The largest decentralised stablecoin. The OG dapp on @ethereum.

@MakerDAO and DAI are one of the most successful #DeFi stories, but how do they work?

Understand Maker Protocol, assess DAI risk & alphas for you.

This is part 4 of #stablecoinwar series. Let's dive in. 🧵 1/n

@MakerDAO and DAI are one of the most successful #DeFi stories, but how do they work?

Understand Maker Protocol, assess DAI risk & alphas for you.

This is part 4 of #stablecoinwar series. Let's dive in. 🧵 1/n

@ethereum @MakerDAO A/ Mechanics of @MakerDAO

A quick refresher on types of #stablecoins- there are

1) fiat-backed

2) crypto-backed

3) algorithmic

DAI is a crypto-backed stablecoin, which means that all of its assets live on the blockchain! How do we make that happen? 2/n

A quick refresher on types of #stablecoins- there are

1) fiat-backed

2) crypto-backed

3) algorithmic

DAI is a crypto-backed stablecoin, which means that all of its assets live on the blockchain! How do we make that happen? 2/n

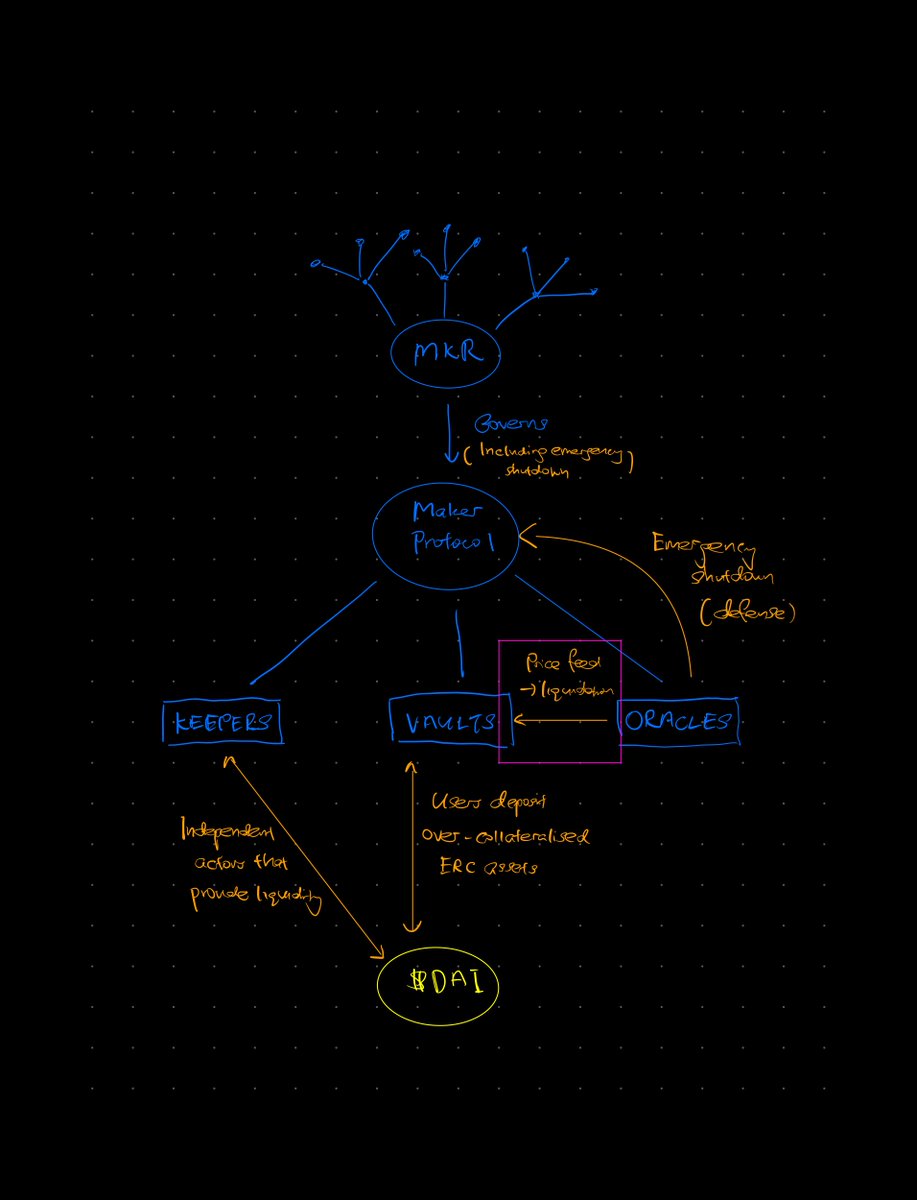

@ethereum @MakerDAO At its core, we have Maker Protocol. It is essentially a set of smart contracts that provide all the rules for this financial system.

This may sound confusing, so let's use a simple analogy! 3/n

This may sound confusing, so let's use a simple analogy! 3/n

@ethereum @MakerDAO If you've ever played snakes and ladder, you know the rules:

1) you roll a dice to decide the number of steps you can take

2) when you land on a square with a snake, you 'fall back'

3) when you land on a square with a ladder, you 'climb up'

Simple yea? 4/n

1) you roll a dice to decide the number of steps you can take

2) when you land on a square with a snake, you 'fall back'

3) when you land on a square with a ladder, you 'climb up'

Simple yea? 4/n

@ethereum @MakerDAO Likewise, the Maker Protocol gives you the rules that you use to interact with the ecosystem, including amount of DAI you can mint with some crypto assets.

Just by following the rules, you've a functioning #DeFi system. 🪄

There are 4 key players in this system. 5/n

Just by following the rules, you've a functioning #DeFi system. 🪄

There are 4 key players in this system. 5/n

@ethereum @MakerDAO They are:

1) MKR holders, which form the DAO (decentralised autonomous organisation).

2) Keepers

3) Vaults

4) Oracles

Don't worry if their names are awfully vague, each of them actually has a clear function. We will also explain the interactions, so let's start with MKR! 6/n

1) MKR holders, which form the DAO (decentralised autonomous organisation).

2) Keepers

3) Vaults

4) Oracles

Don't worry if their names are awfully vague, each of them actually has a clear function. We will also explain the interactions, so let's start with MKR! 6/n

@ethereum @MakerDAO 1) MKR holders.

The governance token of @MakerDAO is MKR. If you hold MKR, you can vote during proposals. It's like having shares in a public company- when proposals arise, you've a say.

Well, what do MKR holders actually vote on? 7/n

The governance token of @MakerDAO is MKR. If you hold MKR, you can vote during proposals. It's like having shares in a public company- when proposals arise, you've a say.

Well, what do MKR holders actually vote on? 7/n

@ethereum @MakerDAO Examples of proposals include:

- Adding new collateral type (e.g. USDC was later accepted as a collateral)

- Modifying DAI savings rate (similar to how central banks control interest rate)

- Trigger emergency shutdown (more on this later!) 8/n

- Adding new collateral type (e.g. USDC was later accepted as a collateral)

- Modifying DAI savings rate (similar to how central banks control interest rate)

- Trigger emergency shutdown (more on this later!) 8/n

@ethereum @MakerDAO In short, MKR holders set the rules for Maker Protocol. Sounds like lots of fun (and responsibility) if you ask me!

We will also go through triggering an emergency shutdown later, so let's continue with our next key player- keepers. 9/n

We will also go through triggering an emergency shutdown later, so let's continue with our next key player- keepers. 9/n

@ethereum @MakerDAO 2) Keepers

They are independent (and usually automated) traders who provide liquidity for #DAI.

How? E.g. when price of 1 DAI > 1 USD, they can sell the DAI they own for profit. As a side effect, this increases DAI's supply and reduces price.

Next up- vaults. 10/n

They are independent (and usually automated) traders who provide liquidity for #DAI.

How? E.g. when price of 1 DAI > 1 USD, they can sell the DAI they own for profit. As a side effect, this increases DAI's supply and reduces price.

Next up- vaults. 10/n

@ethereum @MakerDAO 3) Vaults

They are smart contracts (programs) that users interact with to get DAI.

Users will deposit over-collateralised @ethereum assets and in return, they get to borrow some DAI.

Well, why do people do that though? 11/n

They are smart contracts (programs) that users interact with to get DAI.

Users will deposit over-collateralised @ethereum assets and in return, they get to borrow some DAI.

Well, why do people do that though? 11/n

@ethereum @MakerDAO Borrowing DAI against their @ethereum assets allow them to have cash to do things (e.g. trade, buy NFTs) while still keeping the upside of owning the underlying collateral.

