Let's talk electricity.

Europe is in danger of rolling electricity shortages from what I call a crisis of confidence.

I will explain why, back it with data & kindly ask YOU to share it as the fix lies in voting for balanced policies. We must adapt, urgently!

1/n

#Electricity

Europe is in danger of rolling electricity shortages from what I call a crisis of confidence.

I will explain why, back it with data & kindly ask YOU to share it as the fix lies in voting for balanced policies. We must adapt, urgently!

1/n

#Electricity

For those of you short of time, attached a brief summary of the issue at hand.

I was asked to compare the 1970ies energy crisis with today's for a Turkish newspaper. My answer below.

For those of you with time, please read on.

2/n #Greenflation #Stagflation @WifeyAlpha

I was asked to compare the 1970ies energy crisis with today's for a Turkish newspaper. My answer below.

For those of you with time, please read on.

2/n #Greenflation #Stagflation @WifeyAlpha

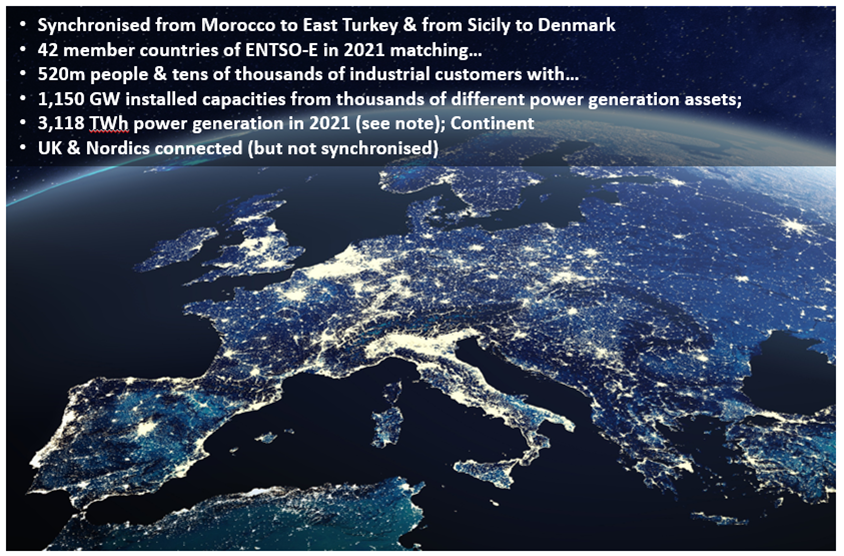

The European electricity grid is a modern miracle. It is the largest synchronous electrical grid (by connected power) in the world. It interconnects 520 million end-customers in 32 countries, including non-European Union members such as Morocco or Turkey.

3/n

3/n

In 2019, the total net electricity consumption (known as load) on the Continent was 2,635 terawatt-hours (TWh). Including all European countries - Great Britain, Ireland, the Nordics/Baltics, which are not synchronous but connected, it gets >3,300TWh. Big!

4/n Source: Entso-e

4/n Source: Entso-e

Here is the thing. The grid builds on physics, not ideology. One such law says that the alternating current that flows through the grid needs to match generation with consumption – that is 525,960 minutes per year - because electricity cannot be stored in the grid.

5/n

5/n

If you skipped the above, go back to it now please.

It was the most important tweet of the thread. It is all that matters. All the rest (you will soon understand) is NOISE, often most dangerous NOISE.

Thank you for your trust. Now, please read on.

6/n

It was the most important tweet of the thread. It is all that matters. All the rest (you will soon understand) is NOISE, often most dangerous NOISE.

Thank you for your trust. Now, please read on.

6/n

The grid's health condition, measured locally but of supra-regional significance, is the network FREQUENCY.

It reflects the indispensable balance bw generation and consumption. It MUST be kept in a VERY tight corridor to avoid infrastructure damage or a shut-down.

7/n

It reflects the indispensable balance bw generation and consumption. It MUST be kept in a VERY tight corridor to avoid infrastructure damage or a shut-down.

7/n

In order to keep the frequency STABLE, at any given moment across Europe load & generation are forecast, by the quarter-hour, hour, day, etc) & auctioned off among thousand of participants. All of this is, may I say, is high tech (unlike e-retailing) - major league tech.

8/n

8/n

Frequency deviations – incidents - happen for various reasons, require INSTANT addressing & increased with the share of wind & solar.

Embrace renewables but know that they are NOT dispatchable (reliable) sources of energy from a grid perspective (think minute by minute).

