1/10 Tonight question was about #TVL on #DEFI, and i just asked myself is there any TVL leakage from DEFI since the turmoil we are all facing the past 6 months? Let's dig into some data here as parf of my 2nd 🧵and see where the #smartmoney has been going ?👇

2/10 TVL on @Defilama is now sitting below 100b, decreasing by almost 28% in a week and divided by 3 since $BTC #ath.

3/10 On the other hand, #crypto total market cap is sitting at 898b, and as the DEFI TVL, "just" decreased also by 26% in a week and divided by 3 since $BTC #ATH.

4/10 So my first but too quick conclusion would be: There was no #TVL leak in #DEFI since November 2021, the TVL just following price action of crypto market. However, this conclusion is WRONG as it doesn’t take #Stablecoin into account.

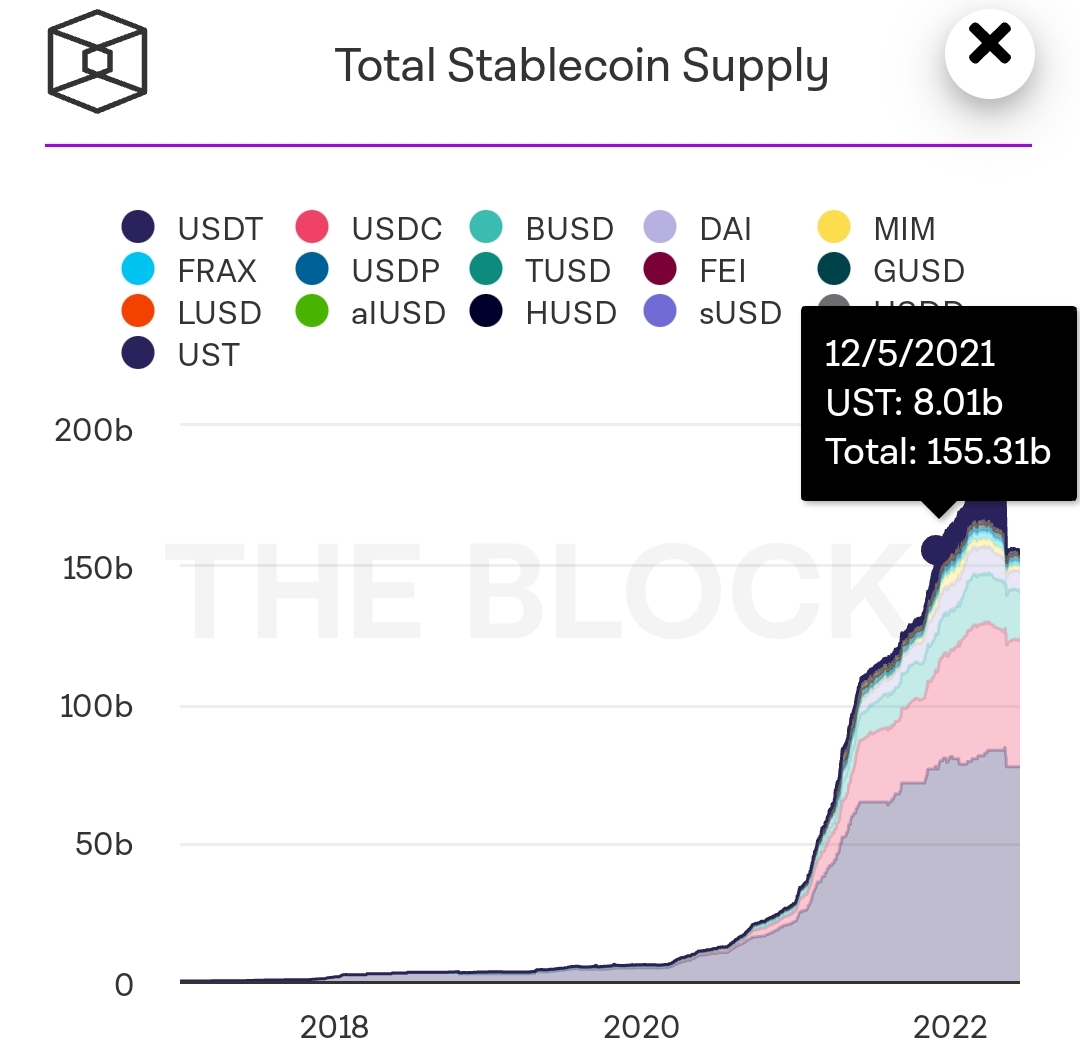

5/10 Now according to @TheBlock__ stablecoin MC is at 188b, up by 26% since $BTC #ATH. See the link below for more details:

