1/5 🧵

Is the #Fed still lagging behind its announced portfolio reduction plan?

Although it was announced that the balance sheet would be reduced by $47.5B monthly, in 12 weeks, the portfolio decreased by only $51.7B.

Is the #Fed still lagging behind its announced portfolio reduction plan?

Although it was announced that the balance sheet would be reduced by $47.5B monthly, in 12 weeks, the portfolio decreased by only $51.7B.

2/5 🧵

During this time, the #MBS portfolio even grew by $18.5B. If the Fed can't reduce the #portfolio even by half, how they will reduce it from September 2022 is a big question. Generally, before, the #Fed didn't allow itself such a hack.

During this time, the #MBS portfolio even grew by $18.5B. If the Fed can't reduce the #portfolio even by half, how they will reduce it from September 2022 is a big question. Generally, before, the #Fed didn't allow itself such a hack.

3/5 🧵

The #US Treasury has again reduced its #holdings on deposits with the #Fed; now, $530B remains in the #accounts of the US Treasury, compared to $650B planned for the end of the #quarter.

The #US Treasury has again reduced its #holdings on deposits with the #Fed; now, $530B remains in the #accounts of the US Treasury, compared to $650B planned for the end of the #quarter.

4/5 🧵

But their "other" deposits at the #Fed grew sharply (+$45.8B) so that the #liquidity of the #banks still decreased (-$36B for the week), and deposits immediately reduced by $62.8B because reverse #REPO were growing and #markets were a little sad.

But their "other" deposits at the #Fed grew sharply (+$45.8B) so that the #liquidity of the #banks still decreased (-$36B for the week), and deposits immediately reduced by $62.8B because reverse #REPO were growing and #markets were a little sad.

5/5 🧵

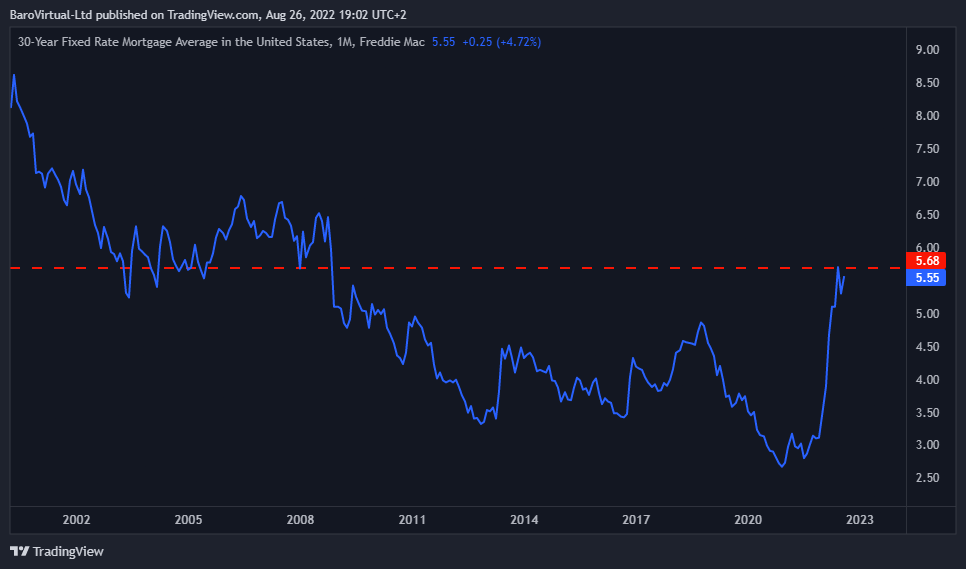

If the #Fed starts acting according to the announced plan, the #markets will be hurt. Moreover, one gets the impression that Yellen may be implementing her plan. In Jackson Hole, #Powell implemented an 8-minute psychotherapy session with a #hawkish bent.

If the #Fed starts acting according to the announced plan, the #markets will be hurt. Moreover, one gets the impression that Yellen may be implementing her plan. In Jackson Hole, #Powell implemented an 8-minute psychotherapy session with a #hawkish bent.

• • •

Missing some Tweet in this thread? You can try to

force a refresh