9/n

Embrace renewables but know that they are NOT dispatchable (reliable) sources of energy from a grid perspective (think minute by minute).

9/n

In fact, frequency incidents measured in time have increased to over 52 hours in 2021 versus 33 hours in 2020. That is an increase of more than 50% in just one year.

You see, by now nothing is "casual" anymore at grid level and I will explain why below.

10/n

You see, by now nothing is "casual" anymore at grid level and I will explain why below.

10/n

So what?

Well, in 2021 alone the European Grid had two major incidents, classified as “Scale 2” incidents, for which final reports had to be prepared by an expert panel at Entso-e.

That is a bit like @POTUS calling the Fed due to 9.1% CPI print. So what is going on?

11/n

Well, in 2021 alone the European Grid had two major incidents, classified as “Scale 2” incidents, for which final reports had to be prepared by an expert panel at Entso-e.

That is a bit like @POTUS calling the Fed due to 9.1% CPI print. So what is going on?

11/n

The problem is that the Continental grid is increasingly incapable to match load with generation.

The table below is the easiest way to illustrate it. It shows net exports & imports by countries over time (save the table; not easy to get the numbers).

Red numbers: bad.!

12/n

The table below is the easiest way to illustrate it. It shows net exports & imports by countries over time (save the table; not easy to get the numbers).

Red numbers: bad.!

12/n

So where did Europe get the remaining electricity it did not have this year to cover its load?

Answer: from Norway, Sweden and the United Kingdom.

So what's the problem?

13/n @alexstubb

Answer: from Norway, Sweden and the United Kingdom.

So what's the problem?

13/n @alexstubb

Basically, there are 4 major short-term "issues" & one gigantic structural long-term "problem".

Short-term:

a) Germany's shut-in of 35TWh pa nuclear output;

b) France & the UK's reactor outputs;

c) Norway's water reservoir levels;

d) Ukraine's grid integration.

14/n

Short-term:

a) Germany's shut-in of 35TWh pa nuclear output;

b) France & the UK's reactor outputs;

c) Norway's water reservoir levels;

d) Ukraine's grid integration.

14/n

Now, before we go to each short-term issue, let us be very clear: none of the four would be issues if it wasn't for the failures of all net importers to get their own house in order.

Please go back to tweet 12: Italy is worst with Austria & Hungary as close 2nd.

15/n

Please go back to tweet 12: Italy is worst with Austria & Hungary as close 2nd.

15/n

#Italy closed its nukes in 90ies; never replaced lost capacities; Grid...

(a) does not have enough gen capacities for annual loads;

(b) relies on natgas without secured access the needed molecules;

(c) does not have 1 MW offshore wind;

Mama Mia

16/n @AlessioUrban

(a) does not have enough gen capacities for annual loads;

(b) relies on natgas without secured access the needed molecules;

(c) does not have 1 MW offshore wind;

Mama Mia

16/n @AlessioUrban

#Austria has hydro but hydro does not like heat (as we just had) while its generation never matched loads - after all the Germans had it, right?

Issue is, the Energiewende is in year 20 & Merkel abandoned nukes in 2010.

The Austrian government was asleep at the wheel.

17/n

Issue is, the Energiewende is in year 20 & Merkel abandoned nukes in 2010.

The Austrian government was asleep at the wheel.

17/n

Like #Austria, #Hungary built its grid on natgas, except that they do not have much themselves.

So you buy it from Russia, right? Well, you know the rest.

Hungary never seemed to have managed much at grid level. It needs much fixing.

18/n

So you buy it from Russia, right? Well, you know the rest.

Hungary never seemed to have managed much at grid level. It needs much fixing.