theblockcrypto.com/amp/linked/128…

theblockcrypto.com/amp/linked/128…

6/10 if we take the assumption #stablecoins are intrinsically not volatile (cough.. Except $UST), then #stablecoin represented 5% of all cryptos in November 2021, and now represents 21% in June 2022. That's a massive x4 increase in 6 months !!

-> Keep on rolling baby!

-> Keep on rolling baby!

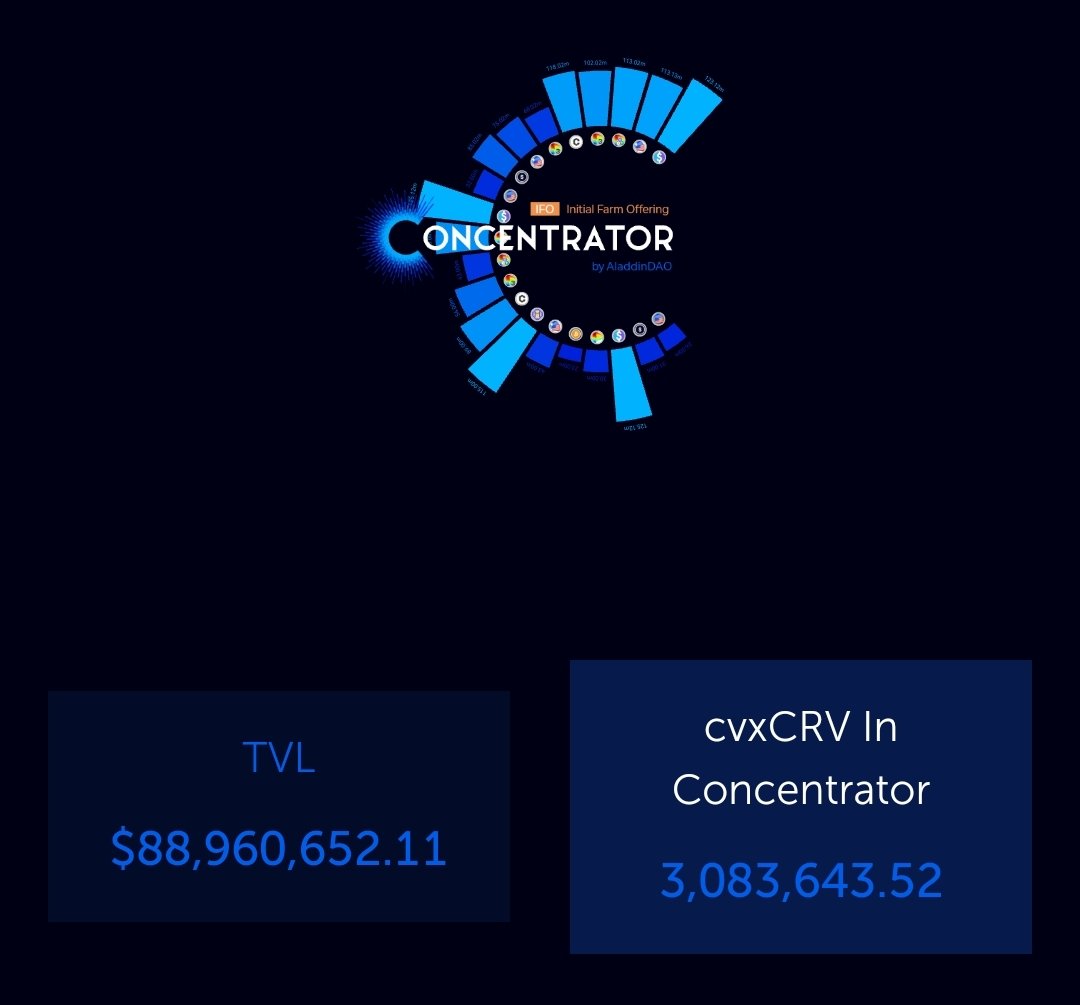

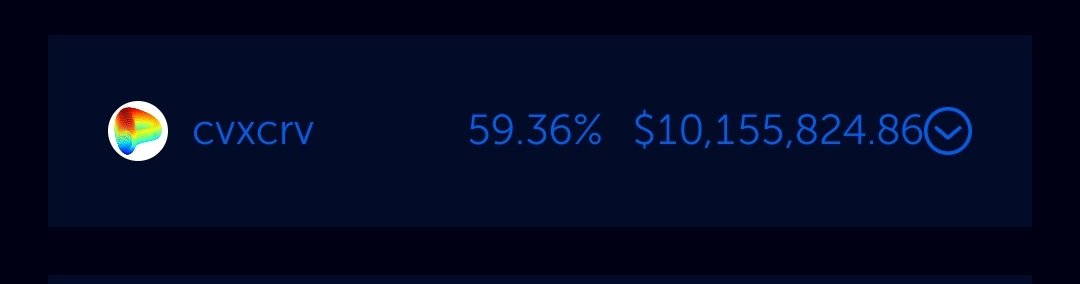

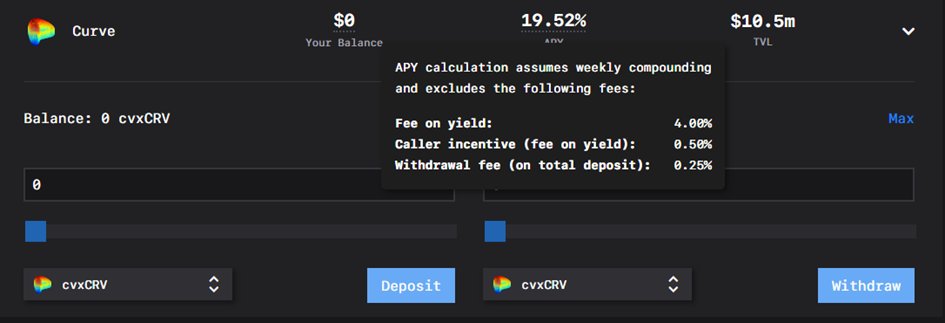

7/10 However there is one metric I could not find: #stablecoin TVL in DEFI. So let’s make a global assumption based on @Uniswap and @Curve protocols. On @Uniswap, 50% TVL are in stable, whereas on @CurveFinance it's closer to 25%. Assumption taken: Stable TVL in Defi 37.5%.

8/10 So with this assumption, and following the increase trend of stablecoin #marketcap from November '21 to June '22, as of today:

Stablecoin TVL = 37.5b

Volatile assets TVL = 62,5b

And in Novembre 2021:

Stablecoin TVL = 28b

Volatile assets TVL = 272b

Stablecoin TVL = 37.5b

Volatile assets TVL = 62,5b

And in Novembre 2021:

Stablecoin TVL = 28b

Volatile assets TVL = 272b

