1/7 So what are the news about @AuraFinance. I must say i'm quite impressed by the development of the project, so here is a quick summary of the past few weeks 👇👏

2/7 Aura granted the Famous and Unique Llama Airforce for a specific Dashbord to follow bribes. Check this out: llama.airforce/#/bribes/overv…

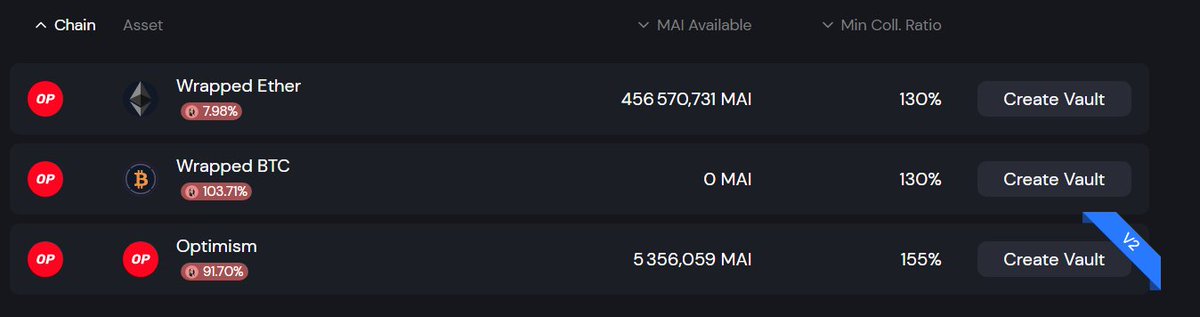

3/7 Thanks to #hiddenhand @redactedcartel solution deploying on #optimism, L1 vlAURA holders can vote for L2 pools and receive rewarss on L2.

4/7 First project to receive bribes through Aura is @beethoven_x.

https://twitter.com/0xSolarcurve/status/1560753894573150208?t=jKNe9Kv2fzWCwrc8JiCtjw&s=19

5/7 Then, Aura is still getting more and more voting power, reaching the cap of 30% of veBAL, follow this website for getting updated as you wish: defiwars.xyz/balancer

6/7 Finally, something rarely seen in Crypto, the #DAO has taken some strict measures to protect the health of his project :

-Shutdown unhealthy pools

-Remove Aura rewards to other Bal liquid wrappers like @StakeDAOHQ

-Shutdown unhealthy pools

-Remove Aura rewards to other Bal liquid wrappers like @StakeDAOHQ

7/7 i advise you to follow @0xSolarcurve & @SmallCapScience for regular updates on @AuraFinance. And if you like this quick summary olease retweet this post :

https://twitter.com/Subli_Defi/status/1561264673206505473?t=mdQt5R4IZPik6bYlMzzBRQ&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh