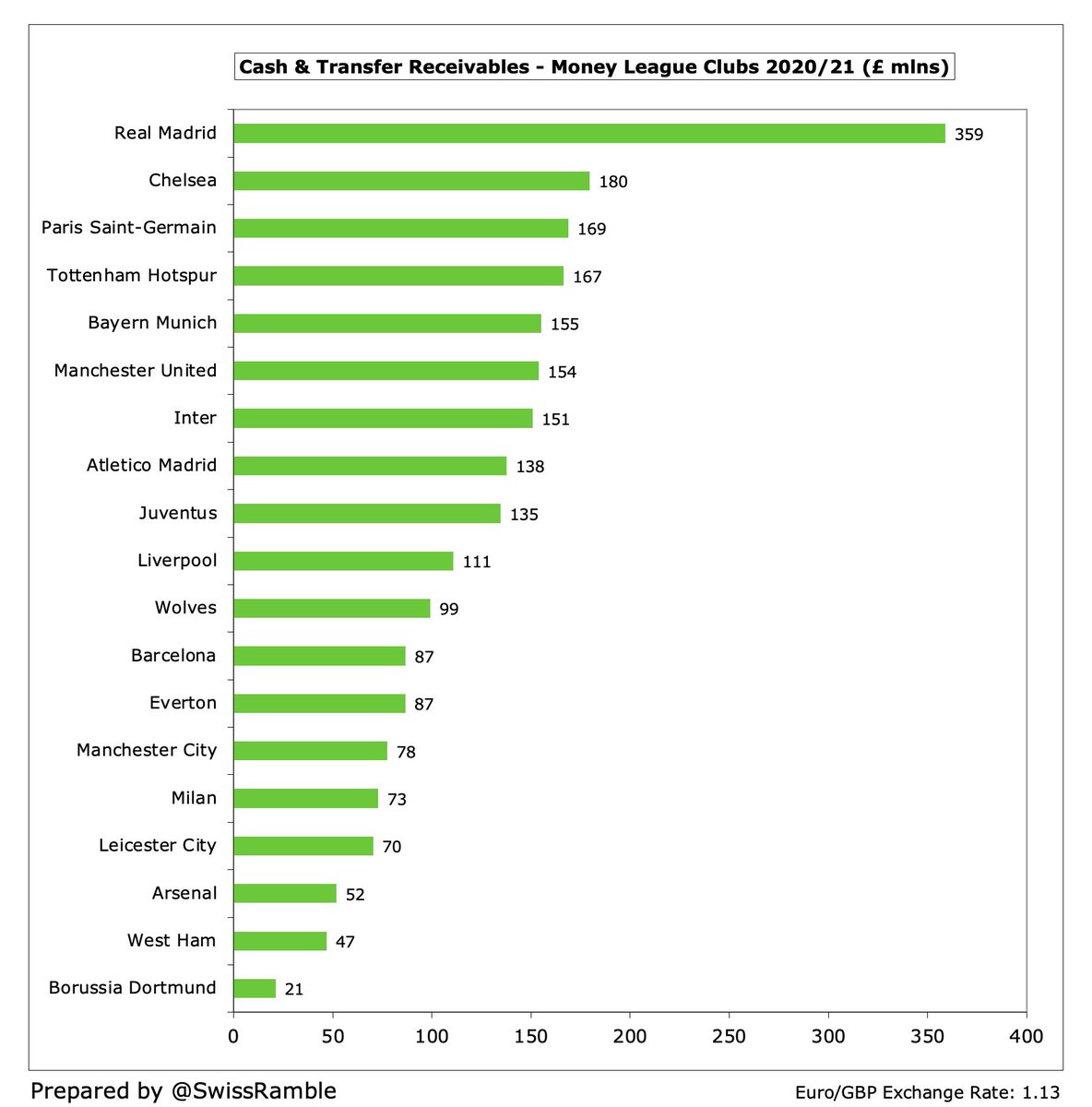

The other side of the coin is cash and transfer receivables, where the highest balance is at #RealMadrid £359m, followed by #CFC, #PSG, #THFC, #FCBayern, #MUFC and #Inter (all between £150m and £180m).

Using UEFA’s definition of net financial and transfer debt, the highest amounts owed are actually at two English clubs, namely #CFC £1.5 bln and #THFC £857m, with #FCBarcelona in third place with “only” £590m. So, again, why is debt such an issue at Barca?

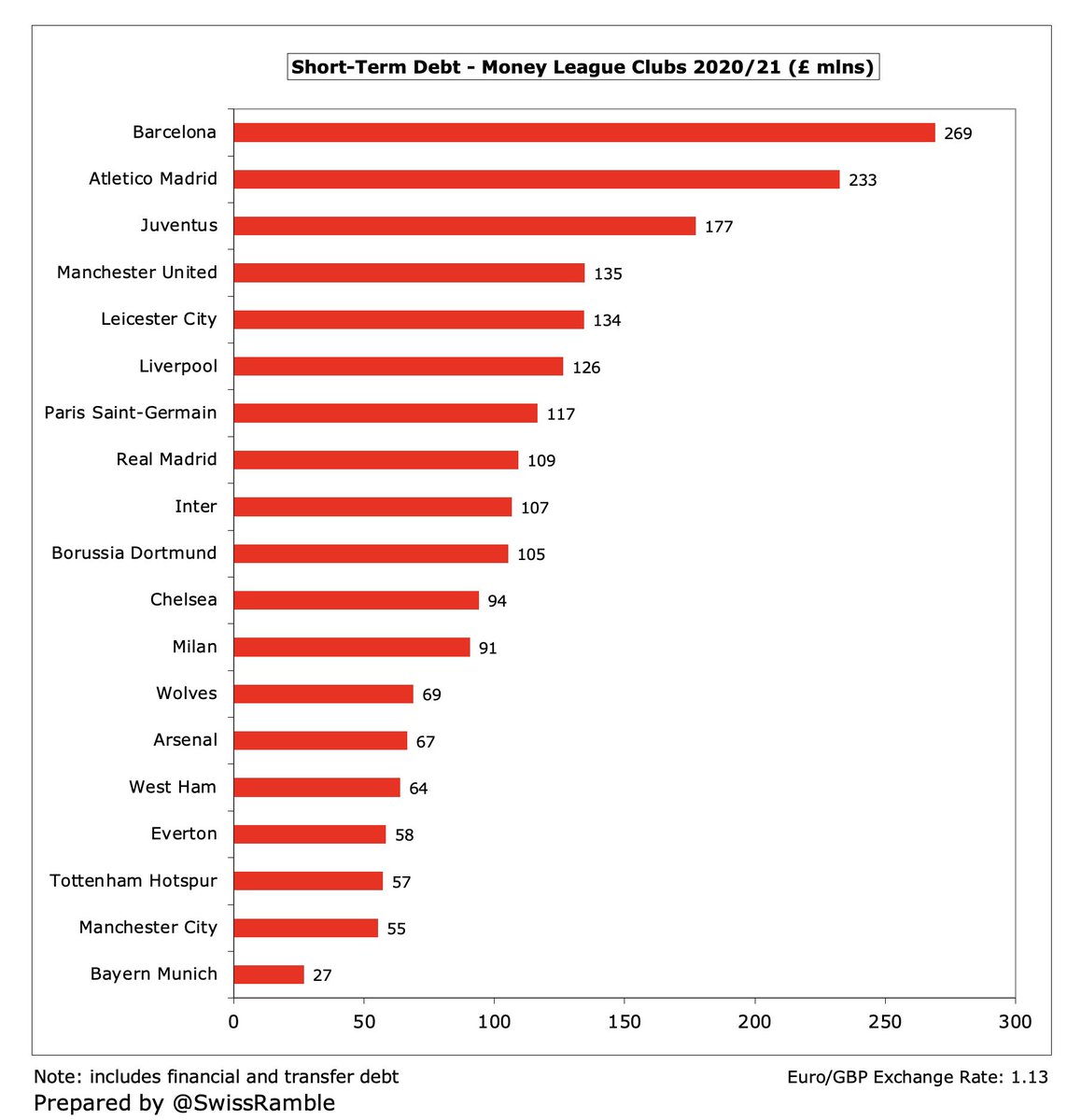

One reason why #FCBarcelona have more problems with debt than English clubs is that so much of it is short-term, i.e. needs to be repaid within the next 12 months. £269m of Barca’s £676m is short-term, while for #CFC it is only £94m of £1.5 bln, and for #THFC £57m of £1.0 bln.

#FCBarcelona £269m short-term debt is easily the highest, comprising £167m bank loans and £102m transfer fees, followed by #Atleti £233m and #Juventus £167m. The highest English club is #MUFC £135m.

The reason that debt is not so immediately problematic for the leading English clubs is that so much of it is structured via long-term financing, e.g. #THFC owe just over a billion in financial/transfer debt, but £966m is long-term with bank loans only maturing in 22 years.

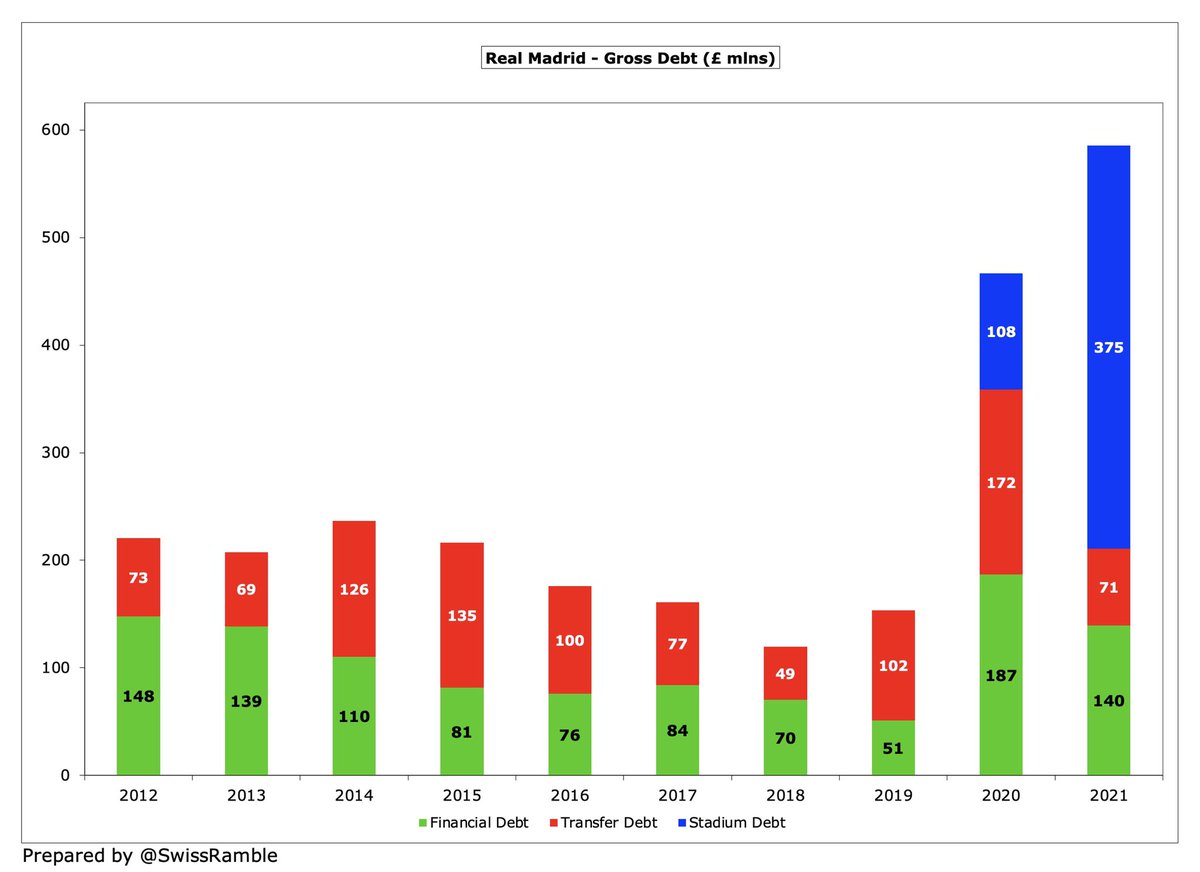

It will probably come as no surprise that debt has steeply increased since the pandemic struck with financial and transfer debt rising £1.2 bln (16%) since 2019. That said, 90% of this growth is at just 4 clubs: #RealMadrid £432m, #THFC £278m, #FCBarcelona £207m and #LCFC £163m.

Transfer debt is basically flat over the last two years, partly due to COVID depressing the transfer market. Half the clubs have seen growth, led by the North London clubs, #THFC £82m and #AFC £56m. In contrast, large decreases at #Milan £71m, #LFC £52m and #MUFC £51m.

However, financial debt has shot up £1.2 bln in the last two years, led by #RealMadrid £463m, #FCBarcelona £232m, #LCFC £196m and #THFC £196m. Only 4 clubs reduced debt in this period: #WWFC £70m, #Juventus £63m, #Atleti £50m and #MCFC £8m.

Both Spanish giants have seen significant debt growth, but there are different drivers, #RealMadrid debt has risen £466m to £586m since 2018, mainly due to £375m stadium debt. #FCBarcelona debt is up £575m to £676m in just 4 years, largely spent on players (transfers and wages).

The highest debt growth at English clubs is due to infrastructure investment. #THFC debt has risen from £163m in 2016 to £1.0 bln to finance their new stadium, while #LCFC £290m increase in the past 4 years to £351m is mainly for their new training ground.

It’s worth noting that the debt growth in the past two years would have been even higher without £405m being removed by technical adjustments, as £278m was converted into equity (#Inter £178m, #EFC £100m) and £127m loans written-off by owners (#WWFC).

In the same way, #CFC £1.5 bln debt should have been written-off since these 2020/21 accounts, as per Roman Abramovich’s statement that he would “not be asking for any loans to be repaid” as part of the Chelsea sale.

However, that’s not the end of the story. For total debt, we also need to include other operational debt: (a) wages owed to staff; (b) money owed to tax authorities; (c) trade creditors, i.e. amounts outstanding for things like rent & electricity; (d) other creditors.

That adds up to another £2.5 bln of debt, mostly at the Spanish clubs: #Atleti £515m, #FCBarcelona £342m and #RealMadrid £203m. Note: #PSG are shown here as £315m, but that figure is over-stated, as the accounts I have do not split other debt and other liabilities.

Other debt includes staff debt, which is high at Spanish clubs (#FCBarcelona £213m, #Realmadrid £120m and #Atleti £83m), as they often pay wages twice a year, so high cash balances when accounts are published end-June can be misleading, as this is largely needed to make payroll.

Total debt is where the figures get a bit concerning. Excluding Abramovich-funded #CFC, two clubs have more than a billion of total debt: #THFC £1,195m and #FCBarcelona £1,018m. They are followed by #Atleti £835m, #RealMadrid £788m, #MUFC £780m, #Juventus £743m and #Inter £733m.

“But there’s one more thing”, as Steve Jobs used to say. The broadest definition of debt is total liabilities, which also includes: (a) accruals, where no invoice has been received; (b) provisions, which are estimate of probable future losses, e.g. legal claims.

Also includes deferred income for payments received for services not yet provided, e.g. season ticket revenue for matches to be played in future. Booked as a liability, as cash received has not yet being fully earned, but it is clearly not a debt that will have to be repaid.

Therefore, total liabilities is a somewhat academic definition of debt, but for the purposes of completeness, this metric shows that #CHFC have the highest liabilities with £1.8 bln, followed by #THFC £1.5 bln, #FCBarcelona £1.3 bln and #MUFC £1.0 bln.

While it is important to be able to ultimately pay off debt, the ability to service the debt via interest expenses is absolutely crucial. The highest interest payments (in cash terms) in 2020/21 were #FCBarcelona £29m, #Atleti £23m, #MUFC £21m, #THFC £18m and #Inter £15m.

That concludes this year’s version of “Everything you always wanted to know about debt, but were afraid to ask”. As we have seen, debt is an innocent four-letter word, but it has many different meanings, so always read the small print.

• • •

Missing some Tweet in this thread? You can try to

force a refresh