9/10 Follow me, we are getting there. As volatile assets price decrease by 3, the difference between 272b/3 and 62,5b is just the TVL leak from DEFI which equals to 28,5b. As a conclusion, I estimate that 30% of the TVL just left DEFI, which I find extremely important.

10/10 Worrying or not, I can’t say, but here we have an estimated figure that shows people large funds leaving DEFI for the moment. I hope i'm right in my assumptions, if anyone has more data on Stablecoin TVL on Defi, i would be more than pleased to redo my homework.

If you like my 2nd essai, please feel free to dump it on Twitter by a quick and nice retweet:

Take care.

https://twitter.com/Subli_Defi/status/1537552252763783168?s=20&t=fvK7Dv37_5C4OE_98duBdA

Take care.

Guys do you know where to find stablecoin TVL in Defi?

@phtevenstrong

@thedefiedge

@CryptoWizardd

@rektdiomedes

@JackNiewold

@BarryFried1

@Dynamo_Patrick

@DefiMoon

@CurveCap

@Route2FI

@DeFi_naly

@phtevenstrong

@thedefiedge

@CryptoWizardd

@rektdiomedes

@JackNiewold

@BarryFried1

@Dynamo_Patrick

@DefiMoon

@CurveCap

@Route2FI

@DeFi_naly

@Darrenlautf this might interest you as part of your defi news. ;)

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh