A 🧵thread on the overview of #ZeroKnowledge's Landscape, Points of differentiation between projects & Valuation difference.

This is my attempt to compile the current landscape of ZK, If there is additional info/updates, do reach out via DMs.🙏 (1/13)

This is my attempt to compile the current landscape of ZK, If there is additional info/updates, do reach out via DMs.🙏 (1/13)

Format: Companies L1/L2 (Projects)

1) @StarkWareLtd L2; (StarkNet,StarkEx)

2)@the_matter_labs L2; (zkSync(ZkRollup,ZkPorter))

3)@0xPolygon L2; (Polygon Zero, Hermez 2.0, Miden, Nightfall)

4)@Scroll_ZKP L2

5)@MinaProtocol L1

6)@AleoHQ L1

7)@aztecnetwork L2

(2/13)

1) @StarkWareLtd L2; (StarkNet,StarkEx)

2)@the_matter_labs L2; (zkSync(ZkRollup,ZkPorter))

3)@0xPolygon L2; (Polygon Zero, Hermez 2.0, Miden, Nightfall)

4)@Scroll_ZKP L2

5)@MinaProtocol L1

6)@AleoHQ L1

7)@aztecnetwork L2

(2/13)

A more detailed differentiation with breakdown can be seen here:

forwardanalytics.substack.com/p/zero-knowled…

(3/13)

forwardanalytics.substack.com/p/zero-knowled…

(3/13)

To better dissect the different problems the projects are solving, it's important to understand the different tech stacks.

1) SNARK vs STARK

2) ZK #Rollups vs #Validiums vs #Volitions vs #Adamantium

3) Different kinds of approaches to zkVM/zkEVM

(4/13)

1) SNARK vs STARK

2) ZK #Rollups vs #Validiums vs #Volitions vs #Adamantium

3) Different kinds of approaches to zkVM/zkEVM

(4/13)

1) #SNARK vs #STARK

>In general, SNARKs require a trusted setup, while STARKs is trustless( via verifiable randomness),

>SNARKs uses elliptic curves, vuln to quantum attacks, while STARKs is quantum-resistant

>STARK has a larger proof size (less desirable.)

However...

(5/13)

>In general, SNARKs require a trusted setup, while STARKs is trustless( via verifiable randomness),

>SNARKs uses elliptic curves, vuln to quantum attacks, while STARKs is quantum-resistant

>STARK has a larger proof size (less desirable.)

However...

(5/13)

Tech advancement have blurred the lines, where @0xPolygonZero's Plonky2, a recursive SNARK 100x faster than existing alternatives, combines PLONK(SNARK) with FRI (STARK), with fast proofs and no trusted setup. (6/13)

2) #Rollup vs #Validium vs #Volition vs #Adamantium

The difference lies in the Data Availability (DA) model.

1) zkRollup:

Data is published on-chain (on same settlement & DA layer)

2) Validium:

Data offchain reduces cost,(with higher privacy) but less decentralized

(7/13)

The difference lies in the Data Availability (DA) model.

1) zkRollup:

Data is published on-chain (on same settlement & DA layer)

2) Validium:

Data offchain reduces cost,(with higher privacy) but less decentralized

(7/13)

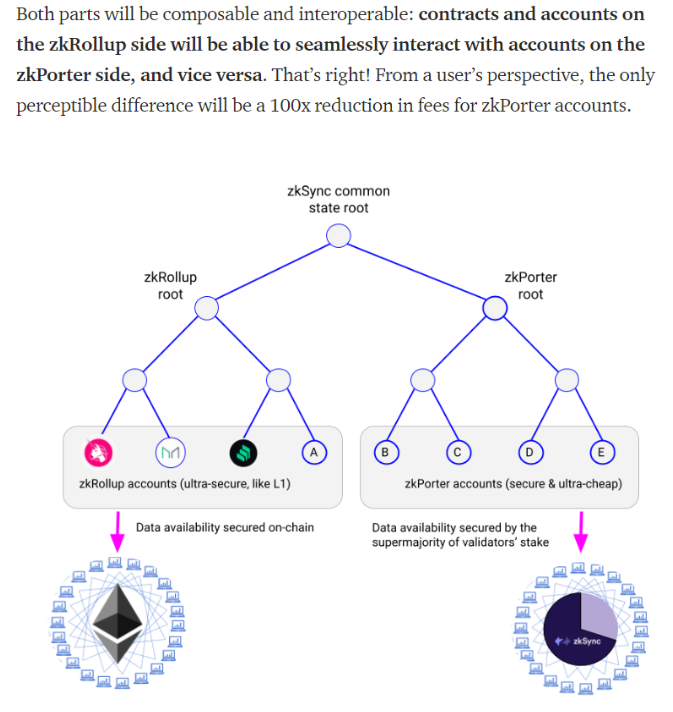

3) Volition:

A hybrid data availability model (Rollups + Validium). User choose when to place data onchain or offchain.

A good example is @zksync, where zkRollup root is the Rollup portion and #zkPorter is the Validium mode.

(DA under Validium is secured by Validators.)

(8/13)

A hybrid data availability model (Rollups + Validium). User choose when to place data onchain or offchain.

A good example is @zksync, where zkRollup root is the Rollup portion and #zkPorter is the Validium mode.

(DA under Validium is secured by Validators.)

(8/13)

4)Adamantium

ethresear.ch/t/adamantium-p…

"Upgraded" Validium, which retains the scaling benefits of offchain availability, without trusting the Data Availability Commitee(DAC). Even when users are offline, funds can't be stolen/frozen and can be moved back to L1 automatically. (9/13)

ethresear.ch/t/adamantium-p…

"Upgraded" Validium, which retains the scaling benefits of offchain availability, without trusting the Data Availability Commitee(DAC). Even when users are offline, funds can't be stolen/frozen and can be moved back to L1 automatically. (9/13)

Notable mention:

While @zkSync’s zkPorter is rather similar to Starkware’s Validium, zkSync community seems more decentralized as it is made up of “Guardian” incentivized by ZkSync’s Token, rather than an appointed group of DAC by Starkware. (10/13)

While @zkSync’s zkPorter is rather similar to Starkware’s Validium, zkSync community seems more decentralized as it is made up of “Guardian” incentivized by ZkSync’s Token, rather than an appointed group of DAC by Starkware. (10/13)

3) Different types of zkEVM/VM

Diff. projs have different approaches to solving zkEVM. @LuozhuZhang wrote a good thread here:

In short, it can be categorized into

1)Language Lvl (Starkware/Matterlabs)

2)Bytecode Lvl (Scroll/Hermes)

3)Consensys Lvl

(11/13)

Diff. projs have different approaches to solving zkEVM. @LuozhuZhang wrote a good thread here:

https://twitter.com/LuozhuZhang/status/1538166488275689473

In short, it can be categorized into

1)Language Lvl (Starkware/Matterlabs)

2)Bytecode Lvl (Scroll/Hermes)

3)Consensys Lvl

(11/13)

For "language lvl", Solidity is being transpiled into zk friendly languages(e.g. Cairo & Zinc) to be run on their own VMs,

While "Bytecode lvl", can achieve full compatibility at EVM opcode level, thus L1 apps and tools can be migrated to L2 without additional mods.

(12/13)

While "Bytecode lvl", can achieve full compatibility at EVM opcode level, thus L1 apps and tools can be migrated to L2 without additional mods.

(12/13)

Latest raise/valuations to my knowledge:

Starkware: raised 100m at $8B

Matterlabs: raised 50M at $2B

Polygon: currently $5.6B FDV (@ $0.56)

Mina: if based on 1.5B token, $915M FDV

Aztec: Raised 17.2M at ?? Val

Scroll: Raised 30M at ?? Val

Aleo: Raised 200M as $1.45B

(13/13)

Starkware: raised 100m at $8B

Matterlabs: raised 50M at $2B

Polygon: currently $5.6B FDV (@ $0.56)

Mina: if based on 1.5B token, $915M FDV

Aztec: Raised 17.2M at ?? Val

Scroll: Raised 30M at ?? Val

Aleo: Raised 200M as $1.45B

(13/13)

special thanks to @alexrusnak (advisor of @0xPolygonZero) for sharing on plonky2, @dcfpascal_ from @gbvofficial who have been diving into Zk stuffs too, @LuozhuZhang for his sharing of his epic thread on zkevm.

@alexrusnak @0xPolygonZero @dcfpascal_ @gbvofficial @LuozhuZhang Also additional *Alpha*... @alexrusnak is building a really cool indexing streaming solution, also implementing Zk tech. Any interested VCs / Dapps / Builders can reach out to Alex to know more. 🥰

+@Sol68635937 one of my best buddies in the space and have always been sharing lots of resources with. LFG!

Also, follow and subscribe to @ForwardAnalytic's substack, as we are moving our articles over from our webbased format, to @SubstackInc

https://twitter.com/MrGavinLow/status/1546103134564777985?t=DhAbrFdZkCAwNdAfE2OwZg&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh