0/ a fundamental look at the state of @arbitrum, the leading optimistic #rollup L2 in the #Ethereum ecosystem!✨

🧵with @aurumcrypto research insights (0/26)👇

🧵with @aurumcrypto research insights (0/26)👇

1/ @arbitrum has seen a 36% increase in active daily users on #arbitrum one mainnet on a month on month basis, while #ArbitrumOdyssey is still paused📈

source: @tokenterminal 📊

source: @tokenterminal 📊

https://twitter.com/tokenterminal/status/1567180880149372932

2/ number of active users has been steadily growing since January 2021 and growth has accelerated in recent weeks with #arbitrum one mainnet reaching >32k active daily users on September 5th

source: @tokenterminal 📊

source: @tokenterminal 📊

3/ the increase in activity on #arbitrum is also visible in the number of daily deposits on @arbitrum one, which has increased rapidly since August

4/ also, the arbitrum bridge holds over 2.7bn in value, putting @arbitrum on one level with @avalancheavax

source: @DuneAnalytics

source: @DuneAnalytics

5/ interestingly, looking at number/value of deposits, we see that, while @optimismFND has more bridge depositors in the past 7 days (80k) than @arbitrum (14k), #arbitrum's value bridged over the same period is 47% higher, indicating higher whale activity

source: @DuneAnalytics

source: @DuneAnalytics

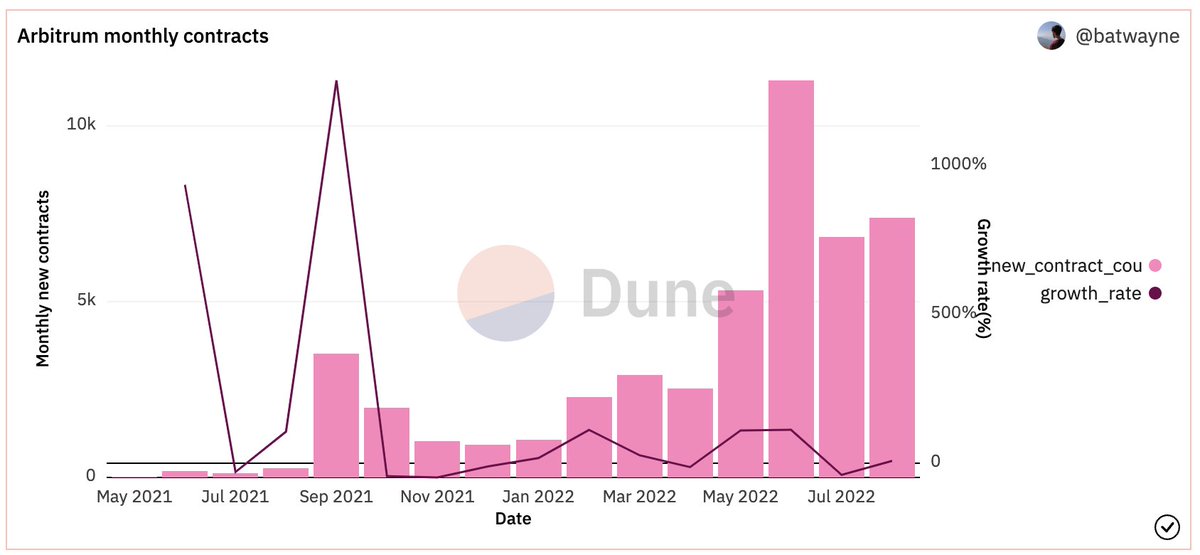

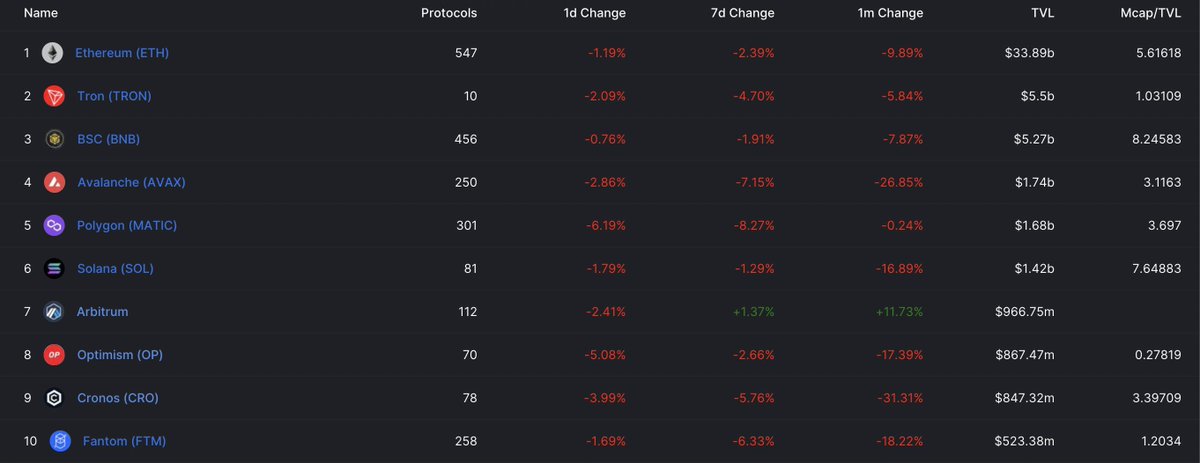

5/ Another indicator that signals it's not only the users but also the devs that take an interest in @arbitrum, is the # of new smart contracts deployed. This number has been growing consistently for months now, hinting at increased developer activity

source: @DuneAnalytics

source: @DuneAnalytics

6/ as of today there are almost 48k contracts live on @arbitrum one mainnet, with the number growing rapidly

source: @DuneAnalytics

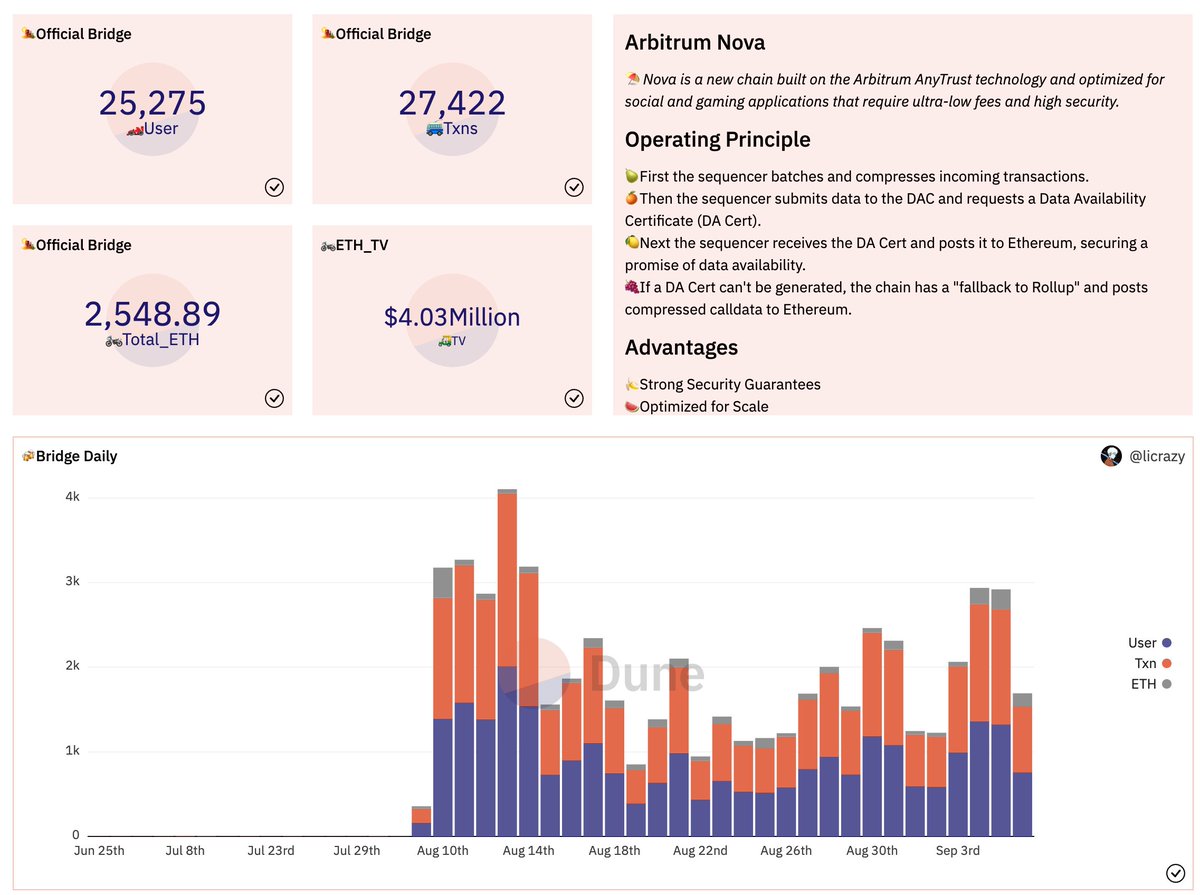

source: @DuneAnalytics

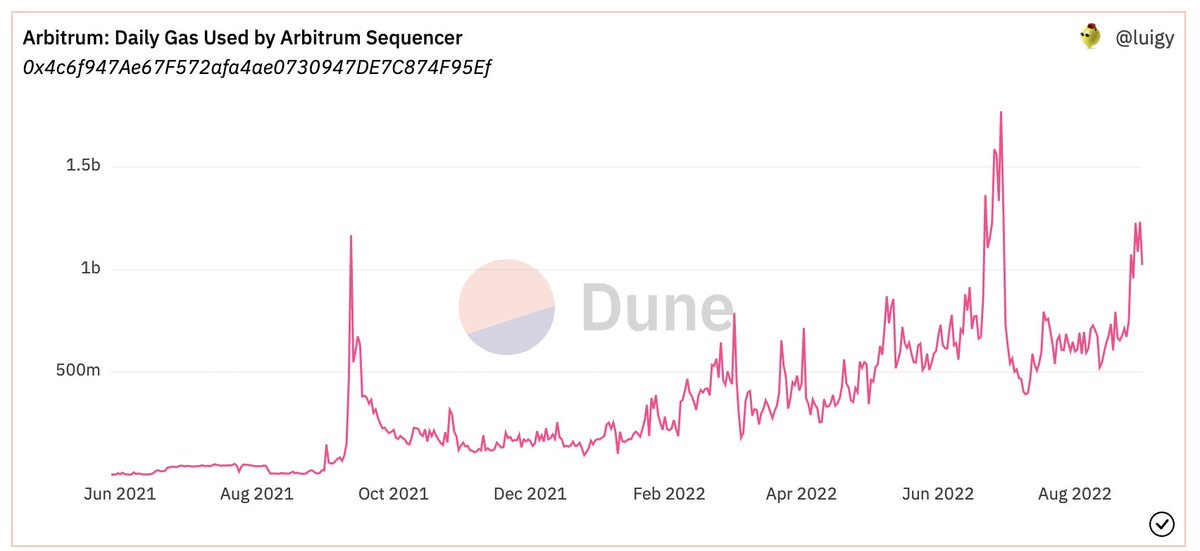

7/ the increased on-chain activity has also increased the amount of L1 gas consumed by the sequencer (revenue for $ETH L1), which has increased strongly the past few months in terms of daily gas used for the arbitrum sequencer, indicating a higher tx load

source: @DuneAnalytics

source: @DuneAnalytics

8/ so, not only the #arbitrum protocol earns on tx fees but also #Ethereum L1. On Aug 31st, @arbitrum earned total daily revenues of $33.3k ($8.5k protocol revenue) and roughly $645k over the past 30 days

source: @tokenterminal

source: @tokenterminal

9/ fees on the chart in 6 might seem low, but that is mainly because it's shown in USD terms and $ETH price has decreased a lot. Additionally, lower L1 activity has mitigated congestion problems and reduced gas cost for #rollups. Number of tx is rising

source: @DuneAnalytics

source: @DuneAnalytics

10/ On average, the @arbitrum protocol earns roughly 26% of the fees generated on its L2, while ~74% accounts for supply side revenue (fee revenue for L1 miners)

source: @tokenterminal

source: @tokenterminal

11/ with a total of almost USD 11m in revenue that has already been generated on @arbitrum, this would provide roughly USD 2.9m that could potentially be distributed to $ARBI holders (once live)

source: @tokenterminal

source: @tokenterminal

12/ @arbitrum has completed the #Nitro upgrade on #ArbitrumOne last week, thereby increasing throughput (7-10x), introducing advanced calldata compression (lower fees) & improving $ETH L1 gas compatibility & L1 interoperability through tighter L1 block sync

source: @arbitrum

source: @arbitrum

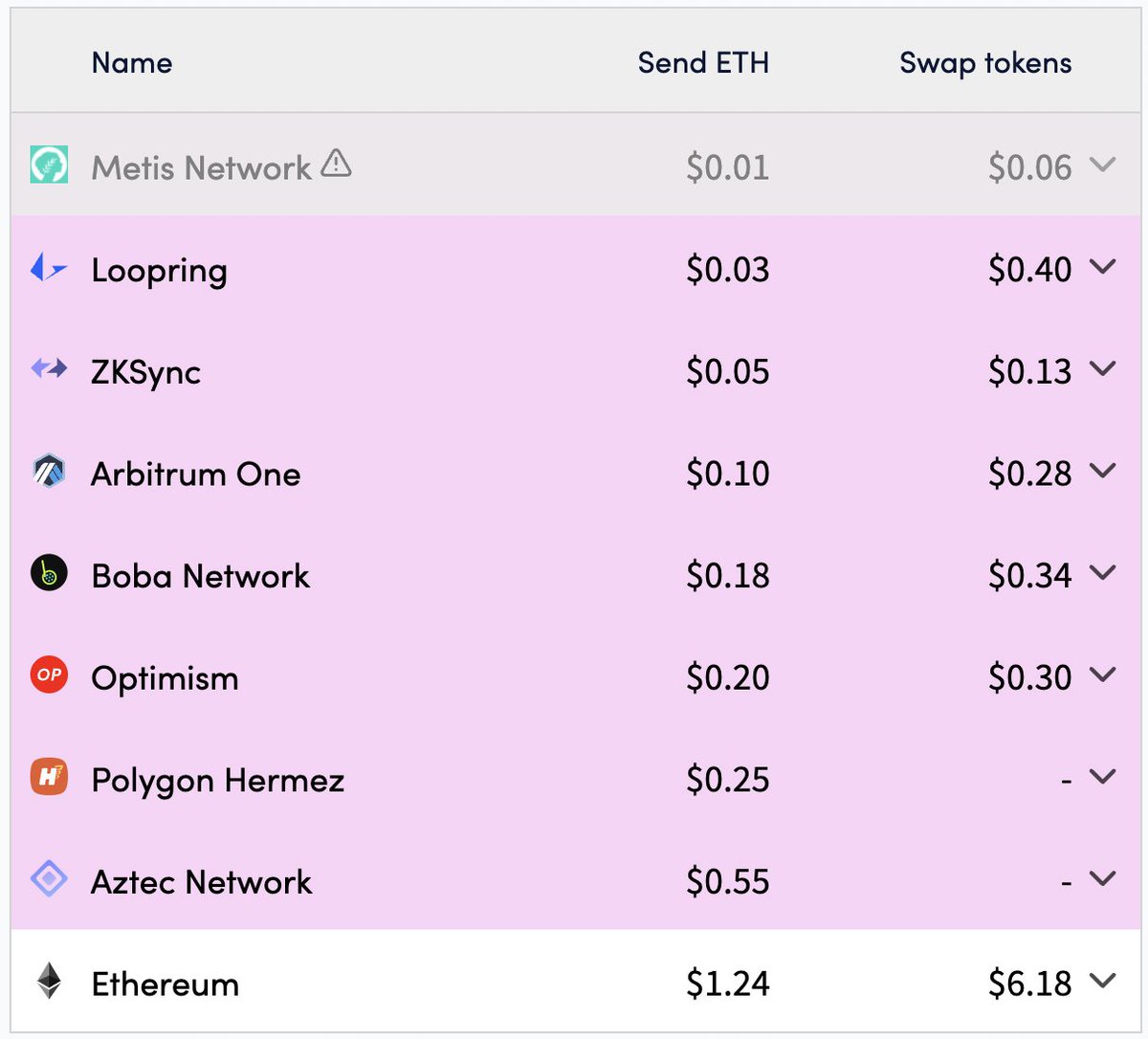

13/ @arbitrum fees are now only half of the fees on @optimismFND and 1/10 of L1 fees, making #arbitrum one mainnet the cheapest optimistic #rollup L2 that does fully rely on #Ethereum for data availability

source: l2fees.info

source: l2fees.info

14/ with over 100 applications on mainnet, #arbitrum is among the top 10 chains overall and the largest rollup in terms of number of dApps

source: @DefiLlama

source: @DefiLlama

15/ @arbitrum is the largest optimistic #rollup by TVL with almost USD 2.7bn in locked value according to @l2beat, taking >50% of #L2 market share. Roughly 43% of TVL is $ETH while stablecoins make up another 42% and other crypto assets account for 16% of TVL...

source: @l2beat

source: @l2beat

16/ ...which is even more impressive considering @arbitrum doesn't have a token of its own. While on many other rollups (market with ⚠️ in post 5) inflate TVL with their own tokens:

- $OP is 20% of #Optimism TVL

- $METIS is 60% of @MetisDAO TVL

source: @l2beat & @DuneAnalytics

- $OP is 20% of #Optimism TVL

- $METIS is 60% of @MetisDAO TVL

source: @l2beat & @DuneAnalytics

17/ @arbitrum is the only protocol among the 10 chains by TVL that doesn't have a token (yet). It's also the only protocol with double digit TVL growth in the last month according to data from @DefiLlama

18/ the delta in TVL compared to the @l2beat numbers can be mostly attributed to different measurement approaches & levels of application support. Total value secured by @arbitrum does seem to be closer to an impressive 2.7bn though

source: @DuneAnalytics

source: @DuneAnalytics

19/ the @arbitrum ecosystem is flourishing with dApps like @GMX_IO (decentralized perpetuals exchange) taking the spotlight

@GMX_IO TVL (🔵) grew 20% over the past month, surpassing $300m, with market cap (🟣) growing in tandem to reach ~$400m

source: @DefiLlama

@GMX_IO TVL (🔵) grew 20% over the past month, surpassing $300m, with market cap (🟣) growing in tandem to reach ~$400m

source: @DefiLlama

20/ there are also many other exciting promising projects on #arbitrum:

@dopex_io - $DPX

@Treasure_DAO - $MAGIC

@SperaxUSD - $SPA

@PlutusDAO_io - $PLS

@DAOJonesOptions - $JONES

@vestafinance - $VSTA

@handle_fi - $FOREX

@Y2kfinance - TBD

@dopex_io - $DPX

@Treasure_DAO - $MAGIC

@SperaxUSD - $SPA

@PlutusDAO_io - $PLS

@DAOJonesOptions - $JONES

@vestafinance - $VSTA

@handle_fi - $FOREX

@Y2kfinance - TBD

21/ additionally, @arbitrum has recently launched #ArbitrumNova, a chain based on #arbitrum's AnyTrust technology

for more info see here:

for more info see here:

https://twitter.com/expctchaos/status/1535109516747935745

22/ #arbitrum nova has already started to gain some traction with over 25k unique users that have bridged funds to #nova via the official @arbitrum bridge, and some NFT activity already happening on the chain

source: @DuneAnalytics

source: @DuneAnalytics

23/ TVL on #ArbitrumNova is also growing fast, having increased 44% in the past 7 days

source: @l2beat

source: @l2beat

24/ overall, the growing # of tx / active users & increasing dev activity, coupled with growing a TVL & a flourishing ecosystem are bullish. Also, the hype around the #Odyssey & a potential $ARBI airdrop is real & will continue to bring both more attention & users to @arbitrum

25/ overall, the growing # of tx / active users & increasing dev activity, coupled with growing a TVL & a flourishing ecosystem are bullish. Also, the hype around the #Odyssey & a potential $ARBI airdrop is real & will continue to bring both more attention & users to @arbitrum

26/ also, its not to be underestimated that @arbitrum got here without marketing efforts or token-based incentive programs. Growth has been all organic so far & $ARBI incentives will likely draw in even more liquidity & increase adoption, thereby accelerating ecosystem growth

27/ finally, with the #nitro upgrade and the launch of #nova, @OffchainLabs have once again demonstrated that they are amongst the leaders in the space with regards to innovation & delivering strong tech, hinting at a bright future for the network

27/ If you liked this thread, please support a fellow #arbinaut by following & sharing the first post of the thread (linked here) 🥰✨

https://twitter.com/expctchaos/status/1567256640990183426

• • •

Missing some Tweet in this thread? You can try to

force a refresh