18/n

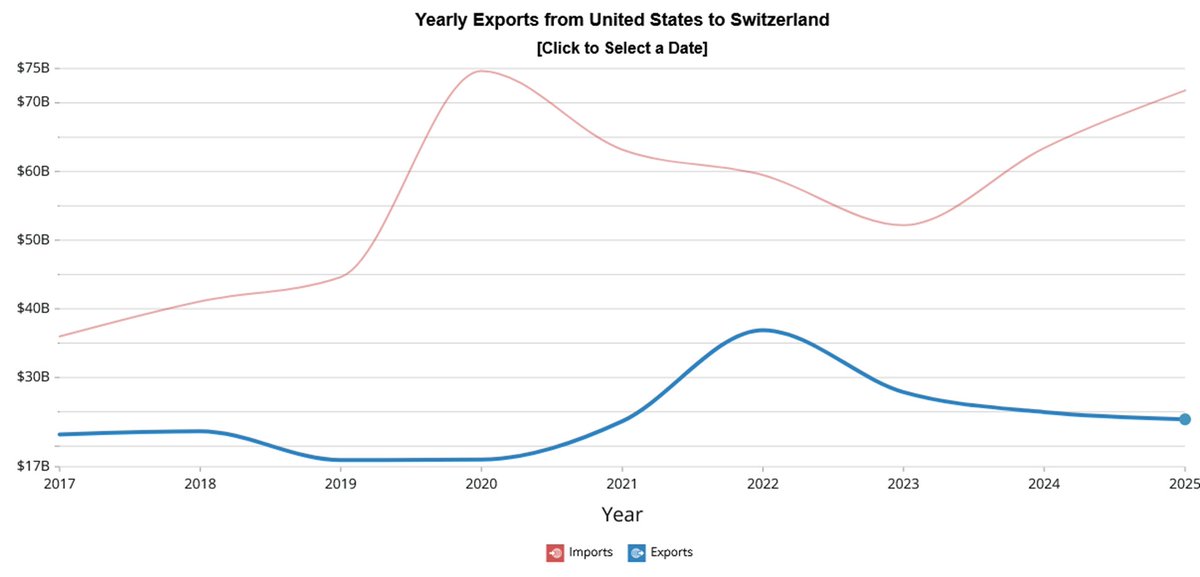

My country, #Switzerland.

Aren't we the champions of logistics & l-term planning? My a**.

Guilty as charged: We didn't replace 2 aging reactors at Beznau which will cost us 6TWh (10%) of generation in next 5y.

I will address it with my local MP - basta!

19/n @BobgonzaleBob

Aren't we the champions of logistics & l-term planning? My a**.

Guilty as charged: We didn't replace 2 aging reactors at Beznau which will cost us 6TWh (10%) of generation in next 5y.

I will address it with my local MP - basta!

19/n @BobgonzaleBob

#Slovakia: it completed 2 new reactors after significant resistence from anti-nuclear lobbies (Enel lost bank financings).

The 17 year saga completed reactor 3 (reactor 4: 95%). Yet, Mochovce 3 is still not connected to the grid.

Message: Slovakia needs them now!

20/n

The 17 year saga completed reactor 3 (reactor 4: 95%). Yet, Mochovce 3 is still not connected to the grid.

Message: Slovakia needs them now!

20/n

Similar story in Finland, for different reasons.

Poor project management out of the gate was predicted by a WNISR report back in 2006: "the project will lead to financial disaster."

Olkiluoto 3 is finally completed, at the grid and tested. Let's go #Finland.

21/n @alexstubb

Poor project management out of the gate was predicted by a WNISR report back in 2006: "the project will lead to financial disaster."

Olkiluoto 3 is finally completed, at the grid and tested. Let's go #Finland.

21/n @alexstubb

O3 can reduce the Finish deficit by half according to our calculation.

With reservoir water levels rather lowish in Norway & the Sweds having their own little policy issues, I would love to see Finland narrowing the gap & for @MarinSanna to go celebrating it hard. My view

22/n

With reservoir water levels rather lowish in Norway & the Sweds having their own little policy issues, I would love to see Finland narrowing the gap & for @MarinSanna to go celebrating it hard. My view

22/n

Belgium expanded its renewable fleet nicely, esp offshore wind (which usually is 50% more productive than onshore) & solar.

But like CH #Belgium has what we call an "age bomb" problem of its nuclear fleet that needs addressing (50% of generation).

23/n @FluxysGroup

But like CH #Belgium has what we call an "age bomb" problem of its nuclear fleet that needs addressing (50% of generation).

23/n @FluxysGroup

Now let us briefly touch the Dutch.

They rely heavily on natgas to keep the lights on. Nothing wrong with that as the #Netherlands has access to LNG regas & offshore production.

In fact, Groningen is a bit of a Ghawar for Europe. But you know the the rest, do you?

24/n

They rely heavily on natgas to keep the lights on. Nothing wrong with that as the #Netherlands has access to LNG regas & offshore production.

In fact, Groningen is a bit of a Ghawar for Europe. But you know the the rest, do you?

24/n

We now look at the 4 short term issues & at the long term structural problem.

This is getting long. But I feel it is important to shed some light at this blackbox.

I will continue this thread but have to send out the first 25 tweets herewith to keep adding.

25/n

This is getting long. But I feel it is important to shed some light at this blackbox.

I will continue this thread but have to send out the first 25 tweets herewith to keep adding.

25/n

Short-term issue 1: Germany turns off 4 GW of nuclear.

What does that mean?

That effectively means it turns off 32 Terawatt-hours (TWh) of electricity production (4 GW x 24 x 365 days x 92% capacity factor = 32,237 GWh or 32TWh.

26/n

nzz.ch/meinung/der-an…

What does that mean?

That effectively means it turns off 32 Terawatt-hours (TWh) of electricity production (4 GW x 24 x 365 days x 92% capacity factor = 32,237 GWh or 32TWh.

26/n

nzz.ch/meinung/der-an…

This move will most likely turn Germany into a net importer of electricity come 2023.

By extension, it has to become a massive issue for the rest of Europe but certainly for Italy, Austria and Luxembourg.

Please study the below table again...

27/n @VeroWendland

By extension, it has to become a massive issue for the rest of Europe but certainly for Italy, Austria and Luxembourg.

Please study the below table again...

27/n @VeroWendland

Now, doesn't Germany activate its so called "grid reserves", those mainly being coal-fired power plants.

Well, it does. But if you study my earlier thread on the European electricity crisis carefully, you will learn that this is not a god-given.

28/n

Well, it does. But if you study my earlier thread on the European electricity crisis carefully, you will learn that this is not a god-given.

28/n

https://twitter.com/BurggrabenH/status/1554969363744186369?s=20&t=slSMh179ISCBVaCNUwclTw

Fact is that 20 year of German Energiewende systematically reduced its dispatchable (frequency reliable) electricity output options to the point where natgas has to save the day - which we struggle to get.

This is the definition of a perfect storm.

29/n

This is the definition of a perfect storm.

29/n

So when the Ministry for Economics & Environment @BMWK tweets "there is enough power", my advice to Mr Habeck is to send the tweeting junior to come visit Burggraben for - shall we say - a "crash course".

30/n

30/n

https://twitter.com/BMWK/status/1547233577288585218?s=20&t=slSMh179ISCBVaCNUwclTw

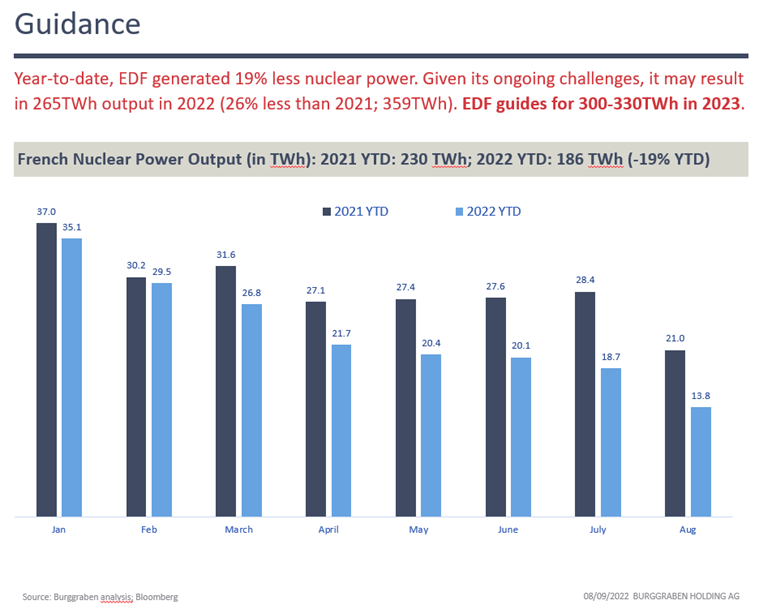

Which brings us to (short-)term issue 2: France.

France is the champion of nuclear power. It's fleet of 57 reactors should be capable to deliver 450TWh pa (62 GW installed). But it does not.

Our forecast is for 59% utilisation or 315TWh based on EDF's guidance.

31/n

France is the champion of nuclear power. It's fleet of 57 reactors should be capable to deliver 450TWh pa (62 GW installed). But it does not.

Our forecast is for 59% utilisation or 315TWh based on EDF's guidance.

31/n

To deliver 315TWh, EDF needs to bring back significant capacity, i.e. solve some of its corrosion issues. Can it?

We will see. EDF has a way to over-promise and under-deliver over the years. So this "major, not minor" - make no mistake.

32/n @kittysquiddy

We will see. EDF has a way to over-promise and under-deliver over the years. So this "major, not minor" - make no mistake.

32/n @kittysquiddy

Fact of the matter is that France's nuclear output looks more like that of run of rivers hydro profile in Austria - with quite a summer heat wave attached - than that of a nuclear power plant fleet.

See for yourself.

33/n Source: Bloomberg; in MW

See for yourself.

33/n Source: Bloomberg; in MW

Hopefully many of you understand now why I wrote in the beginning that "politicans love to blame Putin but that is only half the truth (or even less)".

Power prices in France for November express many issues, but not high gas prices - that is a certainty.

34/n €/MWh

Power prices in France for November express many issues, but not high gas prices - that is a certainty.

34/n €/MWh

Meanwhile, France - for the first time in decades - turned into a net importer of electricity year-to-date.

You see, that makes the electricity market - shall we say - a little nervous. Rightly so. It certainly makes me nervous.

35/n

You see, that makes the electricity market - shall we say - a little nervous. Rightly so. It certainly makes me nervous.

35/n

It does not stop there. EDF also operates reactors in England & Belgium. Those output patterns look similar to that of France (<60% utilisation for 2022).

The UK fleet has the lowest output since 1982. EDF is in a crisis of confidence. @EmmanuelMacron has work ahead.

36/n MW

The UK fleet has the lowest output since 1982. EDF is in a crisis of confidence. @EmmanuelMacron has work ahead.

36/n MW

Here is where it gets real frustrating.

German reactors are widely considered as some of the safest, best globally. Their capacity factors? 92%. That was similar at 20GW, not just at 4GW today.

That is what we turn off, after an average time on the grid of 22 years.

37/n

German reactors are widely considered as some of the safest, best globally. Their capacity factors? 92%. That was similar at 20GW, not just at 4GW today.

That is what we turn off, after an average time on the grid of 22 years.

37/n

It gets worse.

It also happens to be true that Germany is one of only a handful of countries that could become "nuclear independent" - i.e. having uranium access, being able to enrich and to build these reactors locally.

Share it. These are the facts.

38/n

It also happens to be true that Germany is one of only a handful of countries that could become "nuclear independent" - i.e. having uranium access, being able to enrich and to build these reactors locally.

Share it. These are the facts.

38/n

But you don't understand - we don't want nuclear.

Why? Nuclear is the safest, cleanest, most reliable (for grid frequency) & most resource friendly electricity known that mankind.

As they say, you are entitled of your own opinion, but not your own facts.

39/n

Why? Nuclear is the safest, cleanest, most reliable (for grid frequency) & most resource friendly electricity known that mankind.

As they say, you are entitled of your own opinion, but not your own facts.

39/n

Which brings us to short-term issue 3: Norway.

Why is that even worth mentioning? Because the Continent turned into a net importer of power (without rationing electricity).

The Nordics (known as Nordpool among traders) must bridge the power gap. Can they?

40/n

Why is that even worth mentioning? Because the Continent turned into a net importer of power (without rationing electricity).

The Nordics (known as Nordpool among traders) must bridge the power gap. Can they?

40/n

First, the Nordpool really means SWE & NOR (FIN is an importer).

NOR has gigantic water reservoirs. Lately however, less than expected snow in spring kept certain water levels below average which made the Minister contemplate cutting e-exports.

41/n

NOR has gigantic water reservoirs. Lately however, less than expected snow in spring kept certain water levels below average which made the Minister contemplate cutting e-exports.

41/n

https://twitter.com/BurggrabenH/status/1555946544293064704?s=20&t=slSMh179ISCBVaCNUwclTw

Are they? We can measure this below for Elspot 1 & 2 (about 21 GWh). They are indeed at the lowest in 25 years.

However, 3, 4 & 5 are fine (40 GWh). Will they have to cut exports? IDK.

If they do, the Continent will experience power shortages with 99% certainty.

42/n In GWh

However, 3, 4 & 5 are fine (40 GWh). Will they have to cut exports? IDK.

If they do, the Continent will experience power shortages with 99% certainty.

42/n In GWh

Which brings us to short-term issue 4: Ukraine.

In March, ENTSO-E set up the synchronisation with the Ukrainian grid on an emergency basis to provide power support.

While heroic, its SYNCHRONISATION adds substantial risk to grid (think frequency again).

43/n

In March, ENTSO-E set up the synchronisation with the Ukrainian grid on an emergency basis to provide power support.

While heroic, its SYNCHRONISATION adds substantial risk to grid (think frequency again).

43/n

Let us now look at the long-term problem of this energy crisis which I like to call a crisis of confidence.

In 1979, J Carter addressed the nation due to its energy crisis & rampant inflation with the same title.

The issues sounds eerily similar.

44/n

In 1979, J Carter addressed the nation due to its energy crisis & rampant inflation with the same title.

The issues sounds eerily similar.

44/n

What is the issue?

Well, a few committed themselves in the name of all of us to reduce carbon emissions. The Commission transformed such commitments into laws - "Fitfor55" laws - reference to reducing emissions by 55% til 2030.

Does everybody understand what that means?

45/n

Well, a few committed themselves in the name of all of us to reduce carbon emissions. The Commission transformed such commitments into laws - "Fitfor55" laws - reference to reducing emissions by 55% til 2030.

Does everybody understand what that means?

45/n

Will such laws "save" the planet from reaching 3% higher temperatures?

I have my doubts. Instead, emissions will be determined by Asian countries & by the forecast population growth of certain African nations (Nigeria: from 219m to 600m by 2050 etc.).

Accept.

46/n

I have my doubts. Instead, emissions will be determined by Asian countries & by the forecast population growth of certain African nations (Nigeria: from 219m to 600m by 2050 etc.).

Accept.

46/n

Were Germany or all of Europe to de-industrialise overnight - I mean 100% de-industrialise -, it wouldn't make a dent in global CO2 emissions.

Take China: it alone adds 33GW of new coal-fired plants to the grid by 2023 as it needs more electricity - now!

47/n

Take China: it alone adds 33GW of new coal-fired plants to the grid by 2023 as it needs more electricity - now!

47/n

Nor will the world have the metals & minerals to deliver European climate targets, let alone global climate ambitions of the entire world.

48/n Source: Prof Simon Michaux

48/n Source: Prof Simon Michaux

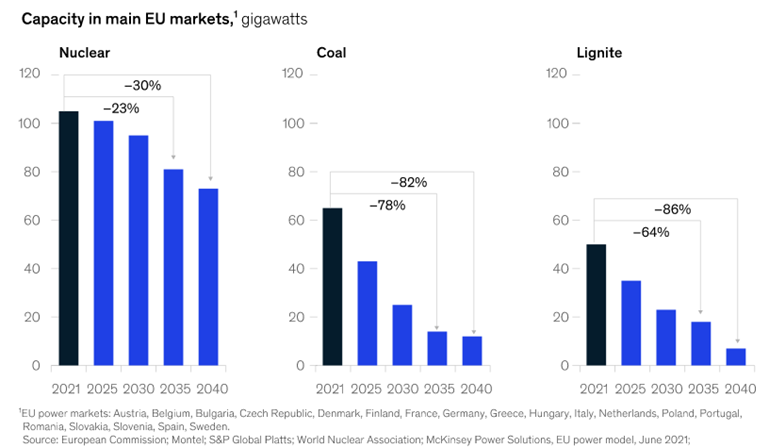

Meanwhile, Europe alone has what I like to call an "age bomb" problem around the corner.

If it takes 15 years to replace one aging nuclear with a new one, we are simply late already.

Not just Europe, the US or Japan have it too.

49/n

If it takes 15 years to replace one aging nuclear with a new one, we are simply late already.

Not just Europe, the US or Japan have it too.

49/n

Can we replace them with wind (much better than solar)? Nope!

It would take 3,146 15MW turbines to replace 19GW of nuclear by 2030. NL installed one such turbine - that is it. 7 years left.

To replace the energy DENSITY of #nuclear would take decades & trillions.

50/n

It would take 3,146 15MW turbines to replace 19GW of nuclear by 2030. NL installed one such turbine - that is it. 7 years left.

To replace the energy DENSITY of #nuclear would take decades & trillions.

50/n

Can Renewables Energy Sources (RES) not help?

Of course they can. Offshore in the Nord Sea achieves capacity factors as high as 38%, almost as good as a hard coal plants.

Solar in Germany? A waste of precious mineral resources.

51/n EU Capacity Factors bf utilisation

Of course they can. Offshore in the Nord Sea achieves capacity factors as high as 38%, almost as good as a hard coal plants.

Solar in Germany? A waste of precious mineral resources.

51/n EU Capacity Factors bf utilisation

But that is besides the point.

Frequency stability dictates that RES must be accompanied with, among others, storage to dispatch energy if & when operators need it to MATCH peak loads with generation MINUTE BY MINUTE to prevent shortages or, god forbit, a blackout..!

52/n

Frequency stability dictates that RES must be accompanied with, among others, storage to dispatch energy if & when operators need it to MATCH peak loads with generation MINUTE BY MINUTE to prevent shortages or, god forbit, a blackout..!

52/n

Take Germany. It had excess electricity in 2022 YTD but required peak load assistance frequently.

Its generation mix is already incapable to match its load requirements minute by minute!

Instead, it relies on French nuclear imports (irony).

It needed no help in 2015.

53/n

Its generation mix is already incapable to match its load requirements minute by minute!

Instead, it relies on French nuclear imports (irony).

It needed no help in 2015.

53/n

Assume operators fix all short-term problems tomorrow, magically so.

Are we safe? No, we are not. Again, for RES to work reliably it requires...

(a) a doubling of the grid which takes decades as nobody wants a high-voltage transmission line near-by.

54/n

Are we safe? No, we are not. Again, for RES to work reliably it requires...

(a) a doubling of the grid which takes decades as nobody wants a high-voltage transmission line near-by.

54/n

And (b) it requires grid-scale chemical storage to convert volatile generation into a dispatchable (nuclear- or fossil-power-like) form of electricity.

Call RES "w-power" (w = weather) for the lack of a better name. Auf Deutsch: zickig!

We need "s-power" (s = stable)

55/n

Call RES "w-power" (w = weather) for the lack of a better name. Auf Deutsch: zickig!

We need "s-power" (s = stable)

55/n

However, from a frequency stability perspective, non-dispatchable energy (wind, solar or run of rivers) has near-zero value without transmission lines & storage.

This is called "secured capacity" (German: gesicherte Leistung).

Don't you argue here! These are facts.

56/n

This is called "secured capacity" (German: gesicherte Leistung).

Don't you argue here! These are facts.

56/n

Germany therefore relies on a steady flow of imports (even if it stays a net exporter for the year) to match load with generation minute by minute.

Can it import such amounts? Will FRA, CH, AT, CZE, POL et al build capacities for GER?

Answer: not much more and maybe.

57/n

Can it import such amounts? Will FRA, CH, AT, CZE, POL et al build capacities for GER?

Answer: not much more and maybe.

57/n

How much storage does Germany need in order to convert its "w-power" into "s-power"?

Answer: At least 15TWh of chemical storage will be needed.

How much does it have? A few Megawatts.

58/n

Answer: At least 15TWh of chemical storage will be needed.

How much does it have? A few Megawatts.

58/n

The EU Commission assumes 550GW of chemical storage that must be installed by 2050 to decarbonise the grid when assuming rather generous capacity factors.

These are big numbers and, frankly, a ridiculous timetable.

59/n Source: EU Commission Paper

These are big numbers and, frankly, a ridiculous timetable.

59/n Source: EU Commission Paper

...but the reality looks sobering.

Of today’s installed capacities of 53GW in Europe, 95% comes from Pumped Storage (PS) in the Alps (days to dispatch like Hydrogen).

PS is hard to expand (>10 years, few locations) while only chemical-storage can match frequency issues.

61/

Of today’s installed capacities of 53GW in Europe, 95% comes from Pumped Storage (PS) in the Alps (days to dispatch like Hydrogen).

PS is hard to expand (>10 years, few locations) while only chemical-storage can match frequency issues.

61/

Having doubts? Well, go visit Nant de Drance (NdD) in Switzerland. This CHF2bn Pumped Storage assets was just completed.

Here some numbers for perspective: we would need 1,200 NdD by 2050 (assuming it could meet frequency needs which it cannot).

62/

Here some numbers for perspective: we would need 1,200 NdD by 2050 (assuming it could meet frequency needs which it cannot).

62/

Let us now look at installed chemical storage - globally!

First, of the currently operational Lithium-Ion batteries for grid purposes of a total of 4,150 MW installed capacity globally.

63/n

First, of the currently operational Lithium-Ion batteries for grid purposes of a total of 4,150 MW installed capacity globally.

63/n

Can we roll out grid-scale batteries by 2030 and then some, only for Germany (to reduce complexity).

Answer: No. Grid-scale batteries need years to reach the Technological Readiness Level (TRL) to be rolled out industrially and leaving aside mineral sourcing issues.

64/n

Answer: No. Grid-scale batteries need years to reach the Technological Readiness Level (TRL) to be rolled out industrially and leaving aside mineral sourcing issues.

64/n

Here is another perspective.

The Tesla Gigafactory (once completed) would produce a quantity of batteries each year that could store 30GWh (a big number). But Europe consumes 3,300,000GWh pa.

An annual Gigafactory output could store a minutes of EU power demand.

65/n

The Tesla Gigafactory (once completed) would produce a quantity of batteries each year that could store 30GWh (a big number). But Europe consumes 3,300,000GWh pa.

An annual Gigafactory output could store a minutes of EU power demand.

65/n

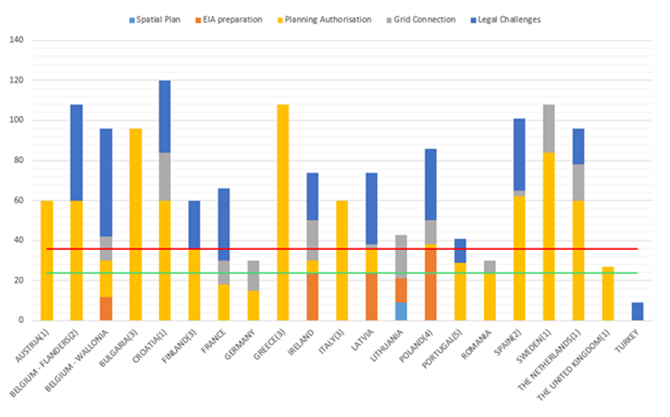

Let us briefly touch on the NIMBY - not in my backyard - problem.

It doesn't only apply to nuclear, it applies to wind too.

In one German example, permitting was so slow that by the time the wind farm was given the green light, the selected turbine model was obsolete

66/n

It doesn't only apply to nuclear, it applies to wind too.

In one German example, permitting was so slow that by the time the wind farm was given the green light, the selected turbine model was obsolete

66/n

Leaving the intermittence problem aside, Europe is not permitting enough new wind farms to meet its renewable energy targets.

Complex rules, slow procedures and local resistance means that wind takes up to 10 years to be installed. We are not China & that is a good thing.

67/

Complex rules, slow procedures and local resistance means that wind takes up to 10 years to be installed. We are not China & that is a good thing.

67/

Meanwhile, climate laws force operators to turn off dispatchable sources en masse! And they do.

I call this behaviour "compliance-driven". However, to avoid blackouts we mustn't turn off ANY form of "s-power" until we replaced it with the SAME.

This is dangerous.

68/n

I call this behaviour "compliance-driven". However, to avoid blackouts we mustn't turn off ANY form of "s-power" until we replaced it with the SAME.

This is dangerous.

68/n

Can technology bail us out?

I think so. Bill Gates calls it "energy miracles". He sponsors countless "crazy ideas" to deliver break-through tech on storage, fission, fusion, hydrogen, thermal - you name, he is in. We need all of it.

69/n

I think so. Bill Gates calls it "energy miracles". He sponsors countless "crazy ideas" to deliver break-through tech on storage, fission, fusion, hydrogen, thermal - you name, he is in. We need all of it.

69/n

What am I trying to explain?

Europe will NOT deliver on its climate targets.

The energy transition is an order of mangnitude more complex than laws or ideology allow for. Accept.

68/n

Europe will NOT deliver on its climate targets.

The energy transition is an order of mangnitude more complex than laws or ideology allow for. Accept.

68/n

Instead, existing laws and claims of a few about what can be achieved with wind & solar and by when have brought us to a dangerous juncture.

Do they mean bad? Of course not. Yet, the road to hell is paved with good intentions.

69/n

Do they mean bad? Of course not. Yet, the road to hell is paved with good intentions.

69/n

I am tired now.

Finally and for my German speaking audience, here is an excellent reportage by ZDF on the issue at hand. I highly recommend it.

Let me stop it here & allow all this to sink in.

70/n Thank you

zdf.de/verbraucher/wi…

Finally and for my German speaking audience, here is an excellent reportage by ZDF on the issue at hand. I highly recommend it.

Let me stop it here & allow all this to sink in.

70/n Thank you

zdf.de/verbraucher/wi…

Let me add this here. It explains everything in one picture.

H/t @organicbluetuna @kittysquiddy

H/t @organicbluetuna @kittysquiddy

https://twitter.com/organicbluetuna/status/1568327654264168448

• • •

Missing some Tweet in this thread? You can try to

force a refresh