A quick example will really help our understanding here! 12/n

A quick example will really help our understanding here! 12/n

@ethereum @MakerDAO E.g. we deposit 100 USD worth of ETH and borrow 60 DAI. After making some small trades with DAI, we decide it's time to return the DAI and get our ETH back.

Because ETH prices rose in the meantime, we got usability of cash and still owned ETH.

What if ETH prices fall? 13/n

Because ETH prices rose in the meantime, we got usability of cash and still owned ETH.

What if ETH prices fall? 13/n

@ethereum @MakerDAO If the price of collateral falls below the amount of DAI issued to us, then our collateral will be liquidated.

Wait, what's liquidation? And how does the vault even know the price of our collateral at any given moment?

Time to talk about our final player- oracles. 14/n

Wait, what's liquidation? And how does the vault even know the price of our collateral at any given moment?

Time to talk about our final player- oracles. 14/n

@ethereum @MakerDAO 4) Oracles

Oracles are a set of trusted price feeds chosen by MKR holders (our governance peeps). They allow the whole ecosystem to know the price of @ethereum assets, since those prices are not native to the blockchain.

With great price feeds come scary liquidations. 15/n

Oracles are a set of trusted price feeds chosen by MKR holders (our governance peeps). They allow the whole ecosystem to know the price of @ethereum assets, since those prices are not native to the blockchain.

With great price feeds come scary liquidations. 15/n

@ethereum @MakerDAO Liquidations occur when price of collateral < price of issued DAI. Thus, the goal is to recover the debt from the loan.

The Maker Protocol does so through 2 types of auctions. 16/n

The Maker Protocol does so through 2 types of auctions. 16/n

@ethereum @MakerDAO The first is a collateral auction, whereby the bidder pays DAI to receive collateral from liquidated vault. The received DAI is used to pay off the debt.

But if there is still remaining debt, then we invoke debt auction. 17/n

But if there is still remaining debt, then we invoke debt auction. 17/n

@ethereum @MakerDAO In debt auction, the bidder pays DAI to receive minted MKR. The bidder will do so if they believe that MKR tokens will appreciate in value.

The bidder's paid DAI will be used to pay off the remaining debt.

Do you still remember the emergency shutdown mentioned earlier? 18/n

The bidder's paid DAI will be used to pay off the remaining debt.

Do you still remember the emergency shutdown mentioned earlier? 18/n

@ethereum @MakerDAO Emergency shutdowns are used to protect against black swan events (e.g. attacks against the protocol). They can be triggered by MKR holders or Emergency Oracles.

There are 3 steps in emergency shutdown. 19/n

There are 3 steps in emergency shutdown. 19/n

@ethereum @MakerDAO 1. Freeze vault creation & movement. Users retrieve collateral not actively backing debt.

2. Collateral auction to pay off debt.

3. DAI holders claim collateral by calculating price of DAI in USD & price of collateral in USD.

Whew! That's how @MakerDAO works.

Is DAI risky? 20/n

2. Collateral auction to pay off debt.

3. DAI holders claim collateral by calculating price of DAI in USD & price of collateral in USD.

Whew! That's how @MakerDAO works.

Is DAI risky? 20/n

@ethereum @MakerDAO B/ Risk assessment

Let's use our 3C framework to assess DAI.

1. Decentralised- we can inspect the blockchain to know that the collateral exist.

2. Capital inefficient, but that's a plus since it's over-collateralised.

3. Collateral. There are 3 risk factors here. 21/n

Let's use our 3C framework to assess DAI.

1. Decentralised- we can inspect the blockchain to know that the collateral exist.

2. Capital inefficient, but that's a plus since it's over-collateralised.

3. Collateral. There are 3 risk factors here. 21/n

@ethereum @MakerDAO Risk factor 1- inherent volatile nature of crypto assets.

March 12 2020 is now fatefully known as Black Thursday. Prices of crypto crashed 50%, which triggered many liquidations.

High gas fees & congestion prevented users from adding collateral. Then came the zero bidders. 22/n

March 12 2020 is now fatefully known as Black Thursday. Prices of crypto crashed 50%, which triggered many liquidations.

High gas fees & congestion prevented users from adding collateral. Then came the zero bidders. 22/n

@ethereum @MakerDAO A subset of auctions were won by bidders who submitted bids decimal points above zero. In other words, they essentially got the liquidated collateral for free.

All this demand for #DAI pushed its price to as high as 1.12USD.

It was a nightmare. 23/n

All this demand for #DAI pushed its price to as high as 1.12USD.

It was a nightmare. 23/n

@ethereum @MakerDAO While the @MakerDAO quickly implemented changes (see linked blog post), we are still unsure of what will happen should another similar crash occurs.

With that in mind, let's move on to risk factor 2. 24/n

blog.makerdao.com/the-market-col…

With that in mind, let's move on to risk factor 2. 24/n

blog.makerdao.com/the-market-col…

@ethereum @MakerDAO Risk factor 2- Lack of diversity of assets.

~1/3 of Total Value Locked (TVL) is #USDC. While I am very bullish on USDC, USDC will need more time to prove its staying power.

It is not just a lack of diversity of assets, there is also a lack of diversity across blockchains. 25/n

~1/3 of Total Value Locked (TVL) is #USDC. While I am very bullish on USDC, USDC will need more time to prove its staying power.

It is not just a lack of diversity of assets, there is also a lack of diversity across blockchains. 25/n

@ethereum @MakerDAO Risk factor 3- You're heavily betting on the @ethereum blockchain

Maker Protocol mainly functions on the @ethereum blockchain. This means that you are susceptible to Ethereum's problems, mainly high gas prices and congestion.

@MakerDAO has looked ahead- 26/n

Maker Protocol mainly functions on the @ethereum blockchain. This means that you are susceptible to Ethereum's problems, mainly high gas prices and congestion.

@MakerDAO has looked ahead- 26/n

@ethereum @MakerDAO They are planning to deploy on the zero-knowledge @ethereum rollup, @StarkWareLtd, in 3Q 2022.

This should lower transaction fees and increase possible transactions per second.

What do all 3 risk factors mean? 27/n

This should lower transaction fees and increase possible transactions per second.

What do all 3 risk factors mean? 27/n

@ethereum @MakerDAO @StarkWareLtd At its core, you've to decide which tradeoff among the 3Cs you prefer.

Being a #crypto-backed stablecoin means that you can verify on the blockchain that its collateral exist. Contrast this with having to trust @Tether_to or @circlepay. 28/n

Being a #crypto-backed stablecoin means that you can verify on the blockchain that its collateral exist. Contrast this with having to trust @Tether_to or @circlepay. 28/n

@ethereum @MakerDAO @StarkWareLtd @Tether_to @circlepay But the majority of collateral are volatile assets, and extreme market conditions may render even over-collateralisation useless.

It is also important to note that if you hold both #USDC and #DAI, you've double exposure to USDC risk.

Alright, time for some alphas! 29/n

It is also important to note that if you hold both #USDC and #DAI, you've double exposure to USDC risk.

Alright, time for some alphas! 29/n

@ethereum @MakerDAO @StarkWareLtd @Tether_to @circlepay C/ Alphas (not financial advice 🙂)

Investing alpha: I'm honestly undecided on whether MKR is a good investment. Even though @MakerDAO's subreddit has ~30k members, it feels very dead.

Thankfully, I've a better building alpha for ya. 😉 30/n

reddit.com/r/MakerDAO/

Investing alpha: I'm honestly undecided on whether MKR is a good investment. Even though @MakerDAO's subreddit has ~30k members, it feels very dead.

Thankfully, I've a better building alpha for ya. 😉 30/n

reddit.com/r/MakerDAO/

@ethereum @MakerDAO @StarkWareLtd @Tether_to @circlepay Building alpha: There is a need for a native multi-chain stablecoin to reduce exposure risk to a single L1. More innovation is also needed to use non-crypto financial assets as collateral.

If you've any ideas, leave a comment down below! 31/n

If you've any ideas, leave a comment down below! 31/n

@ethereum @MakerDAO @StarkWareLtd @Tether_to @circlepay I hope you've found this thread helpful.

Follow me @0x_armin to not miss the upcoming breakdown on @fraxfinance.

Like/Retweet the first tweet below to help your friends learn about #DAI 🍻: 32/end

Follow me @0x_armin to not miss the upcoming breakdown on @fraxfinance.

Like/Retweet the first tweet below to help your friends learn about #DAI 🍻: 32/end

https://twitter.com/0x_armin/status/1538144513171943424

• • •

Missing some Tweet in this thread? You can try to

force a refresh