1/ The latest @spencernoon newsletter is full of great insight on L1s adoption.

For example,

guess which #blockchain had the most Daily Active Addresses in the past 12 months?

Vote before finding out below 👇

#ethereum, #BSC, #Polygon or #Solana

For example,

guess which #blockchain had the most Daily Active Addresses in the past 12 months?

Vote before finding out below 👇

#ethereum, #BSC, #Polygon or #Solana

2/ Just in case you peeped before voting, first consider the protocol revenue.

In the past year #ethereum was an absolute leader with $10b in revenue followed by:

• #BSC - $883M

• #Avalanche - $129M

• #Solana - $43.3M

• #Polygon - $24.1M

!BSC generated more fees than #BTC!

In the past year #ethereum was an absolute leader with $10b in revenue followed by:

• #BSC - $883M

• #Avalanche - $129M

• #Solana - $43.3M

• #Polygon - $24.1M

!BSC generated more fees than #BTC!

3/ So you might assume that #ethereum had the most daily active addresses.

But no.

#BSC typically had >80% more DAA than $ETH.

Only #Solana boasted with a comparable number of active addresses.

@cz_binance is up to something here 👀

But no.

#BSC typically had >80% more DAA than $ETH.

Only #Solana boasted with a comparable number of active addresses.

@cz_binance is up to something here 👀

4/ Yet BSC suffered the biggest drop in active addresses.

According to @spencernoon, daily addresses have fallen ~60% from the peak, plateauing at 800-950k wallets/day.

According to @spencernoon, daily addresses have fallen ~60% from the peak, plateauing at 800-950k wallets/day.

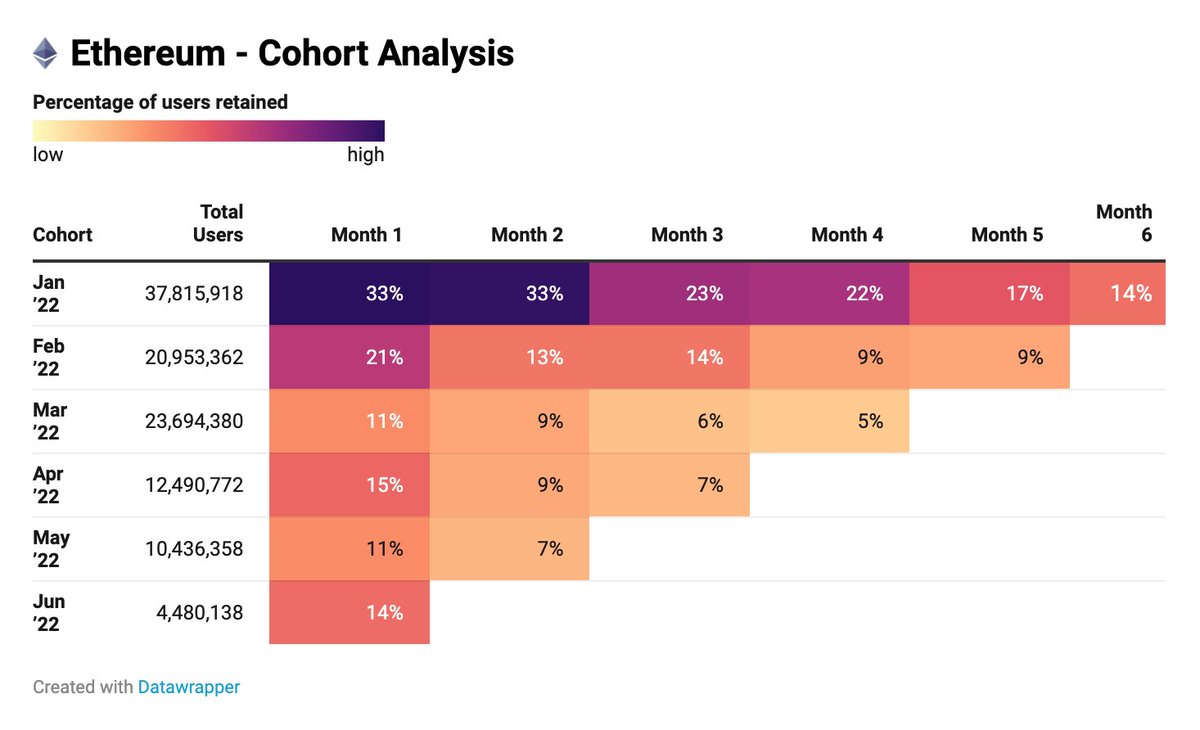

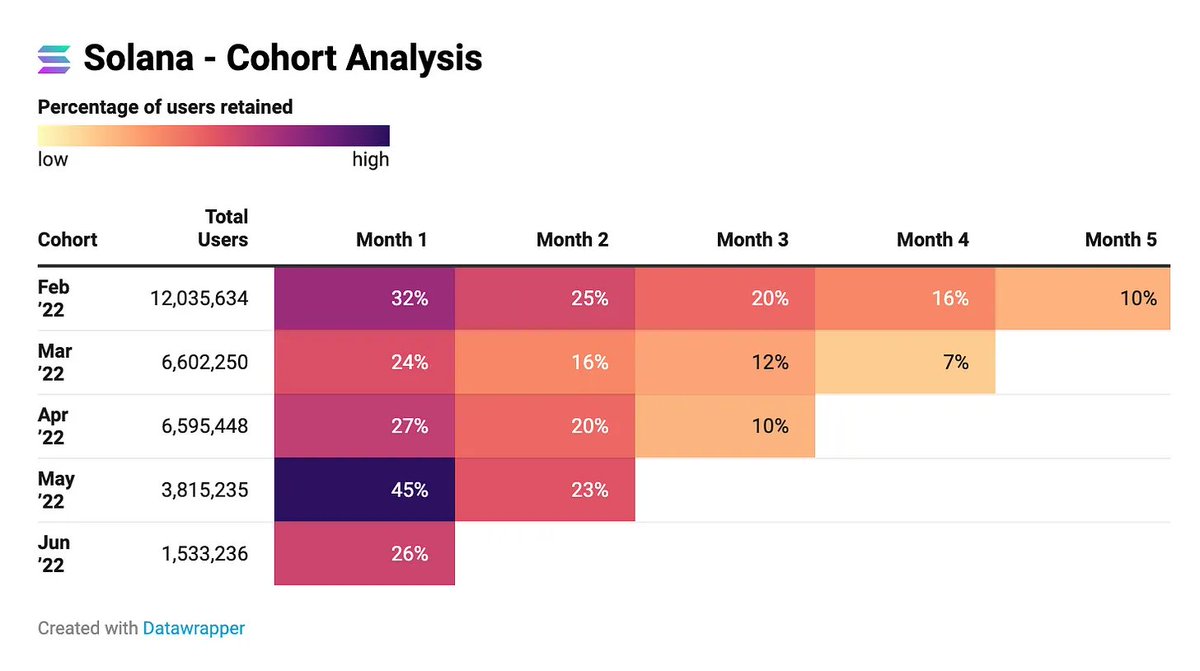

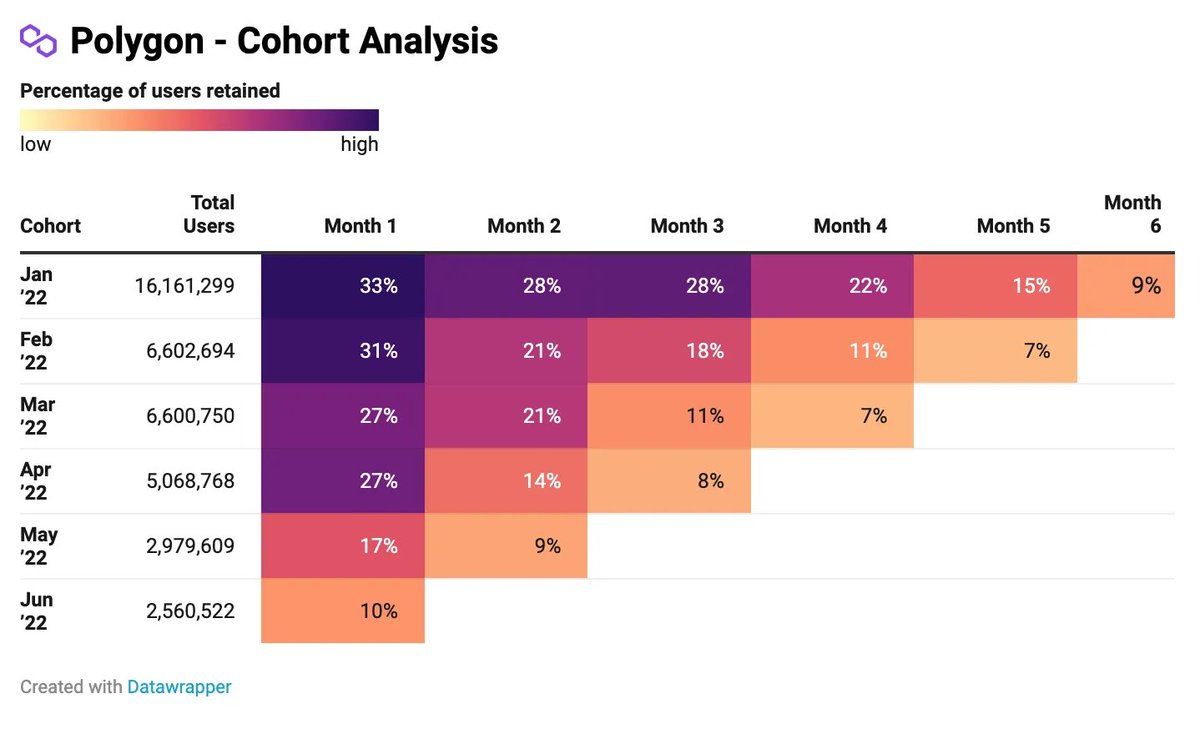

5/ When it comes to user retention, Polygon and Solana fare much better than Ethereum.

The Cohort Analysis table shows user retention by month.

Higher percentage means higher user retention.

The Cohort Analysis table shows user retention by month.

Higher percentage means higher user retention.

6/ Ethereum shows 21% retention for the February cohort then dropping to 9% at the 5th month.

Solana started with 32% after the first month and fell to 10% 4 months later.

Solana user-retention is much higher in almost every month.

Solana started with 32% after the first month and fell to 10% 4 months later.

Solana user-retention is much higher in almost every month.

7/ Polygon's user retention is lower than Solana, but higher than for Ethereum.

Seems like users really don't like those high gas fees!

Seems like users really don't like those high gas fees!

8/ Thanks to @spencernoon and @pythianism for the great insight.

Their newsletter is great for on-chain analysis.

If you want to subscribe, follow the link below:

ournetwork.substack.com

Their newsletter is great for on-chain analysis.

If you want to subscribe, follow the link below:

ournetwork.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh